Enlarge image

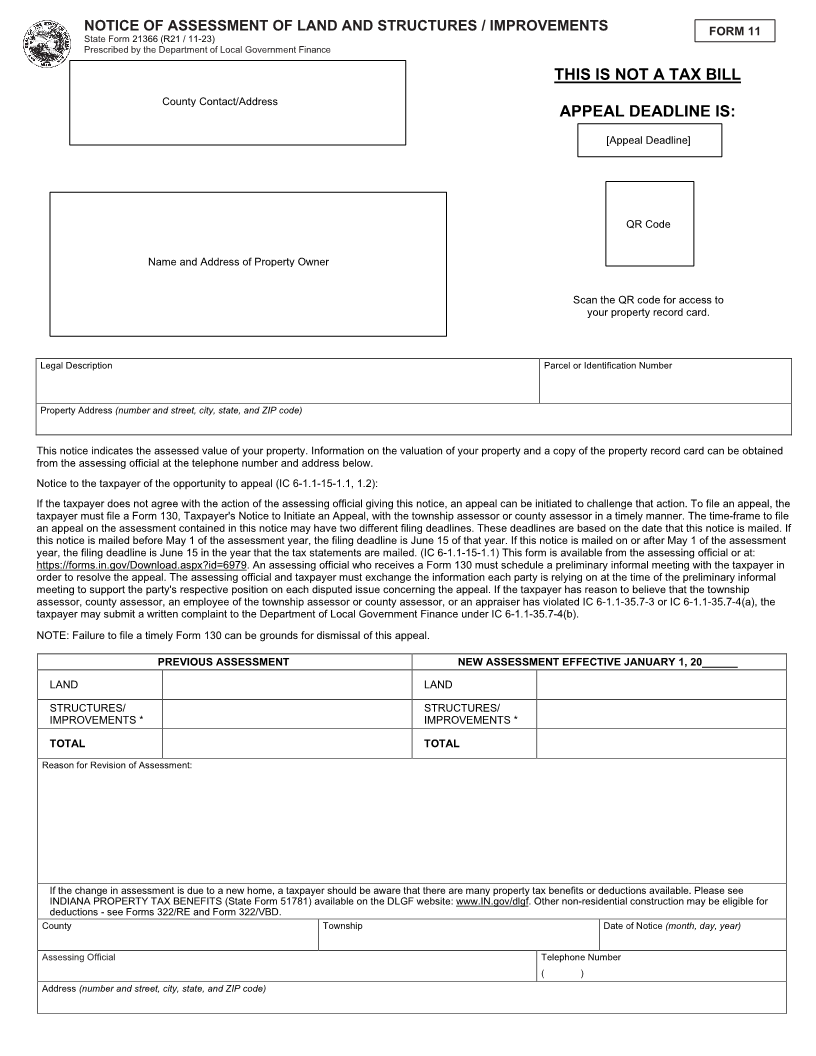

NOTICE OF ASSESSMENT OF LAND AND STRUCTURES / IMPROVEMENTS FORM 11

State Form21366 (R2 1/ 11-23)

Prescribed by the Department of Local Government Finance

THIS IS NOT A TAX BILL

County Contact/Address

APPEAL DEADLINE IS:

[Appeal Deadline]

QR Code

Name and Address of Property Owner

Scan the QR code for access to

your property record card.

Legal Description Parcel or Identification Number

Property Address (number and street, city, state, and ZIP code)

This notice indicates the assessed value of your property. Information on the valuation of your property and a copy of the property record card can be obtained

from the assessing official at the telephone number and address below.

Notice to the taxpayer of the opportunity to appeal (IC 6-1.1-15-1.1, 1.2):

If the taxpayer does not agree with the action of the assessing official giving this notice, an appeal can be initiated to challenge that action. To file an appeal, the

taxpayer must file a Form 130, Taxpayer's Notice to Initiate an Appeal, with the township assessor or county assessor in a timely manner. The time-frame to file

an appeal on the assessment contained in this notice may have two different filing deadlines. These deadlines are based on the date that this notice is mailed. If

this notice is mailed before May 1 of the assessment year, the filing deadline is June 15 of that year. If this notice is mailed on or after May 1 of the assessment

year, the filing deadline is June 15 in the year that the tax statements are mailed. (IC 6-1.1-15-1.1) This form is available from the assessing official or at:

https://forms.in.gov/Download.aspx?id=6979. An assessing official who receives a Form 130 must schedule a preliminary informal meeting with the taxpayer in

order to resolve the appeal. The assessing official and taxpayer must exchange the information each party is relying on at the time of the preliminary informal

meeting to support the party's respective position on each disputed issue concerning the appeal. If the taxpayer has reason to believe that the township

assessor, county assessor, an employee of the township assessor or county assessor, or an appraiser has violated IC 6-1.1-35.7-3 or IC 6-1.1-35.7-4(a), the

taxpayer may submit a written complaint to the Department of Local Government Finance under IC 6-1.1-35.7-4(b).

NOTE: Failure to file a timely Form 130 can be grounds for dismissal of this appeal.

PREVIOUS ASSESSMENT NEW ASSESSMENT EFFECTIVE JANUARY 1, 20______

LAND LAND

STRUCTURES/ STRUCTURES/

IMPROVEMENTS * IMPROVEMENTS *

TOTAL TOTAL

Reason for Revision of Assessment:

If the change in assessment is due to a new home, a taxpayer should be aware that there are many property tax benefits or deductions available. Please see

INDIANA PROPERTY TAX BENEFITS (State Form 51781) available on the DLGF website: www.IN.gov/dlgf. Other non-residential construction may be eligible for

deductions - see Forms 322/RE and Form 322/VBD.

County Township Date of Notice (month, day, year)

Assessing Official Telephone Number

( )

Address (number and street, city, state, and ZIP code)