Enlarge image

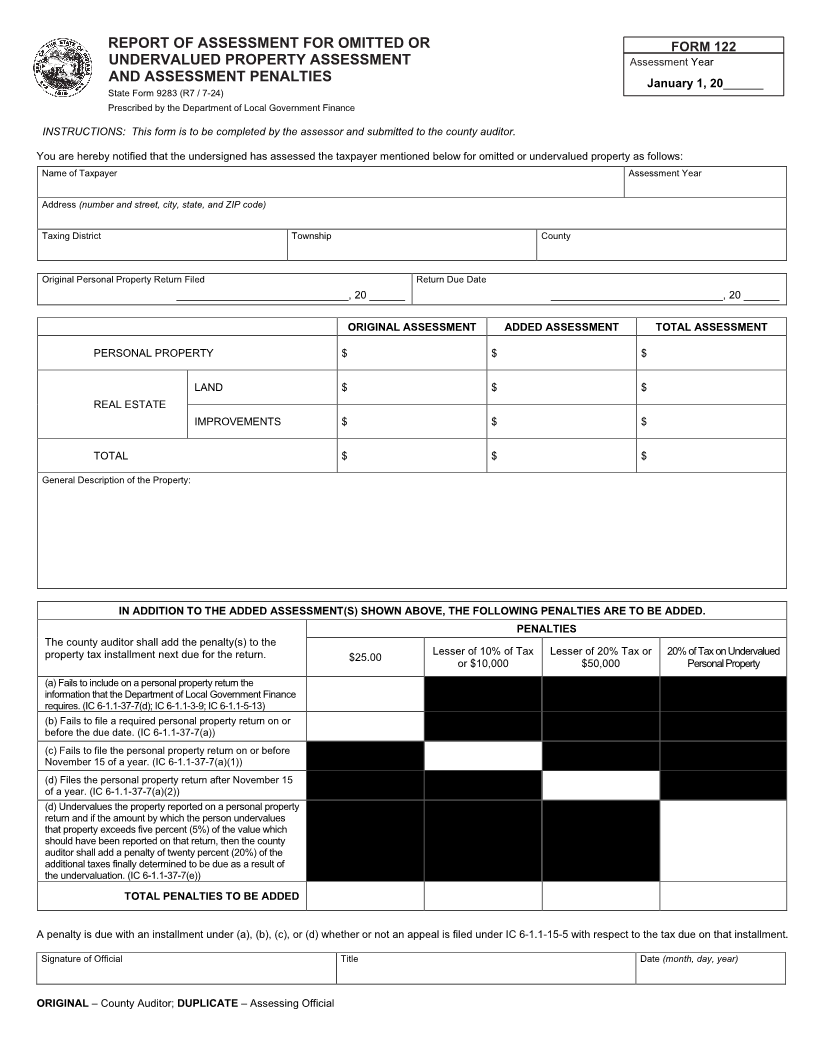

REPORT OF ASSESSMENT FOR OMITTED OR FORM 122

UNDERVALUED PROPERTY ASSESSMENT Assessment Year

AND ASSESSMENT PENALTIES January 1, 20______

State Form 9283 (R7 / 7-24)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS: This form is to be completed by the assessor and submitted to the county auditor.

You are hereby notified that the undersigned has assessed the taxpayer mentioned below for omitted or undervalued property as follows:

Name of Taxpayer Assessment Year

Address (number and street, city, state, and ZIP code)

Taxing District Township County

Original Personal Property Return Filed Return Due Date

_____________________________, 20 ______ _____________________________, 20 ______

ORIGINAL ASSESSMENT ADDED ASSESSMENT TOTAL ASSESSMENT

PERSONAL PROPERTY $ $ $

LAND $ $ $

REAL ESTATE

IMPROVEMENTS $ $ $

TOTAL $ $ $

General Description of the Property:

IN ADDITION TO THE ADDED ASSESSMENT(S) SHOWN ABOVE, THE FOLLOWING PENALTIES ARE TO BE ADDED.

PENALTIES

The county auditor shall add the penalty(s) to the

Lesser of 10% of Tax Lesser of 20% Tax or 20% of Tax on Undervalued

property tax installment next due for the return. $25.00 or $10,000 $50,000 Personal Property

(a) Fails to include on a personal property return the

information that the Department of Local Government Finance

requires. (IC 6-1.1-37-7(d); IC 6-1.1-3-9; IC 6-1.1-5-13)

(b) Fails to file a required personal property return on or

before the due date. (IC 6-1.1-37-7(a))

(c) Fails to file the personal property return on or before

November 15 of a year. (IC 6-1.1-37-7(a)(1))

(d) Files the personal property return after November 15

of a year. (IC 6-1.1-37-7(a)(2))

(d) Undervalues the property reported on a personal property

return and if the amount by which the person undervalues

that property exceeds five percent (5%) of the value which

should have been reported on that return, then the county

auditor shall add a penalty of twenty percent (20%) of the

additional taxes finally determined to be due as a result of

the undervaluation. (IC 6-1.1-37-7(e))

TOTAL PENALTIES TO BE ADDED

A penalty is due with an installment under (a), (b), (c), or (d) whether or not an appeal is filed under IC 6-1.1-15-5 with respect to the tax due on that installment.

Signature of Official Title Date (month, day, year)

ORIGINAL – County Auditor; DUPLICATE – Assessing Official