Enlarge image

Reset Form

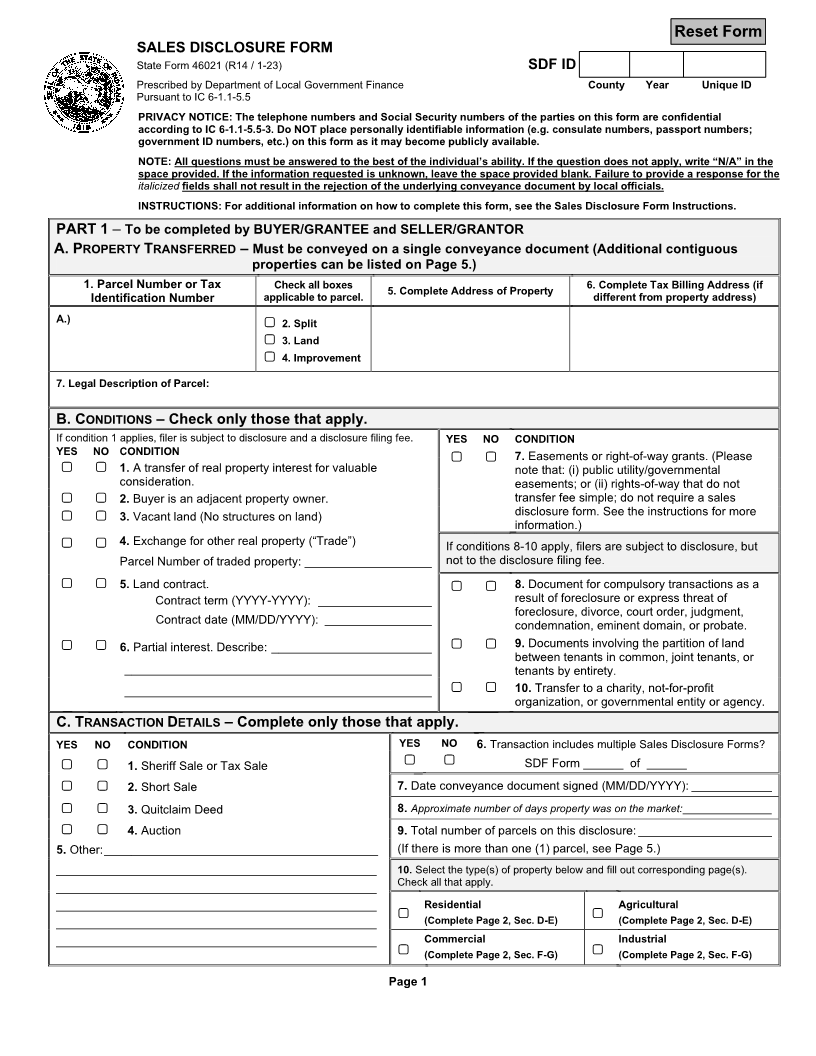

SALES DISCLOSURE FORM

State Form 46021 (R1 4/ 1-23) SDF ID

Prescribed by Department of Local Government Finance County Year Unique ID

Pursuant to IC 6-1.1-5.5

PRIVACY NOTICE: The telephone numbers and Social Security numbers of the parties on this form are confidential

according to IC 6-1.1-5.5-3. Do NOT place personally identifiable information (e.g. consulate numbers, passport numbers;

government ID numbers, etc.) on this form as it may become publicly available.

NOTE: All questions must be answered to the best of the individual’s ability. If the question does not apply, write “N/A” in the

space provided. If the information requested is unknown, leave the space provided blank. Failure to provide a response for the

italicized fields shall not result in the rejection of the underlying conveyance document by local officials.

INSTRUCTIONS: For additional information on how to complete this form, see the Sales Disclosure Form Instructions.

