Enlarge image

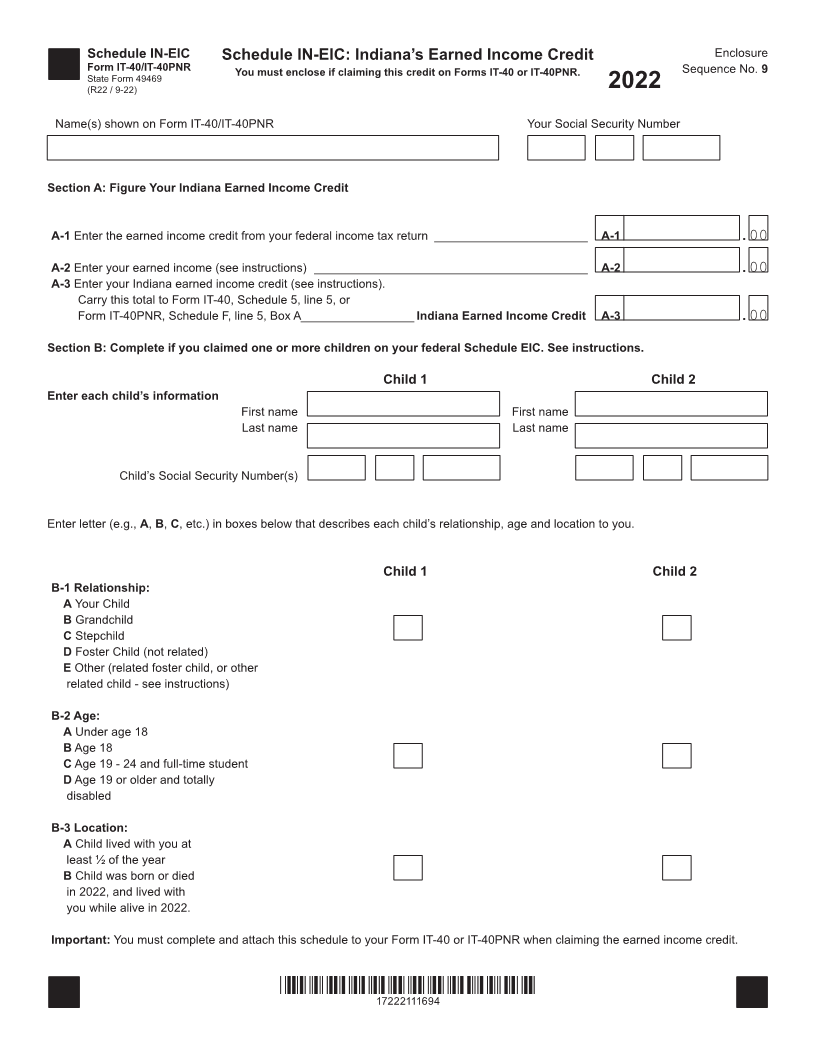

Schedule IN-EIC Schedule IN-EIC: Indiana’s Earned Income Credit Enclosure

Form IT-40/IT-40PNR You must enclose if claiming this credit on Forms IT-40 or IT-40PNR. Sequence No. 9

State Form 49469

(R22 / 9-22) 2022

Name(s) shown on Form IT-40/IT-40PNR Your Social Security Number

Section A: Figure Your Indiana Earned Income Credit

A-1 Enter the earned income credit from your federal income tax return _______________________ A-1 .00

A-2 Enter your earned income (see instructions) _________________________________________ A-2 .00

A-3 Enter your Indiana earned income credit (see instructions).

Carry this total to Form IT-40, Schedule 5, line 5, or

Form IT-40PNR, Schedule F, line 5, Box A _________________ Indiana Earned Income Credit A-3 .00

Section B: Complete if you claimed one or more children on your federal Schedule EIC. See instructions.

Child 1 Child 2

Enter each child’s information

First name First name

Last name Last name

Child’s Social Security Number(s)

Enter letter (e.g., A, B, ,Cetc.) in boxes below that describes each child’s relationship, age and location to you.

Child 1 Child 2

B-1 Relationship:

A Your Child

B Grandchild

C Stepchild

D Foster Child (not related)

E Other (related foster child, or other

related child - see instructions)

B-2 Age:

A Under age 18

B Age 18

C Age 19 - 24 and full-time student

D Age 19 or older and totally

disabled

B-3 Location:

A Child lived with you at

least ½ of the year

B Child was born or died

in 2022, and lived with

you while alive in 2022.

Important: You must complete and attach this schedule to your Form IT-40 or IT-40PNR when claiming the earned income credit.

*17222111694*

17222111694