Enlarge image

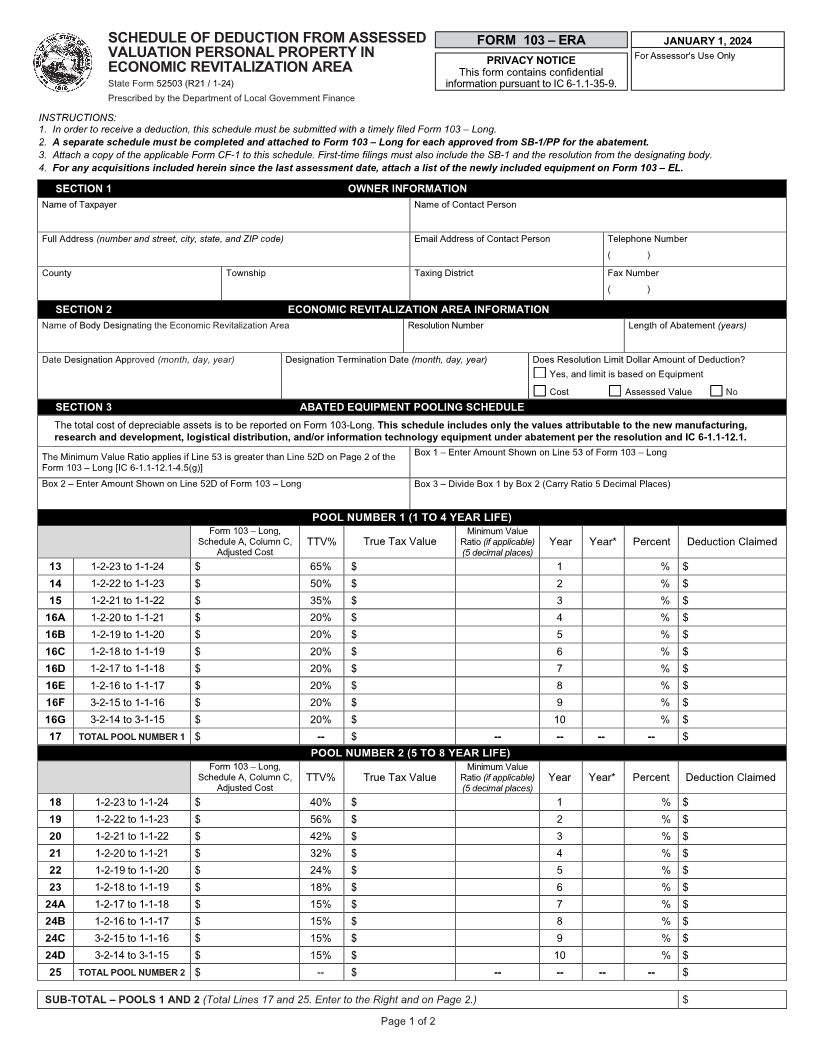

SCHEDULE OF DEDUCTION FROM ASSESSED FORM 103 – ERA JANUARY 1, 2024

VALUATION PERSONAL PROPERTY IN PRIVACY NOTICE For Assessor's Use Only

ECONOMIC REVITALIZATION AREA This form contains confidential

State Form 52503 (R21 / 1-24) information pursuant to IC 6-1.1-35-9.

Prescribed by the Department of Local Government Finance

INSTRUCTIONS:

1. In order to receive a deduction, this schedule must be submitted with a timely filed Form 103 – Long.

2. A separate schedule must be completed and attached to Form 103 – Long for each approved from SB-1/PP for the abatement.

3. Attach a copy of the applicable Form CF-1 to this schedule. First-time filings must also include the SB-1 and the resolution from the designating body.

4. For any acquisitions included herein since the last assessment date, attach a list of the newly included equipment on Form 103 – EL.

SECTION 1 OWNER INFORMATION

Name of Taxpayer Name of Contact Person

Full Address (number and street, city, state, and ZIP code) Email Address of Contact Person Telephone Number

( )

County Township Taxing District Fax Number

( )

SECTION 2 ECONOMIC REVITALIZATION AREA INFORMATION

Name of Body Designating the Economic Revitalization Area Resolution Number Length of Abatement (years)

Date Designation Approved (month, day, year) Designation Termination Date (month, day, year) Does Resolution Limit Dollar Amount of Deduction?

