Enlarge image

Reset Form

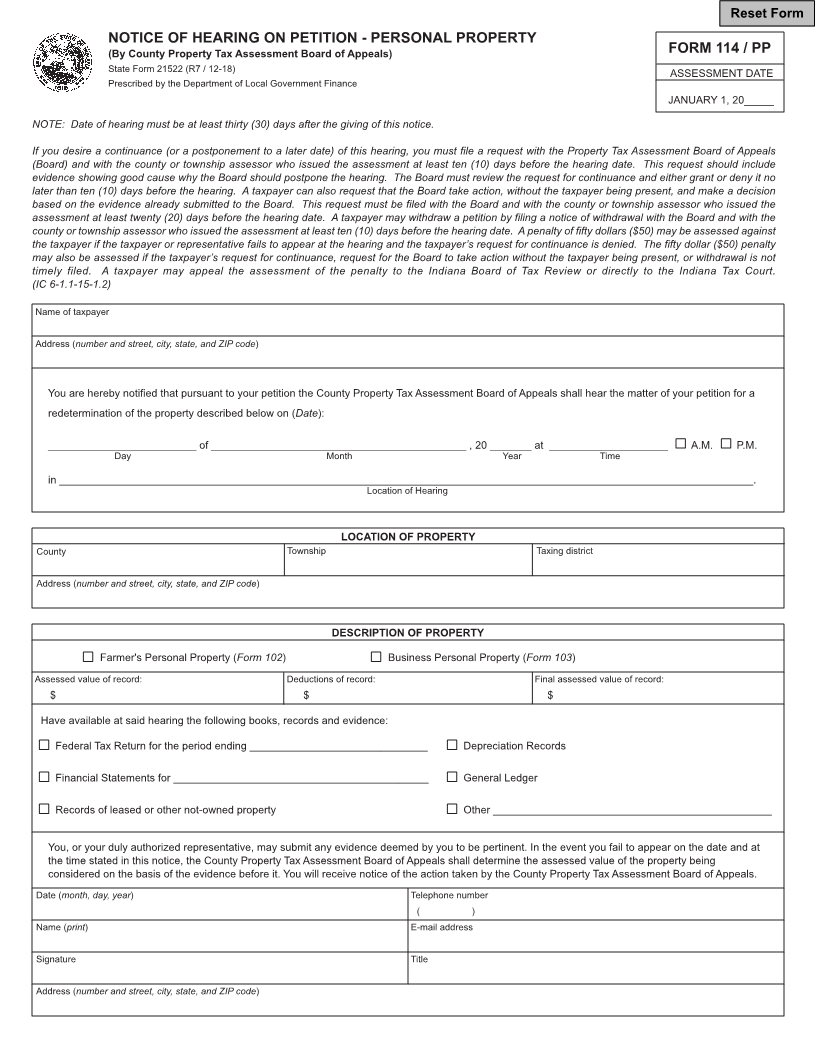

NOTICE OF HEARING ON PETITION - PERSONAL PROPERTY

(By County Property Tax Assessment Board of Appeals) FORM 114 / PP

State Form 21522 (R7 / 12-18) ASSESSMENT DATE

Prescribed by the Department of Local Government Finance

JANUARY 1, 20_____

NOTE: Date of hearing must be at least thirty (30) days after the giving of this notice.

If you desire a continuance (or a postponement to a later date) of this hearing, you must file a request with the Property Tax Assessment Board of Appeals

(Board) and with the county or township assessor who issued the assessment at least ten (10) days before the hearing date. This request should include

evidence showing good cause why the Board should postpone the hearing. The Board must review the request for continuance and either grant or deny it no

later than ten (10) days before the hearing. A taxpayer can also request that the Board take action, without the taxpayer being present, and make a decision

based on the evidence already submitted to the Board. This request must be filed with the Board and with the county or township assessor who issued the

assessment at least twenty (20) days before the hearing date. A taxpayer may withdraw a petition by filing a notice of withdrawal with the Board and with the

county or township assessor who issued the assessment at least ten (10) days before the hearing date. A penalty of fifty dollars ($50) may be assessed against

the taxpayer if the taxpayer or representative fails to appear at the hearing and the taxpayer’s request for continuance is denied. The fifty dollar ($50) penalty

may also be assessed if the taxpayer’s request for continuance, request for the Board to take action without the taxpayer being present, or withdrawal is not

timely filed. A taxpayer may appeal the assessment of the penalty to the Indiana Board of Tax Review or directly to the Indiana Tax Court.

(IC 6-1.1-15-1.2)

Name of taxpayer

Address (number and street, city, state, and ZIP code)

You are hereby notified that pursuant to your petition the County Property Tax Assessment Board of Appeals shall hear the matter of your petition for a

redetermination of the property described below on (Date):

_________________________ of ___________________________________________ , 20 _______ at ____________________ A.M. P.M.

Day Month Year Time

in _____________________________________________________________________________________________________________________.

Location of Hearing

LOCATION OF PROPERTY

County Township Taxing district

Address (number and street, city, state, and ZIP code)

DESCRIPTION OF PROPERTY

Farmer's Personal Property (Form 102) Business Personal Property (Form 103)

Assessed value of record: Deductions of record: Final assessed value of record:

$ $ $

Have available at said hearing the following books, records and evidence:

Federal Tax Return for the period ending ______________________________ Depreciation Records

Financial Statements for ___________________________________________ General Ledger

Records of leased or other not-owned property Other _______________________________________________

You, or your duly authorized representative, may submit any evidence deemed by you to be pertinent. In the event you fail to appear on the date and at

the time stated in this notice, the County Property Tax Assessment Board of Appeals shall determine the assessed value of the property being

considered on the basis of the evidence before it. You will receive notice of the action taken by the County Property Tax Assessment Board of Appeals.

Date (month, day, year) Telephone number

( )

Name (print) E-mail address

Signature Title

Address (number and street, city, state, and ZIP code)