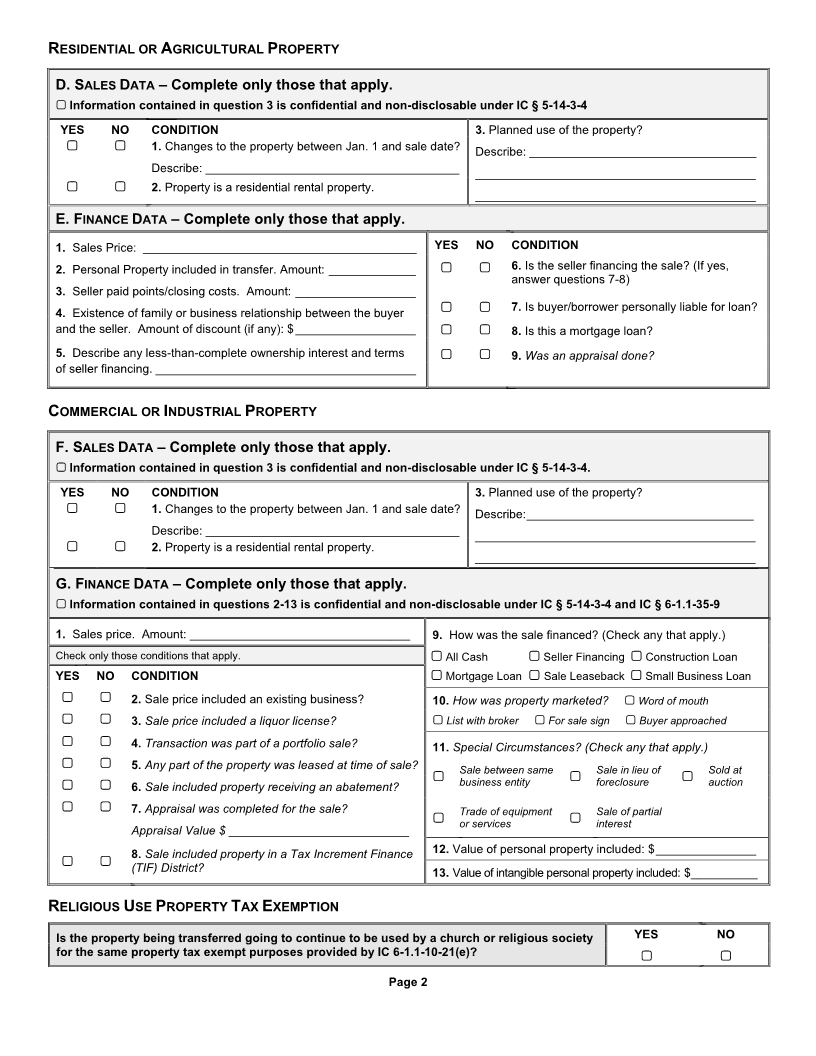

PART 1 – To be completed by BUYER/GRANTEE and SELLER/GRANTOR

A. PROPERTY TRANSFERRED – Must be conveyed on a single conveyance document (Additional contiguous

properties can be listed on Page 5.)

1. Parcel Number or Tax Check all boxes 5. Complete Address of Property 6. Complete Tax Billing Address (if

Identification Number applicable to parcel. different from property address)

A.) 2. Split

▢

3. Land

▢

4. Improvement

▢

7. Legal Description of Parcel:

B. CONDITIONS – Check only those that apply.

If condition 1 applies, filer is subject to disclosure and a disclosure filing fee. YES NO CONDITION

YES NO CONDITION 7. Easements or right-of-way grants. (Please

▢ ▢

1. A transfer of real property interest for valuable

▢ ▢ consideration. note that: (i) public utility/governmental

easements; or (ii) rights-of-way that do not

2. Buyer is an adjacent property owner. transfer fee simple; do not require a sales

▢ ▢ disclosure form. See the instructions for more

3. Vacant land (No structures on land)

▢ ▢ information.)

4. Exchange for other real property (“Trade”)

▢ ▢ If conditions 8-10 apply, filers are subject to disclosure, but

Parcel Number of traded property: ___________________ not to the disclosure filing fee.

5. Land contract. 8. Document for compulsory transactions as a

▢ ▢ ▢ ▢ result of foreclosure or express threat of

Contract term (YYYY-YYYY): _________________

foreclosure, divorce, court order, judgment,

Contract date (MM/DD/YYYY): ________________ condemnation, eminent domain, or probate.

9. Documents involving the partition of land

▢ ▢ 6. Partial interest. Describe: ________________________ ▢ ▢ between tenants in common, joint tenants, or

______________________________________________ tenants by entirety.

10. Transfer to a charity, not-for-profit

______________________________________________ ▢ ▢ organization, or governmental entity or agency.

C. TRANSACTION DETAILS – Complete only those that apply.

YES NO CONDITION YES NO 6. Transaction includes multiple Sales Disclosure Forms?

1. Sheriff Sale or Tax Sale

▢ ▢ ▢ ▢ SDF Form ______ of ______

2. Short Sale 7. Date conveyance document signed (MM/DD/YYYY): ____________

▢ ▢

3. Quitclaim Deed 8. Approximate number of days property was on the market: _______________

▢ ▢

4. Auction 9. Total number of parcels on this disclosure: ____________________

▢ ▢

5. Other: _________________________________________ (If there is more than one (1) parcel, see Page 5.)

________________________________________________ 10. Select the type(s) of property below and fill out corresponding page(s).

________________________________________________ Check all that apply.

________________________________________________ Residential Agricultural

________________________________________________ ▢ (Complete Page 2, Sec. D-E) ▢ (Complete Page 2, Sec. D-E)

________________________________________________ Commercial Industrial

▢ (Complete Page 2, Sec. F-G) ▢ (Complete Page 2, Sec. F-G)

Page 1