Enlarge image

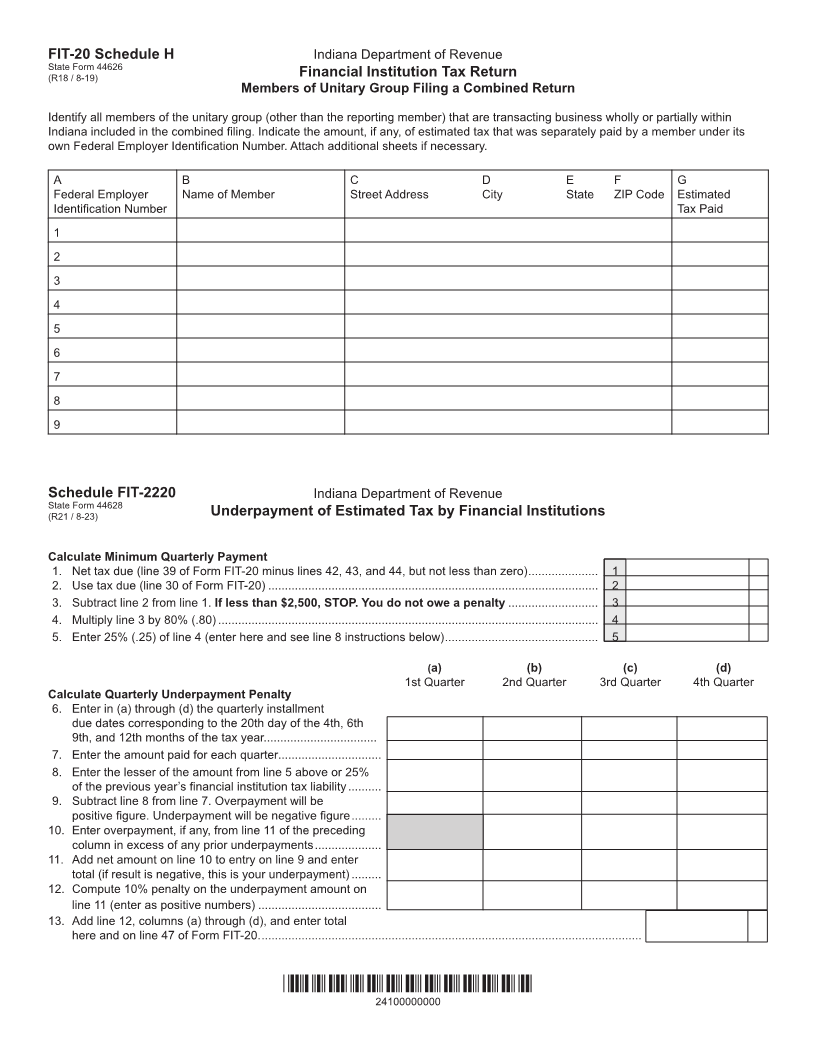

FIT-20 Schedule H Indiana Department of Revenue

State Form 44626

(R18 / 8-19) Financial Institution Tax Return

Members of Unitary Group Filing a Combined Return

Identify all members of the unitary group (other than the reporting member) that are transacting business wholly or partially within

Indiana included in the combined filing. Indicate the amount, if any, of estimated tax that was separately paid by a member under its

own Federal Employer Identification Number. Attach additional sheets if necessary.

A B C D E F G

Federal Employer Name of Member Street Address City State ZIP Code Estimated

Identification Number Tax Paid

1

2

3

4

5

6

7

8

9

Schedule FIT-2220 Indiana Department of Revenue

State Form 44628

(R21 / 8-23) Underpayment of Estimated Tax by Financial Institutions

Calculate Minimum Quarterly Payment

1. Net tax due (line 39 of Form FIT-20 minus lines 42, 43, and 44, but not less than zero) ..................... 1

2. Use tax due (line 30 of Form FIT-20) ................................................................................................... 2

3. Subtract line 2 from line 1. If less than $2,500, STOP. You do not owe a penalty ........................... 3

4. Multiply line 3 by 80% (.80) .................................................................................................................. 4

5. Enter 25% (.25) of line 4 (enter here and see line 8 instructions below) .............................................. 5

(a) (b) (c) (d)

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Calculate Quarterly Underpayment Penalty

6. Enter in (a) through (d) the quarterly installment

due dates corresponding to the 20th day of the 4th, 6th

9th, and 12th months of the tax year..................................

7. Enter the amount paid for each quarter...............................

8. Enter the lesser of the amount from line 5 above or 25%

of the previous year’s financial institution tax liability ..........

9. Subtract line 8 from line 7. Overpayment will be

positive figure. Underpayment will be negative figure .........

10. Enter overpayment, if any, from line 11 of the preceding

column in excess of any prior underpayments ....................

11. Add net amount on line 10 to entry on line 9 and enter

total (if result is negative, this is your underpayment) .........

12. Compute 10% penalty on the underpayment amount on

line 11 (enter as positive numbers) .....................................

13. Add line 12, columns (a) through (d), and enter total

here and on line 47 of Form FIT-20. ..................................................................................................................

*24100000000*

24100000000