Enlarge image

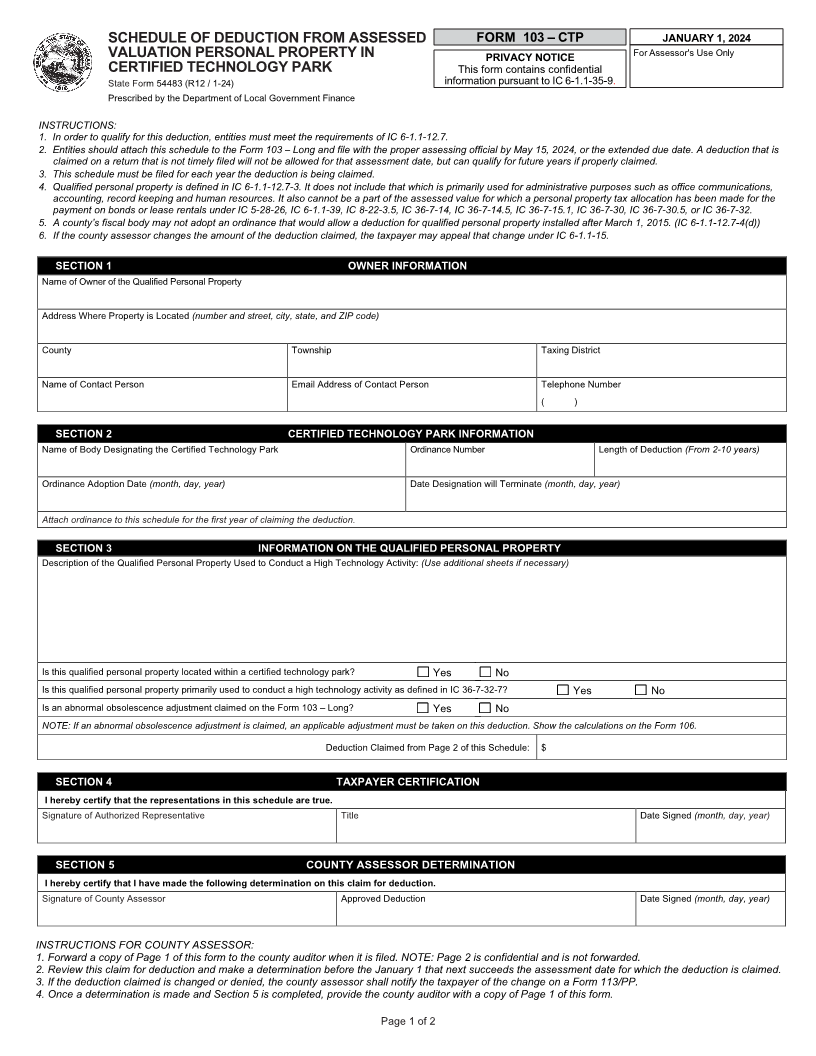

SCHEDULE OF DEDUCTION FROM ASSESSED FORM 103 – CTP JANUARY 1, 2024

VALUATION PERSONAL PROPERTY IN PRIVACY NOTICE For Assessor's Use Only

CERTIFIED TECHNOLOGY PARK This form contains confidential

State Form 54483 (R12 / 1-24) information pursuant to IC 6-1.1-35-9.

Prescribed by the Department of Local Government Finance

INSTRUCTIONS:

1. In order to qualify for this deduction, entities must meet the requirements of IC 6-1.1-12.7.

2. Entities should attach this schedule to the Form 103 –Long and file with the proper assessing official by May 15, 2024, or the extended due date. A deduction that is

claimed on a return that is not timely filed will not be allowed for that assessment date, but can qualify for future years if properly claimed.

3. This schedule must be filed for each year the deduction is being claimed.

4. Qualified personal property is defined in IC 6-1.1-12.7-3. It does not include that which is primarily used for administrative purposes such as office communications,

accounting, record keeping and human resources. It also cannot be a part of the assessed value for which a personal property tax allocation has been made for the

payment on bonds or lease rentals under IC 5-28-26, IC 6-1.1-39, IC 8-22-3.5, IC 36-7-14, IC 36-7-14.5, IC 36-7-15.1, IC 36-7-30, IC 36-7-30.5, or IC 36-7-32.

5. A county’s fiscal body may not adopt an ordinance that would allow a deduction for qualified personal property installed after March 1, 2015. (IC 6-1.1-12.7-4(d))

6. If the county assessor changes the amount of the deduction claimed, the taxpayer may appeal that change under IC 6-1.1-15.

SECTION 1 OWNER INFORMATION

Name of Owner of the Qualified Personal Property

Address Where Property is Located (number and street, city, state, and ZIP code)

County Township Taxing District

Name of Contact Person Email Address of Contact Person Telephone Number

( )

SECTION 2 CERTIFIED TECHNOLOGY PARK INFORMATION

Name of Body Designating the Certified Technology Park Ordinance Number Length of Deduction (From 2-10 years)

Ordinance Adoption Date (month, day, year) Date Designation will Terminate (month, day, year)

Attach ordinance to this schedule for the first year of claiming the deduction.

NF

SECTION 3 INFORMATION ON THE QUALIFIED PERSONAL PROPERTY

Description of the Qualified Personal Property Used to Conduct a High Technology Activity: (Use additional sheets if necessary)

Is this qualified personal property located within a certified technology park? ☐ Yes ☐ No

Is this qualified personal property primarily used to conduct a high technology activity as defined in IC 36-7-32-7? ☐ Yes ☐ No

Is an abnormal obsolescence adjustment claimed on the Form 103 – Long? ☐ Yes ☐ No

NOTE: If an abnormal obsolescence adjustment is claimed, an applicable adjustment must be taken on this deduction. Show the calculations on the Form 106.

Deduction Claimed from Page 2 of this Schedule: $

SECTION 4 TAXPAYER CERTIFICATION

I hereby certify that the representations in this schedule are true.

Signature of Authorized Representative Title Date Signed (month, day, year)

SECTION 5 COUNTY ASSESSOR DETERMINATION

I hereby certify that I have made the following determination on this claim for deduction.

Signature of County Assessor Approved Deduction Date Signed (month, day, year)

INSTRUCTIONS FOR COUNTY ASSESSOR:

1. Forward a copy of Page 1 of this form to the county auditor when it is filed. NOTE: Page 2 is confidential and is not forwarded.

2. Review this claim for deduction and make a determination before the January 1 that next succeeds the assessment date for which the deduction is claimed.

3. If the deduction claimed is changed or denied, the county assessor shall notify the taxpayer of the change on a Form 113/PP.

4. Once a determination is made and Section 5 is completed, provide the county auditor with a copy of Page 1 of this form.

Page 1 of 2