Enlarge image

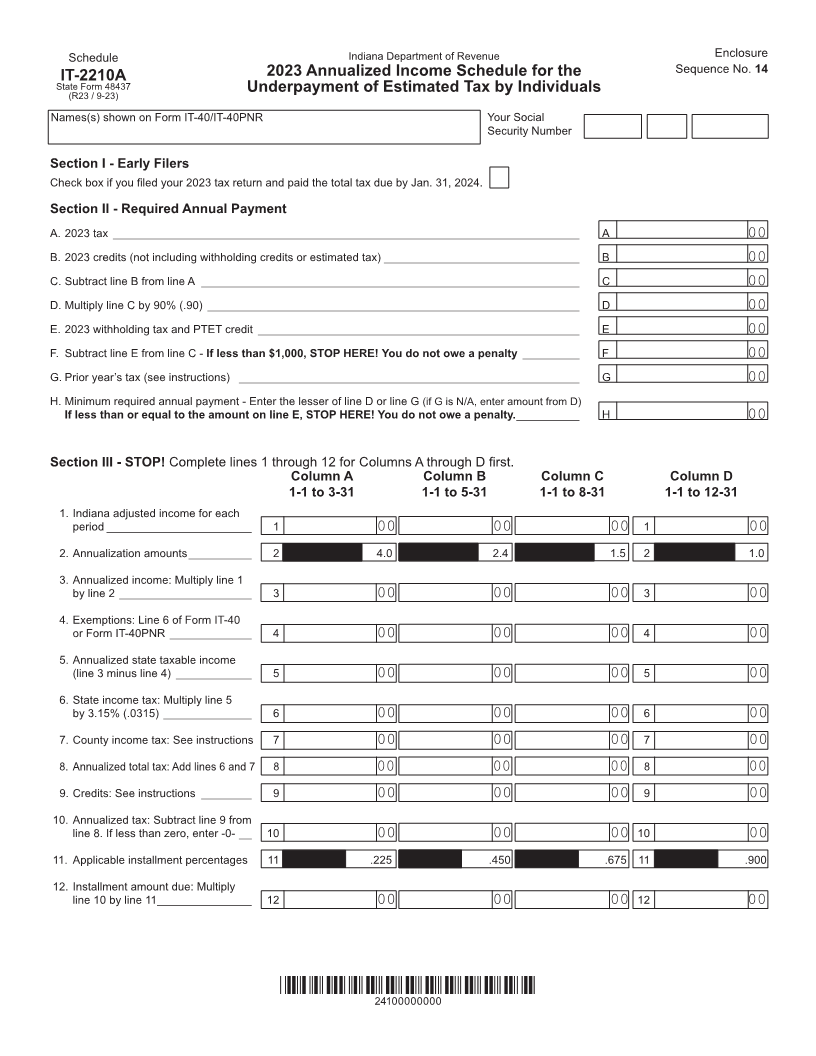

Schedule Indiana Department of Revenue Enclosure

Sequence No. 14

StateIT-2210AForm 48437 2023 Annualized Income Schedule for the

(R23 / 9-23) Underpayment of Estimated Tax by Individuals

Names(s) shown on Form IT-40/IT-40PNR Your Social

Security Number

Section I - Early Filers

Check box if you filed your 2023 tax return and paid the total tax due by Jan. 31, 2024.

Section II - Required Annual Payment

A. 2023 tax __________________________________________________________________________ A 00

B. 2023 credits (not including withholding credits or estimated tax) _______________________________ B 00

C. Subtract line B from line A ____________________________________________________________ C 00

D. Multiply line C by 90% (.90) ___________________________________________________________ D 00

E. 2023 withholding tax and PTET credit ___________________________________________________ E 00

F. Subtract line E from line C - If less than $1,000, STOP HERE! You do not owe a penalty _________ F 00

G. Prior year’s tax (see instructions) ______________________________________________________ G 00

H. Minimum required annual payment - Enter the lesser of line D or line G (if G is N/A, enter amount from D)

If less than or equal to the amount on line E, STOP HERE! You do not owe a penalty. __________ H 00

