Enlarge image

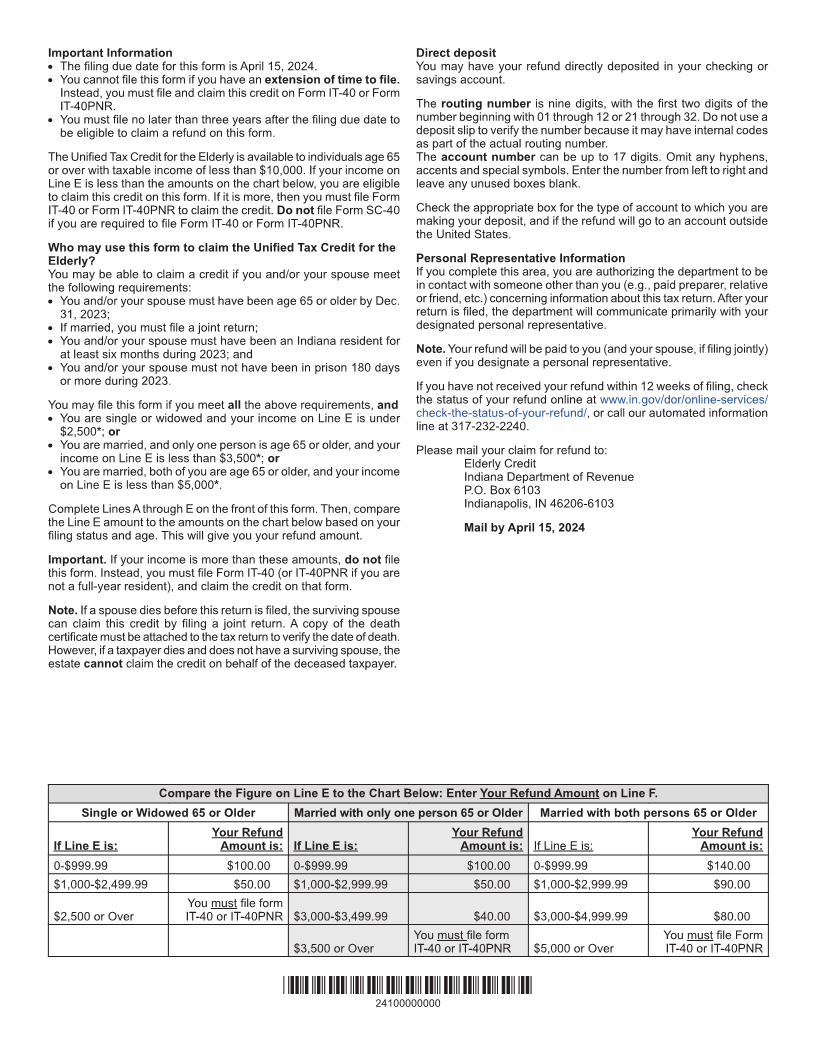

Form Unified Tax Credit for the Elderly

SC-40 2023

State Form 44404 Married Claimants Must File Jointly Due April 15, 2024

(R22 / 9-23)

Your Social Security Number

Your first name Initial Last name

Spouse’s first name Initial Last name

Spouse’s Social Security Number

Present address (number and street or rural route)

Taxpayer's date of death Spouse's date of death

City or Town State ZIP/Postal code

2023 2023

M M D D M M D D

1. Check box if you were age 65 or older by Dec. 31, 2023 Check box if spouse was age 65 or older by Dec. 31, 2023

□ □

2. Were you a resident of Indiana for six months or more during 2023? Yes No

□ □

3. Was your spouse a resident of Indiana for six months or more during 2023? Yes No

□ □

Determine Your Income

Certain income, such as Social Security, veteran’s disability pensions and life insurance proceeds, should not be entered on this form.

Enter all other income received by you and your spouse during the tax year. Complete all spaces. If you had no income from any of the

sources listed below, place a zero (-0-) in the space provided. Round all entries.

A. Wages, salaries, tips and commissions, unemployment compensation, etc ............................. A 00

B. Dividend and interest income .................................................................................................... B 00

C. Net gain or loss from rental income, business income, etc ....................................................... C 00

D. Pensions or annuities (Do not enter Social Security benefits) .............................................. D 00

E. Total Income (Add Lines A through D and enter the total here) ............................................... E 00

F. Your Elderly Credit (See chart on back to figure your refund) ................................................ F 00

G. Direct Deposit (1) Routing Number (3) Checking (4) Savings

□ □

(2) Account Number

(5) Place an "X" in the box if refund will go to an account outside the United States.

□

Under penalty of perjury, I (we) have examined this return and to the best of my (our) knowledge and belief, it is true, complete, and correct

and that I am (we are) not required to file an Indiana income tax return.

____________________________________________________ _______________________________________________

Your Signature Date Spouse's Signature Date

Daytime Telephone Number

I authorize the department to discuss my return with my personal Paid Preparer: Firm’s Name (or yours if self-employed)

representative. □ Yes □ No

If yes, complete the information below. __________________________________________________________

Personal Representative’s Name (please print)

□ PTIN

__________________________________________________________

Telephone

number

Address ___________________________________________________ Address ___________________________________________________

City ______________________________________________________ City ______________________________________________________

State _______________________ ZIP Code __________________ State _______________________ ZIP Code __________________

*16223111694*

16223111694