Enlarge image

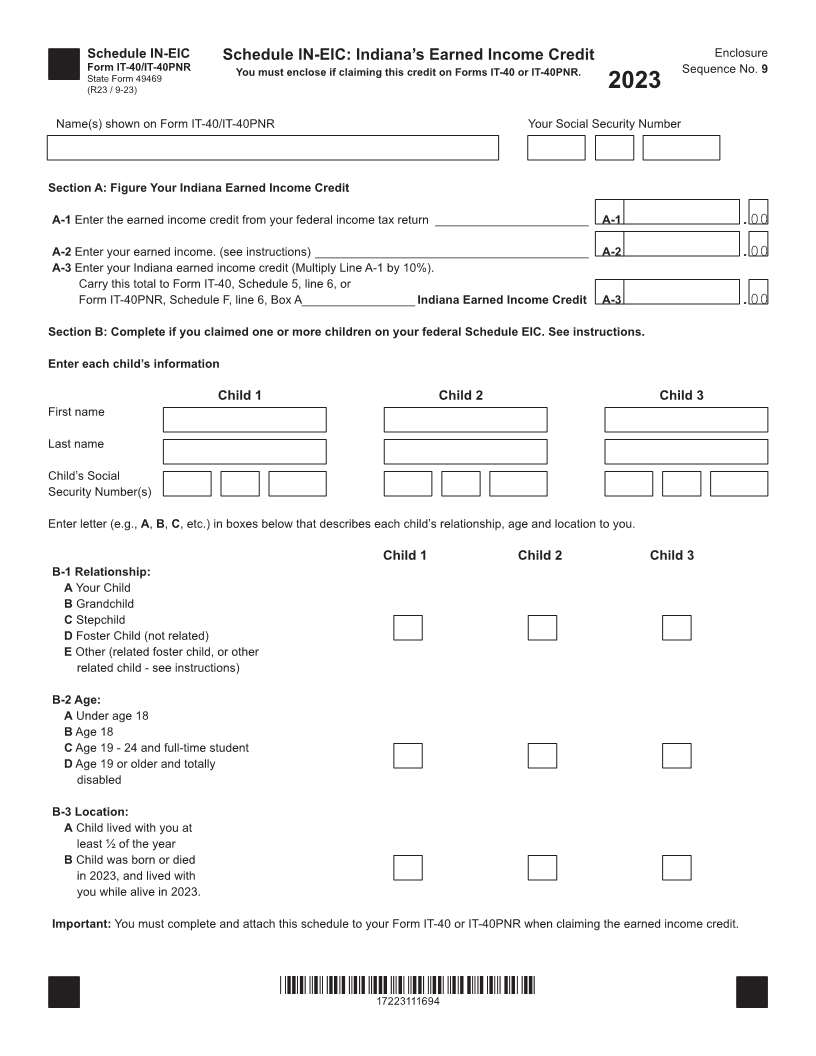

Schedule IN-EIC Schedule IN-EIC: Indiana’s Earned Income Credit Enclosure

Form IT-40/IT-40PNR You must enclose if claiming this credit on Forms IT-40 or IT-40PNR. Sequence No. 9

State Form 49469

(R23 / 9-23) 2023

Name(s) shown on Form IT-40/IT-40PNR Your Social Security Number

Section A: Figure Your Indiana Earned Income Credit

A-1 Enter the earned income credit from your federal income tax return _______________________ A-1 .00

A-2 Enter your earned income. (see instructions) _________________________________________ A-2 .00

A-3 Enter your Indiana earned income credit (Multiply Line A-1 by 10%).

Carry this total to Form IT-40, Schedule 5, line 6, or

Form IT-40PNR, Schedule F, line 6, Box A _________________ Indiana Earned Income Credit A-3 .00

Section B: Complete if you claimed one or more children on your federal Schedule EIC. See instructions.

Enter each child’s information

Child 1 Child 2 Child 3

First name

Last name

Child’s Social

Security Number(s)

Enter letter (e.g., A, B, ,Cetc.) in boxes below that describes each child’s relationship, age and location to you.

Child 1 Child 2 Child 3

B-1 Relationship:

A Your Child

B Grandchild

C Stepchild

D Foster Child (not related)

E Other (related foster child, or other

related child - see instructions)

B-2 Age:

A Under age 18

B Age 18

C Age 19 - 24 and full-time student

D Age 19 or older and totally

disabled

B-3 Location:

A Child lived with you at

least ½ of the year

B Child was born or died

in 2023, and lived with

you while alive in 2023.

Important: You must complete and attach this schedule to your Form IT-40 or IT-40PNR when claiming the earned income credit.

*17223111694*

17223111694