Enlarge image

Reset Form

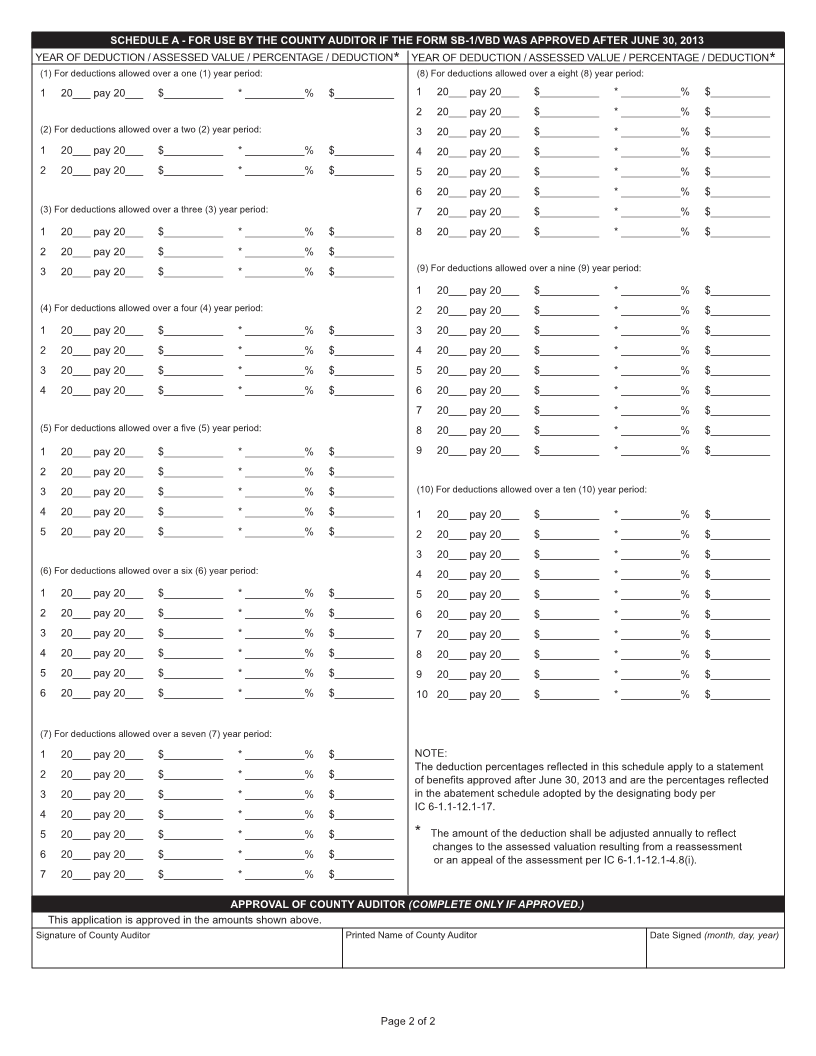

APPLICATION FOR DEDUCTION FROM ASSESSED VALUATION 20____ PAY 20____

REAL PROPERTY VACANT BUILDING DEDUCTION

State Form 53179 (R5 / 1-21) FORM 322 / VBD

Prescribed by the Department of Local Government Finance

INSTRUCTIONS:

1. This form is to be filed with the county auditor of the county in which the eligible vacant building is located.

2. To obtain a vacant building deduction, a Form 322/VBD must be filed with the county auditor before May 10 in the year in which the property owner or

his tenant occupies the vacant building or not later than thirty (30) days after the assessment notice is mailed to the property owner if it was mailed after

April 9. If the property owner misses these deadlines in the initial year of occupation, he can apply between January 1 and May 10 of a subsequent year.

3. The eligible vacant building must have been unoccupied for at least one (1) year and be zoned for commercial or industrial purposes.

4. A copy of the approved Form SB-1/VBD, the resolution adopted by the designating body, and the Form CF-1/VBD must be attached to this application.

5. A property owner who files this form must provide the county auditor and the designating body with a Form CF-1/VBD to show compliance with the

approved Form SB-1/VBD. The Form CF-1/VBD must also be updated and provided to the county auditor and the designating body for each

assessment year in which the deduction is applicable.

SECTION 1 PROPERTY INFORMATION

Address of property (number and street, city, state, and ZIP code)

County Township DLGF taxing district number Parcel number

Name of owner Name of contact person

Mailing address of owner (number and street, city, state, and ZIP code)

Telephone number Fax number E-mail address

( ) ( )

SECTION 2 REQUEST FOR DEDUCTION AND DESCRIPTION OF BENEFIT TO TAXING JURISDICTION

Describe the real property investment

Total cost of the real property investment

Is this property within an Economic Revitalization Area (ERA)? Is this property within a Tax Increment Financing (TIF) district as defined in IC 6-1.1-21.2-3?

Yes No Yes No

ASSESSED VALUE OF LAND ASSESSED VALUE OF ASSESSED VALUE OF LAND AND *ASSESSED VALUE OF ELIGIBLE

IMPROVEMENTS IMPROVEMENTS (TOTAL A/V) VACANT BUILDING

$$$ $

*NOTE: The amount of the deduction is the assessed value of the building or part of the building that is occupied by the property owner or a tenant of the

property owner that qualifies as an eligible vacant building as defined in IC 6-1.1-12.1, multiplied by the percentage determined by the designating body

under IC 6-1.1-12.1-17.

I hereby certify that the above named taxpayer is liable for property taxes at the above listed location on the indicated assessment date and that the

representations on this application are true and correct. I further certify that the real property investment identified above is eligible for the vacant

building deduction as outlined in IC 6-1.1-12.1-4.8 and IC 6-1.1-12.1-16, as applicable.

Signature of owner or representative (if representative, attach power of attorney) Date signed (month, day, year)

Printed name of signatory Title Telephone number of preparer

( )

Page 1 of 2