Enlarge image

Reset Form

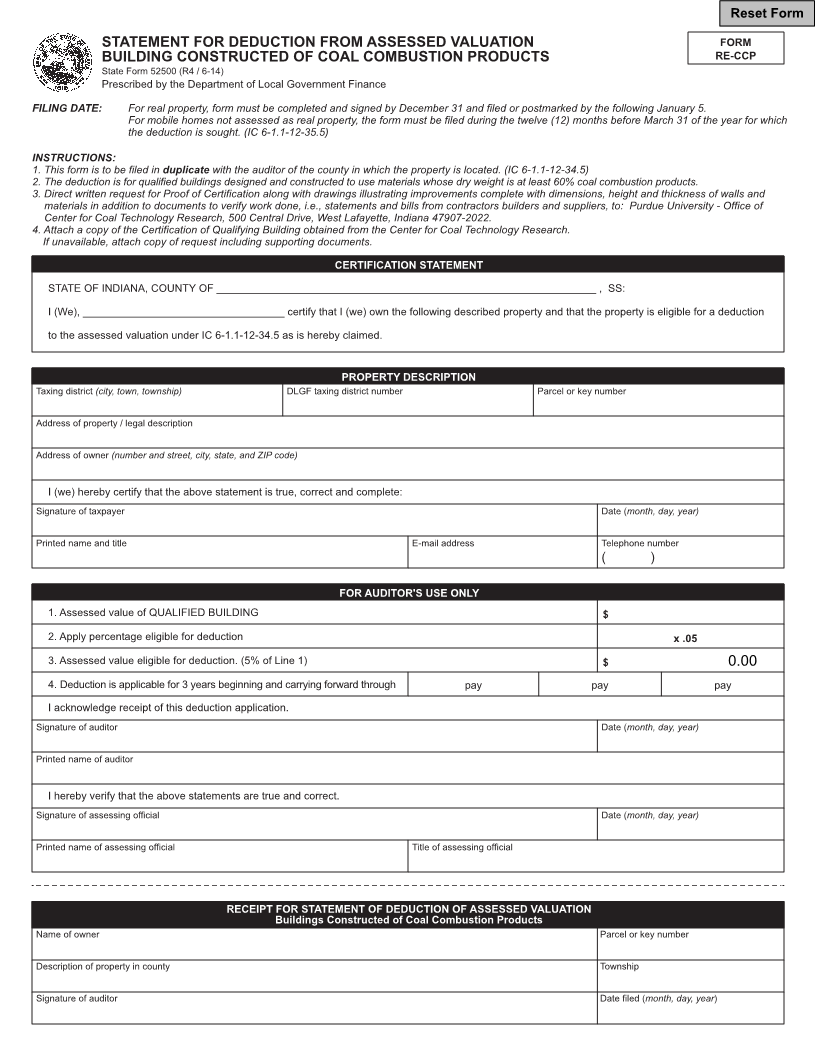

STATEMENT FOR DEDUCTION FROM ASSESSED VALUATION FORM

BUILDING CONSTRUCTED OF COAL COMBUSTION PRODUCTS RE-CCP

State Form 52500 (R4 / 6-14)

Prescribed by the Department of Local Government Finance

FILING DATE: For real property, form must be completed and signed by December 31 and filed or postmarked by the following January 5.

For mobile homes not assessed as real property, the form must be filed during the twelve (12) months before March 31 of the year for which

the deduction is sought. (IC 6-1.1-12-35.5)

INSTRUCTIONS:

1. This form is to be filed in duplicate with the auditor of the county in which the property is located. (IC 6-1.1-12-34.5)

2. The deduction is for qualified buildings designed and constructed to use materials whose dry weight is at least 60% coal combustion products.

3. Direct written request for Proof of Certification along with drawings illustrating improvements complete with dimensions, height and thickness of walls and

materials in addition to documents to verify work done, i.e., statements and bills from contractors builders and suppliers, to: Purdue University - Office of

Center for Coal Technology Research, 500 Central Drive, West Lafayette, Indiana 47907-2022.

4. Attach a copy of the Certification of Qualifying Building obtained from the Center for Coal Technology Research.

If unavailable, attach copy of request including supporting documents.

CERTIFICATION STATEMENT

STATE OF INDIANA, COUNTY OF ________________________________________________________________ , SS:

I (We), __________________________________ certify that I (we) own the following described property and that the property is eligible for a deduction

to the assessed valuation under IC 6-1.1-12-34.5 as is hereby claimed.

PROPERTY DESCRIPTION

Taxing district (city, town, township) DLGF taxing district number Parcel or key number

Address of property / legal description

Address of owner (number and street, city, state, and ZIP code)

I (we) hereby certify that the above statement is true, correct and complete:

Signature of taxpayer Date (month, day, year)

Printed name and title E-mail address Telephone number

( )

FOR AUDITOR'S USE ONLY

1. Assessed value of QUALIFIED BUILDING $

2. Apply percentage eligible for deduction x .05

3. Assessed value eligible for deduction. (5% of Line 1) $ 0.00

4. Deduction is applicable for 3 years beginning and carrying forward through pay pay pay

I acknowledge receipt of this deduction application.

Signature of auditor Date (month, day, year)

Printed name of auditor

I hereby verify that the above statements are true and correct.

Signature of assessing official Date (month, day, year)

Printed name of assessing official Title of assessing official

RECEIPT FOR STATEMENT OF DEDUCTION OF ASSESSED VALUATION

Buildings Constructed of Coal Combustion Products

Name of owner Parcel or key number

Description of property in county Township

Signature of auditor Date filed (month, day, year)