Enlarge image

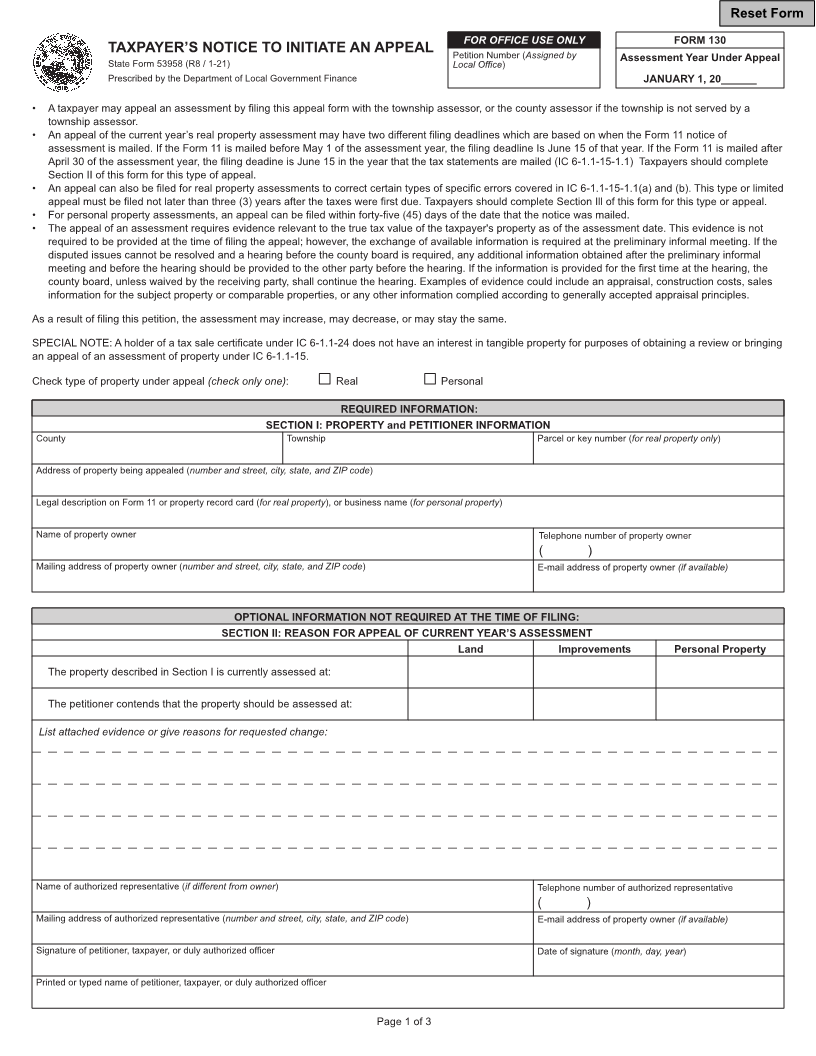

Reset Form

FOR OFFICE USE ONLY FORM 130

TAXPAYER’S NOTICE TO INITIATE AN APPEAL Petition Number (Assigned by

State Form 53958 (R8 / 1-21) Local Office) Assessment Year Under Appeal

Prescribed by the Department of Local Government Finance JANUARY 1, 20______

• A taxpayer may appeal an assessment by filing this appeal form with the township assessor, or the county assessor if the township is not served by a

township assessor.

• An appeal of the current year’s real property assessment may have two different filing deadlines which are based on when the Form 11 notice of

assessment is mailed. If the Form 11 is mailed before May 1 of the assessment year, the filing deadline Is June 15 of that year. If the Form 11 is mailed after

April 30 of the assessment year, the filing deadine is June 15 in the year that the tax statements are mailed (IC 6-1.1-15-1.1) Taxpayers should complete

Section II of this form for this type of appeal.

• An appeal can also be filed for real property assessments to correct certain types of specific errors covered in IC 6-1.1-15-1.1(a) and (b). This type or limited

appeal must be filed not later than three (3) years after the taxes were first due. Taxpayers should complete Section Ill of this form for this type or appeal.

• For personal property assessments, an appeal can be filed within forty-five (45) days of the date that the notice was mailed.

• The appeal of an assessment requires evidence relevant to the true tax value of the taxpayer's property as of the assessment date. This evidence is not

required to be provided at the time of filing the appeal; however, the exchange of available information is required at the preliminary informal meeting. If the

disputed issues cannot be resolved and a hearing before the county board is required, any additional information obtained after the preliminary informal

meeting and before the hearing should be provided to the other party before the hearing. If the information is provided for the first time at the hearing, the

county board, unless waived by the receiving party, shall continue the hearing. Examples of evidence could include an appraisal, construction costs, sales

information for the subject property or comparable properties, or any other information complied according to generally accepted appraisal principles.

