Enlarge image

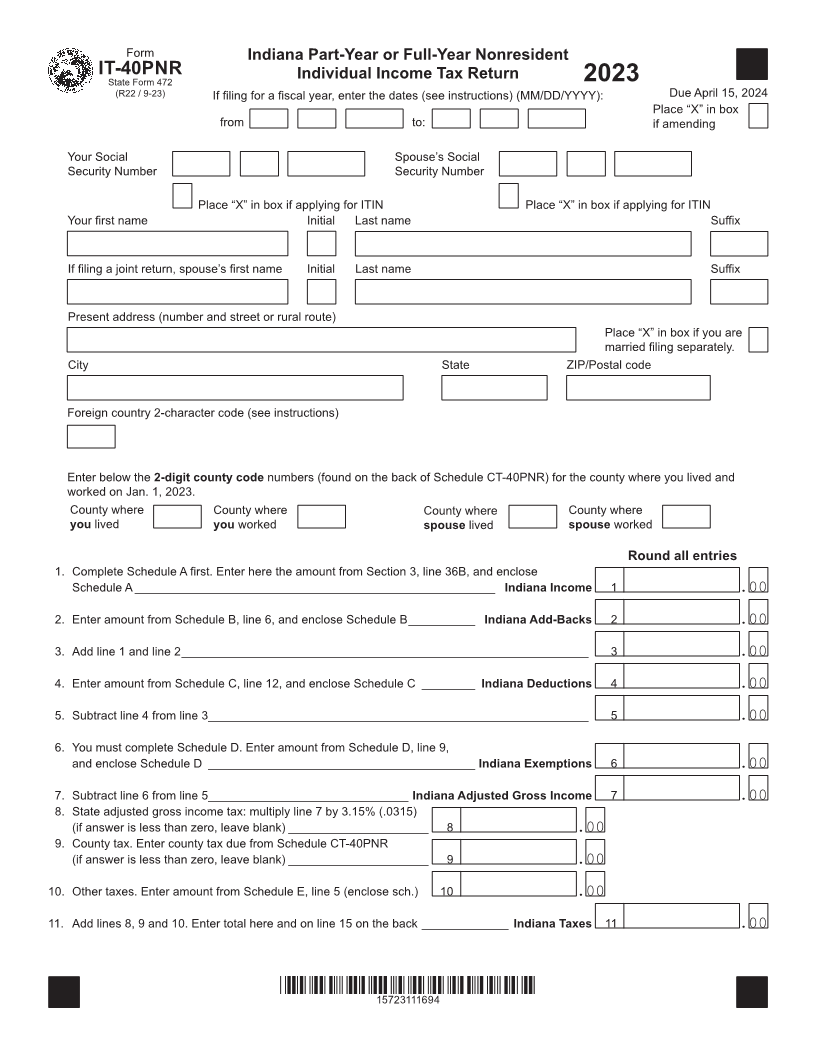

Form Indiana Part-Year or Full-Year Nonresident

IT-40PNR

State Form 472 Individual Income Tax Return 2023

(R22 / 9-23) If filing for a fiscal year, enter the dates (see instructions) (MM/DD/YYYY): Due April 15, 2024

Place “X” in box

from to: if amending

Your Social Spouse’s Social

Security Number Security Number

Place “X” in box if applying for ITIN Place “X” in box if applying for ITIN

Your first name Initial Last name Suffix

If filing a joint return, spouse’s first name Initial Last name Suffix

Present address (number and street or rural route)

Place “X” in box if you are

married filing separately.

City State ZIP/Postal code

Foreign country 2-character code (see instructions)

Enter below the 2-digit county code numbers (found on the back of Schedule CT-40PNR) for the county where you lived and

worked on Jan. 1, 2023.