☐ Yes, and limit is based on Equipment

☐ Cost ☐ Assessed Value ☐ No

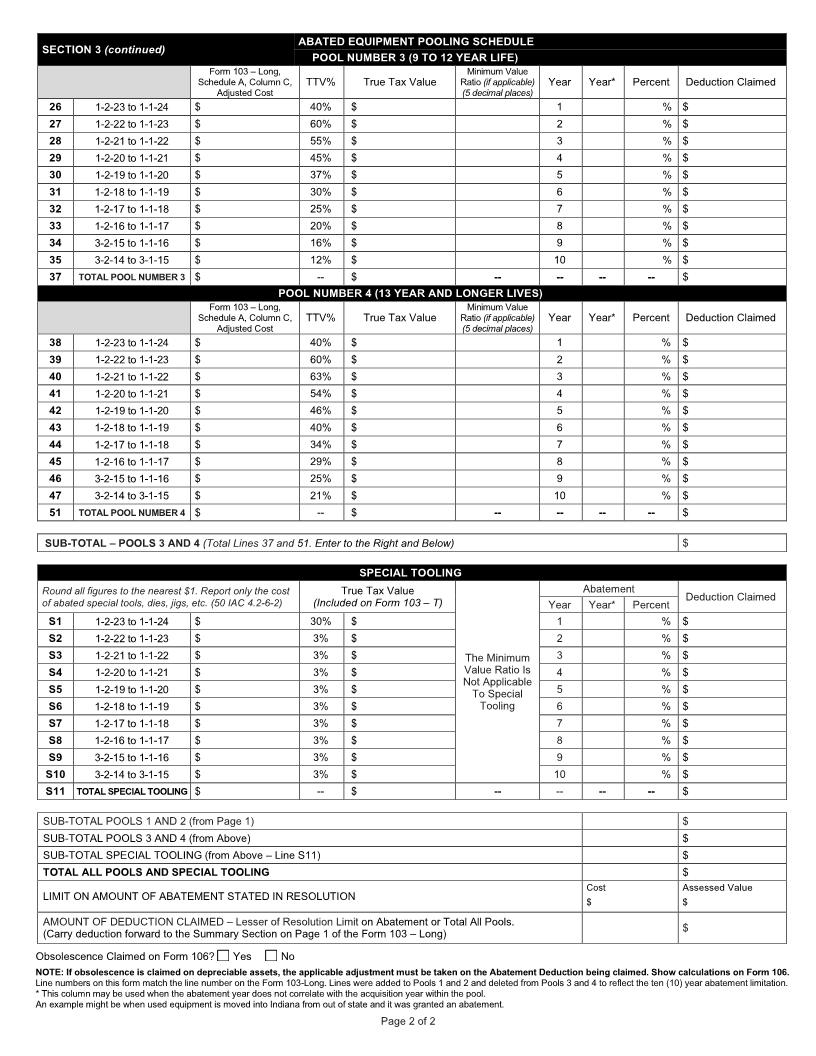

SECTION 3 ABATED EQUIPMENT POOLING SCHEDULE

The total cost of depreciable assets is to be reported on Form 103-Long. This schedule includes only the values attributable to the new manufacturing,

research and development, logistical distribution, and/or information technology equipment under abatement per the resolution and IC 6-1.1-12.1.

The Minimum Value Ratio applies if Line 53 is greater than Line 52D on Page 2 of the Box 1 – Enter Amount Shown on Line 53 of Form 103 – Long

Form 103 – Long [IC 6-1.1-12.1-4.5(g)]

Box 2 – Enter Amount Shown on Line 52D of Form 103 – Long Box 3 – Divide Box 1 by Box 2 (Carry Ratio 5 Decimal Places)

POOL NUMBER 1 (1 TO 4 YEAR LIFE)

Form 103 – Long, Minimum Value

Schedule A, Column C, TTV% True Tax Value Ratio (if applicable) Year Year* Percent Deduction Claimed

Adjusted Cost (5 decimal places)

13 1-2-23 to 1-1-24 $ 65% $ 1 % $

14 1-2-22 to 1-1-23 $ 50% $ 2 % $

15 1-2-21 to 1-1-22 $ 35% $ 3 % $

16A 1-2-20 to 1-1-21 $ 20% $ 4 % $

16B 1-2-19 to 1-1-20 $ 20% $ 5 % $

16C 1-2-18 to 1-1-19 $ 20% $ 6 % $

16D 1-2-17 to 1-1-18 $ 20% $ 7 % $

16E 1-2-16 to 1-1-17 $ 20% $ 8 % $

16F 3-2-15 to 1-1-16 $ 20% $ 9 % $

16G 3-2-14 to 3-1-15 $ 20% $ 10 % $

17 TOTAL POOL NUMBER 1 $ -- $ -- -- -- -- $

POOL NUMBER 2 (5 TO 8 YEAR LIFE)

Form 103 – Long, Minimum Value

Schedule A, Column C, TTV% True Tax Value Ratio (if applicable) Year Year* Percent Deduction Claimed

Adjusted Cost (5 decimal places)

18 1-2-23 to 1-1-24 $ 40% $ 1 % $

19 1-2-22 to 1-1-23 $ 56% $ 2 % $

20 1-2-21 to 1-1-22 $ 42% $ 3 % $

21 1-2-20 to 1-1-21 $ 32% $ 4 % $

22 1-2-19 to 1-1-20 $ 24% $ 5 % $

23 1-2-18 to 1-1-19 $ 18% $ 6 % $

24A 1-2-17 to 1-1-18 $ 15% $ 7 % $

24B 1-2-16 to 1-1-17 $ 15% $ 8 % $

24C 3-2-15 to 1-1-16 $ 15% $ 9 % $

24D 3-2-14 to 3-1-15 $ 15% $ 10 % $

25 TOTAL POOL NUMBER 2 $ -- $ -- -- -- -- $

SUB-TOTAL – POOLS 1 AND 2 (Total Lines 17 and 25. Enter to the Right and on Page 2.) $

Page 1 of 2