Enlarge image

Reset Form

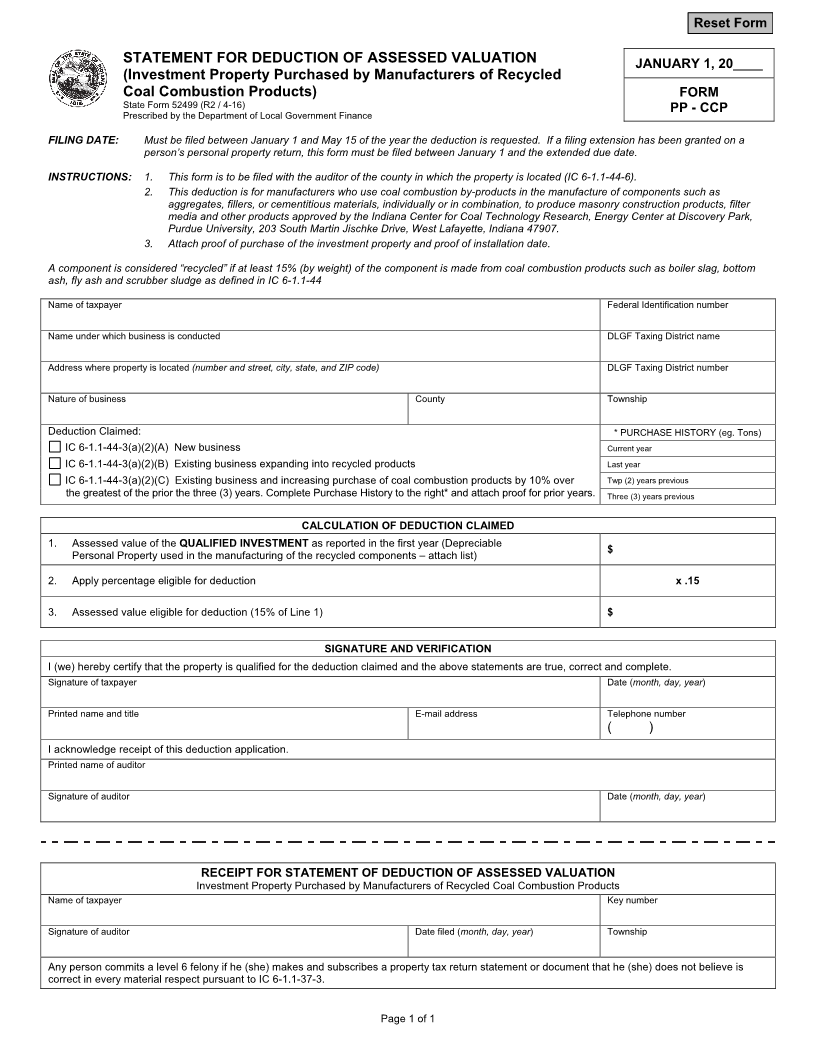

STATEMENT FOR DEDUCTION OF ASSESSED VALUATION JANUARY 1, 20____

(Investment Property Purchased by Manufacturers of Recycled

Coal Combustion Products) FORM

State Form 52499 (R2 / 4-16) PP - CCP

Prescribed by the Department of Local Government Finance

FILING DATE: Must be filed between January 1 and May 15 of the year the deduction is requested. If a filing extension has been granted on a

person’s personal property return, this form must be filed between January 1 and the extended due date.

INSTRUCTIONS: 1. This form is to be filed with the auditor of the county in which the property is located (IC 6-1.1-44-6).

2. This deduction is for manufacturers who use coal combustion by-products in the manufacture of components such as

aggregates, fillers, or cementitious materials, individually or in combination, to produce masonry construction products, filter

media and other products approved by the Indiana Center for Coal Technology Research, Energy Center at Discovery Park,

Purdue University, 203 South Martin Jischke Drive, West Lafayette, Indiana 47907.

3. Attach proof of purchase of the investment property and proof of installation date.

A component is considered “recycled” if at least 15% (by weight) of the component is made from coal combustion products such as boiler slag, bottom

ash, fly ash and scrubber sludge as defined in IC 6-1.1-44

Name of taxpayer Federal Identification number

Name under which business is conducted DLGF Taxing District name

Address where property is located (number and street, city, state, and ZIP code) DLGF Taxing District number

Nature of business County Township

Deduction Claimed: * PURCHASE HISTORY (eg. Tons)

IC 6-1.1-44-3(a)(2)(A) New business Current year

IC 6-1.1-44-3(a)(2)(B) Existing business expanding into recycled products Last year

IC 6-1.1-44-3(a)(2)(C) Existing business and increasing purchase of coal combustion products by 10% over Twp (2) years previous

the greatest of the prior the three (3) years. Complete Purchase History to the right* and attach proof for prior years. Three (3) years previous

CALCULATION OF DEDUCTION CLAIMED

1. Assessed value of the QUALIFIED INVESTMENT as reported in the first year (Depreciable $

Personal Property used in the manufacturing of the recycled components – attach list)

2. Apply percentage eligible for deduction x .15

3. Assessed value eligible for deduction (15% of Line 1) $

SIGNATURE AND VERIFICATION

I (we) hereby certify that the property is qualified for the deduction claimed and the above statements are true, correct and complete.

Signature of taxpayer Date (month, day, year)

Printed name and title E-mail address Telephone number

( )

I acknowledge receipt of this deduction application.

Printed name of auditor

Signature of auditor Date (month, day, year)

RECEIPT FOR STATEMENT OF DEDUCTION OF ASSESSED VALUATION

Investment Property Purchased by Manufacturers of Recycled Coal Combustion Products

Name of taxpayer Key number

Signature of auditor Date filed (month, day, year) Township

Any person commits a level 6 felony if he (she) makes and subscribes a property tax return statement or document that he (she) does not believe is

correct in every material respect pursuant to IC 6-1.1-37-3.

Page 1 of 1