Enlarge image

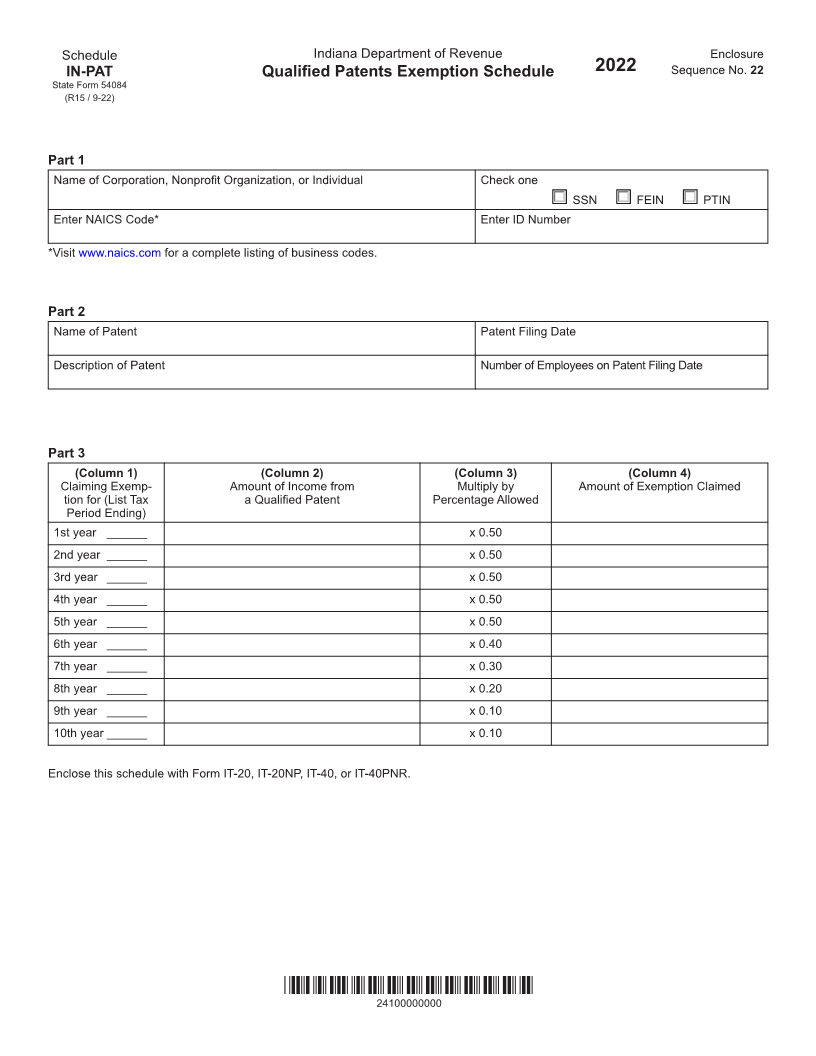

Schedule Indiana Department of Revenue Enclosure

IN-PAT Qualified Patents Exemption Schedule 2022 Sequence No. 22

State Form 54084

(R15 / 9-22)

Part 1

Name of Corporation, Nonprofit Organization, or Individual Check one

□ SSN □ FEIN □ PTIN

Enter NAICS Code* Enter ID Number

*Visit www.naics.com for a complete listing of business codes.

Part 2

Name of Patent Patent Filing Date

Description of Patent Number of Employees on Patent Filing Date

Part 3

(Column 1) (Column 2) (Column 3) (Column 4)

Claiming Exemp- Amount of Income from Multiply by Amount of Exemption Claimed

tion for (List Tax a Qualified Patent Percentage Allowed

Period Ending)

1st year ______ x 0.50

2nd year ______ x 0.50

3rd year ______ x 0.50

4th year ______ x 0.50

5th year ______ x 0.50

6th year ______ x 0.40

7th year ______ x 0.30

8th year ______ x 0.20

9th year ______ x 0.10

10th year ______ x 0.10

Enclose this schedule with Form IT-20, IT-20NP, IT-40, or IT-40PNR.

*24100000000*

24100000000