Enlarge image

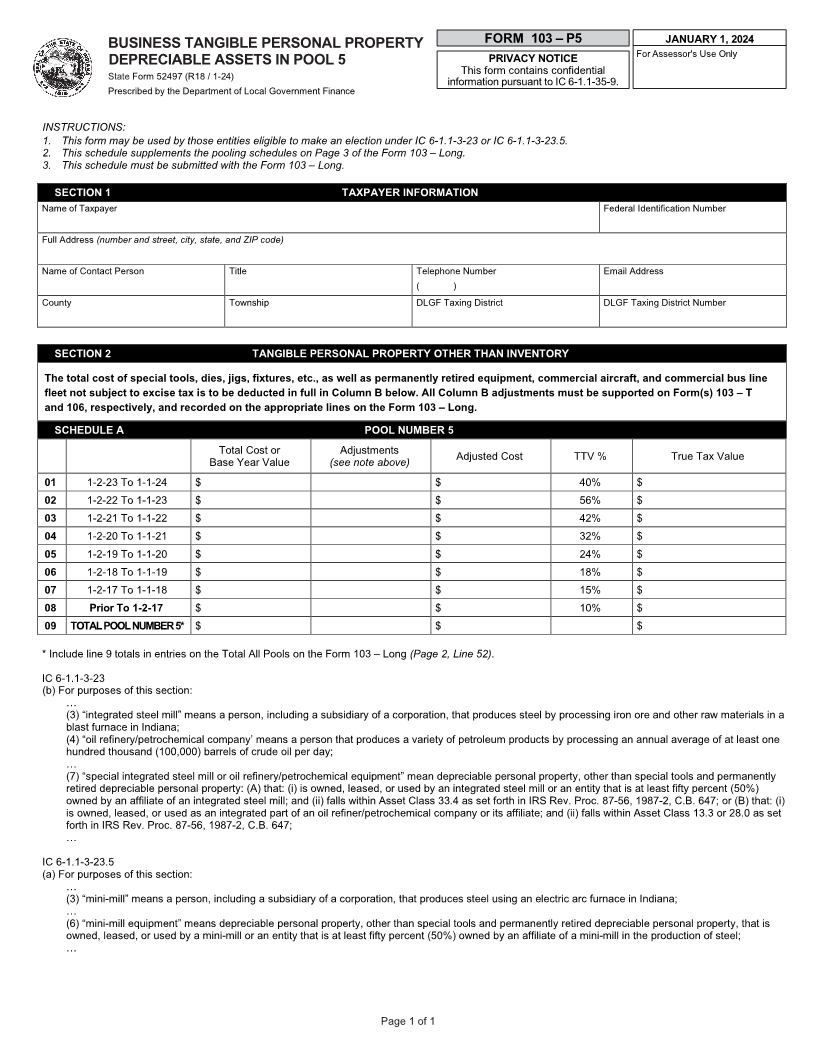

FORM 103 – P5 JANUARY 1, 2024

BUSINESS TANGIBLE PERSONAL PROPERTY PRIVACY NOTICE For Assessor's Use Only

DEPRECIABLE ASSETS IN POOL 5

State Form 52497 (R18 / 1-24) This form contains confidential

information pursuant to IC 6-1.1-35-9.

Prescribed by the Department of Local Government Finance

INSTRUCTIONS:

1. This form may be used by those entities eligible to make an election under IC 6-1.1-3-23 or IC 6-1.1-3-23.5.

2. This schedule supplements the pooling schedules on Page 3 of the Form 103 – Long.

3. This schedule must be submitted with the Form 103 – Long.

SECTION 1 TAXPAYER INFORMATION

Name of Taxpayer Federal Identification Number

Full Address (number and street, city, state, and ZIP code)

Name of Contact Person Title Telephone Number Email Address

( )

County Township DLGF Taxing District DLGF Taxing District Number

SECTION 2 TANGIBLE PERSONAL PROPERTY OTHER THAN INVENTORY

The total cost of special tools, dies, jigs, fixtures, etc., as well as permanently retired equipment, commercial aircraft, and commercial bus line

fleet not subject to excise tax is to be deducted in full in Column B below. All Column B adjustments must be supported on Form(s) 103 – T

and 106, respectively, and recorded on the appropriate lines on the Form 103 – Long.

SCHEDULE A POOL NUMBER 5

Total Cost or Adjustments Adjusted Cost TTV % True Tax Value

Base Year Value (see note above)

01 1-2-2 3To 1-1-2 4 $ $ 40% $

02 1-2-2 2To 1-1-2 3 $ $ 56% $

03 1-2-2 1To 1-1-2 2 $ $ 42% $

04 1-2-20 To 1-1-21 $ $ 32% $

05 1-2-1 9To 1-1- 20 $ $ 24% $

06 1-2-1 8To 1-1-1 9 $ $ 18% $

07 1-2-1 7To 1-1-1 8 $ $ 15% $

08 Prior To 1-2-1 7 $ $ 10% $

09 TOTAL POOL NUMBER 5* $ $ $

* Include line 9 totals in entries on the Total All Pools on the Form 103 – Long (Page 2, Line 52).

IC 6-1.1-3-23

(b) For purposes of this section:

…

(3) “integrated steel mill” means a person, including a subsidiary of a corporation, that produces steel by processing iron ore and other raw materials in a

blast furnace in Indiana;

(4) “oil refinery/petrochemical company’ means a person that produces a variety of petroleum products by processing an annual average of at least one

hundred thousand (100,000) barrels of crude oil per day;

…

(7) “special integrated steel mill or oil refinery/petrochemical equipment” mean depreciable personal property, other than special tools and permanently

retired depreciable personal property: (A) that: (i) is owned, leased, or used by an integrated steel mill or an entity that is at least fifty percent (50%)

owned by an affiliate of an integrated steel mill; and (ii) falls within Asset Class 33.4 as set forth in IRS Rev. Proc. 87-56, 1987-2, C.B. 647; or (B) that: (i)

is owned, leased, or used as an integrated part of an oil refiner/petrochemical company or its affiliate; and (ii) falls within Asset Class 13.3 or 28.0 as set

forth in IRS Rev. Proc. 87-56, 1987-2, C.B. 647;

…

IC 6-1.1-3-23.5

(a) For purposes of this section:

…

(3) “mini-mill” means a person, including a subsidiary of a corporation, that produces steel using an electric arc furnace in Indiana;

…

(6) “mini-mill equipment” means depreciable personal property, other than special tools and permanently retired depreciable personal property, that is

owned, leased, or used by a mini-mill or an entity that is at least fifty percent (50%) owned by an affiliate of a mini-mill in the production of steel;

…

Page 1 of 1