County where County where County where County where

you lived you worked spouse lived spouse worked

Round all entries

1. Complete Schedule A first. Enter here the amount from Section 3, line 36B, and enclose

Schedule A ______________________________________________________ Indiana Income 1 .00

2. Enter amount from Schedule B, line 6, and enclose Schedule B __________ Indiana Add-Backs 2 .00

3. Add line 1 and line 2 _____________________________________________________________ 3 .00

4. Enter amount from Schedule C, line 12, and enclose Schedule C ________ Indiana Deductions 4 .00

5. Subtract line 4 from line 3 _________________________________________________________ 5 .00

6. You must complete Schedule D. Enter amount from Schedule D, line 9,

and enclose Schedule D ________________________________________Indiana Exemptions 6 .00

7. Subtract line 6 from line 5 ______________________________ Indiana Adjusted Gross Income 7 .00

8. State adjusted gross income tax: multiply line 7 by 3.15% (.0315)

(if answer is less than zero, leave blank) _____________________ 8 .00

9. County tax. Enter county tax due from Schedule CT-40PNR

(if answer is less than zero, leave blank) _____________________ 9 .00

10. Other taxes. Enter amount from Schedule E, line 5 (enclose sch.) 10 .00

11. Add lines 8, 9 and 10. Enter total here and on line 15 on the back _____________ Indiana Taxes 11 .00

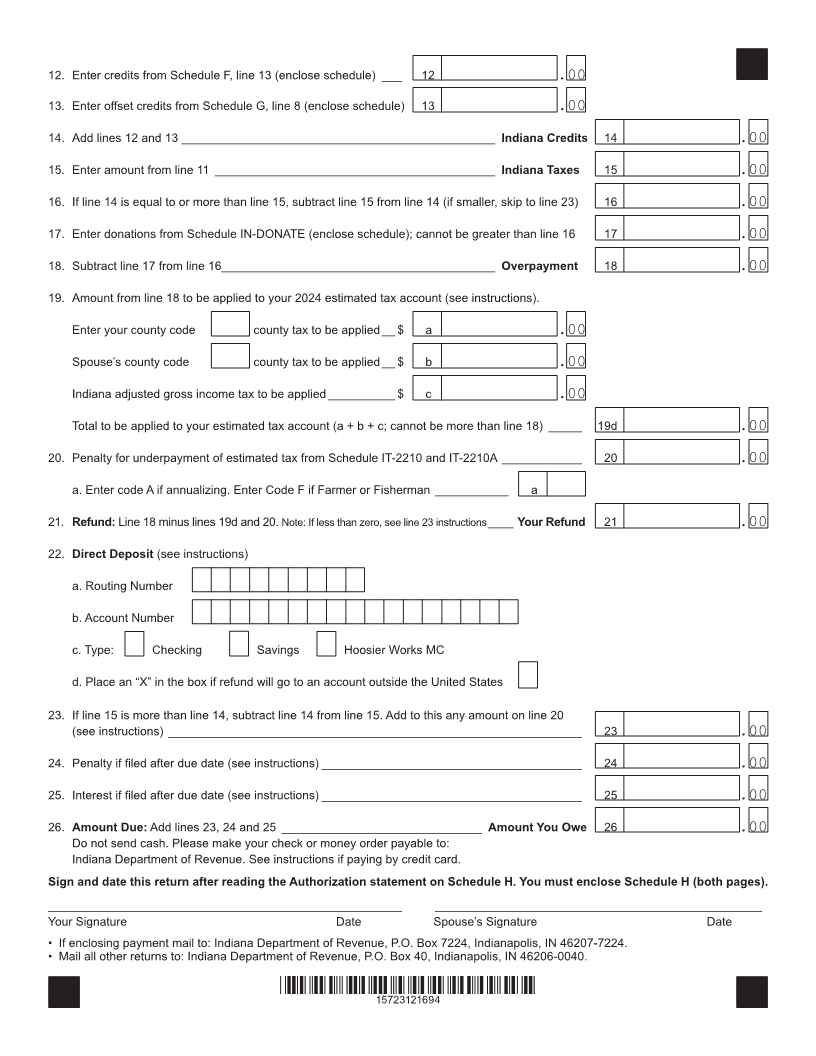

*15723111694*

15723111694