Enlarge image

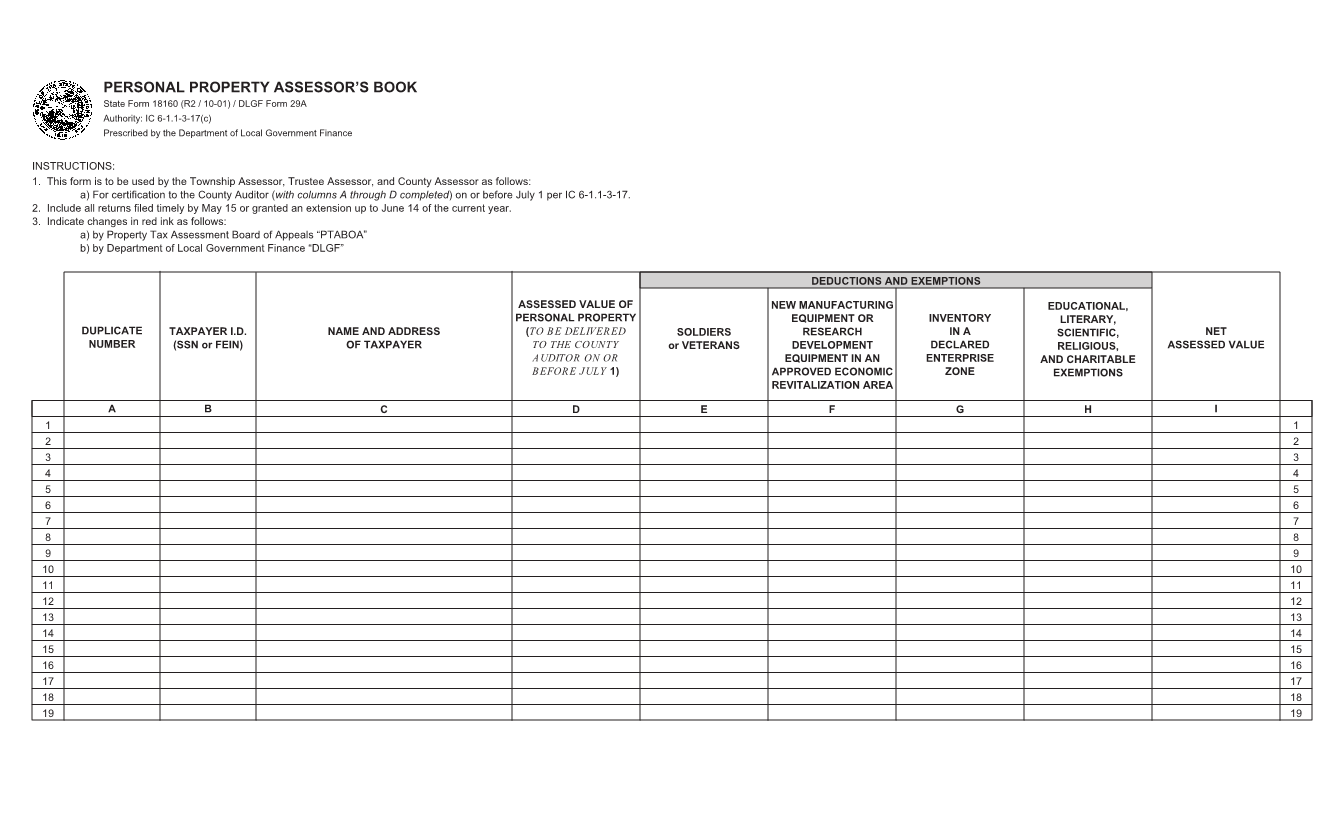

PERSONAL PROPERTY ASSESSOR’S BOOK

State Form 18160 (R2 / 10-01) / DLGF Form 29A

Authority: IC 6-1.1-3-17(c)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS:

1. This form is to be used by the Township Assessor, Trustee Assessor, and County Assessor as follows:

a) For certification to the County Auditor (with columns A through D completed) on or before July 1 per IC 6-1.1-3-17.

2. Include all returns filed timely by May 15 or granted an extension up to June 14 of the current year.

3. Indicate changes in red ink as follows:

a) by Property Tax Assessment Board of Appeals “PTABOA”

b) by Department of Local Government Finance “DLGF”

DEDUCTIONS AND EXEMPTIONS

ASSESSED VALUE OF NEW MANUFACTURING EDUCATIONAL,

PERSONAL PROPERTY EQUIPMENT OR INVENTORY LITERARY,

DUPLICATE TAXPAYER I.D. NAME AND ADDRESS (TO BE DELIVERED SOLDIERS RESEARCH IN A SCIENTIFIC, NET

NUMBER (SSN or FEIN) OF TAXPAYER TO THE COUNTY or VETERANS DEVELOPMENT DECLARED RELIGIOUS, ASSESSED VALUE

AUDITOR ON OR EQUIPMENT IN AN ENTERPRISE AND CHARITABLE

BEFORE JULY 1) APPROVED ECONOMIC ZONE EXEMPTIONS

REVITALIZATION AREA

A B C D E F G H I

1 1

2 2

3 3

4 4

5 5

6 6

7 7

8 8

9 9

10 10

11 11

12 12

13 13

14 14

15 15

16 16

17 17

18 18

19 19