Enlarge image

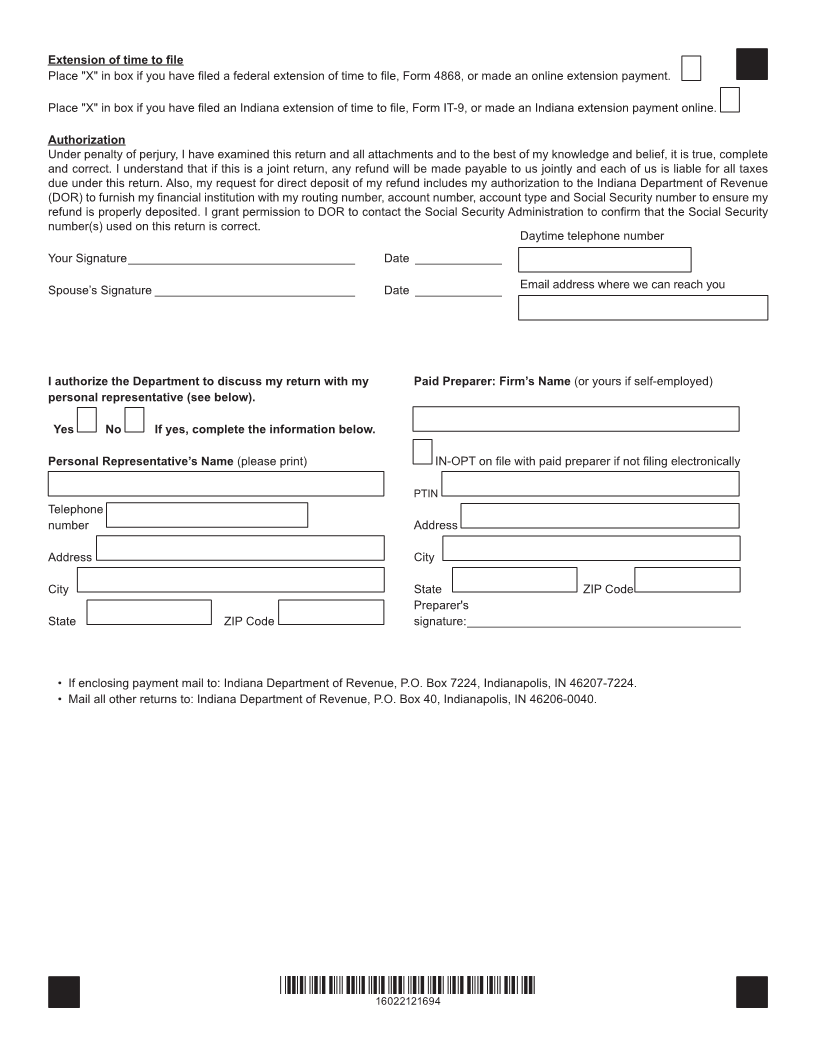

Form Reciprocal Nonresident Indiana

IT-40RNR Individual Income Tax Return Place "X" in box

State Form 44406

(R21 / 9-22) Due April 18, 2023 2022 if amending

Your Social Spouse’s Social Check the box if you are

Security Number Security Number married filing separately.

Your first name Initial Last name Suffix

If filing a joint return, spouse’s first name Initial Last name Suffix

Present address (number and street or rural route) Foreign country

2-character code

City State ZIP/Postal code If any individual listed above died during

2022, enter date of death below (MMDD).

Enter the 2-digit code numbers (see instructions) for the county and/or state where you lived Taxpayer's

and worked on Jan. 1, 2022. date of death 2022

Yourself Spouse

State where County where State where County where Spouse’s

you lived you worked you lived you worked date of death 2022

Your State of Residence: Check the appropriate box to indicate your state of residence for 2022.

Kentucky Michigan Ohio Pennsylvania Wisconsin Important: You must file

Form IT-40PNR if you have

Note: You must file Form IT-40PNR, Part-Year Resident or Nonresident Indiana Individual Income Tax Indiana riverboat winnings.

Return, if you were a resident of a state other than those listed; had Indiana income other than wages,

salaries, tips or commissions; or were a part-year resident of Indiana during 2022.

Read Instructions First Yours (A) Spouse's (B)

1. Enter gross income from your Indiana employment .................. 1A 00 1B 00

2. Allowable deductions: attach federal Schedule 1 ........................ 2A 00 2B 00

3. Indiana adjusted gross income: line 1 minus line 2 ..................... 3A 00 3B 00

4. County tax rate from chart (see instructions) .............................. 4A . 4B .

5. County tax due: multiply line 3 x line 4 ....................................... 5A 00 5B 00

6. Total county tax due: add lines 5A and 5B ......................................................................... Total Tax 6 00

7. Indiana state tax withheld: See Instructions ...................................................................................... 7 00

8. Indiana county tax withheld: See Instructions .................................................................................... 8 00

9. Add lines 7 and 8 ......................................................................................................... Total Credits 9 00

10. Overpayment: if line 9 is more than line 6, subtract line 6 from line 9 and enter amount to be

refunded to you ............................................................................................................ Your Refund 10 00

11. a. Routing Number c. Type: Checking Savings

Direct

b. Account Number Deposit

(see instructions)

d. Place an “X” in the box if refund will go to an account outside the United States

12. Subtract line 9 from line 6 if line 6 is greater than line 9..................................................................... 12 00

13. Penalty if filed after the due date (see instructions) ........................................................................... 13 00

14. Interest if filed after the due date (see instructions) ........................................................................... 14 00

15. Total amount you owe: add lines 12, 13 and 14 ................................................... Amount You Owe 15 00

Do not send cash. Please make your check or money order payable to:

Indiana Department of Revenue. See instructions if paying by credit card or electronic check.

*16022111694*

16022111694