Enlarge image

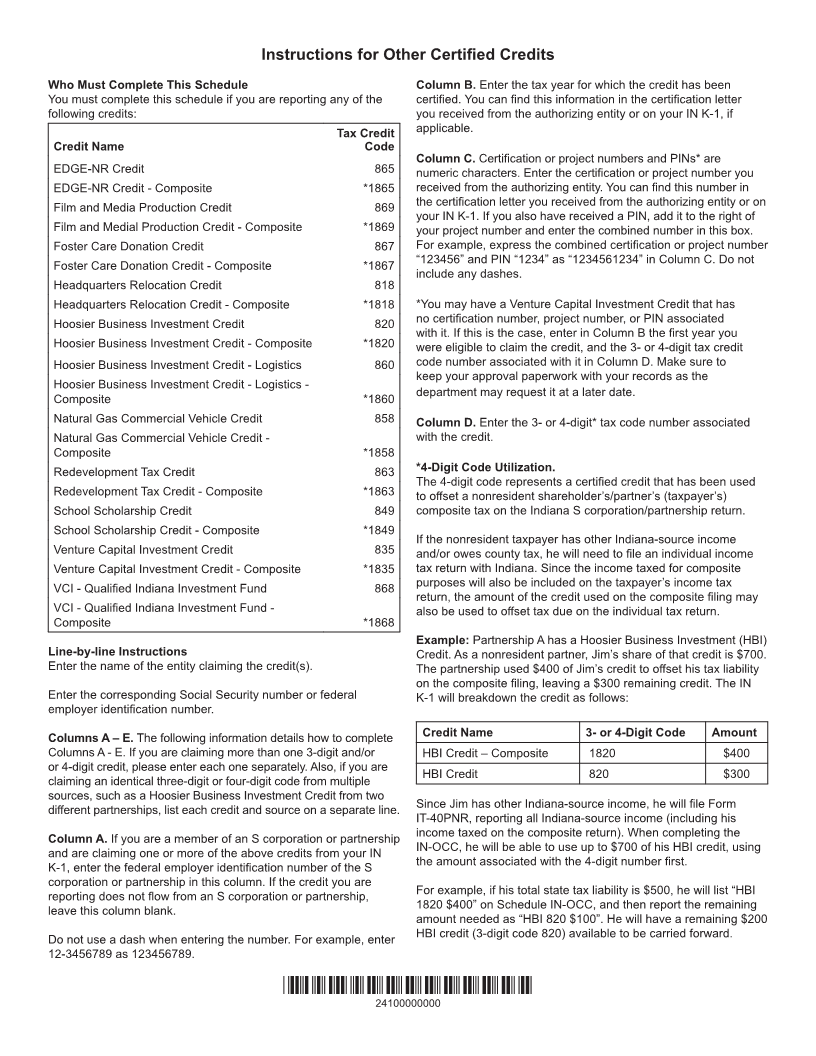

Schedule IN-OCC Enclosure

State Form 55629 Other Certified Credits Sequence No. 25

(R8 / 9-22)

2022

Name shown on Form IT-40/IT-40PNR Your Social Security Number

Name shown on IT-20/IT-20NP/IT-65/IT-20S/FIT-20/IT-41 Federal Employer Identification Number

Complete this schedule if you are reporting any of the following credits: EDGE-NR Credit; EDGE-NR Credit -Composite; Film and Media Production

Credit; Film and Medial Production Credit - Composite; Foster Care Donation Credit; Foster Care Donation Credit - Composite; Headquarters

Relocation Credit; Headquarters Relocation Credit - Composite Hoosier Business Investment Credit; Hoosier Business Investment Credit - Composite;

Hoosier Business Investment Credit - Logistics; Hoosier Business Investment Credit - Logistics - Composite; Natural Gas Commercial Vehicle Credit;

Natural Gas Commercial Vehicle Credit - Composite; Redevelopment Tax Credit; Redevelopment Tax Credit - Composite; School Scholarship Credit;

School Scholarship Credit - Composite; Venture Capital Investment Credit; Venture Capital Investment Credit - Composite; VCI - Qualified Indiana

Investment Fund; VCI - Qualified Indiana Investment Fund - Composite.

Column A Column B Column C Column D Column E

IT-20S/IT65 Certification/

Enter FEIN if Credit Certification Project Tax Credit Amount

is from IN K-1 Year Number Code Claimed

1. 1 .00

2. 2 .00

3. 3 .00

4. 4 .00

5. 5 .00

6. 6 .00

7. 7 .00

8. 8 .00

9. 9 .00

10. 10 .00

11. 11 .00

12. 12 .00

13. 13 .00

14. 14 .00

15. 15 .00

16. Add amounts from Column E, lines 1 - 15, and enter total here. Carry to the

appropriate line on: Schedule 6; Schedule G; Form IT-20; Form IT-20NP; Form IT-41; or

Form FIT-20 (Form IT-65 and Form IT-20S filers must see special reporting instructions) ____Total 16 .00

*21522111694*

21522111694