Enlarge image

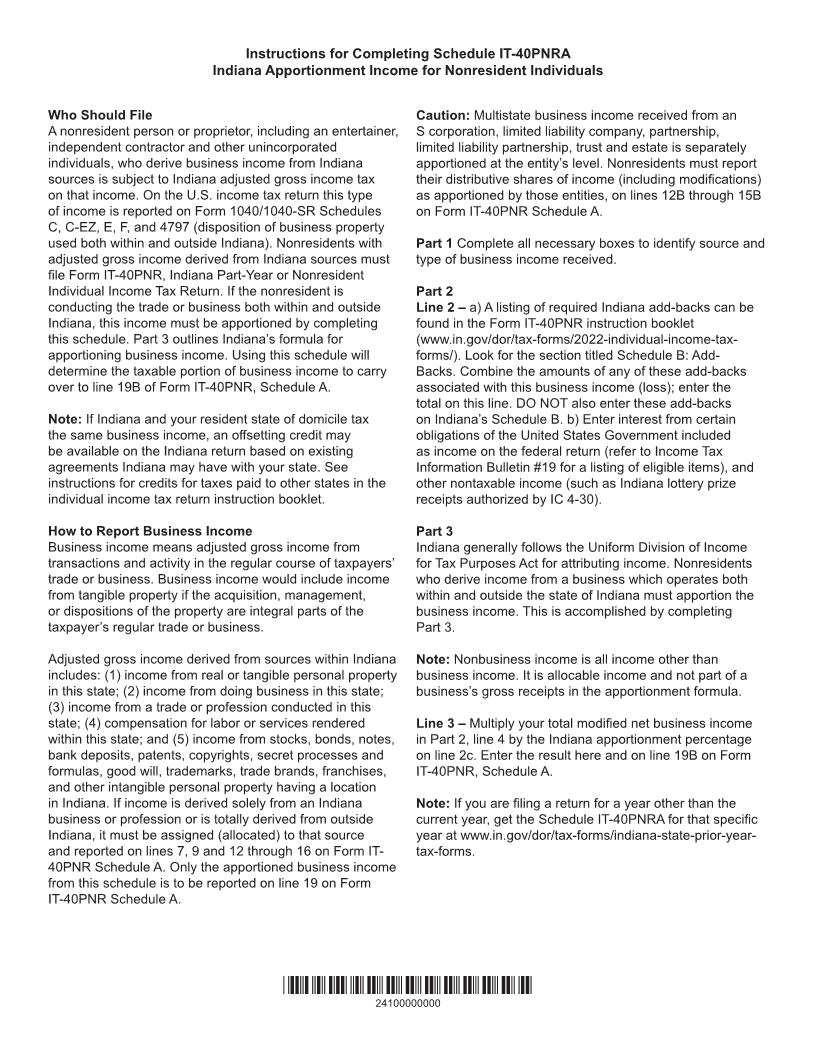

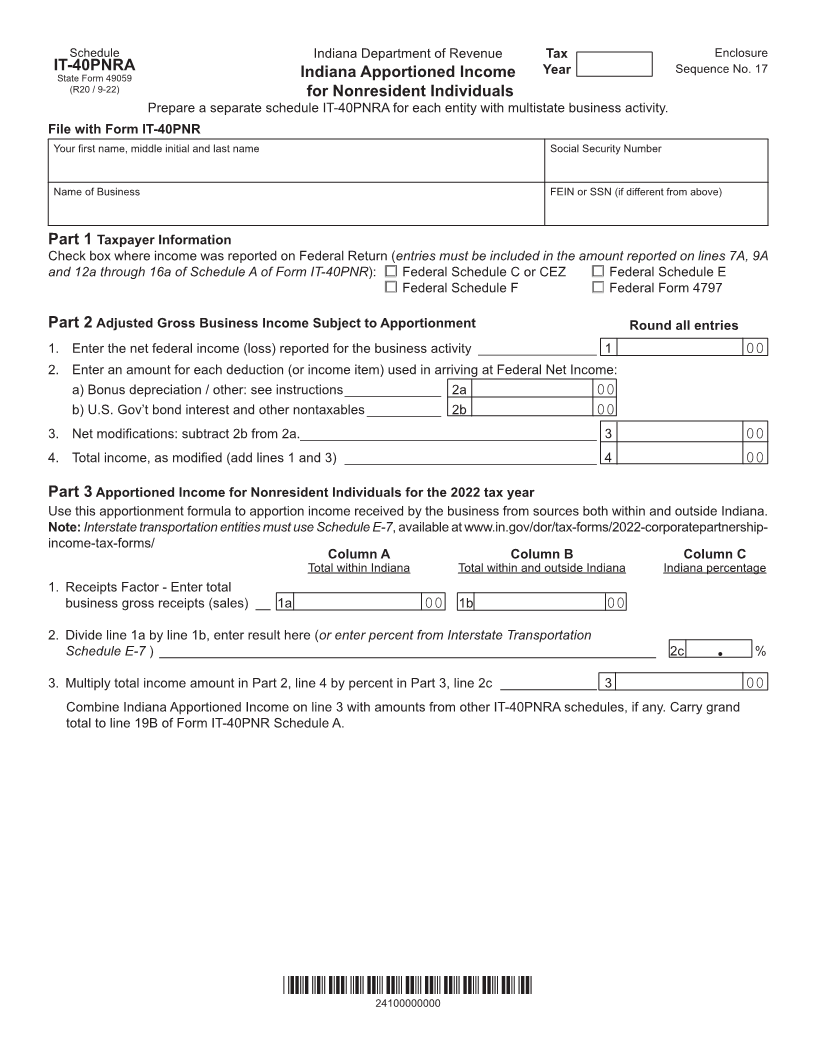

Schedule Indiana Department of Revenue Tax Enclosure

IT-40PNRA Sequence No. 17

State Form 49059 Indiana Apportioned Income Year

(R20 / 9-22) for Nonresident Individuals

Prepare a separate schedule IT-40PNRA for each entity with multistate business activity.

File with Form IT-40PNR

Your first name, middle initial and last name Social Security Number

Name of Business FEIN or SSN (if different from above)

Part 1 Taxpayer Information

Check box where income was reported on Federal Return (entries must be included in the amount reported on lines 7A, 9A

and 12a through 16a of Schedule A of Form IT-40PNR): □ Federal Schedule C or CEZ □ Federal Schedule E

□ Federal Schedule F □ Federal Form 4797

Part 2 Adjusted Gross Business Income Subject to Apportionment Round all entries

1. Enter the net federal income (loss) reported for the business activity ________________ 1 00

2. Enter an amount for each deduction (or income item) used in arriving at Federal Net Income:

a) Bonus depreciation / other: see instructions _____________ 2a 00

b) U.S. Gov’t bond interest and other nontaxables __________ 2b 00

3. Net modifications: subtract 2b from 2a.________________________________________ 3 00

4. Total income, as modified (add lines 1 and 3) __________________________________ 4 00

Part 3 Apportioned Income for Nonresident Individuals for the 2022 tax year

Use this apportionment formula to apportion income received by the business from sources both within and outside Indiana.

Note: Interstate transportation entities must use Schedule E-7, available at www.in.gov/dor/tax-forms/2022-corporatepartnership-

income-tax-forms/

Column A Column B Column C

Total within Indiana Total within and outside Indiana Indiana percentage

1. Receipts Factor - Enter total

business gross receipts (sales) __ 1a 00 1b 00

2. Divide line 1a by line 1b, enter result here (or enter percent from Interstate Transportation

Schedule E-7 ) ___________________________________________________________________ 2c . %

3. Multiply total income amount in Part 2, line 4 by percent in Part 3, line 2c _____________ 3 00

Combine Indiana Apportioned Income on line 3 with amounts from other IT-40PNRA schedules, if any. Carry grand

total to line 19B of Form IT-40PNR Schedule A.

*24100000000*

24100000000