Enlarge image

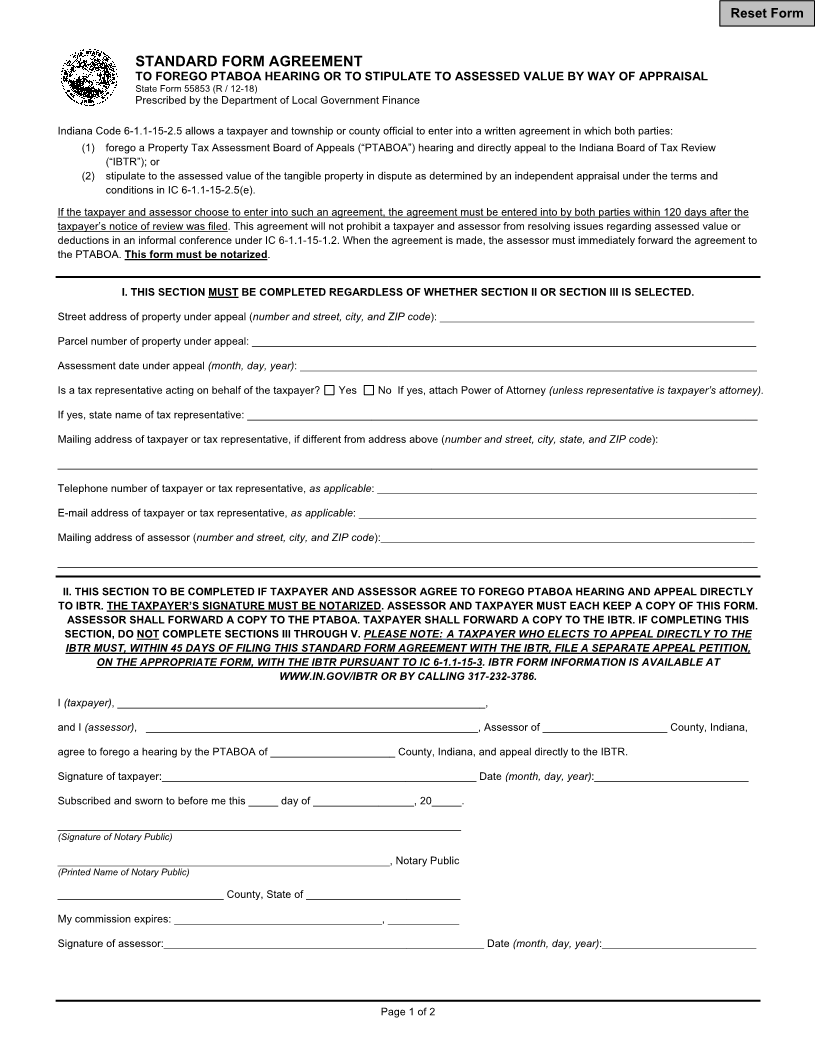

Reset Form

STANDARD FORM AGREEMENT

TO FOREGO PTABOA HEARING OR TO STIPULATE TO ASSESSED VALUE BY WAY OF APPRAISAL

State Form 55853 (R / 12-18)

Prescribed by the Department of Local Government Finance

Indiana Code 6-1.1-15-2.5 allows a taxpayer and township or county official to enter into a written agreement in which both parties:

(1) forego a Property Tax Assessment Board of Appeals (“PTABOA”) hearing and directly appeal to the Indiana Board of Tax Review

(“IBTR”); or

(2) stipulate to the assessed value of the tangible property in dispute as determined by an independent appraisal under the terms and

conditions in IC 6-1.1-15-2.5(e).

If the taxpayer and assessor choose to enter into such an agreement, the agreement must be entered into by both parties within 120 days after the

taxpayer’s notice of review was filed. This agreement will not prohibit a taxpayer and assessor from resolving issues regarding assessed value or

deductions in an informal conference under IC 6-1.1-15-1.2. When the agreement is made, the assessor must immediately forward the agreement to

the PTABOA. This form must be notarized.

I. THIS SECTION MUST BE COMPLETED REGARDLESS OF WHETHER SECTION II OR SECTION III IS SELECTED.

Street address of property under appeal (number and street, city, and ZIP code): _____________________________________________________

Parcel number of property under appeal: _____________________________________________________________________________________

Assessment date under appeal (month, day, year): _____________________________________________________________________________

Is a tax representative acting on behalf of the taxpayer? Yes No If yes, attach Power of Attorney (unless representative is taxpayer’s attorney).

If yes, state name of tax representative: ______________________________________________________________________________________

Mailing address of taxpayer or tax representative, if different from address above (number and street, city, state, and ZIP code):

______________________________________________________________________________________________________________________

Telephone number of taxpayer or tax representative, as applicable: ________________________________________________________________

E-mail address of taxpayer or tax representative, as applicable: ___________________________________________________________________

Mailing address of assessor (number and street, city, and ZIP code):_______________________________________________________________

______________________________________________________________________________________________________________________

II. THIS SECTION TO BE COMPLETED IF TAXPAYER AND ASSESSOR AGREE TO FOREGO PTABOA HEARING AND APPEAL DIRECTLY

TO IBTR. THE TAXPAYER’S SIGNATURE MUST BE NOTARIZED. ASSESSOR AND TAXPAYER MUST EACH KEEP A COPY OF THIS FORM.

ASSESSOR SHALL FORWARD A COPY TO THE PTABOA. TAXPAYER SHALL FORWARD A COPY TO THE IBTR. IF COMPLETING THIS

SECTION, DO NOT COMPLETE SECTIONS III THROUGH V. PLEASE NOTE: A TAXPAYER WHO ELECTS TO APPEAL DIRECTLY TO THE

IBTR MUST, WITHIN 45 DAYS OF FILING THIS STANDARD FORM AGREEMENT WITH THE IBTR, FILE A SEPARATE APPEAL PETITION,

ON THE APPROPRIATE FORM, WITH THE IBTR PURSUANT TO IC 6-1.1-15-3. IBTR FORM INFORMATION IS AVAILABLE AT

WWW.IN.GOV/IBTR OR BY CALLING 317-232-3786.

I (taxpayer), ______________________________________________________________,

and I (assessor), ________________________________________________________, Assessor of _____________________ County, Indiana,

agree to forego a hearing by the PTABOA of _____________________ County, Indiana, and appeal directly to the IBTR.

Signature of taxpayer:_____________________________________________________ Date (month, day, year):__________________________

Subscribed and sworn to before me this _____ day of _________________, 20_____.

____________________________________________________________________

(Signature of Notary Public)

________________________________________________________, Notary Public

(Printed Name of Notary Public)

____________________________ County, State of __________________________

My commission expires: ___________________________________, ____________

Signature of assessor:______________________________________________________ Date(month, day, year):__________________________

Page 1 of 2