Enlarge image

INDIANA 2 02 2 Publication EIC Indiana Earned Income Credit This booklet is for use in preparing the Earned Income Credit section of Indiana individual returns for tax year 2022.

Enlarge image | INDIANA 2 02 2 Publication EIC Indiana Earned Income Credit This booklet is for use in preparing the Earned Income Credit section of Indiana individual returns for tax year 2022. |

Enlarge image |

Publication EIC: Indiana Earned Income Credit

DISCLAIMER. This publication is intended to provide nontechnical assistance to the general public. Every attempt has been made to

provide information that is consistent with the appropriate statutes, rules, and court decisions. Any information that is inconsistent with

current law, regulations, or court decisions is not binding on either the Department or the taxpayer. Therefore, information provided

in this publication should serve only as a foundation for further investigation and study of the current law and procedures related to its

subject matter.

SP 359

(R6 / 12-22)

Page 2

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

Table of Contents

Introduction

What is the Earned Income Credit? ...........................................................................................................................................................................4

Can I Claim Indiana’s EIC? .........................................................................................................................................................................................4

Table 1. Indiana Earned Income Credit in a Nutshell .............................................................................................................................................4

This publication contains: ...........................................................................................................................................................................................4

Do I Need This Publication? .......................................................................................................................................................................................4

Chapter 1. How to figure Indiana’s EIC

To figure the EIC ..........................................................................................................................................................................................................5

Step 1 All Filers ............................................................................................................................................................................................................5

Step 2 Investment Income ..........................................................................................................................................................................................5

Step 3 Qualifying Child ..............................................................................................................................................................................................6

Step 4 Filers Without a Qualifying Child .................................................................................................................................................................6

Step 5 Modified Adjusted Gross Income (MAGI) ..................................................................................................................................................6

Step 6 Earned Income .................................................................................................................................................................................................7

Step 7 How to Figure the Credit ................................................................................................................................................................................7

Chapter 2. Rules If You Have a Qualifying Child

How to determine if you have a qualifying child for Indiana EIC purposes ........................................................................................................8

Additional Indiana Relationship Tests .......................................................................................................................................................................8

Chapter 3. Modified Adjusted Gross Income (AGI)

How to figure your modified AGI ............................................................................................................................................................................11

Chapter 4. Worksheets

Worksheet A: Indiana’s Earned Income Credit (EIC) ...........................................................................................................................................12

Worksheet B: Indiana’s Earned Income Credit (EIC) ............................................................................................................................................13

Worksheet 1: Investment Income If You Are Filing Federal Form 1040/1040-SR ............................................................................................15

Worksheet 2: Worksheet for Line 4 of Worksheet 1 ..............................................................................................................................................16

Worksheet 3: Modified AGI If You Are Filing Federal Form 1040/1040-SR ......................................................................................................17

Chapter 5. 2022 Indiana Earned Income Credit (EIC) Table ...................................................................................................18

Chapter 6. Definitions and Special Rules ..........................................................................................................................................24

Page 3

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

Introduction

What is the Earned Income Credit?

The earned income credit (EIC) is a tax credit for certain people who work and have earned income under $49,399. A tax credit usually means

more money in your pocket because it reduces the amount of tax you owe. The EIC may also give you a refund, even if you don’t owe any tax.

Can I Claim Indiana’s EIC?

To claim Indiana’s EIC, you must meet certain rules. These rules are summarized in Table 1.

Table 1. Indiana Earned Income Credit in a Nutshell

First, you must meet all the rules in this Second, you must meet all the rules Third, you must meet the rules in

column. in this column if claiming a child. this column.

Rules for everyone Rules if you have a qualifying child Figuring and claiming the EIC

1. You must have a valid federal earned 3. Your child must meet the federal EIC 5. Your federal EIC must be reduced

income credit. qualifying child age, residency, joint by 10% (.10) of any alternative

2. Your federal AGI, earned income for 2022 return and relationship tests. minimum tax (AMT).

(do not use prior-year earned income), 4. Your child must meet two additional 6. Your Indiana EIC cannot be greater

AND modified AGI each must be less than: relationship tests (which may than 10% of your federal EIC

• $49,399 if you have two or more supersede certain federal relationship (including reduction by

qualifying children. tests). federal AMT).

• $43,450 if you have one qualifying child.

• $16,400 if you do not have a qualifying

child.

This publication contains:

• Instructions to figure Indiana’s EIC

• Rules to determine if you have a qualifying child for Indiana EIC purposes

• Worksheet A

• Worksheet B

• Worksheet 1: Investment Income

• Worksheet 2: Worksheet For Line 4 of Worksheet 1

• Worksheet 3: Modified AGI

• Definitions

Do I Need This Publication?

If you were sent here from the Line 5 EIC instructions found in the IT-40/IT-40PNR instruction booklets:

• Complete Worksheet A

• Complete Worksheet B if:

ο You were self employed at any time during the tax year, or

ο You filed Schedule SE because you were a member of the clergy or you had church employee income, or

ο You filed Schedule C as a statutory employee.

• Complete Worksheet 1 if:

ο Your investment income is more than $3,800,

ο You filed federal Form 4797 (Sale of Business property), and

• Complete Worksheet 2 if federal Form 8814 includes an Alaska Permanent Fund dividend.

• Complete Worksheet 3 if any of the following apply for the tax year:

ο You filed federal Schedule E.

ο You are claiming a loss on federal Form 1040/1040-SR, line 7, and/or Schedule 1, line 3 and/or line 6.

ο You are reporting income or a loss from the rental of personal property not used in a trade or business.

ο You and/or spouse if married filing jointly received a distribution from a pension, annuity, IRA or Coverdell ESA that is not

fully taxable.

ο You reported income on federal Form 1040/1040-SR, Schedule 1, line 8, from federal Form 8814 (relating to election to report

child’s interest and dividends).

Page 4

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

Chapter 1. How to figure Indiana’s EIC

To figure the EIC:

• Follow the steps below.

• Complete the worksheet(s) that apply to you.

• Complete and enclose Schedule IN-EIC.

Step 1 All Filers

1. Did you claim an EIC on your 2022 federal tax return Form 1040/1040-SR, line 27?

Yes. Continue.

No. STOP. You cannot take the credit.

2. If, in 2022:

• 2 or more children lived with you, is the amount on Form IT-40, line 1 (Indiana’s Schedule A, line 36A), less than $49,399?

• 1 child lived with you, is the amount on Form IT-40, line 1 (Indiana’s Schedule A, line 36A), less than $43,450?

• No children lived with you, is the amount on Form IT-40, line 1 (Indiana’s Schedule A, line 36A), less than $16,400?

Yes. Continue.

No. STOP. You cannot take the credit.

3. Are you filing your return for Indiana either as a single individual or married filing jointly?

Yes. Continue.

No. STOP. You cannot take the credit.

Step 2 Investment Income

1. Add amounts from:

Federal Form 1040/1040-SR, Line 2a + __________

Federal Form 1040/1040-SR, Line 2b + __________

Federal Form 1040/1040-SR, Line 3b + __________

Federal Form 1040/1040-SR, Line 7* + __________

Investment Income = __________

* If Line 7 is a loss, enter -0-.

2. Is your investment income more than $3,800?

Yes. Continue.

No. Skip question 3; go to question 4.

3. Did you file federal Form 4797 (relating to sales of business property)?

No. STOP. You cannot take the credit.

Yes. If the amount on Form 1040/1040-SR, line 8, includes an amount from federal Form 4797, you must use Worksheet 1 on

page 15 to see if you can take the EIC. Otherwise, STOP; you cannot take the EIC.

4. Do any of the following apply for 2022?

• You filed federal Schedule E.

• You are claiming a loss on federal Form 1040/1040-SR, line 7, and/or federal Schedule 1, lines 3 and/or 6.

• You are reporting income or a loss from the rental of personal property not used in a trade or business.

• You and/or spouse if married filing jointly received a distribution from a pension, annuity, IRA or Coverdell ESA that is not fully taxable.

• You reported income on federal Schedule 1, line 8, from federal Form 8814 (relating to election to report child’s interest and dividends).

Yes. You must use Worksheet 3 on page 17 to see if you can take the credit.

No. Go to Step 3.

Page 5

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

Step 3 Qualifying Child

1. Did a child live with you in 2022?

No. Go to Step 4.

Yes. Continue.

A qualifying child is a child who is your…

• Son

• Daughter

• Grandchild

• Stepchild

• Foster child and/or related child (see page 24)

AND, was…

• Under age 19 at the end of the year and younger than you (or your spouse, if filing jointly), or

• Under age 24 at the end of the year, a student (see page 25), and younger than you (or your spouse, if filing jointly), or

• Any age and permanently and completely disabled (see page 25),

AND, who…

Is not filing a joint return for the year, or is filing a joint return for the year only as a claim for refund,

AND, who…

Lived with you in the United States for more than half of the year or, if a foster child, for all of the year. If the child did not live with you

for the required time, see Exception to “time lived with you” on page 24.

Caution. If the child meets the conditions to be a qualifying child of any other person (other than your spouse if filing a joint return)

for the year, or the child was married, see page 25.

2. Do you have at least one child who meets the conditions to be your qualifying child?

Yes. The child must have a valid nine-digit Social Security number (SSN) unless the child was born and died during the year*. If at

least one qualifying child has a SSN (or was born and died during the year), go to Step 5. If no qualifying child has a SSN and no

qualifying child meets the exception for children who were born and died during the year, STOP. You cannot take the credit.

No. Continue to Step 4.

*Exception. If your qualified dependent child was born and died during the year and you do not have a SSN for the child, you may be

able to claim the child for earned income credit purposes (see Social Security Number on page 25).

Step 4 Filers Without a Qualifying Child

1. Are you:

• older than 24 and

• younger than 65?

Yes. Continue.

No. STOP. You cannot take the credit.

2. If you have no qualifying child (see Step 3) but you claimed an EIC on your federal tax return Form 1040/1040-SR, line 27, then

you may be eligible to claim Indiana’s EIC. Continue to Step 5.

Step 5 Modified Adjusted Gross Income (AGI)

3. Add amounts from:

Federal Form 1040/1040-SR, line 2a + __________

Federal Form 1040/1040-SR, line 11 + __________

Modified Adjusted Gross Income* = Box A

*Note. If you completed Worksheet 3 on page 17, enter in Box A the amount from Worksheet 3, line 17.

Page 6

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

If you have:

• Two or more qualifying children, is Box A less than $ 49,399?

• One qualifying child, is Box A less than $43,450?

• No qualifying children, is Box A less than $16,400?

Yes. Go to Step 6.

No. STOP. You cannot take the credit.

Step 6 Earned Income

1. Did you file federal Schedule SE because you are a member of the clergy or you had church employee income of $108.28 or more?

Yes. See Clergy or Church employees, whichever applies, in the next column.

No. Continue.

2. Figure earned income:

A. Enter amount from federal 1040/1040-SR, line 1 ____________

B. Subtract, if included on line A above, any:

• Taxable scholarship or fellowship grant not reported on a Form W-2. ____________

• Amount received for work performed while an inmate in a penal institution. ____________

• Amount received as a pension or annuity from a nonqualified deferred compensation

plan or a nongovernmental section 457 plan. This amount may be shown in Box 11 of

Form W-2. If you received such an amount but Box 11 is blank, contact your employer

for the amount received as a pension or annuity. ____________

• Amount of the qualified foster care payments included in Box 1 of Form W-2

that you have elected to exclude from your federal adjusted gross income. - __________

C. Add all of your nontaxable combat pay if you elect to include it in earned income.* + __________

Earned Income = Box B

*Caution. Electing to include nontaxable combat pay may increase or decrease your EIC. Figure the credit with and without your

nontaxable combat pay before making the election.

3. Were you self-employed at any time in 2022, or did you file federal Schedule SE because you were a member of the clergy or you

had church employee income, or did you file federal Schedule C as a statutory employee?

Yes. Skip question 4 and Step 7; go to Worksheet B on page 13.

No. Continue.

4. If you have:

• Two or more qualifying children, is your total earned income (Box B) less than $49,399?

• One qualifying child, is your total earned income (Box B) less than $43,450?

• No qualifying children, is your total earned income (Box B) less than $16,400?

Yes. Go to Step 7.

No. STOP. You cannot take the credit.

Step 7 How to Figure the Credit

Go to Worksheet A on page 12.

Page 7

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

Chapter 2. Rules If You Have a Qualifying Child

Your child is a qualifying child if your child meets four tests. The four tests are:

1. Age,

2. Residency,

3. Joint return, and

4. Relationship.

The first two requirements (age and residency) are identical to the requirements used for federal EIC qualifying child determination

purposes. For Indiana purposes, a married couple (as defined in IRC § 7703) must file a joint federal return to claim the Indiana EIC.

A married couple filing separately is not permitted to claim an Indiana EIC even if the couple is permitted a federal EIC.

NOTE. If you:

• have at least one child that meets the definition of a qualifying child;

• have no qualifying child with a Social Security Number; and

• you do not have a child who was born and died during the year,

you will not be considered an individual with no qualifying children for Indiana EIC purposes and you are not eligible to claim a credit

based on having a qualifying child. You cannot claim the Indiana EIC.

As a rule, for Indiana EIC purposes, you will be able to claim as a qualifying dependent a child who meets the age, residency, joint

federal return, and relationship EIC tests for federal EIC purposes as long as the child also meets the Indiana relationship tests.

How to determine if you have a qualifying child for Indiana EIC purposes

First, review the age, residency, joint federal return and relationship requirements for federal EIC purposes in either:

• the federal tax instruction booklet for federal Form 1040/1040-SR, or

• as found in the federal Publication 596.

If your child does not meet all of these requirements, STOP. You cannot claim this child as a qualifying child for Indiana EIC purposes.

If your child meets these requirements, continue.

