Enlarge image

Reset Form

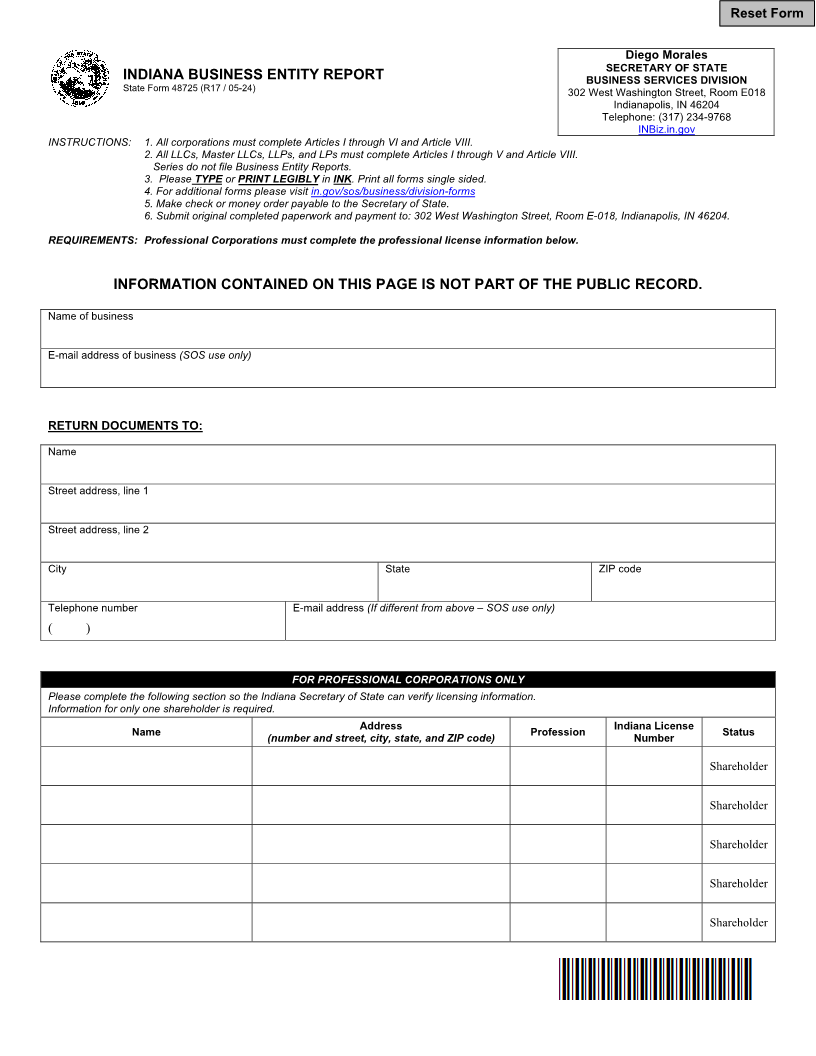

Diego Morales

SECRETARY OF STATE

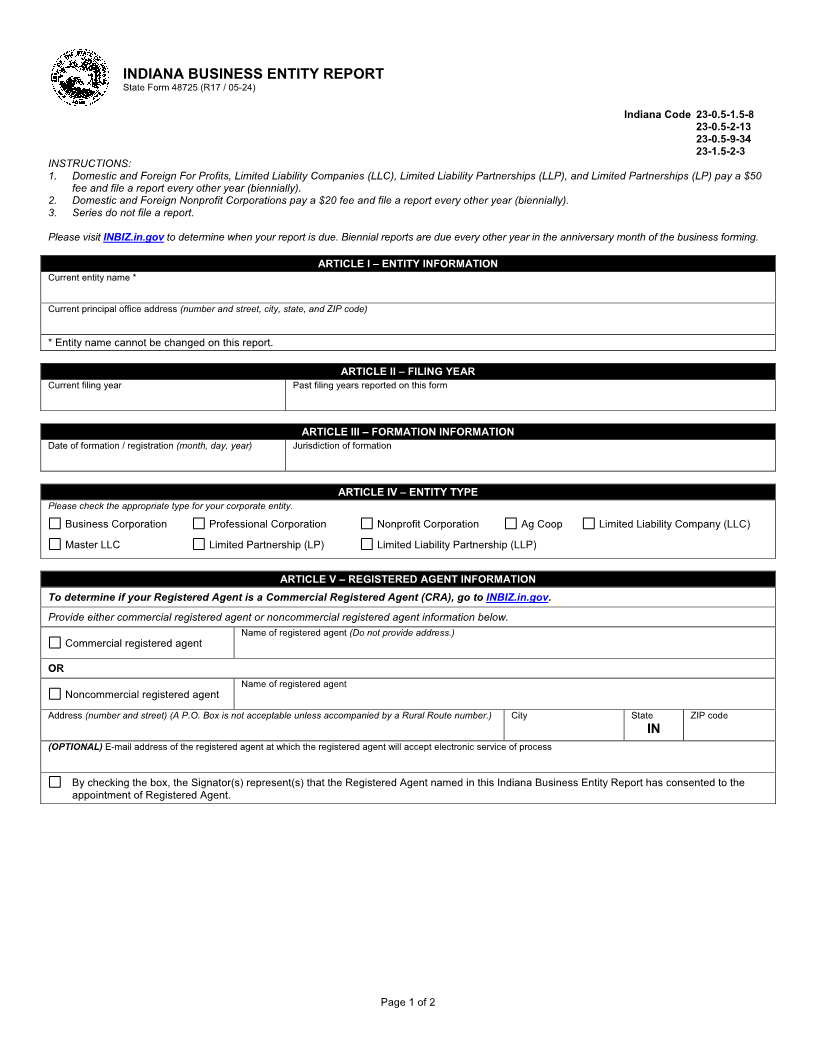

INDIANA BUSINESS ENTITY REPORT BUSINESS SERVICES DIVISION

State Form 48725 (R17 / 05-24) 302 West Washington Street, Room E018

Indianapolis, IN 46204

Telephone: (317) 234-9768

INBiz.in.gov

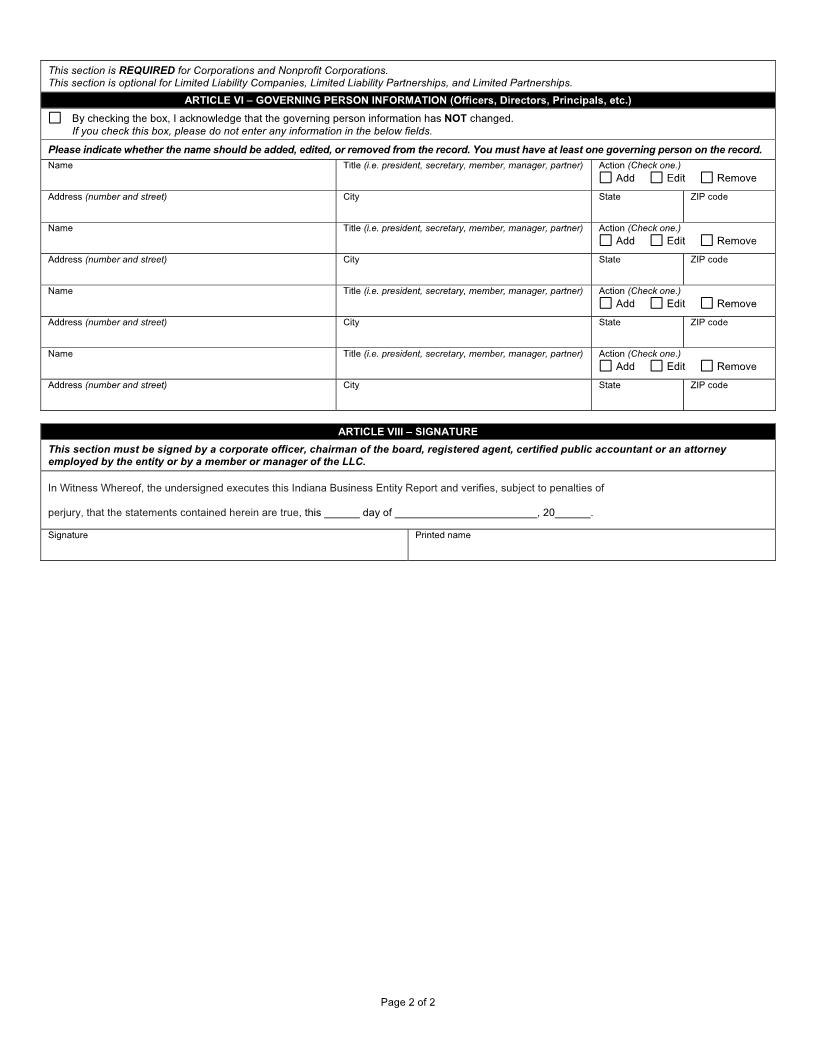

INSTRUCTIONS: 1. All corporations must complete Articles I through VI and Article VIII.

2. All LLCs, Master LLCs, LLPs, and LPs must complete Articles I through V and Article VIII.

Series do not file Business Entity Reports.

3. Please TYPE or PRINT LEGIBLY in INK. Print all forms single sided.

4. For additional forms please visit in.gov/sos/business/division-forms

5. Make check or money order payable to the Secretary of State.

6. Submit original completed paperwork and payment to: 302 West Washington Street, Room E-018, Indianapolis, IN 46204.

REQUIREMENTS: Professional Corporations must complete the professional license information below.

INFORMATION CONTAINED ON THIS PAGE IS NOT PART OF THE PUBLIC RECORD.

Name of business

E-mail address of business (SOS use only)

RETURN DOCUMENTS TO:

Name

Street address, line 1

Street address, line 2

City State ZIP code

Telephone number E-mail address (If different from above – SOS use only)

( )

FOR PROFESSIONAL CORPORATIONS ONLY

Please complete the following section so the Indiana Secretary of State can verify licensing information.

Information for only one shareholder is required.

Name Address Profession Indiana License Status

(number and street, city, state, and ZIP code) Number

Shareholder

Shareholder

Shareholder

Shareholder

Shareholder