Enlarge image

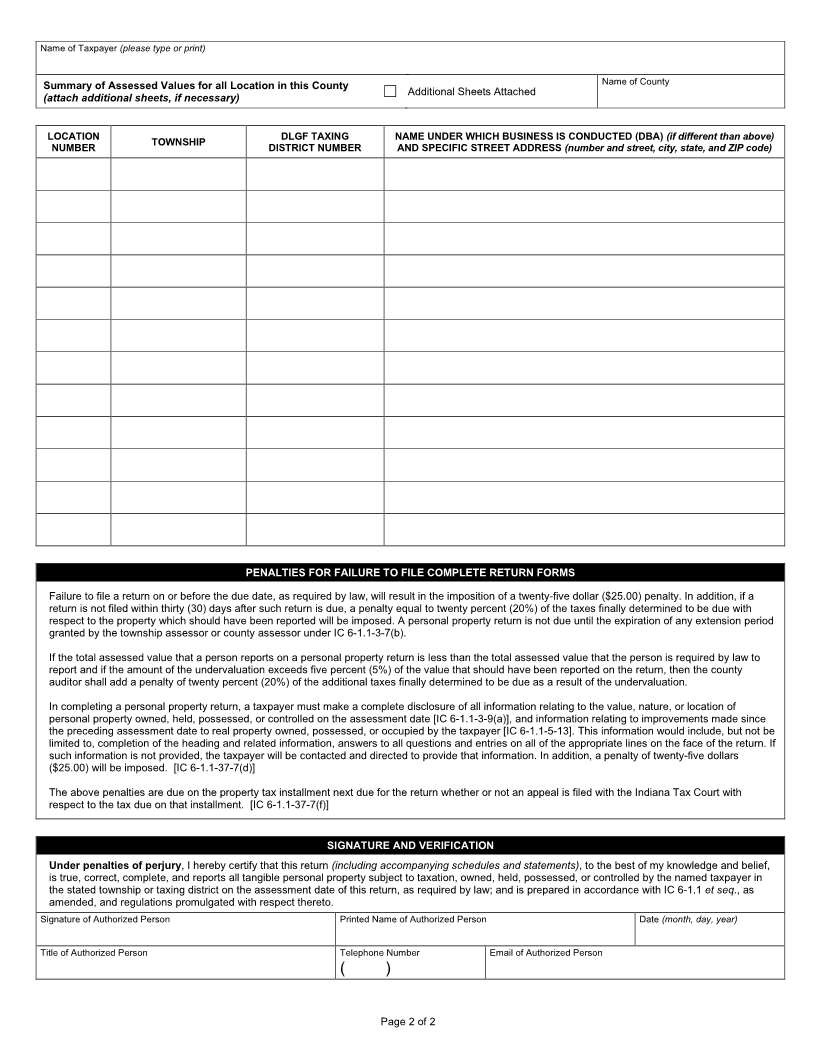

Reset Form

SINGLE RETURN BUSINESS TANGIBLE JANUARY 1, _______

PERSONAL PROPERTY FORM 104-SR For Assessor's Use Only

State Form53855 (R6 / 1-23)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS:

1. This form must accompany a Single Return Business Tangible Personal Property Form (Form 103-SR).

2. This form must be filed with the county assessor not later than May 15, unless an extension is granted in writing.

NOTE: For taxpayers with less than $80,000 in acquisition costs to report within the county, legislation was passed in 2021 which exempts the property. If you

are declaring this exemption, please file Form 103-Short or Form 103-Long.

TAXPAYER INFORMATION

Name of Taxpayer (please type or print) County

Name Business is Conducted Under NAICS Code Number*

Property Address (number and street, city, state, and ZIP code)

Nature of Business

Name for Assessment and Tax Notice (if different than above)

Mailing Address for Assessment and Tax Notice (number and street, city, state, and ZIP code) (if different than above)

FILING REQUIREMENT

All taxpayers filing Form 103-SR must complete Form 104-SR. Taxpayers filing Forms 102, 103-Long , or 103-Short must complete Form 104.

ADDITIONAL RETURN REQUIREMENTS

A copy of Form 103-SR and Form 104-SR, for each township listed on the return, must be filed with the county assessor.

Were expenditures made since the last assessment date for improvements on any real estate owned, possessed, Yes ☐ No

or occupied by the taxpayer in the township wherein this return is filed? ☐

(If Yes, attach a statement setting forth: name of owner, location of real estate and explaining nature, cost, beginning date of construction or improvements, and

date construction was completed. If not completed as of January 1, state the percentage completed at that time.) [IC 6-1.1-5-13]

SUMMARY LOCATION NUMBER LOCATION NUMBER LOCATION NUMBER

(Round all numbers to nearest ten dollars) ______________ ______________ ______________

SCHEDULE A – PERSONAL PROPERTY + $ $ $

FINAL ASSESSED VALUE = $ $ $

SUMMARY LOCATION NUMBER LOCATION NUMBER LOCATION NUMBER

(Round all numbers to nearest ten dollars) ______________ ______________ ______________

SCHEDULE A – PERSONAL PROPERTY + $ $ $

FINAL ASSESSED VALUE = $ $ $

* NAICS – North American Industry Classification System – A complete list of codes may be found at: www.census.gov. For further information, contact the

assessor (contact information is available at: http://www.in.gov/dlgf/contact-your-local-officials).

Page 1 of 2