Additional Indiana Relationship Tests

In general, most qualifying child relationship requirements for Indiana EIC purposes match the federal EIC relationship requirements.

However, there are two differences. Read the following carefully to see if your child qualifies for Indiana.

Difference 1. Indiana foster child definition.

The following Indiana definition is different than the federal foster child definition, so please read it carefully.

• Any child you cared for as your own child and who is (a) your brother, sister, stepbrother, or stepsister; (b) a descendant (such as a

child, including an adopted child) of your brother, sister, step-brother, or stepsister; or (c) a child placed with you by an authorized

placement agency. For example, if you acted as the parent of your niece or nephew, this child is considered your foster child.

AND

• The qualifying foster child must live with you for the entire year (except for temporary absences).

Example 1. Your 12 year-old brother lived with you the entire year. If you are eligible to claim him as a qualifying child for federal EIC

purposes, then you are eligible to claim him for Indiana EIC purposes.

Example 2. The facts are the same as in Example 1, but your brother lived with you for seven months during the year. Even though you

may be eligible to claim him as a qualifying child for federal EIC purposes, you are not eligible to claim him for Indiana EIC purposes

as he did not live with you the entire year.

Difference 2. Qualifying child of more than one person.

Sometimes a child meets the tests to be a qualifying child of more than one person. However, only one person can claim the EIC using that

child. The paragraphs that follow will help you decide who can claim Indiana’s EIC when more than one person has the same qualifying child.

Page 8

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

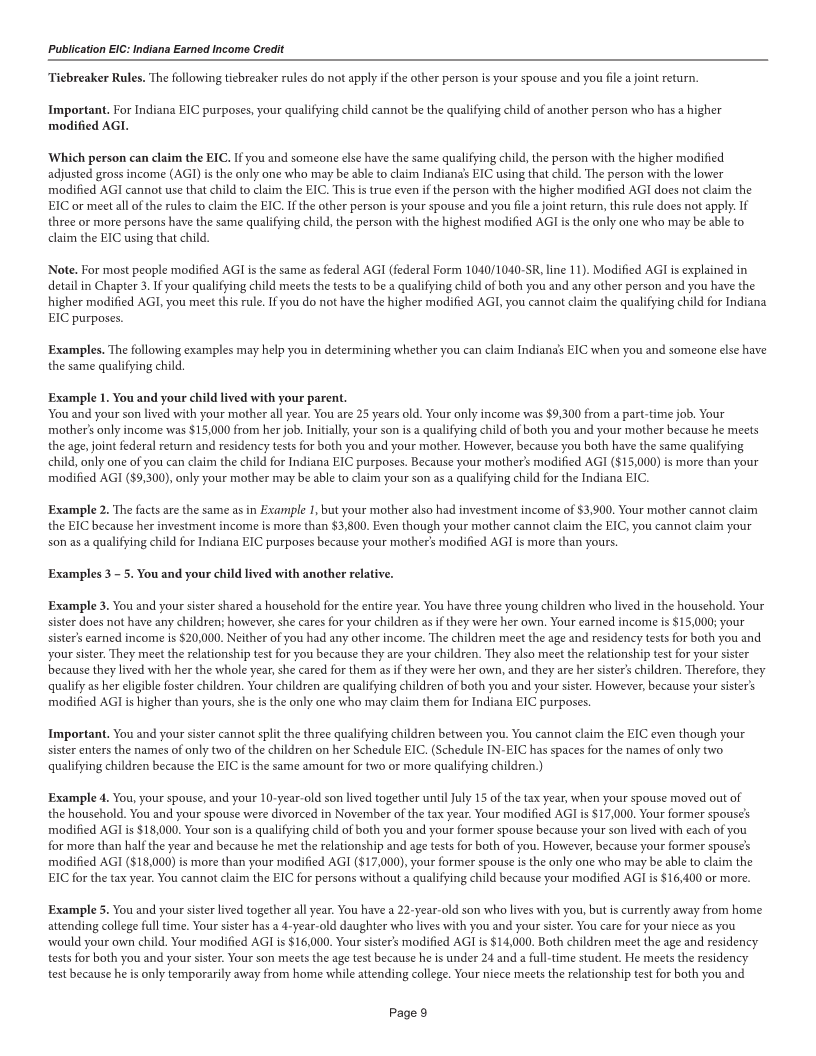

Tiebreaker Rules. The following tiebreaker rules do not apply if the other person is your spouse and you file a joint return.

Important. For Indiana EIC purposes, your qualifying child cannot be the qualifying child of another person who has a higher

modified AGI.

Which person can claim the EIC. If you and someone else have the same qualifying child, the person with the higher modified

adjusted gross income (AGI) is the only one who may be able to claim Indiana’s EIC using that child. The person with the lower

modified AGI cannot use that child to claim the EIC. This is true even if the person with the higher modified AGI does not claim the

EIC or meet all of the rules to claim the EIC. If the other person is your spouse and you file a joint return, this rule does not apply. If

three or more persons have the same qualifying child, the person with the highest modified AGI is the only one who may be able to

claim the EIC using that child.

Note. For most people modified AGI is the same as federal AGI (federal Form 1040/1040-SR, line 11). Modified AGI is explained in

detail in Chapter 3. If your qualifying child meets the tests to be a qualifying child of both you and any other person and you have the

higher modified AGI, you meet this rule. If you do not have the higher modified AGI, you cannot claim the qualifying child for Indiana

EIC purposes.

Examples. The following examples may help you in determining whether you can claim Indiana’s EIC when you and someone else have

the same qualifying child.

Example 1. You and your child lived with your parent.

You and your son lived with your mother all year. You are 25 years old. Your only income was $9,300 from a part-time job. Your

mother’s only income was $15,000 from her job. Initially, your son is a qualifying child of both you and your mother because he meets

the age, joint federal return and residency tests for both you and your mother. However, because you both have the same qualifying

child, only one of you can claim the child for Indiana EIC purposes. Because your mother’s modified AGI ($15,000) is more than your

modified AGI ($9,300), only your mother may be able to claim your son as a qualifying child for the Indiana EIC.

Example 2. The facts are the same as in Example 1, but your mother also had investment income of $3,900. Your mother cannot claim

the EIC because her investment income is more than $3,800. Even though your mother cannot claim the EIC, you cannot claim your

son as a qualifying child for Indiana EIC purposes because your mother’s modified AGI is more than yours.

Examples 3 – 5. You and your child lived with another relative.

Example 3. You and your sister shared a household for the entire year. You have three young children who lived in the household. Your

sister does not have any children; however, she cares for your children as if they were her own. Your earned income is $15,000; your

sister’s earned income is $20,000. Neither of you had any other income. The children meet the age and residency tests for both you and

your sister. They meet the relationship test for you because they are your children. They also meet the relationship test for your sister

because they lived with her the whole year, she cared for them as if they were her own, and they are her sister’s children. Therefore, they

qualify as her eligible foster children. Your children are qualifying children of both you and your sister. However, because your sister’s

modified AGI is higher than yours, she is the only one who may claim them for Indiana EIC purposes.

Important. You and your sister cannot split the three qualifying children between you. You cannot claim the EIC even though your

sister enters the names of only two of the children on her Schedule EIC. (Schedule IN-EIC has spaces for the names of only two

qualifying children because the EIC is the same amount for two or more qualifying children.)

Example 4. You, your spouse, and your 10-year-old son lived together until July 15 of the tax year, when your spouse moved out of

the household. You and your spouse were divorced in November of the tax year. Your modified AGI is $17,000. Your former spouse’s

modified AGI is $18,000. Your son is a qualifying child of both you and your former spouse because your son lived with each of you

for more than half the year and because he met the relationship and age tests for both of you. However, because your former spouse’s

modified AGI ($18,000) is more than your modified AGI ($17,000), your former spouse is the only one who may be able to claim the

EIC for the tax year. You cannot claim the EIC for persons without a qualifying child because your modified AGI is $16,400 or more.

Example 5. You and your sister lived together all year. You have a 22-year-old son who lives with you, but is currently away from home

attending college full time. Your sister has a 4-year-old daughter who lives with you and your sister. You care for your niece as you

would your own child. Your modified AGI is $16,000. Your sister’s modified AGI is $14,000. Both children meet the age and residency

tests for both you and your sister. Your son meets the age test because he is under 24 and a full-time student. He meets the residency

test because he is only temporarily away from home while attending college. Your niece meets the relationship test for both you and

Page 9

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

your sister. She meets the test for you as your eligible foster child because she is your sister’s child, she lived with you all year, and you

cared for her as your own child. Your son meets the relationship test for you but not for your sister because she does not care for him as

her own child. Your son is a qualifying child for you but not for your sister. Your niece could be a qualifying child for both you and your

sister. Because your modified AGI is higher than your sister’s, only you can claim the EIC using your niece. You can claim the EIC for

two children. If your sister’s modified AGI were higher than yours, she could claim the EIC using your niece, and you could claim the

credit using your son. This is so even though you and your sister have the same address and share the same household.

Example 6. You and your child live with someone not related to you.

You, your 2-year-old son, and your son’s father lived together all year. You and your son’s father are not married. Your modified AGI

is $18,000. Your son’s father’s modified AGI is $20,000. Your son is a qualifying child of both you and his father because he meets the

relationship, age, and residency tests for both you and his father. Because the father’s modified AGI was more than yours, only he may

be able to claim your son for Indiana EIC purposes.

What if the person with the highest modified AGI cannot claim the EIC?

If you and someone else have the same qualifying child, and the other person has the higher modified AGI, then the child is the other

person’s qualifying child for Indiana’s EIC purposes. You cannot treat the child as a qualifying child to claim Indiana’s EIC even if the

other person cannot claim Indiana’s EIC.

Example. You and your 8-year-old daughter moved in with your mother two years ago. You are not a qualifying child of your mother.

Your daughter meets the conditions to be a qualifying child for both you and your mother. Your modified AGI for the tax year was

$8,000, and your mother’s was $54,000. Because your mother’s modified AGI was higher, your daughter is your mother’s qualifying

child for Indiana EIC purposes. Since your mother’s modified AGI is $49,399 or greater, she is not eligible to claim Indiana’s EIC. You

cannot claim an Indiana EIC using your child as a qualifying child even though your mother cannot claim the credit.

Example. Your 10-year-old child has taxable interest income of $400, an Alaska Permanent Fund dividend of $1,000, and ordinary

dividends of $1,100, of which $500 are qualified dividends. You choose to report this income on your federal return. You enter $400

on line 1a of federal Form 8814, $2,100 ($1,000 plus $1,100) on line 2a, and $500 on line 2b. After completing lines 4 through 11, you

enter $320 on line 12 of Form 8814 and line 8 of Form 1040/1040-SR, Schedule 1. On Worksheet 2, enter $2,100 on line 1, $500 on line

2, $1,600 on line 3, $400 on line 4, $2,000 on line 5, $1,000 on line 6, 0.500 on line 7, $320 on line 8, $160 on line 9, and $160 on line 10.

You then enter $160 on line 4 of Worksheet 1.

Page 10

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

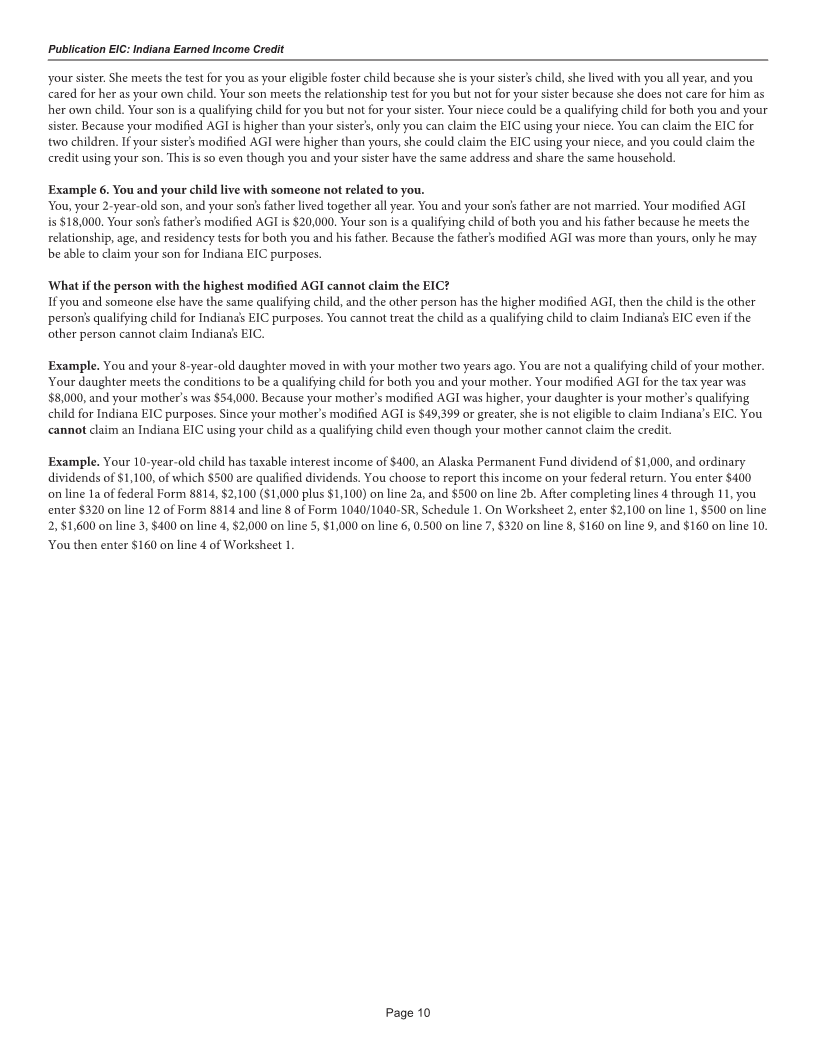

Chapter 3. Modified Adjusted Gross Income (AGI)

Your modified AGI must be less than:

• $49,399 if you have more than one qualifying child,

• $43,450 if you have one qualifying child, or

• $16,400 if you do not have a qualifying child.