As a result of filing this petition, the assessment may increase, may decrease, or may stay the same.

SPECIAL NOTE: A holder of a tax sale certificate under IC 6-1.1-24 does not have an interest in tangible property for purposes of obtaining a review or bringing

an appeal of an assessment of property under IC 6-1.1-15.

Check type of property under appeal (check only one): Real Personal

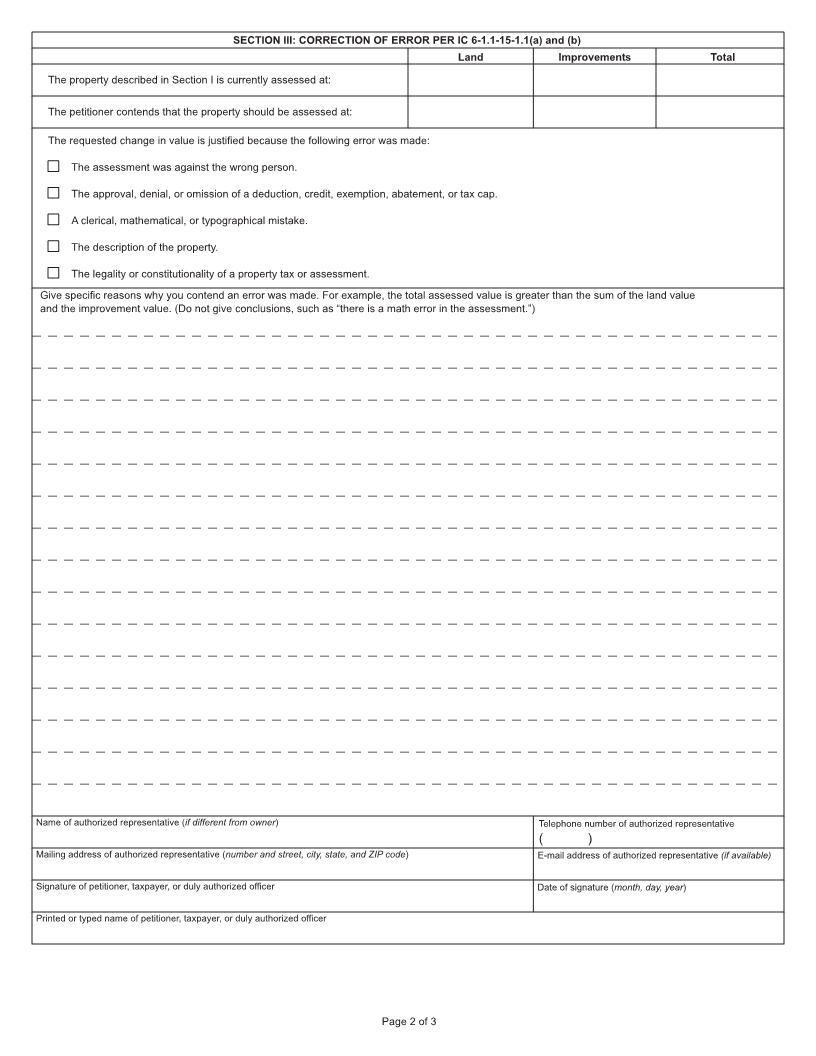

REQUIRED INFORMATION:

SECTION I: PROPERTY and PETITIONER INFORMATION

County Township Parcel or key number (for real property only)

Address of property being appealed (number and street, city, state, and ZIP code)

Legal description on Form 11 or property record card (for real property), or business name (for personal property)

Name of property owner Telephone number of property owner

( )

Mailing address of property owner (number and street, city, state, and ZIP code) E-mail address of property owner (if available)

OPTIONAL INFORMATION NOT REQUIRED AT THE TIME OF FILING:

SECTION II: REASON FOR APPEAL OF CURRENT YEAR’S ASSESSMENT

Land Improvements Personal Property

The property described in Section I is currently assessed at:

The petitioner contends that the property should be assessed at:

List attached evidence or give reasons for requested change:

Name of authorized representative (if different from owner) Telephone number of authorized representative

( )

Mailing address of authorized representative (number and street, city, state, and ZIP code) E-mail address of property owner (if available)

Signature of petitioner, taxpayer, or duly authorized officer Date of signature (month, day, year)

Printed or typed name of petitioner, taxpayer, or duly authorized officer

Page 1 of 3