Enlarge image

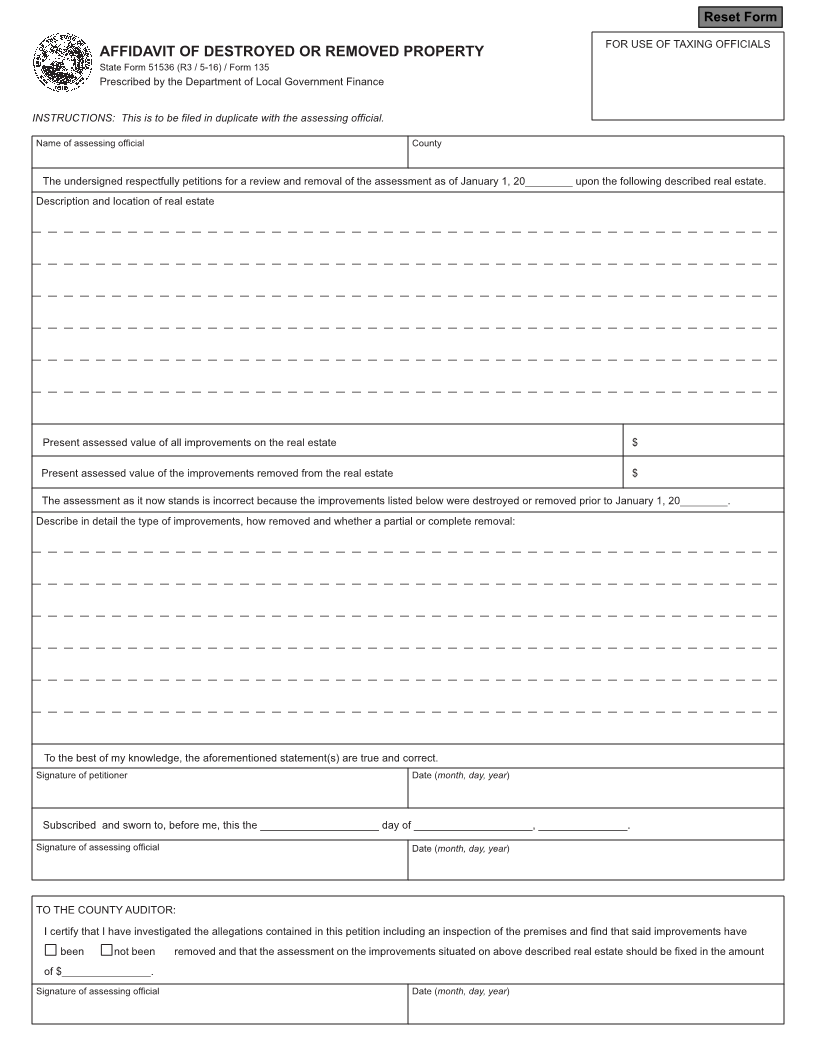

Reset Form

FOR USE OF TAXING OFFICIALS

AFFIDAVIT OF DESTROYED OR REMOVED PROPERTY

State Form 51536 (R3 / 5-16) / Form 135

Prescribed by the Department of Local Government Finance

INSTRUCTIONS: This is to be filed in duplicate with the assessing official.

Name of assessing official County

The undersigned respectfully petitions for a review and removal of the assessment as of January 1, 20________ upon the following described real estate.

Description and location of real estate

Present assessed value of all improvements on the real estate $

Present assessed value of the improvements removed from the real estate $

The assessment as it now stands is incorrect because the improvements listed below were destroyed or removed prior to January 1, 20________.

Describe in detail the type of improvements, how removed and whether a partial or complete removal:

To the best of my knowledge, the aforementioned statement(s) are true and correct.

Signature of petitioner Date (month, day, year)

Subscribed and sworn to, before me, this the ____________________ day of ____________________, _______________.

Signature of assessing official Date (month, day, year)

TO THE COUNTY AUDITOR:

I certify that I have investigated the allegations contained in this petition including an inspection of the premises and find that said improvements have

been not been removed and that the assessment on the improvements situated on above described real estate should be fixed in the amount

of $_______________.

Signature of assessing official Date (month, day, year)