Before you begin…

You must have with you your completed federal tax return, Form 1040/1040-SR, including any federal schedules you completed.

Modified adjusted gross income (AGI). Modified AGI for most people is the same as the federal AGI. AGI is the amount on line 11 of

federal Form 1040/1040-SR.

To find your modified AGI, you must add certain amounts to your AGI if you:

• Claim a loss on federal Schedule C, D, E, or F,

• Claim a loss from the rental of personal property not used in a trade or business,

• Received any tax-exempt interest, or

• Received certain pension, annuity, or individual retirement arrangement (IRA) distributions that were partly nontaxable.

How to figure your modified AGI

Your AGI is the amount on line 11 of your federal Form 1040/1040-SR. To find your modified AGI, you must add certain amounts to

your AGI, including all or part of certain losses (such as 75% of certain business losses) you are claiming on your return.

Use Worksheet 3 on page 17 to figure your modified AGI.

Your modified AGI must be less than:

• $49,399 if you have more than one qualifying child,

• $43,450 if you have one qualifying child, or

• $16,400 if you do not have a qualifying child.

Important. If your modified AGI is too great, STOP. You cannot claim the EIC. You do not need to read the rest of this publication.

You can go back and finish the rest of your tax return.

Page 11

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

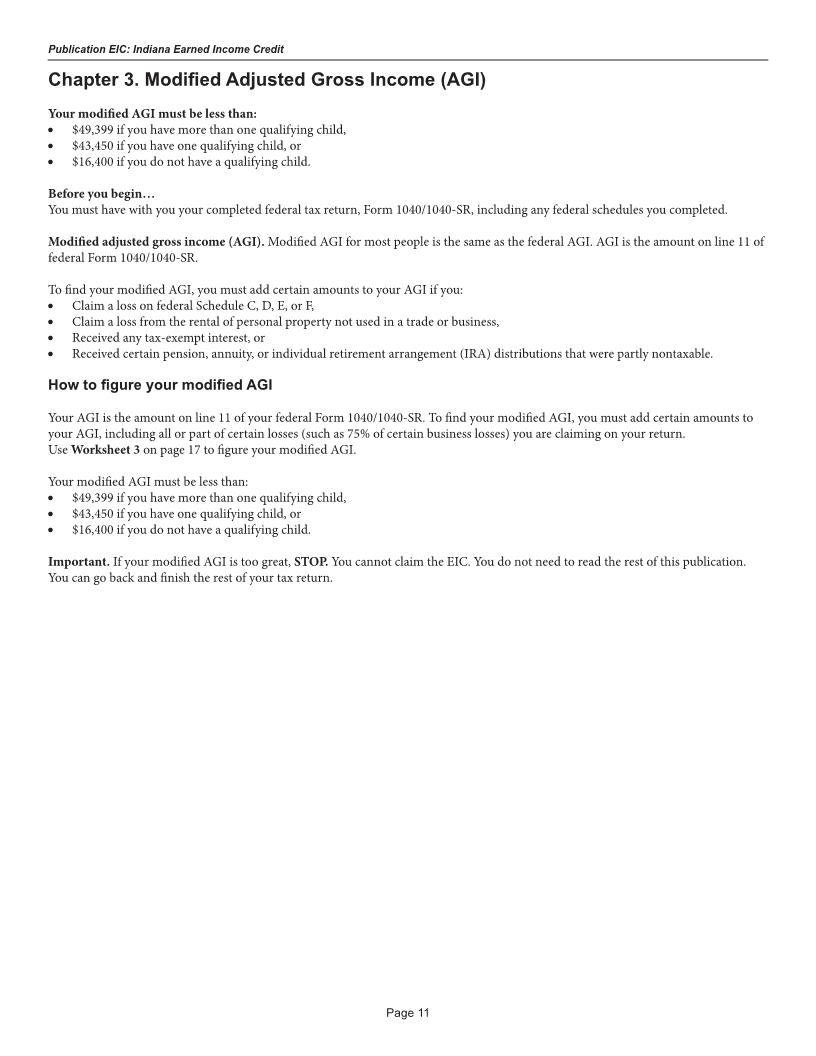

Chapter 4. Worksheets

Worksheet A: Indiana’s Earned Income Credit (EIC)

Before you begin: Be sure you are using the correct worksheet. Use Worksheet A if you answered “No” to Step 6, question 3.

Use Worksheet B if you answered “Yes” to Step 6, question 3.

Part 1 – All filers using Worksheet A

1. Enter your earned income from Step 6, Box B .................................................................................................. 1. ____________

2. Look up the amount on line 1 above in the Indiana Earned Income Credit Table starting on page 18 to find the

credit. Be sure you use the correct column for the number of children you can claim. Enter the credit here .......... 2. ____________

If line 2 is zero, STOP. You cannot claim the credit.

3. Enter your modified adjusted gross income from Step 5, Box A ....................................................................... 3. ____________

4. Are the amounts on lines 3 and 1 the same?

Yes. Skip line 5; enter the amount from line 2 on line 6.

No. Go to line 5.

Part 2 – Filers who answered “No” on line 4

5. If you have:

• No qualifying children, is the amount on line 3 less than $9,150?

• One qualifying child, is the amount on line 3 less than $20,150?

• Two or more qualifying children, is the amount on line 3 less than $20,150?

Yes. Leave line 5 blank; enter the amount from line 2 on line 6.

No. Look up the amount on line 3 in the Indiana Earned Income Credit Table starting on page 18 to find the

credit. Be sure you use the correct column for the number of children you can claim. Enter the credit here ......... 5. ____________

Look at the amounts on line 5 and 2. Then, enter the smaller amount on line 6.

Part 3 – Your Indiana earned income credit

6. This is the amount from Part 1 or Part 2 above ................................................................................................. 6. ____________

7. If you have an alternative minimum tax on our federal tax return, Form 1040/1040-SR, then

multiply that amount by 10% (.10) and enter the result here ............................................................................. 7. ____________

8. Subtract line 7 from line 6 (if zero or less, STOP. You cannot take a credit). Enter this amount here ............... 8. ____________

9. This is the amount from Part 1 or Part 2 above. Enter the earned income credit claimed on your

federal tax return Form 1040/1040-SR .............................................................................................................. 9. ____________

10. Multiply line 9 by .10 (10%). Enter result here ................................................................................................... 10. ____________

11. Look at the amount on line 8 and on line 10. Enter the smaller amount here

and on Schedule IN-EIC, line A-3 .................................................................. Indiana Earned Income Credit 11. ____________

Final Step – You must complete Schedule IN-EIC and enclose it with your filing.

Page 12

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

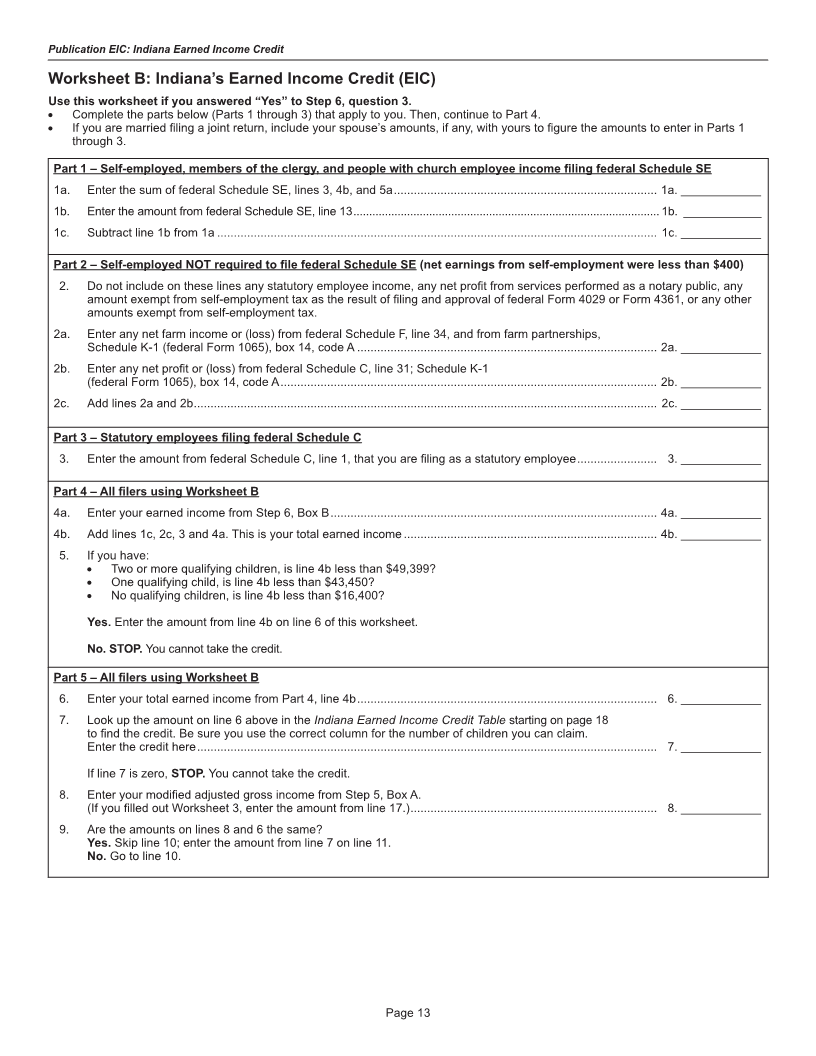

Worksheet B: Indiana’s Earned Income Credit (EIC)

Use this worksheet if you answered “Yes” to Step 6, question 3.

• Complete the parts below (Parts 1 through 3) that apply to you. Then, continue to Part 4.

• If you are married filing a joint return, include your spouse’s amounts, if any, with yours to figure the amounts to enter in Parts 1

through 3.

Part 1 – Self-employed, members of the clergy, and people with church employee income filing federal Schedule SE

1a. Enter the sum of federal Schedule SE, lines 3, 4b, and 5a ............................................................................... 1a. ____________

1b. Enter the amount from federal Schedule SE, line 13 ................................................................................................. 1b. ____________

1c. Subtract line 1b from 1a .................................................................................................................................... 1c. ____________

Part 2 – Self-employed NOT required to file federal Schedule SE (net earnings from self-employment were less than $400)

2. Do not include on these lines any statutory employee income, any net profit from services performed as a notary public, any

amount exempt from self-employment tax as the result of filing and approval of federal Form 4029 or Form 4361, or any other

amounts exempt from self-employment tax.

2a. Enter any net farm income or (loss) from federal Schedule F, line 34, and from farm partnerships,

Schedule K-1 (federal Form 1065), box 14, code A .......................................................................................... 2a. ____________

2b. Enter any net profit or (loss) from federal Schedule C, line 31; Schedule K-1

(federal Form 1065), box 14, code A ................................................................................................................. 2b. ____________

2c. Add lines 2a and 2b ........................................................................................................................................... 2c. ____________

Part 3 – Statutory employees filing federal Schedule C

3. Enter the amount from federal Schedule C, line 1, that you are filing as a statutory employee ........................ 3. ____________

Part 4 – All filers using Worksheet B

4a. Enter your earned income from Step 6, Box B .................................................................................................. 4a. ____________

4b. Add lines 1c, 2c, 3 and 4a. This is your total earned income ............................................................................ 4b. ____________

5. If you have:

• Two or more qualifying children, is line 4b less than $49,399?

• One qualifying child, is line 4b less than $43,450?

• No qualifying children, is line 4b less than $16,400?

Yes. Enter the amount from line 4b on line 6 of this worksheet.

No. STOP. You cannot take the credit.

Part 5 – All filers using Worksheet B

6. Enter your total earned income from Part 4, line 4b .......................................................................................... 6. ____________

7. Look up the amount on line 6 above in the Indiana Earned Income Credit Table starting on page 18

to find the credit. Be sure you use the correct column for the number of children you can claim.

Enter the credit here .......................................................................................................................................... 7. ____________

If line 7 is zero, STOP. You cannot take the credit.

8. Enter your modified adjusted gross income from Step 5, Box A.

(If you filled out Worksheet 3, enter the amount from line 17.) .......................................................................... 8. ____________

9. Are the amounts on lines 8 and 6 the same?

Yes. Skip line 10; enter the amount from line 7 on line 11.

No. Go to line 10.

