Enlarge image

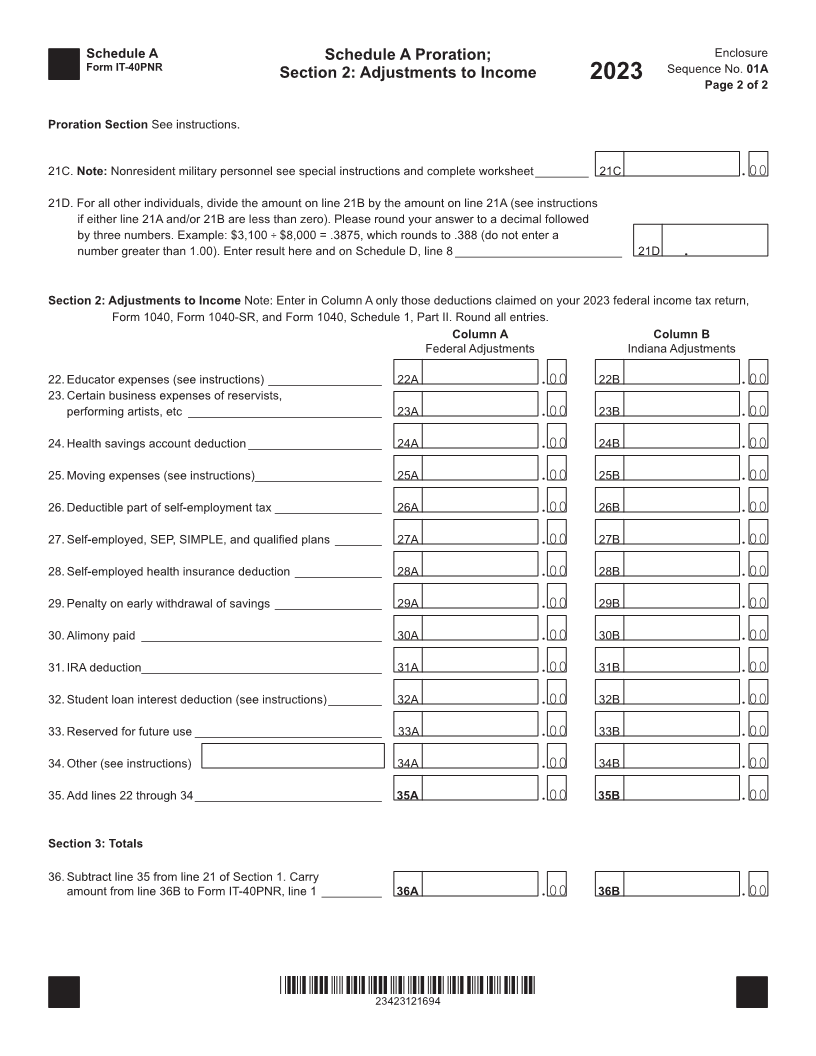

Schedule A Schedule A Section 1: Income or Loss Enclosure

Form IT-40PNR (Complete Proration, Section 2 and Section 3 on back) Sequence No. 01

State Form 48719 2023

(R22 / 9-23) Page 1 of 2

Name(s) shown on Form IT-40PNR Your Social Security Number

Section 1: Income or (Loss) Enter in Column A the same income or loss you reported on your 2023 federal income tax return, Form

1040, Form 1040-SR, and Form 1040 Schedule 1 (except for line 19B and/or a net operating loss carryforward on line 20B; see

instructions). Round all entries.

Column A Column B

Income from Federal Return Income Taxed by Indiana

1. Your wages, salaries, tips, commissions, etc _____________ 1A .00 1B .00

2. Spouse’s wages, salaries, tips, commissions, etc _________ 2A .00 2B .00

3. Taxable interest income _____________________________ 3A .00 3B .00

4. Dividend income __________________________________ 4A .00 4B .00

5. Taxable refunds, credits, or offsets of state

and local taxes from your federal return ________________ 5A .00 5B .00

6. Alimony received __________________________________ 6A .00 6B .00

7. Business income or loss from federal Schedule C ________ 7A .00 7B .00

8. Capital gain or loss from sale or exchange

of property from your federal return ____________________ 8A .00 8B .00

9. Other gains or (losses) from Form 4797 ________________ 9A .00 9B .00

10. Taxable IRA distribution _____________________________ 10A .00 10B .00

11. Taxable pensions and annuities _______________________ 11A .00 11B .00

12. Net rent or royalty income or loss reported on

federal Schedule E ________________________________ 12A .00 12B .00

13. Income or loss from partnerships _____________________ 13A .00 13B .00

14. Income or loss from trusts and estates _________________ 14A .00 14B .00

15. Income or loss from S corporations ____________________ 15A .00 15B .00

16. Farm income or loss from federal Schedule F ____________ 16A .00 16B .00

17. Unemployment compensation ________________________ 17A .00 17B .00

18. Taxable Social Security benefits _______________________ 18A . 00 18B .00

19. Indiana apportioned income from

Schedule IT-40PNRA ___________________________________________________________ 19B .00

20. Other income reported on your federal return ____________ 20A .00 20B .00

List source(s). (Do not include federal net operating loss in Column B. See instructions.)

21. Subtotal: add lines 1 through 20 _______________________ 21A .00 21B .00

*23423111694*

23423111694