Enlarge image

Reset Form

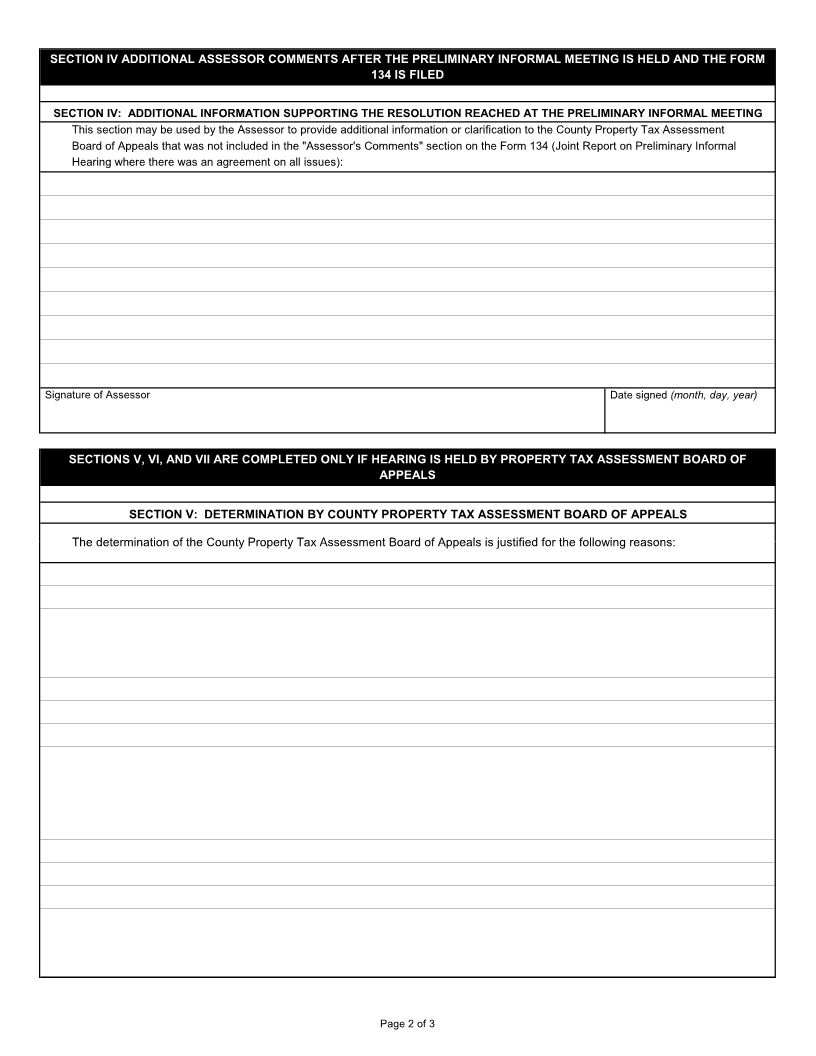

FORM 115

NOTIFICATION OF FINAL ASSESSMENT DETERMINATION PETITION NUMBER

State Form 20916 (R8 / 12-18)

Prescribed by the Department of Local Government Finance

__ __ -- __ __ __ -- __ __ -- -- __ -- __ __ __ 0__ __

Co. Dist. Yr. Prop. Sequence

NOTES: ● This is a notification of the final determination of the assessment of Class

property as a result of the taxpayer's filing of an assessment appeal

pursuant to IC 6-1.1-15-1.1.

Property Class

●If you do not agree with the action of the County Property Tax Assessment

Board of Appeals, you may petition the Indiana Board of Tax Review (IBTR). 1. Agricultural 5. Residential

In order to obtain a review by the IBTR, an individual must, not later than 2. Mineral Rights 6. Mobile Homes

FORTY-FIVE (45) DAYS after the date of this notice, file a petition for review 3. Industrial 7. Personal

with the IBTR (Form 131) and mail a copy of the petition to the County Assessor. 4. Commercial

Date Notification mailed (month, day, year) Check type of property under appeal: Real Personal

SECTION I: TAXPAYER INFORMATION

Name of property owner (Taxpayer) (first, middle, last)

Address of property owner (number and street ) City State ZIP code

Name of Authorized Representative (if different from taxpayer) Representative appointed by the taxpayer.

Representative required to complete State Form 23261, Power of Attorney.

Address of Authorized Representative (number and street ) City State ZIP code

SECTION II: DESCRIPTION OF PROPERTY

County Township Parcel or Key number (for real property)

Address of property (number and street ) City State ZIP code

Legal description provided on Form 11 or Property Record Card (for real property), or business name (for personal property)

SECTION III: FINAL DETERMINATION

Effective date of assessed value Assessed Value determined as a result of the filing of Form 130

Land: Improvements: Personal Property/Deductions:

JANUARY 1, 20_____ $ $ $

You are hereby notified that the assessed value of the property described on this notification is determined to be the value stated

above as of January 1. This determination is made as a result of: Preliminary informal meeting between the taxpayer and the

Assessor (attach Form 134)

Note: Additional assessor comments may be included in

Section IV of this form.

County Property Tax Assessment Board of Appeals hearing

(Complete Sections V, VI, and VII)

Page 1 of 3