Enlarge image

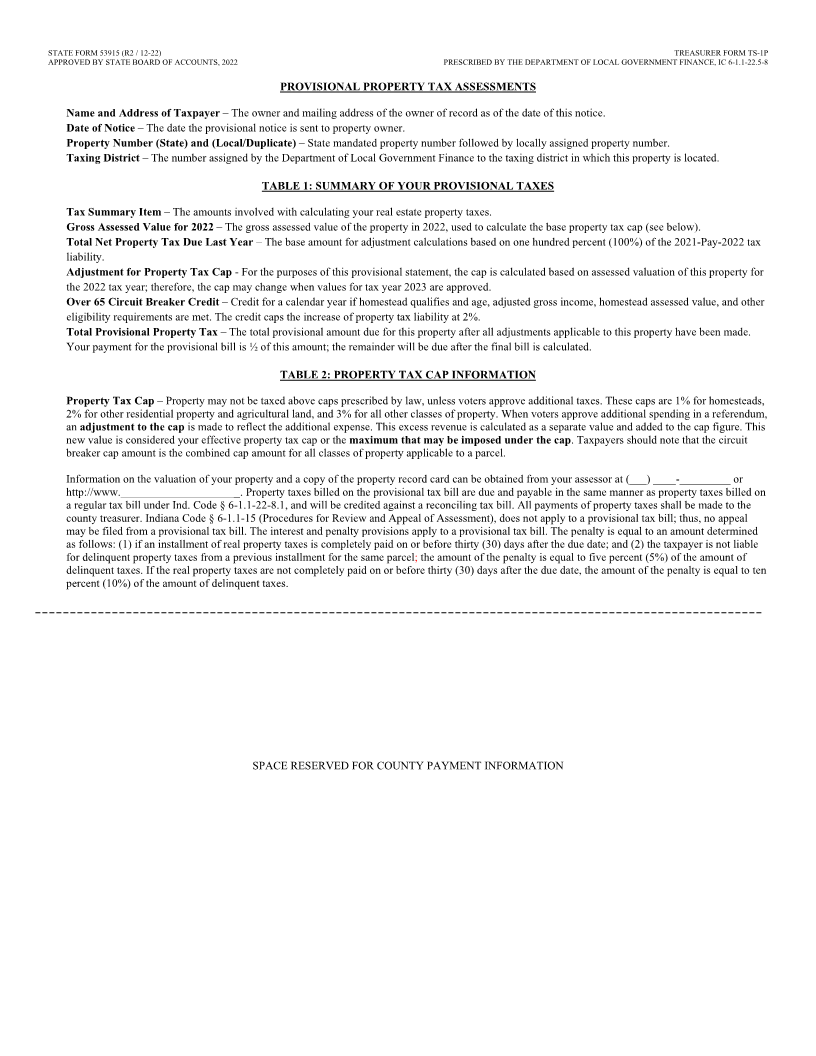

STATE FORM 53915 (R2 / 12-22) TREASURER FORM TS-1P

APPROVED BY STATE BOARD OF ACCOUNTS, 20 19 PRESCRIBED BY THE DEPARTMENT OF LOCAL GOVERNMENT FINANCE, IC 6-1.1-22.5-8

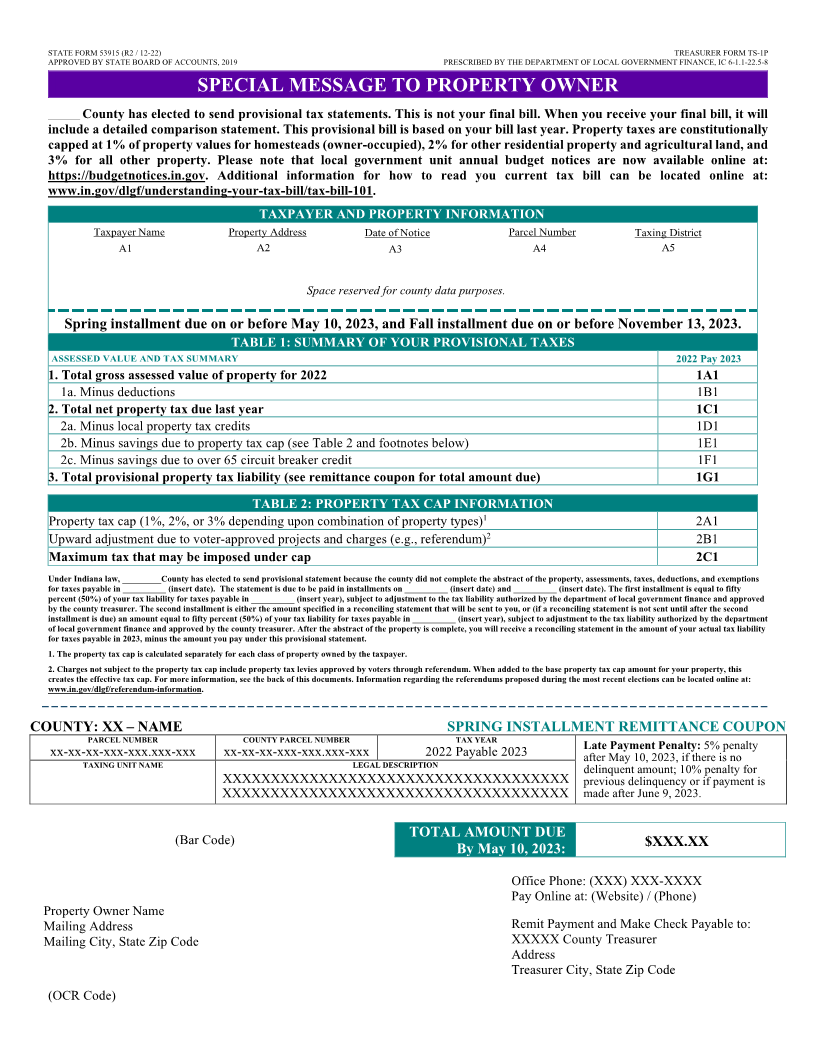

SPECIAL MESSAGE TO PROPERTY OWNER

________ County has elected to send provisional tax statements. This is not your final bill. When you receive your final bill, it will

include a detailed comparison statement. This provisional bill is based on your bill last year. Property taxes are constitutionally

capped at 1% of property values for homesteads (owner-occupied), 2% for other residential property and agricultural land, and

3% for all other property. Please note that local government unit annual budget notices are now available online at:

https://budgetnotices.in.gov. Additional information for how to read you current tax bill can be located online at:

www.in.gov/dlgf/understanding-your-tax-bill/tax-bill-101.

TAXPAYER AND PROPERTY INFORMATION

Taxpayer Name Property Address Date of Notice Parcel Number Taxing District

A1 A2 A3 A4 A5

Space reserved for county data purposes.

Spring installment due on or before May 10, 2023, and Fall installment due on or before November 13, 2023.

TABLE 1: SUMMARY OF YOUR PROVISIONAL TAXES

ASSESSED VALUE AND TAX SUMMARY 2022 Pay 2023

1. Total gross assessed value of property for 2022 1A1

1a. Minus deductions 1B1

2. Total net property tax due last year 1C1

2a. Minus local property tax credits 1D1

2b. Minus savings due to property tax cap (see Table 2 and footnotes below) 1E1

2c. Minus savings due to over 65 circuit breaker credit 1F1

3. Total provisional property tax liability (see remittance coupon for total amount due) 1G1

TABLE 2: PROPERTY TAX CAP INFORMATION

Property tax cap (1%, 2%, or 3% depending upon combination of property types) 1 2A1

Upward adjustment due to voter-approved projects and charges (e.g., referendum) 2 2B1

Maximum tax that may be imposed under cap 2C1

Under Indiana law, _________County has elected to send provisional statement because the county did not complete the abstract of the property, assessments, taxes, deductions, and exemptions

