Enlarge image

Reset Form

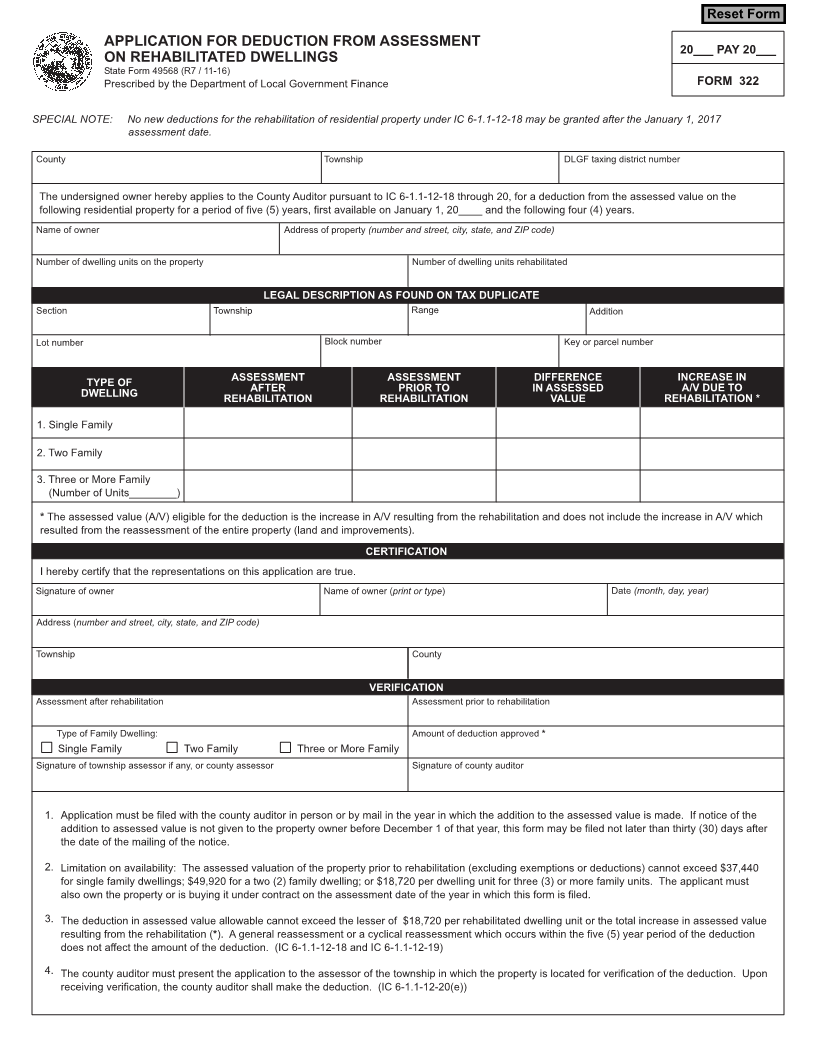

APPLICATION FOR DEDUCTION FROM ASSESSMENT

20___ PAY 20___

ON REHABILITATED DWELLINGS

State Form 49568 (R7 / 11-16)

Prescribed by the Department of Local Government Finance FORM 322

SPECIAL NOTE: No new deductions for the rehabilitation of residential property under IC 6-1.1-12-18 may be granted after the January 1, 2017

assessment date.

County Township DLGF taxing district number

The undersigned owner hereby applies to the County Auditor pursuant to IC 6-1.1-12-18 through 20, for a deduction from the assessed value on the

following residential property for a period of five (5) years, first available on January 1, 20____ and the following four (4) years.

Name of owner Address of property (number and street, city, state, and ZIP code)

Number of dwelling units on the property Number of dwelling units rehabilitated

LEGAL DESCRIPTION AS FOUND ON TAX DUPLICATE

Section Township Range Addition

Lot number Block number Key or parcel number

TYPE OF ASSESSMENT ASSESSMENT DIFFERENCE INCREASE IN

DWELLING AFTER PRIOR TO IN ASSESSED A/V DUE TO

REHABILITATION REHABILITATION VALUE REHABILITATION *

1. Single Family

2. Two Family

3. Three or More Family

(Number of Units________)

* The assessed value (A/V) eligible for the deduction is the increase in A/V resulting from the rehabilitation and does not include the increase in A/V which

resulted from the reassessment of the entire property (land and improvements).

CERTIFICATION

I hereby certify that the representations on this application are true.

Signature of owner Name of owner (print or type) Date (month, day, year)

Address (number and street, city, state, and ZIP code)

Township County

VERIFICATION

Assessment after rehabilitation Assessment prior to rehabilitation

Type of Family Dwelling: Amount of deduction approved *

Single Family Two Family Three or More Family

Signature of township assessor if any, or county assessor Signature of county auditor

1. Application must be filed with the county auditor in person or by mail in the year in which the addition to the assessed value is made. If notice of the

addition to assessed value is not given to the property owner before December 1 of that year, this form may be filed not later than thirty (30) days after

the date of the mailing of the notice.

2. Limitation on availability: The assessed valuation of the property prior to rehabilitation (excluding exemptions or deductions) cannot exceed $37,440

for single family dwellings; $49,920 for a two (2) family dwelling; or $18,720 per dwelling unit for three (3) or more family units. The applicant must

also own the property or is buying it under contract on the assessment date of the year in which this form is filed.

3. The deduction in assessed value allowable cannot exceed the lesser of $18,720 per rehabilitated dwelling unit or the total increase in assessed value

resulting from the rehabilitation (*). A general reassessment or a cyclical reassessment which occurs within the five (5) year period of the deduction

does not affect the amount of the deduction. (IC 6-1.1-12-18 and IC 6-1.1-12-19)

4. The county auditor must present the application to the assessor of the township in which the property is located for verification of the deduction. Upon

receiving verification, the county auditor shall make the deduction. (IC 6-1.1-12-20(e))