Page 13

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

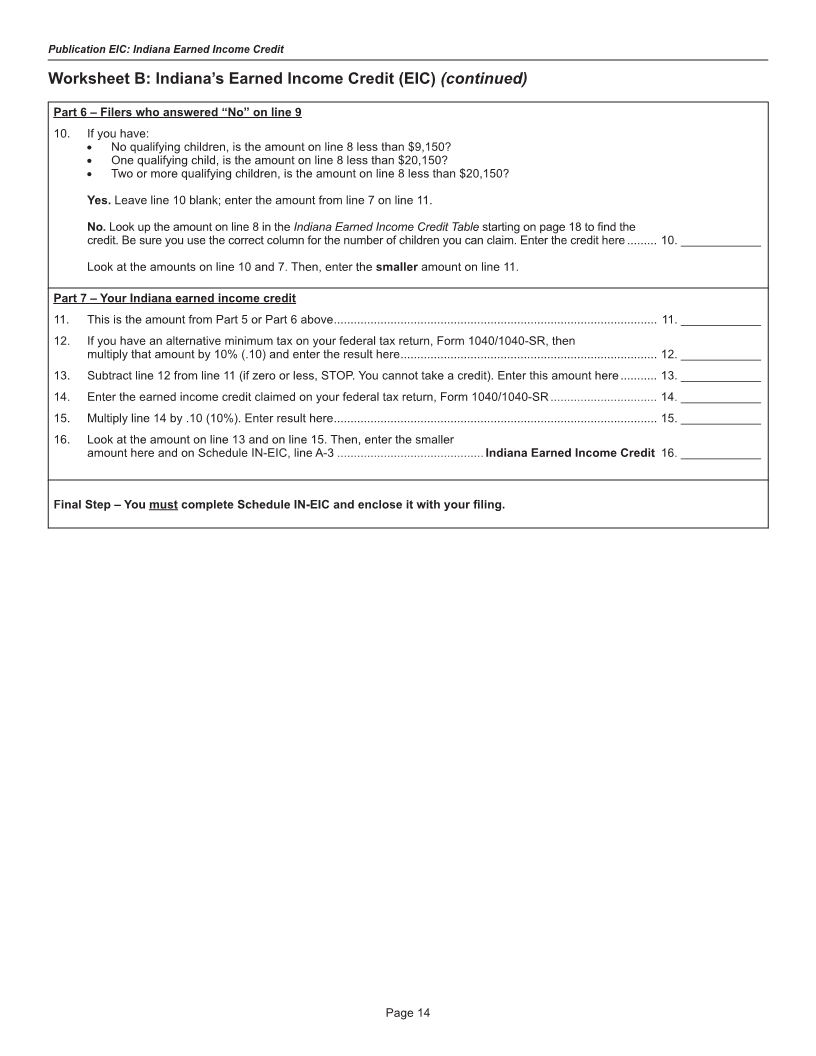

Worksheet B: Indiana’s Earned Income Credit (EIC) (continued)

Part 6 – Filers who answered “No” on line 9

10. If you have:

• No qualifying children, is the amount on line 8 less than $9,150?

• One qualifying child, is the amount on line 8 less than $20,150?

• Two or more qualifying children, is the amount on line 8 less than $20,150?

Yes. Leave line 10 blank; enter the amount from line 7 on line 11.

No. Look up the amount on line 8 in the Indiana Earned Income Credit Table starting on page 18 to find the

credit. Be sure you use the correct column for the number of children you can claim. Enter the credit here ......... 10. ____________

Look at the amounts on line 10 and 7. Then, enter the smaller amount on line 11.

Part 7 – Your Indiana earned income credit

11. This is the amount from Part 5 or Part 6 above ................................................................................................. 11. ____________

12. If you have an alternative minimum tax on your federal tax return, Form 1040/1040-SR, then

multiply that amount by 10% (.10) and enter the result here ............................................................................. 12. ____________

13. Subtract line 12 from line 11 (if zero or less, STOP. You cannot take a credit). Enter this amount here ........... 13. ____________

14. Enter the earned income credit claimed on your federal tax return, Form 1040/1040-SR ................................ 14. ____________

15. Multiply line 14 by .10 (10%). Enter result here ................................................................................................. 15. ____________

16. Look at the amount on line 13 and on line 15. Then, enter the smaller

amount here and on Schedule IN-EIC, line A-3 ............................................ Indiana Earned Income Credit 16. ____________

Final Step – You must complete Schedule IN-EIC and enclose it with your filing.

Page 14

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

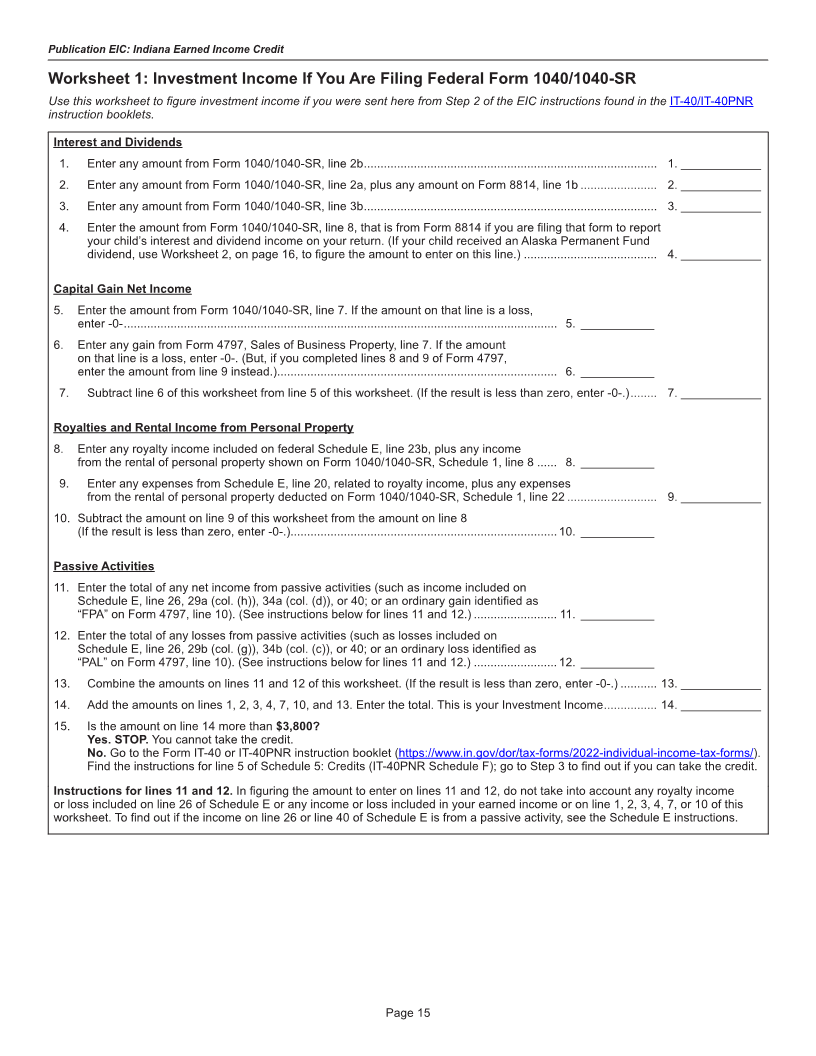

Worksheet 1: Investment Income If You Are Filing Federal Form 1040/1040-SR

Use this worksheet to figure investment income if you were sent here from Step 2 of the EIC instructions found in the IT-40/IT-40PNR

instruction booklets.

Interest and Dividends

1. Enter any amount from Form 1040/1040-SR, line 2b ........................................................................................ 1. ____________

2. Enter any amount from Form 1040/1040-SR, line 2a, plus any amount on Form 8814, line 1b ....................... 2. ____________

3. Enter any amount from Form 1040/1040-SR, line 3b ........................................................................................ 3. ____________

4. Enter the amount from Form 1040/1040-SR, line 8, that is from Form 8814 if you are filing that form to report

your child’s interest and dividend income on your return. (If your child received an Alaska Permanent Fund

dividend, use Worksheet 2, on page 16, to figure the amount to enter on this line.) ........................................ 4. ____________

Capital Gain Net Income

5. Enter the amount from Form 1040/1040-SR, line 7. If the amount on that line is a loss,

enter -0- .................................................................................................................................. 5. ___________

6. Enter any gain from Form 4797, Sales of Business Property, line 7. If the amount

on that line is a loss, enter -0-. (But, if you completed lines 8 and 9 of Form 4797,

enter the amount from line 9 instead.).................................................................................... 6. ___________

7. Subtract line 6 of this worksheet from line 5 of this worksheet. (If the result is less than zero, enter -0-.) ........ 7. ____________

Royalties and Rental Income from Personal Property

8. Enter any royalty income included on federal Schedule E, line 23b, plus any income

from the rental of personal property shown on Form 1040/1040-SR, Schedule 1, line 8 ...... 8. ___________

9. Enter any expenses from Schedule E, line 20, related to royalty income, plus any expenses

from the rental of personal property deducted on Form 1040/1040-SR, Schedule 1, line 22 ........................... 9. ____________

10. Subtract the amount on line 9 of this worksheet from the amount on line 8

(If the result is less than zero, enter -0-.)................................................................................ 10. ___________

Passive Activities

11. Enter the total of any net income from passive activities (such as income included on

Schedule E, line 26, 29a (col. (h)), 34a (col. (d)), or 40; or an ordinary gain identified as

“FPA” on Form 4797, line 10). (See instructions below for lines 11 and 12.) ......................... 11. ___________

12. Enter the total of any losses from passive activities (such as losses included on

Schedule E, line 26, 29b (col. (g)), 34b (col. (c)), or 40; or an ordinary loss identified as

“PAL” on Form 4797, line 10). (See instructions below for lines 11 and 12.) ......................... 12. ___________

13. Combine the amounts on lines 11 and 12 of this worksheet. (If the result is less than zero, enter -0-.) ........... 13. ____________

14. Add the amounts on lines 1, 2, 3, 4, 7, 10, and 13. Enter the total. This is your Investment Income ................ 14. ____________

15. Is the amount on line 14 more than $3,800?

Yes. STOP. You cannot take the credit.

No. Go to the Form IT-40 or IT-40PNR instruction booklet (https://www.in.gov/dor/tax-forms/2022-individual-income-tax-forms/ ).

Find the instructions for line 5 of Schedule 5: Credits (IT-40PNR Schedule F); go to Step 3 to find out if you can take the credit.

Instructions for lines 11 and 12. In figuring the amount to enter on lines 11 and 12, do not take into account any royalty income

or loss included on line 26 of Schedule E or any income or loss included in your earned income or on line 1, 2, 3, 4, 7, or 10 of this

worksheet. To find out if the income on line 26 or line 40 of Schedule E is from a passive activity, see the Schedule E instructions.

Page 15

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

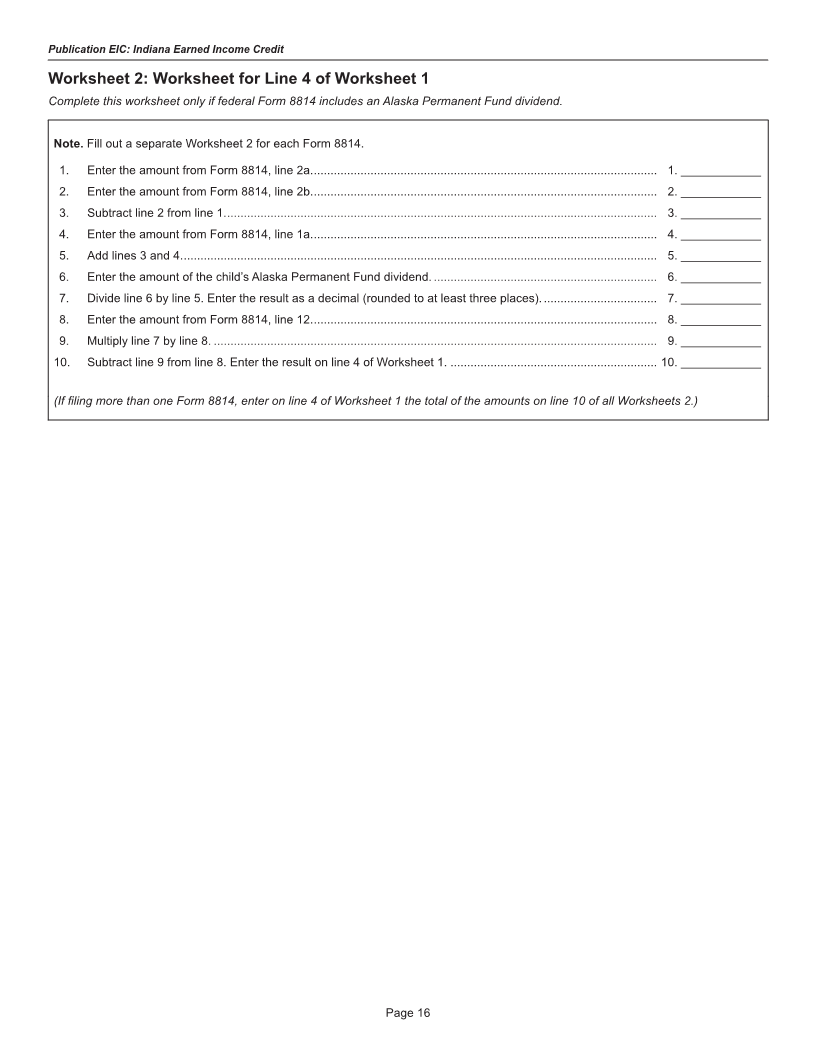

Worksheet 2: Worksheet for Line 4 of Worksheet 1

Complete this worksheet only if federal Form 8814 includes an Alaska Permanent Fund dividend.

Note. Fill out a separate Worksheet 2 for each Form 8814.

1. Enter the amount from Form 8814, line 2a. ....................................................................................................... 1. ____________

2. Enter the amount from Form 8814, line 2b. ....................................................................................................... 2. ____________

3. Subtract line 2 from line 1. ................................................................................................................................. 3. ____________

4. Enter the amount from Form 8814, line 1a. ....................................................................................................... 4. ____________

5. Add lines 3 and 4. .............................................................................................................................................. 5. ____________

6. Enter the amount of the child’s Alaska Permanent Fund dividend. ................................................................... 6. ____________

7. Divide line 6 by line 5. Enter the result as a decimal (rounded to at least three places). .................................. 7. ____________

8. Enter the amount from Form 8814, line 12. ....................................................................................................... 8. ____________

9. Multiply line 7 by line 8. ..................................................................................................................................... 9. ____________

10. Subtract line 9 from line 8. Enter the result on line 4 of Worksheet 1. .............................................................. 10. ____________

(If filing more than one Form 8814, enter on line 4 of Worksheet 1 the total of the amounts on line 10 of all Worksheets 2.)

