Enlarge image

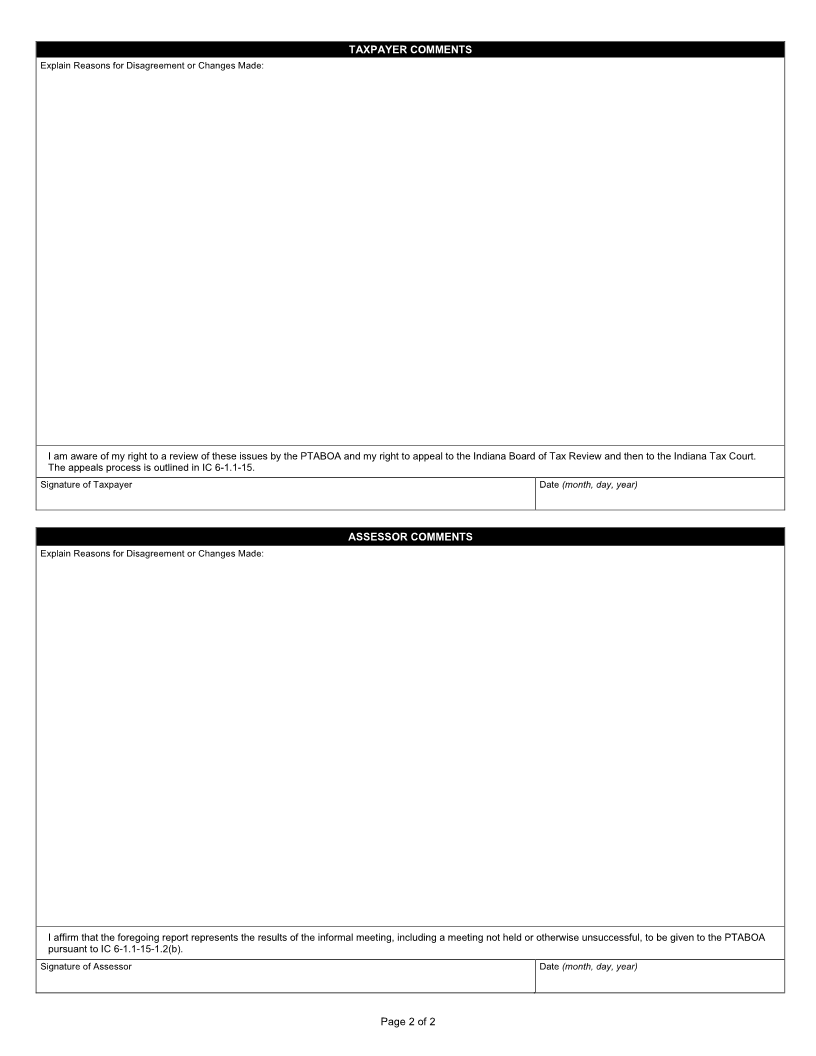

Reset Form

JOINT REPORT BY TAXPAYER / ASSESSOR FOR OFFICE USE ONLY

TO THE COUNTY BOARD OF APPEALS OF FORM 134 Date Received by PTABOA (month, day, year)

A PRELIMINARY INFORMAL MEETING

State Form53626 (R3 / 1-23)

Prescribed by the Department of Local Government Finance Date Received by Auditor (month, day, year)

INSTRUCTIONS:

1. This form must be completed and signed by both the taxpayer and the assessing official upon the completion of the required preliminary informal

meeting outlined in IC 6-1.1-15-1.2.

2.The PTABOA maintains the original report with copies provided to the county auditor, assessor, and taxpayer.

TYPE OF ISSUE UNDER APPEAL

Assessment of (check if applicable) : Issue Concerning (check issue(s))) :

☐ Deduction ☐ Credit ☐ Exemption ☐ Abatement ☐ Tax Cap

☐ Real Property

☐ Other: ________________________________________________________________________________

Petition Number (assigned by local officials)

☐ Personal Property

SECTION 1 PROPERTY AND PETITIONER INFORMATION

Parcel Number County Township

Assessment Date: January 1, _______, payable in _______

Name of Property Owner Telephone Number Email Address

( )

Mailing Address of Property Owner (number and street, city, state, and ZIP code)

Address of Property Under Appeal, if Different (number and street, city, state, and ZIP code)

Name of Authorized Representative (if different from taxpayer) Telephone Number Email Address

( )

Mailing Address of Authorized Representative (number and street, city, state, and ZIP code) DLGF Taxing District Number

SECTION 2 RESULTS OF PRELIMINARY INFORMAL MEETING

Assessment Date: January 1, _______, payable in _______ LAND IMPROVEMENTS PERSONAL PROPERTY / DEDUCTIONS

Current Assessment / Deduction of Record:

Taxpayer Believes Assessment / Deduction Should Be:

Assessor Believes Assessment / Deduction Should Be:

After the Preliminary Informal Meeting, do the taxpayer and the assessor agree on the resolution of all issues? ☐ Yes ☐ No

If yes, explain the issues and changes made:

If both parties do not agree on all the issues, is there a partial agreement on some of the issues? ☐ Yes ☐ No

If yes, list the areas agreed upon:

If yes, list the areas not agreed upon:

If both parties disagree on all of the issues, the taxpayer and the assessor should list the issues in their comments section.

Page 1 of 2