Enlarge image

Reset Form

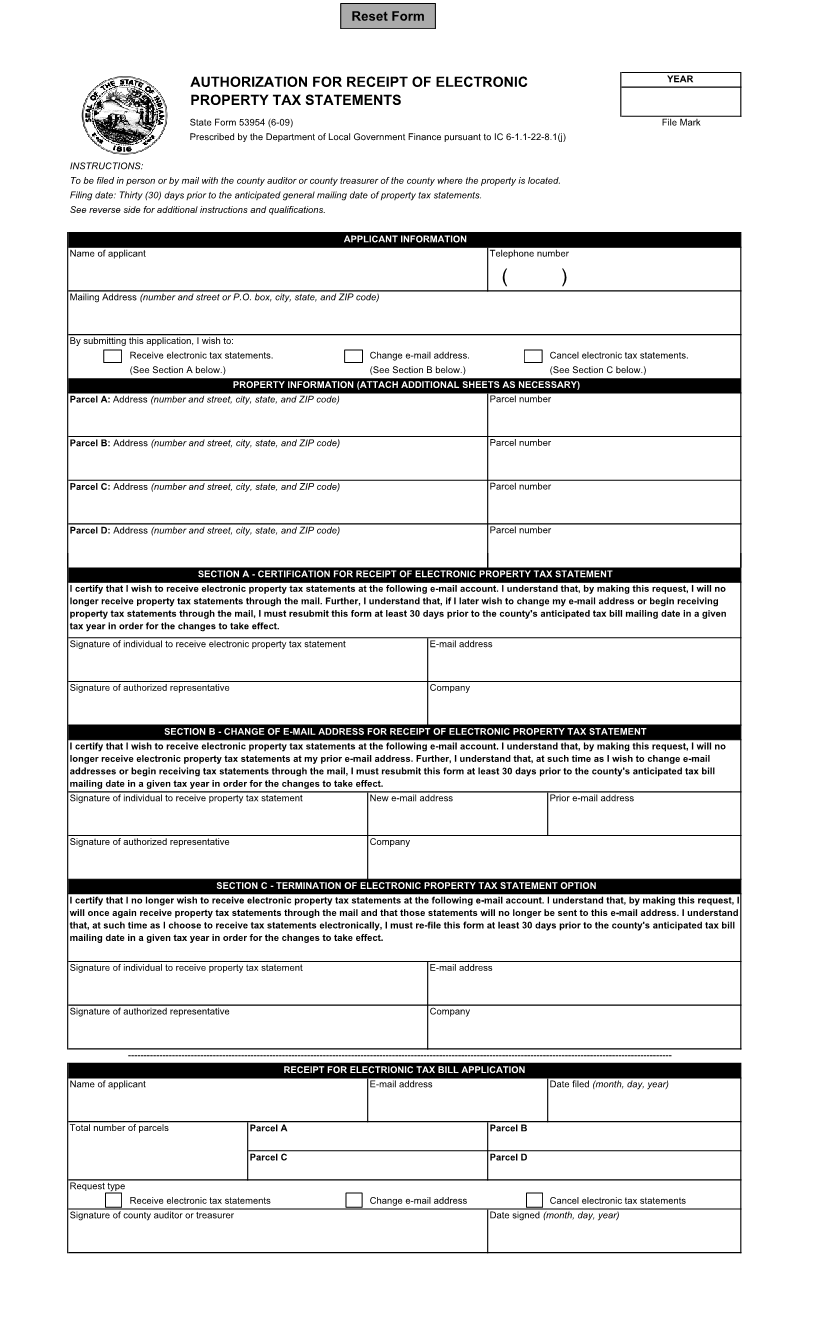

AUTHORIZATION FOR RECEIPT OF ELECTRONIC YEAR

PROPERTY TAX STATEMENTS

State Form 53954 (6-09) File Mark

Prescribed by the Department of Local Government Finance pursuant to IC 6-1.1-22-8.1(j)

INSTRUCTIONS:

To be filed in person or by mail with the county auditor or county treasurer of the county where the property is located.

Filing date: Thirty (30) days prior to the anticipated general mailing date of property tax statements.

See reverse side for additional instructions and qualifications.

APPLICANT INFORMATION

Name of applicant Telephone number

( )

Mailing Address (number and street or P.O. box, city, state, and ZIP code)

By submitting this application, I wish to:

Receive electronic tax statements. Change e-mail address. Cancel electronic tax statements.

(See Section A below.) (See Section B below.) (See Section C below.)

PROPERTY INFORMATION (ATTACH ADDITIONAL SHEETS AS NECESSARY)

Parcel A: Address (number and street, city, state, and ZIP code) Parcel number

Parcel B: Address (number and street, city, state, and ZIP code) Parcel number

Parcel C: Address (number and street, city, state, and ZIP code) Parcel number

Parcel D: Address (number and street, city, state, and ZIP code) Parcel number

SECTION A - CERTIFICATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX STATEMENT

I certify that I wish to receive electronic property tax statements at the following e-mail account. I understand that, by making this request, I will no

longer receive property tax statements through the mail. Further, I understand that, if I later wish to change my e-mail address or begin receiving

property tax statements through the mail, I must resubmit this form at least 30 days prior to the county's anticipated tax bill mailing date in a given

tax year in order for the changes to take effect.

Signature of individual to receive electronic property tax statement E-mail address

Signature of authorized representative Company

SECTION B - CHANGE OF E-MAIL ADDRESS FOR RECEIPT OF ELECTRONIC PROPERTY TAX STATEMENT

I certify that I wish to receive electronic property tax statements at the following e-mail account. I understand that, by making this request, I will no

longer receive electronic property tax statements at my prior e-mail address. Further, I understand that, at such time as I wish to change e-mail

addresses or begin receiving tax statements through the mail, I must resubmit this form at least 30 days prior to the county's anticipated tax bill

mailing date in a given tax year in order for the changes to take effect.

Signature of individual to receive property tax statement New e-mail address Prior e-mail address

Signature of authorized representative Company

SECTION C - TERMINATION OF ELECTRONIC PROPERTY TAX STATEMENT OPTION

I certify that I no longer wish to receive electronic property tax statements at the following e-mail account. I understand that, by making this request, I

will once again receive property tax statements through the mail and that those statements will no longer be sent to this e-mail address. I understand

that, at such time as I choose to receive tax statements electronically, I must re-file this form at least 30 days prior to the county's anticipated tax bill

mailing date in a given tax year in order for the changes to take effect.

Signature of individual to receive property tax statement E-mail address

Signature of authorized representative Company

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

RECEIPT FOR ELECTRIONIC TAX BILL APPLICATION

Name of applicant E-mail address Date filed (month, day, year)

Total number of parcels Parcel A Parcel B

Parcel C Parcel D

Request type

Receive electronic tax statements Change e-mail address Cancel electronic tax statements

Signature of county auditor or treasurer Date signed (month, day, year)