Page 16

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

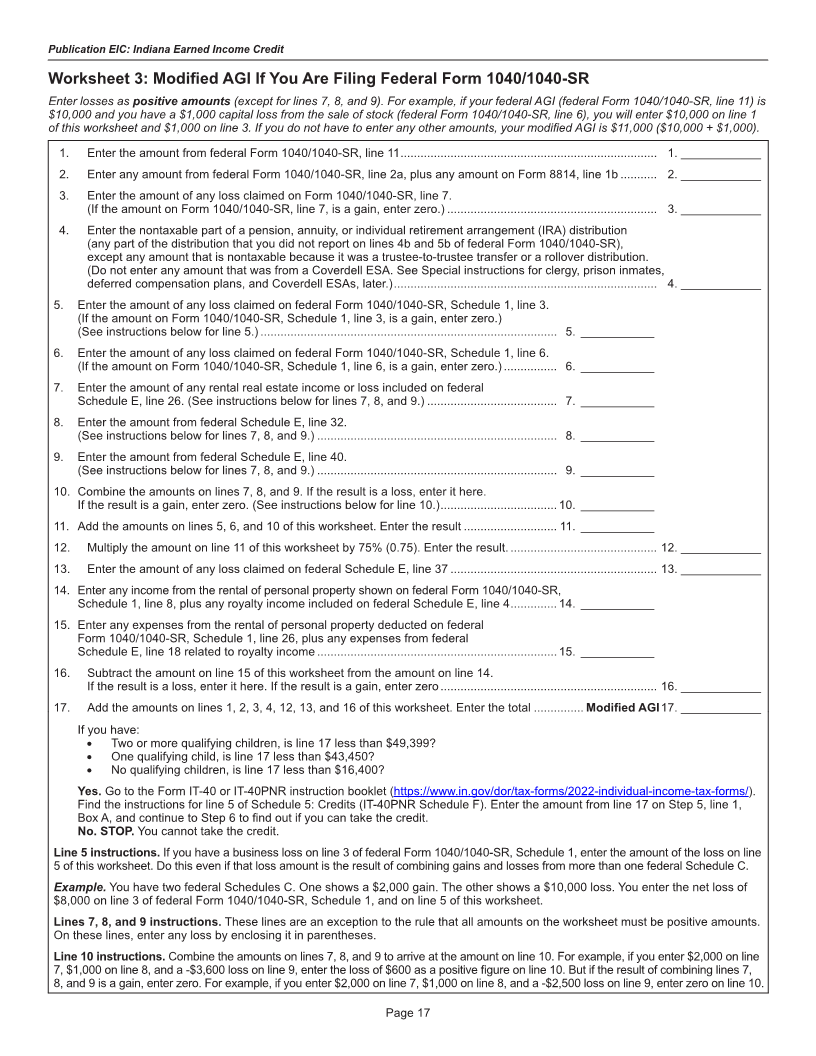

Worksheet 3: Modified AGI If You Are Filing Federal Form 1040/1040-SR

Enter losses as positive amounts (except for lines 7, 8, and 9). For example, if your federal AGI (federal Form 1040/1040-SR, line 11) is

$10,000 and you have a $1,000 capital loss from the sale of stock (federal Form 1040/1040-SR, line 6), you will enter $10,000 on line 1

of this worksheet and $1,000 on line 3. If you do not have to enter any other amounts, your modified AGI is $11,000 ($10,000 + $1,000).

1. Enter the amount from federal Form 1040/1040-SR, line 11 ............................................................................. 1. ____________

2. Enter any amount from federal Form 1040/1040-SR, line 2a, plus any amount on Form 8814, line 1b ........... 2. ____________

3. Enter the amount of any loss claimed on Form 1040/1040-SR, line 7.

(If the amount on Form 1040/1040-SR, line 7, is a gain, enter zero.) ............................................................... 3. ____________

4. Enter the nontaxable part of a pension, annuity, or individual retirement arrangement (IRA) distribution

(any part of the distribution that you did not report on lines 4b and 5b of federal Form 1040/1040-SR),

except any amount that is nontaxable because it was a trustee-to-trustee transfer or a rollover distribution.

(Do not enter any amount that was from a Coverdell ESA. See Special instructions for clergy, prison inmates,

deferred compensation plans, and Coverdell ESAs, later.) ............................................................................... 4. ____________

5. Enter the amount of any loss claimed on federal Form 1040/1040-SR, Schedule 1, line 3.

(If the amount on Form 1040/1040-SR, Schedule 1, line 3, is a gain, enter zero.)

(See instructions below for line 5.) ......................................................................................... 5. ___________

6. Enter the amount of any loss claimed on federal Form 1040/1040-SR, Schedule 1, line 6.

(If the amount on Form 1040/1040-SR, Schedule 1, line 6, is a gain, enter zero.) ................ 6. ___________

7. Enter the amount of any rental real estate income or loss included on federal

Schedule E, line 26. (See instructions below for lines 7, 8, and 9.) ....................................... 7. ___________

8. Enter the amount from federal Schedule E, line 32.

(See instructions below for lines 7, 8, and 9.) ........................................................................ 8. ___________

9. Enter the amount from federal Schedule E, line 40.

(See instructions below for lines 7, 8, and 9.) ........................................................................ 9. ___________

10. Combine the amounts on lines 7, 8, and 9. If the result is a loss, enter it here.

If the result is a gain, enter zero. (See instructions below for line 10.) ................................... 10. ___________

11. Add the amounts on lines 5, 6, and 10 of this worksheet. Enter the result ............................ 11. ___________

12. Multiply the amount on line 11 of this worksheet by 75% (0.75). Enter the result. ............................................ 12. ____________

13. Enter the amount of any loss claimed on federal Schedule E, line 37 .............................................................. 13. ____________

14. Enter any income from the rental of personal property shown on federal Form 1040/1040-SR,

Schedule 1, line 8, plus any royalty income included on federal Schedule E, line 4 .............. 14. ___________

15. Enter any expenses from the rental of personal property deducted on federal

Form 1040/1040-SR, Schedule 1, line 26, plus any expenses from federal

Schedule E, line 18 related to royalty income ........................................................................ 15. ___________

16. Subtract the amount on line 15 of this worksheet from the amount on line 14.

If the result is a loss, enter it here. If the result is a gain, enter zero ................................................................. 16. ____________

17. Add the amounts on lines 1, 2, 3, 4, 12, 13, and 16 of this worksheet. Enter the total ............... Modified AGI 17. ____________

If you have:

• Two or more qualifying children, is line 17 less than $49,399?

• One qualifying child, is line 17 less than $43,450?

• No qualifying children, is line 17 less than $16,400?

Yes. Go to the Form IT-40 or IT-40PNR instruction booklet (https://www.in.gov/dor/tax-forms/2022-individual-income-tax-forms/).

Find the instructions for line 5 of Schedule 5: Credits (IT-40PNR Schedule F). Enter the amount from line 17 on Step 5, line 1,

Box A, and continue to Step 6 to find out if you can take the credit.

No. STOP. You cannot take the credit.

Line 5 instructions. If you have a business loss on line 3 of federal Form 1040/1040-SR, Schedule 1, enter the amount of the loss on line

5 of this worksheet. Do this even if that loss amount is the result of combining gains and losses from more than one federal Schedule C.

Example. You have two federal Schedules C. One shows a $2,000 gain. The other shows a $10,000 loss. You enter the net loss of

$8,000 on line 3 of federal Form 1040/1040-SR, Schedule 1, and on line 5 of this worksheet.

Lines 7, 8, and 9 instructions. These lines are an exception to the rule that all amounts on the worksheet must be positive amounts.

On these lines, enter any loss by enclosing it in parentheses.

Line 10 instructions. Combine the amounts on lines 7, 8, and 9 to arrive at the amount on line 10. For example, if you enter $2,000 on line

7, $1,000 on line 8, and a -$3,600 loss on line 9, enter the loss of $600 as a positive figure on line 10. But if the result of combining lines 7,

8, and 9 is a gain, enter zero. For example, if you enter $2,000 on line 7, $1,000 on line 8, and a -$2,500 loss on line 9, enter zero on line 10.