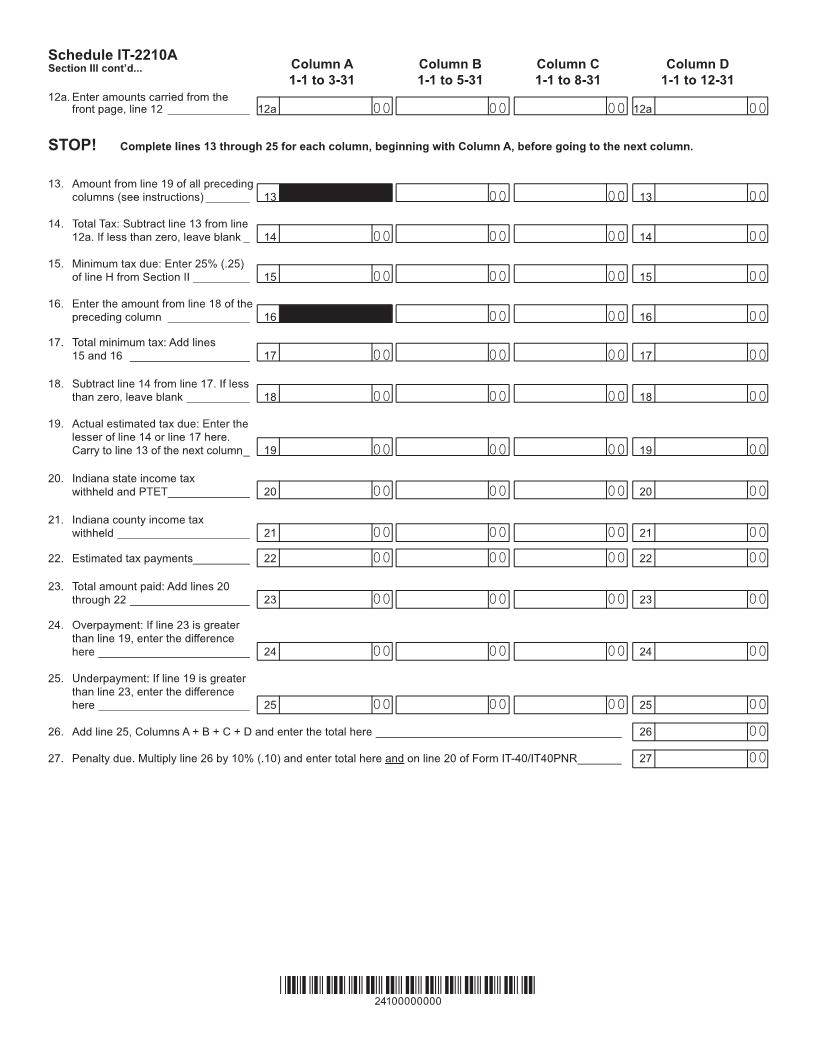

Section III - STOP!Complete lines 1 through 12Cfor olumns A through D first.

Column A Column B Column C Column D

1-1 to 3-31 1-1 to 5-31 1-1 to 8-31 1-1 to 12-31

1. Indiana adjusted income for each

period _______________________ 1 00 00 00 1 00

2. Annualization amounts __________ 2 4.0 2.4 1.5 2 1.0

3. Annualized income: Multiply line 1

by line 2 _____________________ 3 00 00 00 3 00

4. Exemptions: Line 6 of Form IT-40

or Form IT-40PNR _____________ 4 00 00 00 4 00

5. Annualized state taxable income

(line 3 minus line 4) ____________ 5 00 00 00 5 00

6. State income tax: Multiply line 5

by 3.15% (.0315) ______________ 6 00 00 00 6 00

7. County income tax: See instructions 7 00 00 00 7 00

8. Annualized total tax: Add lines 6 and 7 8 00 00 00 8 00

9. Credits: See instructions ________ 9 00 00 00 9 00

10. Annualized tax: Subtract line 9 from

line 8. If less than zero, enter -0- __ 10 00 00 00 10 00

11. Applicable installment percentages 11 .225 .450 .675 11 .900

12. Installment amount due: Multiply

line 10 by line 11 _______________ 12 00 00 00 12 00

*24100000000*

24100000000