Enlarge image

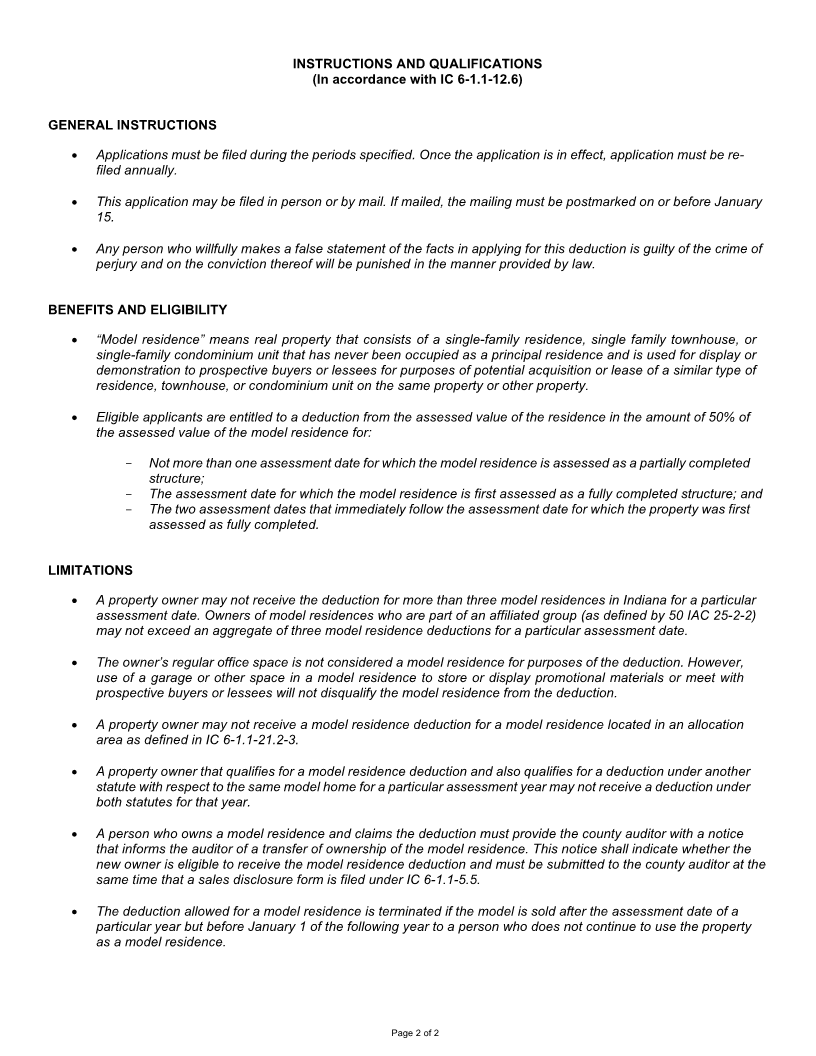

Reset Form

APPLICATION FOR MODEL RESIDENCE DEDUCTION January 1, 20___ payable in 20___

State Form 53812 (R4 / 9-24) For Official Use Only

Prescribed by the Department of Local Government Finance

INSTRUCTIONS: This form is to be filed annually, by mail or in person, with the county auditor of the county where the property is located.

Filing Date: To receive deduction for a calendar year, this form must be completed, signed, and filed or postmarked by the following January 15.

See Page 2 for additional instructions and qualifications.

APPLICANT INFORMATION

Name of Applicant Telephone Number Email Address

( )

Business Address (number and street, city, state, and ZIP code) County

PROPERTY INFORMATION

Address of Model Residence (number and street, city, state, and ZIP code)

Brief Description of Residence and Any Other Real Property Claimed for Deduction

Legal Description Key Number Assessed Value of Qualifying Real Property

As of January 1, 20___, the property is: Have you received this deduction on this property in prior years? If yes, indicate which years

☐ Partially completed ☐ Fully completed ☐ Yes, as partially completed ☐ Yes, as fully completed ☐ No

Deduction Claimed (50% of Qualifying Assessed Value) Is the property located in an allocation area as defined by IC 6-1.1-21.2-3?

☐ Yes ☐ No

Are there other deductions applied to this property? If yes, please list:

☐ Yes ☐ No

Have you filed for this deduction on other properties located in Indiana, either alone or as a member of an affiliated group?

If yes, please list below.

☐ Yes ☐ No

Property Address (number and street, city, state, and ZIP code) Key Number / Legal Description of Property County

A.

B.

C.

CERTIFICATION

I/We certify, under penalty of perjury, that the above and foregoing information is true and correct.

Signature of Applicant or Authorized Representative Printed Name of Applicant or Authorized representative Date Signed (month, day, year)

VERIFICATION BY ASSESSING OFFICIAL

Is property recommended for deduction? Assessed Value of Qualifying Real Property Recommended Deduction (50% of Qualifying Real Property)

☐ Yes ☐ No

Signature of Assessing Official Printed Name of Assessing Official Date Signed (month, day, year)

FINAL DETERMINATION OF COUNTY AUDITOR

Approved Deduction

Deduction determined by County Auditor for January 1, 20____ payable in 20____: $

Signature of County Auditor Printed Name of County Auditor Date Signed (month, day, year)

Description or Reasons for Change:

Distribution on date of filing: Original – County Auditor; File stamped copy – Applicant; File stamped copy – Township Assessor, if any, or County Assessor

Distribution on date that determination is made: Original – County Auditor; Copy – Applicant; Copy – Township Assessor, if any, or County Assessor

Page 1 of 2