Page 17

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

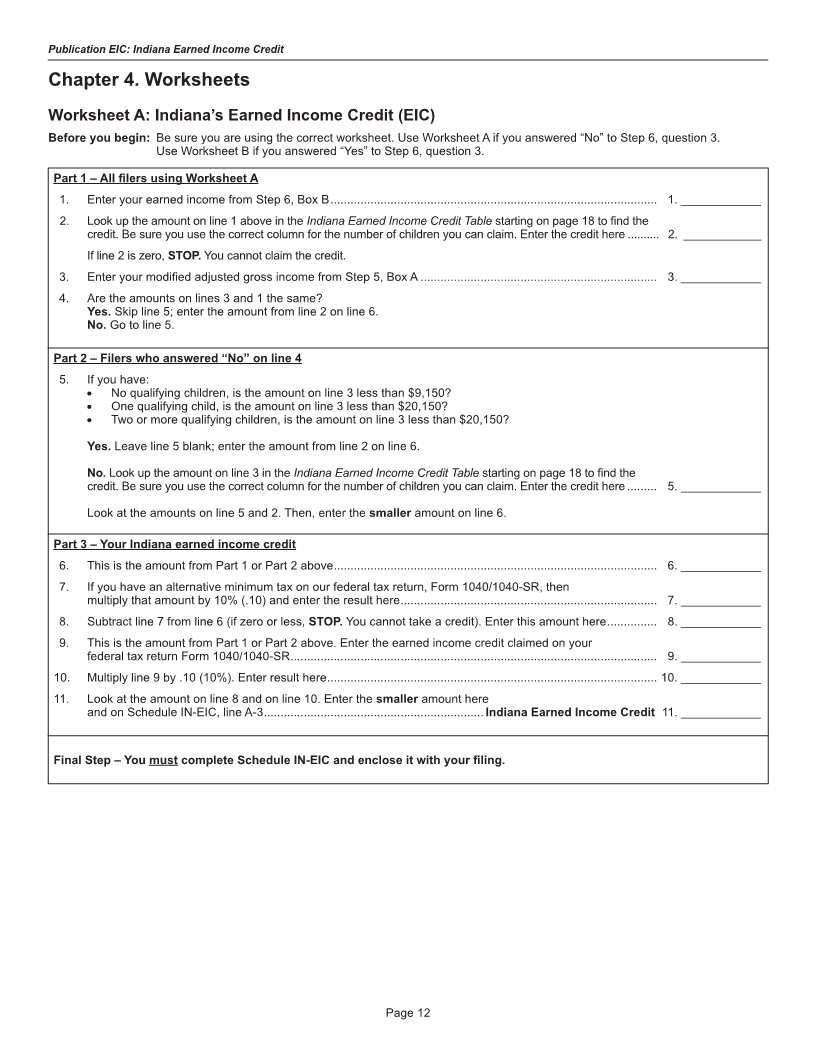

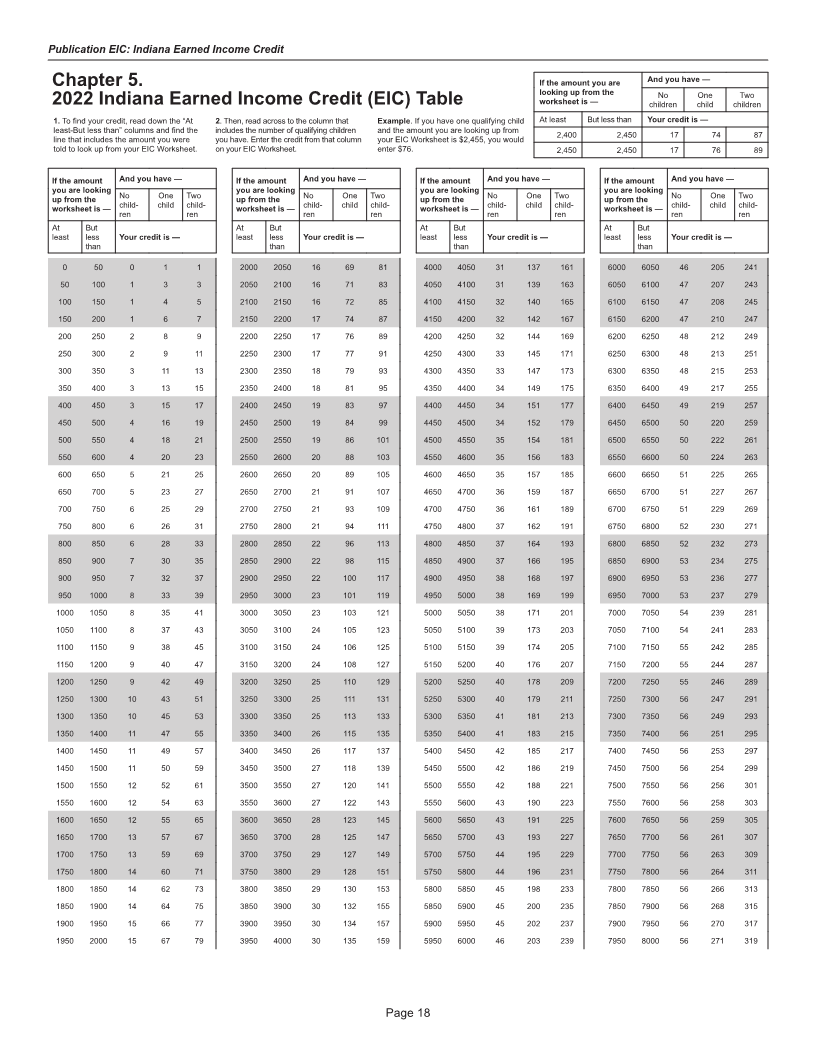

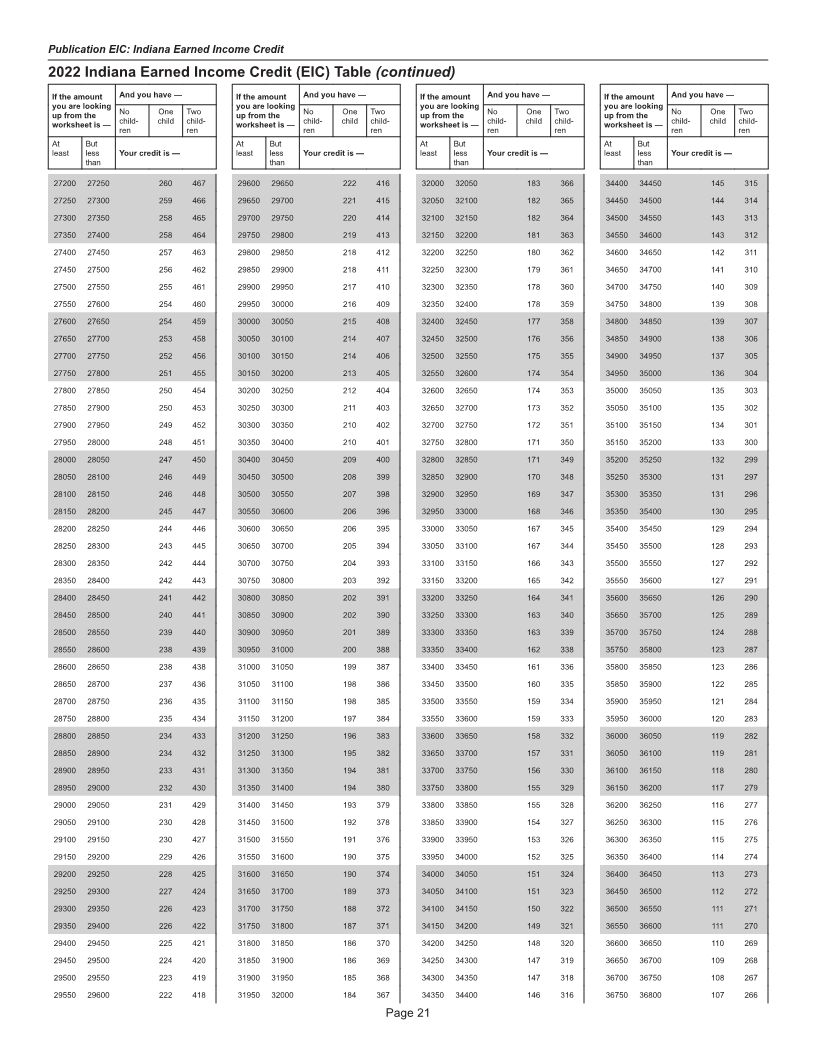

Chapter 5. If the amount you are And you have —

looking up from the No One Two

2022 Indiana Earned Income Credit (EIC) Table worksheet is — children child children

1. To find your credit, read down the “At 2. Then, read across to the column that Example. If you have one qualifying child At least But less than Your credit is —

least-But less than” columns and find the includes the number of qualifying children and the amount you are looking up from 2,400 2,450 17 74 87

line that includes the amount you were you have. Enter the credit from that column your EIC Worksheet is $2,455, you would

told to look up from your EIC Worksheet. on your EIC Worksheet. enter $76. 2,450 2,450 17 76 89

If the amount And you have — If the amount And you have — If the amount And you have — If the amount And you have —

you are looking No One Two you are looking No One Two you are looking No One Two you are looking No One Two

up from the child- child child- up from the child- child child- up from the child- child child- up from the child- child child-

worksheet is — ren ren worksheet is — ren ren worksheet is — ren ren worksheet is — ren ren

At But At But At But At But

least less Your credit is — least less Your credit is — least less Your credit is — least less Your credit is —

than than than than

0 50 0 1 1 2000 2050 16 69 81 4000 4050 31 137 161 6000 6050 46 205 241

50 100 1 3 3 2050 2100 16 71 83 4050 4100 31 139 163 6050 6100 47 207 243

100 150 1 4 5 2100 2150 16 72 85 4100 4150 32 140 165 6100 6150 47 208 245

150 200 1 6 7 2150 2200 17 74 87 4150 4200 32 142 167 6150 6200 47 210 247

200 250 2 8 9 2200 2250 17 76 89 4200 4250 32 144 169 6200 6250 48 212 249

250 300 2 9 11 2250 2300 17 77 91 4250 4300 33 145 171 6250 6300 48 213 251

300 350 3 11 13 2300 2350 18 79 93 4300 4350 33 147 173 6300 6350 48 215 253

350 400 3 13 15 2350 2400 18 81 95 4350 4400 34 149 175 6350 6400 49 217 255

400 450 3 15 17 2400 2450 19 83 97 4400 4450 34 151 177 6400 6450 49 219 257

450 500 4 16 19 2450 2500 19 84 99 4450 4500 34 152 179 6450 6500 50 220 259

500 550 4 18 21 2500 2550 19 86 101 4500 4550 35 154 181 6500 6550 50 222 261

550 600 4 20 23 2550 2600 20 88 103 4550 4600 35 156 183 6550 6600 50 224 263

600 650 5 21 25 2600 2650 20 89 105 4600 4650 35 157 185 6600 6650 51 225 265

650 700 5 23 27 2650 2700 21 91 107 4650 4700 36 159 187 6650 6700 51 227 267

700 750 6 25 29 2700 2750 21 93 109 4700 4750 36 161 189 6700 6750 51 229 269

750 800 6 26 31 2750 2800 21 94 111 4750 4800 37 162 191 6750 6800 52 230 271

800 850 6 28 33 2800 2850 22 96 113 4800 4850 37 164 193 6800 6850 52 232 273

850 900 7 30 35 2850 2900 22 98 115 4850 4900 37 166 195 6850 6900 53 234 275

900 950 7 32 37 2900 2950 22 100 117 4900 4950 38 168 197 6900 6950 53 236 277

950 1000 8 33 39 2950 3000 23 101 119 4950 5000 38 169 199 6950 7000 53 237 279

1000 1050 8 35 41 3000 3050 23 103 121 5000 5050 38 171 201 7000 7050 54 239 281

1050 1100 8 37 43 3050 3100 24 105 123 5050 5100 39 173 203 7050 7100 54 241 283

1100 1150 9 38 45 3100 3150 24 106 125 5100 5150 39 174 205 7100 7150 55 242 285

1150 1200 9 40 47 3150 3200 24 108 127 5150 5200 40 176 207 7150 7200 55 244 287

1200 1250 9 42 49 3200 3250 25 110 129 5200 5250 40 178 209 7200 7250 55 246 289

1250 1300 10 43 51 3250 3300 25 111 131 5250 5300 40 179 211 7250 7300 56 247 291

1300 1350 10 45 53 3300 3350 25 113 133 5300 5350 41 181 213 7300 7350 56 249 293

1350 1400 11 47 55 3350 3400 26 115 135 5350 5400 41 183 215 7350 7400 56 251 295

1400 1450 11 49 57 3400 3450 26 117 137 5400 5450 42 185 217 7400 7450 56 253 297

1450 1500 11 50 59 3450 3500 27 118 139 5450 5500 42 186 219 7450 7500 56 254 299

1500 1550 12 52 61 3500 3550 27 120 141 5500 5550 42 188 221 7500 7550 56 256 301

1550 1600 12 54 63 3550 3600 27 122 143 5550 5600 43 190 223 7550 7600 56 258 303

1600 1650 12 55 65 3600 3650 28 123 145 5600 5650 43 191 225 7600 7650 56 259 305

1650 1700 13 57 67 3650 3700 28 125 147 5650 5700 43 193 227 7650 7700 56 261 307

1700 1750 13 59 69 3700 3750 29 127 149 5700 5750 44 195 229 7700 7750 56 263 309

1750 1800 14 60 71 3750 3800 29 128 151 5750 5800 44 196 231 7750 7800 56 264 311

1800 1850 14 62 73 3800 3850 29 130 153 5800 5850 45 198 233 7800 7850 56 266 313

1850 1900 14 64 75 3850 3900 30 132 155 5850 5900 45 200 235 7850 7900 56 268 315

1900 1950 15 66 77 3900 3950 30 134 157 5900 5950 45 202 237 7900 7950 56 270 317

1950 2000 15 67 79 3950 4000 30 135 159 5950 6000 46 203 239 7950 8000 56 271 319

Page 18

|

Enlarge image |

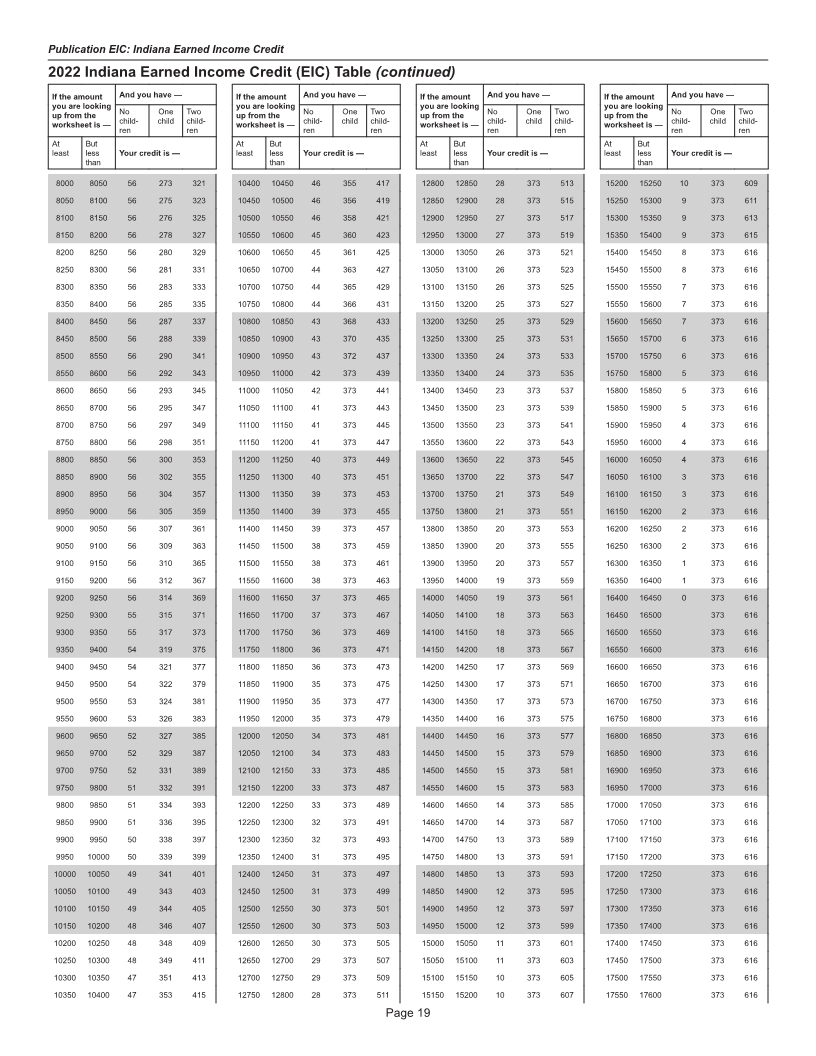

Publication EIC: Indiana Earned Income Credit

2022 Indiana Earned Income Credit (EIC) Table (continued)

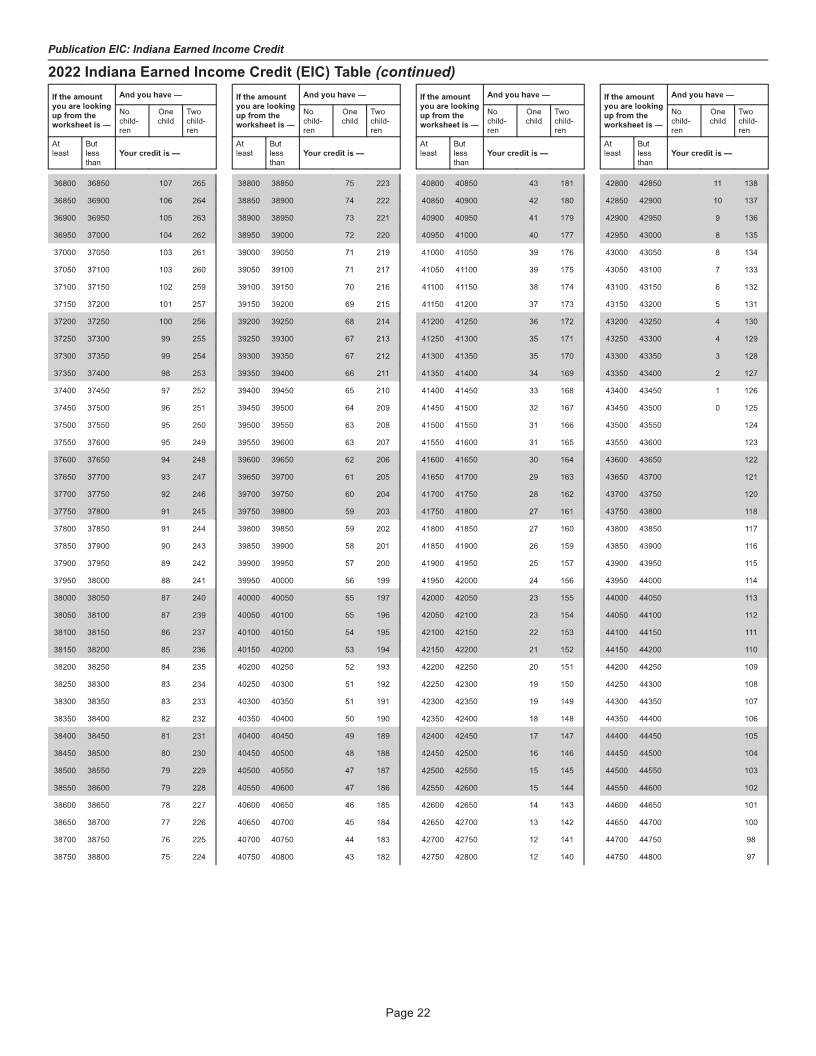

If the amount And you have — If the amount And you have — If the amount And you have — If the amount And you have —

you are looking No One Two you are looking No One Two you are looking No One Two you are looking No One Two

up from the child- child child- up from the child- child child- up from the child- child child- up from the child- child child-

worksheet is — ren ren worksheet is — ren ren worksheet is — ren ren worksheet is — ren ren

