Enlarge image

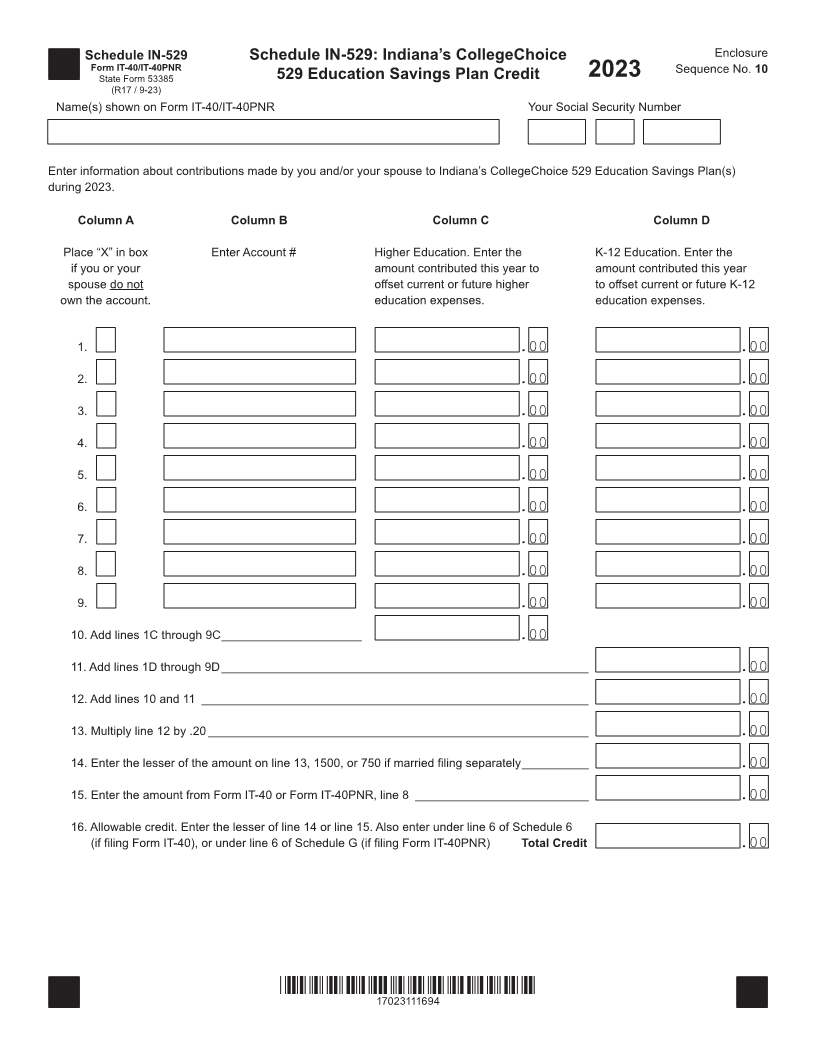

Schedule IN-529 Schedule IN-529: Indiana’s CollegeChoice Enclosure

Form IT-40/IT-40PNR Sequence No. 10

State Form 53385 529 Education Savings Plan Credit 2023

(R17 / 9-23)

Name(s) shown on Form IT-40/IT-40PNR Your Social Security Number

Enter information about contributions made by you and/or your spouse to Indiana’s CollegeChoice 529 Education Savings Plan(s)

during 2023.

Column A Column B Column C Column D

Place “X” in box Enter Account # Higher Education. Enter the K-12 Education. Enter the

if you or your amount contributed this year to amount contributed this year

spouse do not offset current or future higher to offset current or future K-12

own the account. education expenses. education expenses.

1. .00 .00

2. .00 .00

3. .00 .00

4. .00 .00

5. .00 .00

6. .00 .00

7. .00 .00

8. .00 .00

9. .00 .00

10. Add lines 1C through 9C _____________________ .00

11. Add lines 1D through 9D _______________________________________________________ .00

12. Add lines 10 and 11 __________________________________________________________ .00

13. Multiply line 12 by .20 _________________________________________________________ .00

14. Enter the lesser of the amount on line 13, 1500, or 750 if married filing separately __________ .00

15. Enter the amount from Form IT-40 or Form IT-40PNR, line 8 __________________________ .00

16. Allowable credit. Enter the lesser of line 14 or line 15. Also enter under line 6 of Schedule 6

(if filing Form IT-40), or under line 6 of Schedule G (if filing Form IT-40PNR) Total Credit .00

*17023111694*

17023111694