Enlarge image

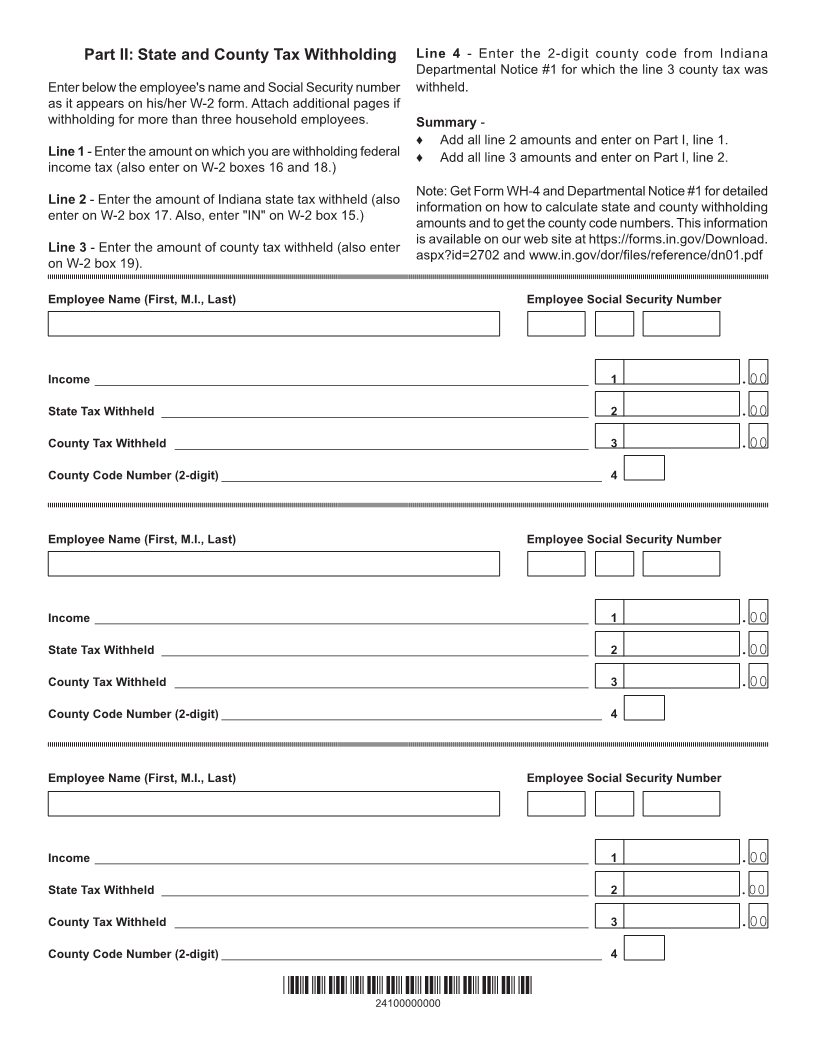

Schedule IN-H Indiana Household Employment Taxes Enclosure

State Form 48684

(R17 / 9-23) Attach to Form IT-40 or Form IT-40PNR. Sequence No. 12

2023

This schedule should be filed by an individual who:

• withholds state and county (if applicable) tax on household employees, AND

• pays those withholding taxes with the filing of his/her individual income tax return.

Name of employer (as shown on individual income tax return) Employer Social Security Number

Federal Employer Identification Number

A Did you file federal Schedule H for the tax year shown above?

Yes. Go to question B.

No. Stop. Do not file this schedule.

B Did you withhold state and/or county income tax for any household employee?

Yes. Complete Part II on the back of this schedule.

No. Stop. Do not file this schedule.

C Make sure you enclose the state copy of your employee's W-2 forms.

Complete Part II (on page 2) first. Carry those totals to the Part I Summary below.

Part 1: Summary of Household Employment Taxes

1. Enter the total State Tax withheld from Part II, line 2 __________________________ 1 .00

2. Enter the total County Tax withheld from Part II, line 3 ________________________ 2 .00

3. Add lines 1 and 2. Enter the total here _____________________________________ 3 .00

Enter this amount on your Indiana individual income tax return on the following lines:

• Form IT-40 Schedule 4, line 2,

• Form IT-40PNR Schedule E, line 2.

Under penalties of perjury, I declare that I have examined this schedule, including accompanying statements and W-2 forms,

and to the best of my knowledge and belief it is true, correct and complete.

___________________________________ ______________________ ___________

Employer's signature Daytime telephone number Date

*24100000000*

24100000000