Enlarge image

Reset Form

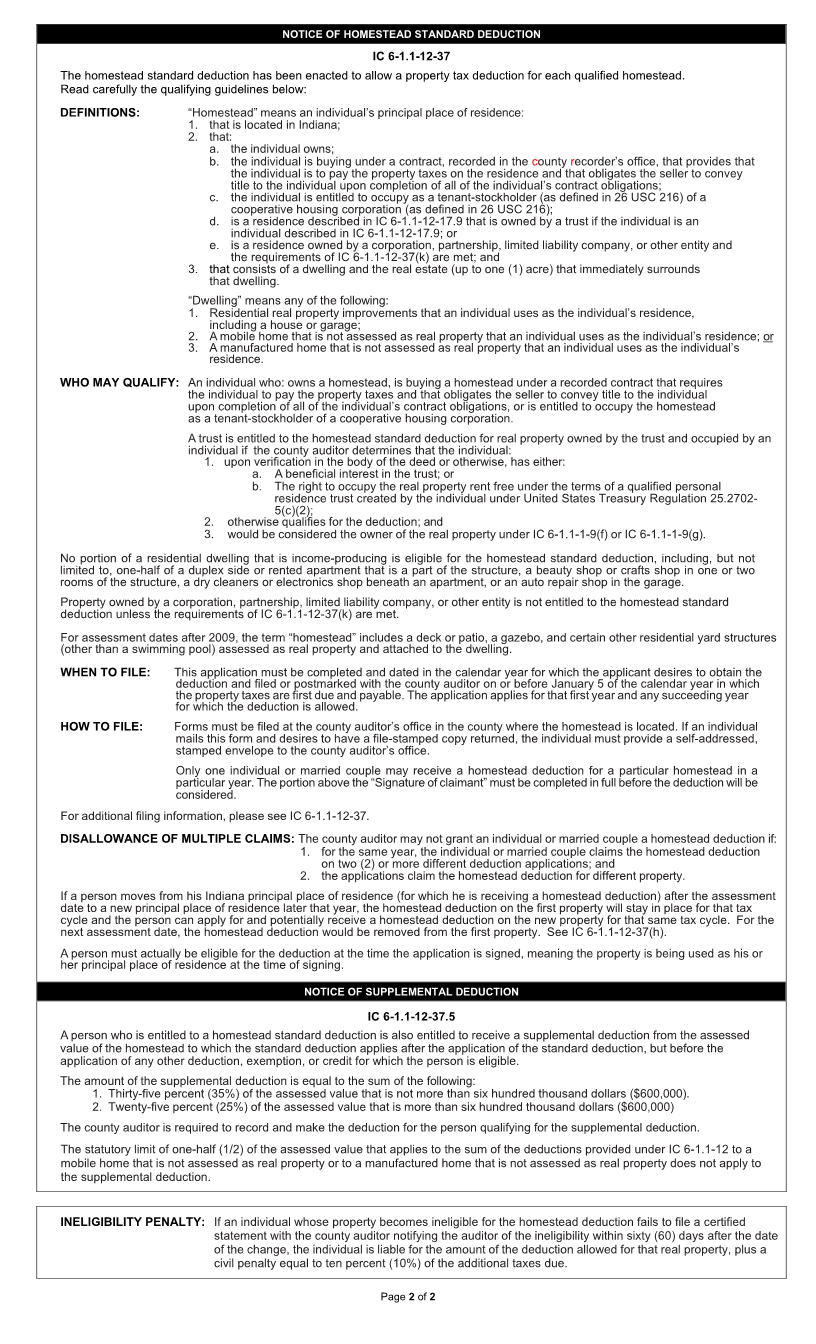

CLAIM FOR HOMESTEAD PROPERTY TAX FORM YEAR

STANDARD / SUPPLEMENTAL DEDUCTION

State Form 5473 (R19 / 1-23) HC10

Prescribed by the Department of Local Government Finance

INSTRUCTIONS: See reverse side for filing instructions.

NOTE: Telephone, Social Security, driver’s license, state identification and federal identification numbers are confidential under IC 6-1.1-12-37.

CERTIFICATION STATEMENT

I (We) ____________________________________________________________________________ certify that I (we) occupied as my (our) principal place of

residence or am (are) buying the following described real property under contract for which a Homestead Property Tax Standard Deduction is hereby claimed on the

date this application is signed, ___________________________ (date of signature). I (We):

☐ Own. ☐ Am (are) buying under recorded contract.

☐ Am (are) entitled to occupy as a tenant-stockholder of a cooperative housing corporation.

☐ Have a beneficial interest in the trust or the right to occupy the property under the terms of a qualified personal residence trust.

☐ Am (are) the shareholder, partner, or member of the entity that owns the property.

CLAIMANT’S INFORMATION

Name of Claimant (legal name) Telephone Number of Claimant Email Address

( )

Social Security Number of Claimant (last five digits) Driver’s License / Identification / Other Number of Claimant (last five digits) Issuing State

(Applicable only if applicant does not have a social security number)

Name of Claimant’s Spouse (legal name)

Social Security Number of Claimant’s Spouse (last five digits) Driver’s License / Identification / Other Number of Claimant’s Spouse (last five digits) Issuing State

(Applicable only if applicant’s spouse does not have a social security number)

CONTRACT RECORDED

If Buying on Contract, Fee Simple Owner’s Name

Recorder’s Office Where Contract is Recorded Record Number Page

PROPERTY DESCRIPTION

County Township Taxing District (city, town, township)

Parcel Number Legal Description Is the property in question:

☐ Real Property ☐ Annually Assessed Mobile Home (IC 6-1.1-7)

If any portion of the residential structure or the land not exceeding one (1) acre that immediately surrounds that structure is used to produce income, describe the use and portion

of the property utilized to produce income.

PROPERTY OWNED ELSEWHERE BY CLAIMANT

State, County, and Township Is Claimant Vacating a Homestead?

☐ Yes ☐ No

Signature of Claimant

I hereby certify the above statements are true, correct, and complete.

Address of Contact (number and street, city, state, and ZIP code) Address of Vacated Homestead, if any (number and street, city, state, and ZIP code)

ASSESSOR USE ONLY ASSESSED VALUE HOMESTEAD VALUE NON-RESIDENTIAL VALUE

Land Not Exceeding One (1) Acre Immediately (1)

Surrounding Residential Improvement

Other Land (2)

Total Land (line 1 plus line 2) (3)

Residential Improvements or Dwelling (4)

Annually Assessed Mobile /

Manufactured Home Garage (5)

Other Improvements (6)

Total Improvements (Line 4 through Line 6) (7)

Total Value (Line 3 plus Line 7) (8)

Signature of Assessor Date Signed (date, month, year)

I hereby certify the above is true, correct, and complete.

Verifying Action – Signature of Auditor Date Signed (date, month, year)

STANDARD DEDUCTION ALLOWANCE

20 ______ Pay 20 ______ Lesser of 60% of the assessed value of the homestead or $48,000.

Notwithstanding any other provision, the sum of the deductions provided in IC 6-1.1-12 to a mobile home that $

is not assessed as real property or to a manufactured home that is not assessed as real property may not

exceed one-half (1/2) of the assessed value of the mobile home or manufactured home.

Signature of Auditor Date Signed (month, day, year)

DISTRIBUTION: Original – County Auditor, File-Stamped Copy – Taxpayer

Page 1of 2