Enlarge image

Reset Form

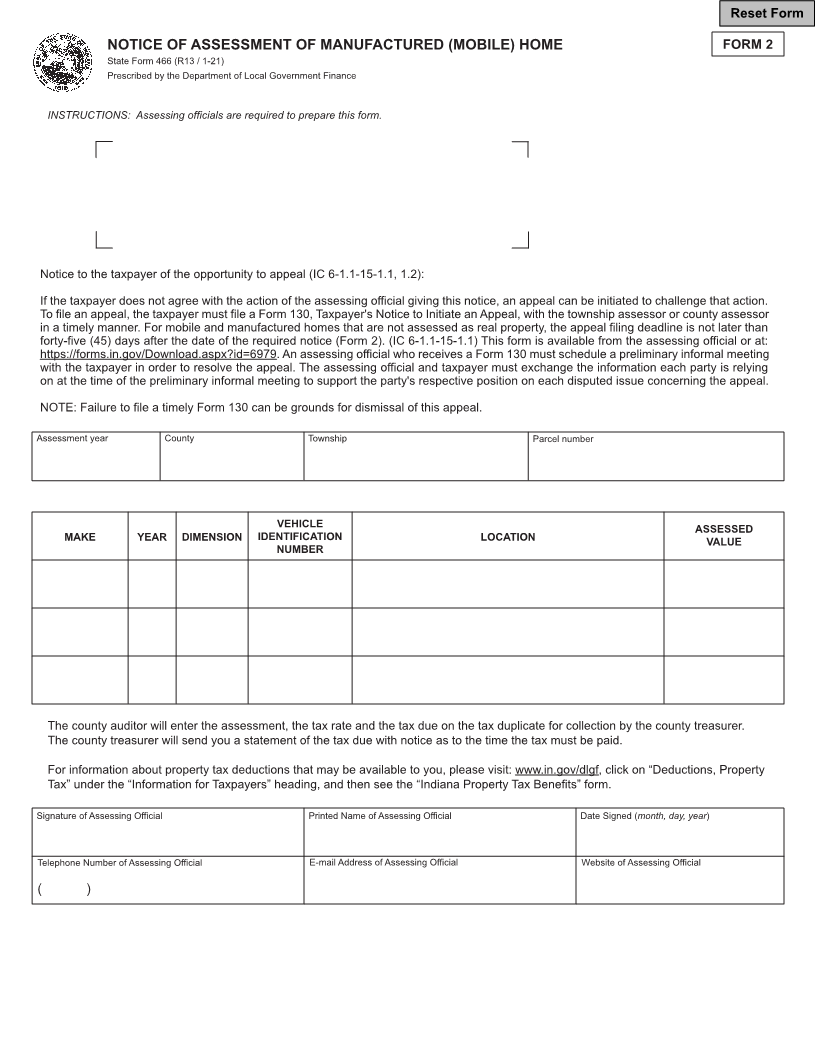

NOTICE OF ASSESSMENT OF MANUFACTURED (MOBILE) HOME FORM 2

State Form 466 (R13 / 1-21)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS: Assessing officials are required to prepare this form.

Notice to the taxpayer of the opportunity to appeal (IC 6-1.1-15-1.1, 1.2):

If the taxpayer does not agree with the action of the assessing official giving this notice, an appeal can be initiated to challenge that action.

To file an appeal, the taxpayer must file a Form 130, Taxpayer's Notice to Initiate an Appeal, with the township assessor or county assessor

in a timely manner. For mobile and manufactured homes that are not assessed as real property, the appeal filing deadline is not later than

forty-five (45) days after the date of the required notice (Form 2). (IC 6-1.1-15-1.1) This form is available from the assessing official or at:

https://forms.in.gov/Download.aspx?id=6979. An assessing official who receives a Form 130 must schedule a preliminary informal meeting

with the taxpayer in order to resolve the appeal. The assessing official and taxpayer must exchange the information each party is relying

on at the time of the preliminary informal meeting to support the party's respective position on each disputed issue concerning the appeal.

NOTE: Failure to file a timely Form 130 can be grounds for dismissal of this appeal.

Assessment year County Township Parcel number

VEHICLE ASSESSED

MAKE YEAR DIMENSION IDENTIFICATION LOCATION VALUE

NUMBER

The county auditor will enter the assessment, the tax rate and the tax due on the tax duplicate for collection by the county treasurer.

The county treasurer will send you a statement of the tax due with notice as to the time the tax must be paid.

For information about property tax deductions that may be available to you, please visit: www.in.gov/dlgf, click on “Deductions, Property

Tax” under the “Information for Taxpayers” heading, and then see the “Indiana Property Tax Benefits” form.

Signature of Assessing Official Printed Name of Assessing Official Date Signed (month, day, year)

Telephone Number of Assessing Official E-mail Address of Assessing Official Website of Assessing Official

( )