At But At But At But At But

least less Your credit is — least less Your credit is — least less Your credit is — least less Your credit is —

than than than than

8000 8050 56 273 321 10400 10450 46 355 417 12800 12850 28 373 513 15200 15250 10 373 609

8050 8100 56 275 323 10450 10500 46 356 419 12850 12900 28 373 515 15250 15300 9 373 611

8100 8150 56 276 325 10500 10550 46 358 421 12900 12950 27 373 517 15300 15350 9 373 613

8150 8200 56 278 327 10550 10600 45 360 423 12950 13000 27 373 519 15350 15400 9 373 615

8200 8250 56 280 329 10600 10650 45 361 425 13000 13050 26 373 521 15400 15450 8 373 616

8250 8300 56 281 331 10650 10700 44 363 427 13050 13100 26 373 523 15450 15500 8 373 616

8300 8350 56 283 333 10700 10750 44 365 429 13100 13150 26 373 525 15500 15550 7 373 616

8350 8400 56 285 335 10750 10800 44 366 431 13150 13200 25 373 527 15550 15600 7 373 616

8400 8450 56 287 337 10800 10850 43 368 433 13200 13250 25 373 529 15600 15650 7 373 616

8450 8500 56 288 339 10850 10900 43 370 435 13250 13300 25 373 531 15650 15700 6 373 616

8500 8550 56 290 341 10900 10950 43 372 437 13300 13350 24 373 533 15700 15750 6 373 616

8550 8600 56 292 343 10950 11000 42 373 439 13350 13400 24 373 535 15750 15800 5 373 616

8600 8650 56 293 345 11000 11050 42 373 441 13400 13450 23 373 537 15800 15850 5 373 616

8650 8700 56 295 347 11050 11100 41 373 443 13450 13500 23 373 539 15850 15900 5 373 616

8700 8750 56 297 349 11100 11150 41 373 445 13500 13550 23 373 541 15900 15950 4 373 616

8750 8800 56 298 351 11150 11200 41 373 447 13550 13600 22 373 543 15950 16000 4 373 616

8800 8850 56 300 353 11200 11250 40 373 449 13600 13650 22 373 545 16000 16050 4 373 616

8850 8900 56 302 355 11250 11300 40 373 451 13650 13700 22 373 547 16050 16100 3 373 616

8900 8950 56 304 357 11300 11350 39 373 453 13700 13750 21 373 549 16100 16150 3 373 616

8950 9000 56 305 359 11350 11400 39 373 455 13750 13800 21 373 551 16150 16200 2 373 616

9000 9050 56 307 361 11400 11450 39 373 457 13800 13850 20 373 553 16200 16250 2 373 616

9050 9100 56 309 363 11450 11500 38 373 459 13850 13900 20 373 555 16250 16300 2 373 616

9100 9150 56 310 365 11500 11550 38 373 461 13900 13950 20 373 557 16300 16350 1 373 616

9150 9200 56 312 367 11550 11600 38 373 463 13950 14000 19 373 559 16350 16400 1 373 616

9200 9250 56 314 369 11600 11650 37 373 465 14000 14050 19 373 561 16400 16450 0 373 616

9250 9300 55 315 371 11650 11700 37 373 467 14050 14100 18 373 563 16450 16500 373 616

9300 9350 55 317 373 11700 11750 36 373 469 14100 14150 18 373 565 16500 16550 373 616

9350 9400 54 319 375 11750 11800 36 373 471 14150 14200 18 373 567 16550 16600 373 616

9400 9450 54 321 377 11800 11850 36 373 473 14200 14250 17 373 569 16600 16650 373 616

9450 9500 54 322 379 11850 11900 35 373 475 14250 14300 17 373 571 16650 16700 373 616

9500 9550 53 324 381 11900 11950 35 373 477 14300 14350 17 373 573 16700 16750 373 616

9550 9600 53 326 383 11950 12000 35 373 479 14350 14400 16 373 575 16750 16800 373 616

9600 9650 52 327 385 12000 12050 34 373 481 14400 14450 16 373 577 16800 16850 373 616

9650 9700 52 329 387 12050 12100 34 373 483 14450 14500 15 373 579 16850 16900 373 616

9700 9750 52 331 389 12100 12150 33 373 485 14500 14550 15 373 581 16900 16950 373 616

9750 9800 51 332 391 12150 12200 33 373 487 14550 14600 15 373 583 16950 17000 373 616

9800 9850 51 334 393 12200 12250 33 373 489 14600 14650 14 373 585 17000 17050 373 616

9850 9900 51 336 395 12250 12300 32 373 491 14650 14700 14 373 587 17050 17100 373 616

9900 9950 50 338 397 12300 12350 32 373 493 14700 14750 13 373 589 17100 17150 373 616

9950 10000 50 339 399 12350 12400 31 373 495 14750 14800 13 373 591 17150 17200 373 616

10000 10050 49 341 401 12400 12450 31 373 497 14800 14850 13 373 593 17200 17250 373 616

10050 10100 49 343 403 12450 12500 31 373 499 14850 14900 12 373 595 17250 17300 373 616

10100 10150 49 344 405 12500 12550 30 373 501 14900 14950 12 373 597 17300 17350 373 616

10150 10200 48 346 407 12550 12600 30 373 503 14950 15000 12 373 599 17350 17400 373 616

10200 10250 48 348 409 12600 12650 30 373 505 15000 15050 11 373 601 17400 17450 373 616

10250 10300 48 349 411 12650 12700 29 373 507 15050 15100 11 373 603 17450 17500 373 616

10300 10350 47 351 413 12700 12750 29 373 509 15100 15150 10 373 605 17500 17550 373 616

10350 10400 47 353 415 12750 12800 28 373 511 15150 15200 10 373 607 17550 17600 373 616

Page 19

|

Enlarge image |

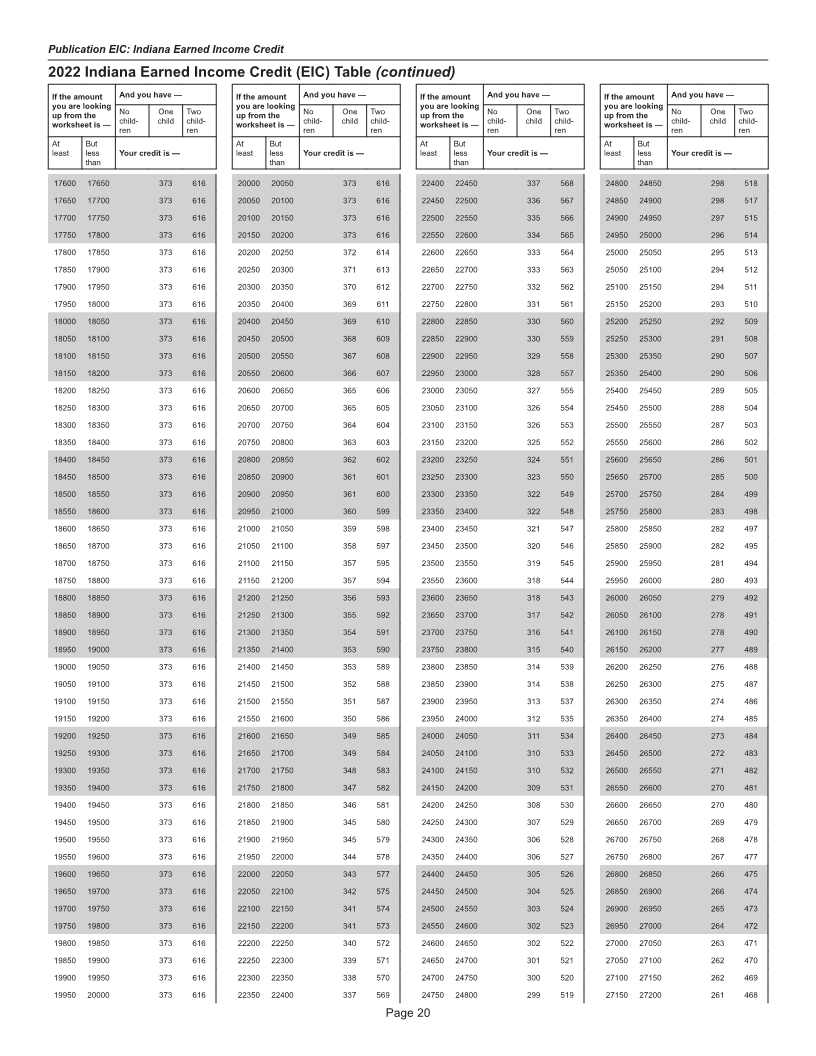

Publication EIC: Indiana Earned Income Credit

2022 Indiana Earned Income Credit (EIC) Table (continued)

If the amount And you have — If the amount And you have — If the amount And you have — If the amount And you have —

you are looking No One Two you are looking No One Two you are looking No One Two you are looking No One Two

up from the child- child child- up from the child- child child- up from the child- child child- up from the child- child child-

worksheet is — ren ren worksheet is — ren ren worksheet is — ren ren worksheet is — ren ren

At But At But At But At But

least less Your credit is — least less Your credit is — least less Your credit is — least less Your credit is —

than than than than

17600 17650 373 616 20000 20050 373 616 22400 22450 337 568 24800 24850 298 518

17650 17700 373 616 20050 20100 373 616 22450 22500 336 567 24850 24900 298 517

17700 17750 373 616 20100 20150 373 616 22500 22550 335 566 24900 24950 297 515

17750 17800 373 616 20150 20200 373 616 22550 22600 334 565 24950 25000 296 514

17800 17850 373 616 20200 20250 372 614 22600 22650 333 564 25000 25050 295 513

17850 17900 373 616 20250 20300 371 613 22650 22700 333 563 25050 25100 294 512

17900 17950 373 616 20300 20350 370 612 22700 22750 332 562 25100 25150 294 511

17950 18000 373 616 20350 20400 369 611 22750 22800 331 561 25150 25200 293 510

18000 18050 373 616 20400 20450 369 610 22800 22850 330 560 25200 25250 292 509

18050 18100 373 616 20450 20500 368 609 22850 22900 330 559 25250 25300 291 508

18100 18150 373 616 20500 20550 367 608 22900 22950 329 558 25300 25350 290 507

18150 18200 373 616 20550 20600 366 607 22950 23000 328 557 25350 25400 290 506

18200 18250 373 616 20600 20650 365 606 23000 23050 327 555 25400 25450 289 505

18250 18300 373 616 20650 20700 365 605 23050 23100 326 554 25450 25500 288 504

18300 18350 373 616 20700 20750 364 604 23100 23150 326 553 25500 25550 287 503

18350 18400 373 616 20750 20800 363 603 23150 23200 325 552 25550 25600 286 502

18400 18450 373 616 20800 20850 362 602 23200 23250 324 551 25600 25650 286 501

18450 18500 373 616 20850 20900 361 601 23250 23300 323 550 25650 25700 285 500

18500 18550 373 616 20900 20950 361 600 23300 23350 322 549 25700 25750 284 499

18550 18600 373 616 20950 21000 360 599 23350 23400 322 548 25750 25800 283 498

18600 18650 373 616 21000 21050 359 598 23400 23450 321 547 25800 25850 282 497

18650 18700 373 616 21050 21100 358 597 23450 23500 320 546 25850 25900 282 495

18700 18750 373 616 21100 21150 357 595 23500 23550 319 545 25900 25950 281 494

18750 18800 373 616 21150 21200 357 594 23550 23600 318 544 25950 26000 280 493

18800 18850 373 616 21200 21250 356 593 23600 23650 318 543 26000 26050 279 492

18850 18900 373 616 21250 21300 355 592 23650 23700 317 542 26050 26100 278 491

18900 18950 373 616 21300 21350 354 591 23700 23750 316 541 26100 26150 278 490

18950 19000 373 616 21350 21400 353 590 23750 23800 315 540 26150 26200 277 489

19000 19050 373 616 21400 21450 353 589 23800 23850 314 539 26200 26250 276 488

19050 19100 373 616 21450 21500 352 588 23850 23900 314 538 26250 26300 275 487

19100 19150 373 616 21500 21550 351 587 23900 23950 313 537 26300 26350 274 486

19150 19200 373 616 21550 21600 350 586 23950 24000 312 535 26350 26400 274 485

19200 19250 373 616 21600 21650 349 585 24000 24050 311 534 26400 26450 273 484

19250 19300 373 616 21650 21700 349 584 24050 24100 310 533 26450 26500 272 483

19300 19350 373 616 21700 21750 348 583 24100 24150 310 532 26500 26550 271 482

19350 19400 373 616 21750 21800 347 582 24150 24200 309 531 26550 26600 270 481

19400 19450 373 616 21800 21850 346 581 24200 24250 308 530 26600 26650 270 480

19450 19500 373 616 21850 21900 345 580 24250 24300 307 529 26650 26700 269 479

19500 19550 373 616 21900 21950 345 579 24300 24350 306 528 26700 26750 268 478

19550 19600 373 616 21950 22000 344 578 24350 24400 306 527 26750 26800 267 477

19600 19650 373 616 22000 22050 343 577 24400 24450 305 526 26800 26850 266 475

19650 19700 373 616 22050 22100 342 575 24450 24500 304 525 26850 26900 266 474

19700 19750 373 616 22100 22150 341 574 24500 24550 303 524 26900 26950 265 473

19750 19800 373 616 22150 22200 341 573 24550 24600 302 523 26950 27000 264 472

19800 19850 373 616 22200 22250 340 572 24600 24650 302 522 27000 27050 263 471

19850 19900 373 616 22250 22300 339 571 24650 24700 301 521 27050 27100 262 470

19900 19950 373 616 22300 22350 338 570 24700 24750 300 520 27100 27150 262 469

19950 20000 373 616 22350 22400 337 569 24750 24800 299 519 27150 27200 261 468

Page 20

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

2022 Indiana Earned Income Credit (EIC) Table (continued)

If the amount And you have — If the amount And you have — If the amount And you have — If the amount And you have —

you are looking No One Two you are looking No One Two you are looking No One Two you are looking No One Two

up from the child- child child- up from the child- child child- up from the child- child child- up from the child- child child-

worksheet is — ren ren worksheet is — ren ren worksheet is — ren ren worksheet is — ren ren

