Enlarge image

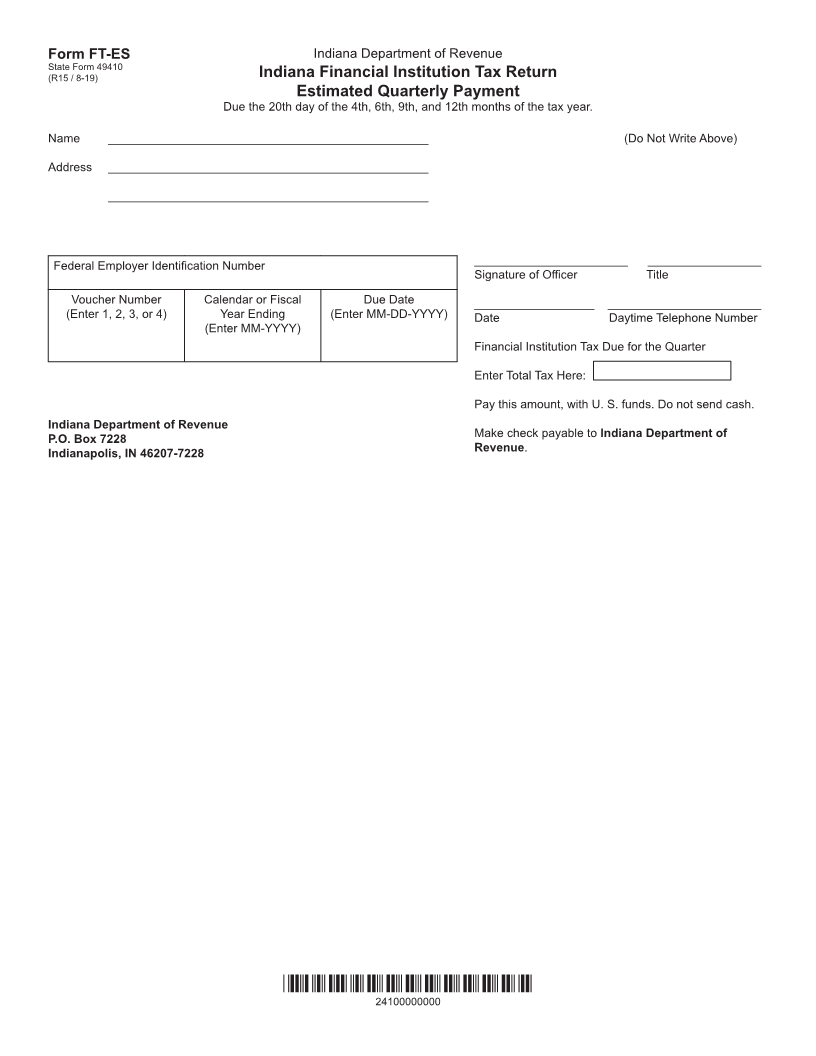

Form FT-ES Indiana Department of Revenue

State Form 49410

(R15 / 8-19) Indiana Financial Institution Tax Return

Estimated Quarterly Payment

Due the 20th day of the 4th, 6th, 9th, and 12th months of the tax year.

Name ________________________________________________ (Do Not Write Above)

Address ________________________________________________

________________________________________________

Federal Employer Identification Number _______________________ _________________

Signature of Officer Title

Voucher Number Calendar or Fiscal Due Date __________________ _______________________

(Enter 1, 2, 3, or 4) Year Ending (Enter MM-DD-YYYY) Date Daytime Telephone Number

(Enter MM-YYYY)

Financial Institution Tax Due for the Quarter

Enter Total Tax Here:

Pay this amount, with U. S. funds. Do not send cash.

Indiana Department of Revenue

P.O. Box 7228 Make check payable to Indiana Department of

Indianapolis, IN 46207-7228 Revenue.

*24100000000*

24100000000