for taxes payable in __________ (insert date). The statement is due to be paid in installments on __________ (insert date) and __________ (insert date). The first installment is equal to fifty

percent (50%) of your tax liability for taxes payable in __________ (insert year), subject to adjustment to the tax liability authorized by the department of local government finance and approved

by the county treasurer. The second installment is either the amount specified in a reconciling statement that will be sent to you, or (if a reconciling statement is not sent until after the second

installment is due) an amount equal to fifty percent (50%) of your tax liability for taxes payable in __________ (insert year), subject to adjustment to the tax liability authorized by the department

of local government finance and approved by the county treasurer. After the abstract of the property is complete, you will receive a reconciling statement in the amount of your actual tax liability

for taxes payable in 2023, minus the amount you pay under this provisional statement.

1. The property tax cap is calculated separately for each class of property owned by the taxpayer.

2. Charges not subject to the property tax cap include property tax levies approved by voters through referendum. When added to the base property tax cap amount for your property, this

creates the effective tax cap. For more information, see the back of this documents. Information regarding the referendums proposed during the most recent elections can be located online at:

www.in.gov/dlgf/referendum-information.

COUNTY: XX – NAME SPRING INSTALLMENT REMITTANCE COUPON

PARCEL NUMBER COUNTY PARCEL NUMBER TAX YEAR

Late Payment Penalty: 5% penalty

xx-xx-xx-xxx-xxx.xxx-xxxTAXING UNIT NAME xx-xx-xx-xxx-xxx.xxx-xxxLEGAL DESCRIPTION2022 Payable 2023 after May 10, 2023, if there is no

delinquent amount; 10% penalty for

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX previous delinquency or if payment is

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX made after June 9, 2023.

TOTAL AMOUNT DUE

(Bar Code) $XXX.XX

By May 10, 2023:

Office Phone: (XXX) XXX-XXXX

Pay Online at: (Website) / (Phone)

Property Owner Name

Mailing Address Remit Payment and Make Check Payable to:

Mailing City, State Zip Code XXXXX County Treasurer

Address

Treasurer City, State Zip Code

(OCR Code)