At But At But At But At But

least less Your credit is — least less Your credit is — least less Your credit is — least less Your credit is —

than than than than

27200 27250 260 467 29600 29650 222 416 32000 32050 183 366 34400 34450 145 315

27250 27300 259 466 29650 29700 221 415 32050 32100 182 365 34450 34500 144 314

27300 27350 258 465 29700 29750 220 414 32100 32150 182 364 34500 34550 143 313

27350 27400 258 464 29750 29800 219 413 32150 32200 181 363 34550 34600 143 312

27400 27450 257 463 29800 29850 218 412 32200 32250 180 362 34600 34650 142 311

27450 27500 256 462 29850 29900 218 411 32250 32300 179 361 34650 34700 141 310

27500 27550 255 461 29900 29950 217 410 32300 32350 178 360 34700 34750 140 309

27550 27600 254 460 29950 30000 216 409 32350 32400 178 359 34750 34800 139 308

27600 27650 254 459 30000 30050 215 408 32400 32450 177 358 34800 34850 139 307

27650 27700 253 458 30050 30100 214 407 32450 32500 176 356 34850 34900 138 306

27700 27750 252 456 30100 30150 214 406 32500 32550 175 355 34900 34950 137 305

27750 27800 251 455 30150 30200 213 405 32550 32600 174 354 34950 35000 136 304

27800 27850 250 454 30200 30250 212 404 32600 32650 174 353 35000 35050 135 303

27850 27900 250 453 30250 30300 211 403 32650 32700 173 352 35050 35100 135 302

27900 27950 249 452 30300 30350 210 402 32700 32750 172 351 35100 35150 134 301

27950 28000 248 451 30350 30400 210 401 32750 32800 171 350 35150 35200 133 300

28000 28050 247 450 30400 30450 209 400 32800 32850 171 349 35200 35250 132 299

28050 28100 246 449 30450 30500 208 399 32850 32900 170 348 35250 35300 131 297

28100 28150 246 448 30500 30550 207 398 32900 32950 169 347 35300 35350 131 296

28150 28200 245 447 30550 30600 206 396 32950 33000 168 346 35350 35400 130 295

28200 28250 244 446 30600 30650 206 395 33000 33050 167 345 35400 35450 129 294

28250 28300 243 445 30650 30700 205 394 33050 33100 167 344 35450 35500 128 293

28300 28350 242 444 30700 30750 204 393 33100 33150 166 343 35500 35550 127 292

28350 28400 242 443 30750 30800 203 392 33150 33200 165 342 35550 35600 127 291

28400 28450 241 442 30800 30850 202 391 33200 33250 164 341 35600 35650 126 290

28450 28500 240 441 30850 30900 202 390 33250 33300 163 340 35650 35700 125 289

28500 28550 239 440 30900 30950 201 389 33300 33350 163 339 35700 35750 124 288

28550 28600 238 439 30950 31000 200 388 33350 33400 162 338 35750 35800 123 287

28600 28650 238 438 31000 31050 199 387 33400 33450 161 336 35800 35850 123 286

28650 28700 237 436 31050 31100 198 386 33450 33500 160 335 35850 35900 122 285

28700 28750 236 435 31100 31150 198 385 33500 33550 159 334 35900 35950 121 284

28750 28800 235 434 31150 31200 197 384 33550 33600 159 333 35950 36000 120 283

28800 28850 234 433 31200 31250 196 383 33600 33650 158 332 36000 36050 119 282

28850 28900 234 432 31250 31300 195 382 33650 33700 157 331 36050 36100 119 281

28900 28950 233 431 31300 31350 194 381 33700 33750 156 330 36100 36150 118 280

28950 29000 232 430 31350 31400 194 380 33750 33800 155 329 36150 36200 117 279

29000 29050 231 429 31400 31450 193 379 33800 33850 155 328 36200 36250 116 277

29050 29100 230 428 31450 31500 192 378 33850 33900 154 327 36250 36300 115 276

29100 29150 230 427 31500 31550 191 376 33900 33950 153 326 36300 36350 115 275

29150 29200 229 426 31550 31600 190 375 33950 34000 152 325 36350 36400 114 274

29200 29250 228 425 31600 31650 190 374 34000 34050 151 324 36400 36450 113 273

29250 29300 227 424 31650 31700 189 373 34050 34100 151 323 36450 36500 112 272

29300 29350 226 423 31700 31750 188 372 34100 34150 150 322 36500 36550 111 271

29350 29400 226 422 31750 31800 187 371 34150 34200 149 321 36550 36600 111 270

29400 29450 225 421 31800 31850 186 370 34200 34250 148 320 36600 36650 110 269

29450 29500 224 420 31850 31900 186 369 34250 34300 147 319 36650 36700 109 268

29500 29550 223 419 31900 31950 185 368 34300 34350 147 318 36700 36750 108 267

29550 29600 222 418 31950 32000 184 367 34350 34400 146 316 36750 36800 107 266

Page 21

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

2022 Indiana Earned Income Credit (EIC) Table (continued)

If the amount And you have — If the amount And you have — If the amount And you have — If the amount And you have —

you are looking No One Two you are looking No One Two you are looking No One Two you are looking No One Two

up from the child- child child- up from the child- child child- up from the child- child child- up from the child- child child-

worksheet is — ren ren worksheet is — ren ren worksheet is — ren ren worksheet is — ren ren

At But At But At But At But

least less Your credit is — least less Your credit is — least less Your credit is — least less Your credit is —

than than than than

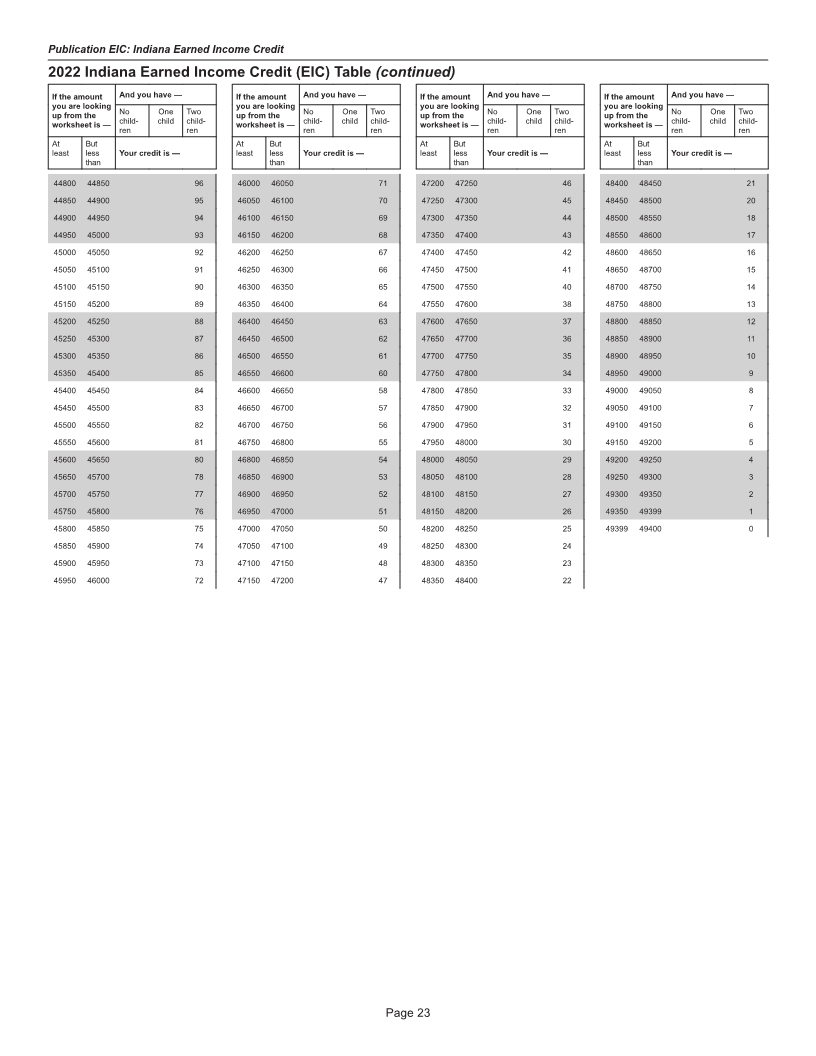

36800 36850 107 265 38800 38850 75 223 40800 40850 43 181 42800 42850 11 138

36850 36900 106 264 38850 38900 74 222 40850 40900 42 180 42850 42900 10 137

36900 36950 105 263 38900 38950 73 221 40900 40950 41 179 42900 42950 9 136

36950 37000 104 262 38950 39000 72 220 40950 41000 40 177 42950 43000 8 135

37000 37050 103 261 39000 39050 71 219 41000 41050 39 176 43000 43050 8 134

37050 37100 103 260 39050 39100 71 217 41050 41100 39 175 43050 43100 7 133

37100 37150 102 259 39100 39150 70 216 41100 41150 38 174 43100 43150 6 132

37150 37200 101 257 39150 39200 69 215 41150 41200 37 173 43150 43200 5 131

37200 37250 100 256 39200 39250 68 214 41200 41250 36 172 43200 43250 4 130

37250 37300 99 255 39250 39300 67 213 41250 41300 35 171 43250 43300 4 129

37300 37350 99 254 39300 39350 67 212 41300 41350 35 170 43300 43350 3 128

37350 37400 98 253 39350 39400 66 211 41350 41400 34 169 43350 43400 2 127

37400 37450 97 252 39400 39450 65 210 41400 41450 33 168 43400 43450 1 126

37450 37500 96 251 39450 39500 64 209 41450 41500 32 167 43450 43500 0 125

37500 37550 95 250 39500 39550 63 208 41500 41550 31 166 43500 43550 124

37550 37600 95 249 39550 39600 63 207 41550 41600 31 165 43550 43600 123

37600 37650 94 248 39600 39650 62 206 41600 41650 30 164 43600 43650 122

37650 37700 93 247 39650 39700 61 205 41650 41700 29 163 43650 43700 121

37700 37750 92 246 39700 39750 60 204 41700 41750 28 162 43700 43750 120

37750 37800 91 245 39750 39800 59 203 41750 41800 27 161 43750 43800 118

37800 37850 91 244 39800 39850 59 202 41800 41850 27 160 43800 43850 117

37850 37900 90 243 39850 39900 58 201 41850 41900 26 159 43850 43900 116

37900 37950 89 242 39900 39950 57 200 41900 41950 25 157 43900 43950 115

37950 38000 88 241 39950 40000 56 199 41950 42000 24 156 43950 44000 114

38000 38050 87 240 40000 40050 55 197 42000 42050 23 155 44000 44050 113

38050 38100 87 239 40050 40100 55 196 42050 42100 23 154 44050 44100 112

38100 38150 86 237 40100 40150 54 195 42100 42150 22 153 44100 44150 111

38150 38200 85 236 40150 40200 53 194 42150 42200 21 152 44150 44200 110

38200 38250 84 235 40200 40250 52 193 42200 42250 20 151 44200 44250 109

38250 38300 83 234 40250 40300 51 192 42250 42300 19 150 44250 44300 108

38300 38350 83 233 40300 40350 51 191 42300 42350 19 149 44300 44350 107

38350 38400 82 232 40350 40400 50 190 42350 42400 18 148 44350 44400 106

38400 38450 81 231 40400 40450 49 189 42400 42450 17 147 44400 44450 105

38450 38500 80 230 40450 40500 48 188 42450 42500 16 146 44450 44500 104

38500 38550 79 229 40500 40550 47 187 42500 42550 15 145 44500 44550 103

38550 38600 79 228 40550 40600 47 186 42550 42600 15 144 44550 44600 102

38600 38650 78 227 40600 40650 46 185 42600 42650 14 143 44600 44650 101

38650 38700 77 226 40650 40700 45 184 42650 42700 13 142 44650 44700 100

38700 38750 76 225 40700 40750 44 183 42700 42750 12 141 44700 44750 98

38750 38800 75 224 40750 40800 43 182 42750 42800 12 140 44750 44800 97

Page 22

|

Enlarge image |

Publication EIC: Indiana Earned Income Credit

2022 Indiana Earned Income Credit (EIC) Table (continued)

If the amount And you have — If the amount And you have — If the amount And you have — If the amount And you have —

you are looking No One Two you are looking No One Two you are looking No One Two you are looking No One Two

up from the child- child child- up from the child- child child- up from the child- child child- up from the child- child child-

worksheet is — ren ren worksheet is — ren ren worksheet is — ren ren worksheet is — ren ren

At But At But At But At But

least less Your credit is — least less Your credit is — least less Your credit is — least less Your credit is —

than than than than

44800 44850 96 46000 46050 71 47200 47250 46 48400 48450 21

44850 44900 95 46050 46100 70 47250 47300 45 48450 48500 20

44900 44950 94 46100 46150 69 47300 47350 44 48500 48550 18

44950 45000 93 46150 46200 68 47350 47400 43 48550 48600 17