Enlarge image

Reset Form

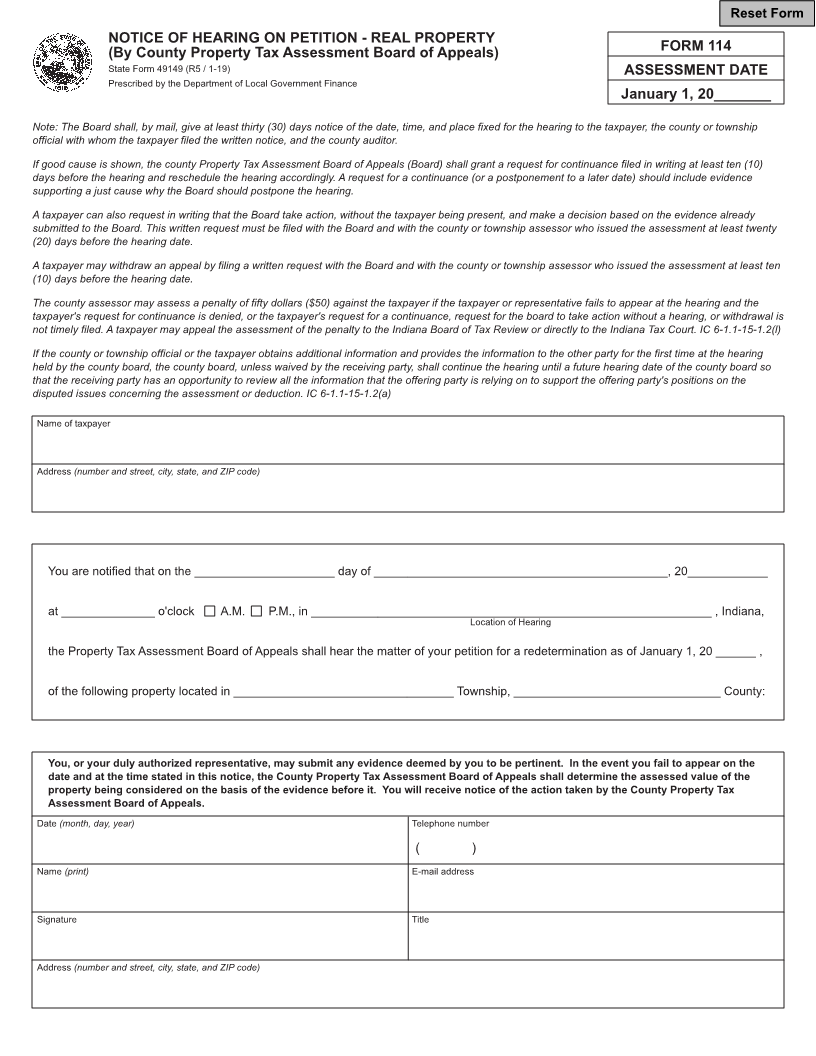

NOTICE OF HEARING ON PETITION - REAL PROPERTY

FORM 114

(By County Property Tax Assessment Board of Appeals)

State Form 49149 (R5 / 1-19) ASSESSMENT DATE

Prescribed by the Department of Local Government Finance

January 1, 20_______

Note: The Board shall, by mail, give at least thirty (30) days notice of the date, time, and place fixed for the hearing to the taxpayer, the county or township

official with whom the taxpayer filed the written notice, and the county auditor.

If good cause is shown, the county Property Tax Assessment Board of Appeals (Board) shall grant a request for continuance filed in writing at least ten (10)

days before the hearing and reschedule the hearing accordingly. A request for a continuance (or a postponement to a later date) should include evidence

supporting a just cause why the Board should postpone the hearing.

A taxpayer can also request in writing that the Board take action, without the taxpayer being present, and make a decision based on the evidence already

submitted to the Board. This written request must be filed with the Board and with the county or township assessor who issued the assessment at least twenty

(20) days before the hearing date.

A taxpayer may withdraw an appeal by filing a written request with the Board and with the county or township assessor who issued the assessment at least ten

(10) days before the hearing date.

The county assessor may assess a penalty of fifty dollars ($50) against the taxpayer if the taxpayer or representative fails to appear at the hearing and the

taxpayer's request for continuance is denied, or the taxpayer's request for a continuance, request for the board to take action without a hearing, or withdrawal is

not timely filed. A taxpayer may appeal the assessment of the penalty to the Indiana Board of Tax Review or directly to the Indiana Tax Court. IC 6-1.1-15-1.2(l)

If the county or township official or the taxpayer obtains additional information and provides the information to the other party for the first time at the hearing

held by the county board, the county board, unless waived by the receiving party, shall continue the hearing until a future hearing date of the county board so

that the receiving party has an opportunity to review all the information that the offering party is relying on to support the offering party's positions on the

disputed issues concerning the assessment or deduction. IC 6-1.1-15-1.2(a)

Name of taxpayer

Address (number and street, city, state, and ZIP code)

You are notified that on the _____________________ day of ____________________________________________, 20____________

at ______________ o'clock A.M. P.M., in ____________________________________________________________ , Indiana,

Location of Hearing

the Property Tax Assessment Board of Appeals shall hear the matter of your petition for a redetermination as of January 1, 20 ______ ,

of the following property located in _________________________________ Township, _______________________________ County:

You, or your duly authorized representative, may submit any evidence deemed by you to be pertinent. In the event you fail to appear on the

date and at the time stated in this notice, the County Property Tax Assessment Board of Appeals shall determine the assessed value of the

property being considered on the basis of the evidence before it. You will receive notice of the action taken by the County Property Tax

Assessment Board of Appeals.

Date (month, day, year) Telephone number

( )

Name (print) E-mail address

Signature Title

Address (number and street, city, state, and ZIP code)