Enlarge image

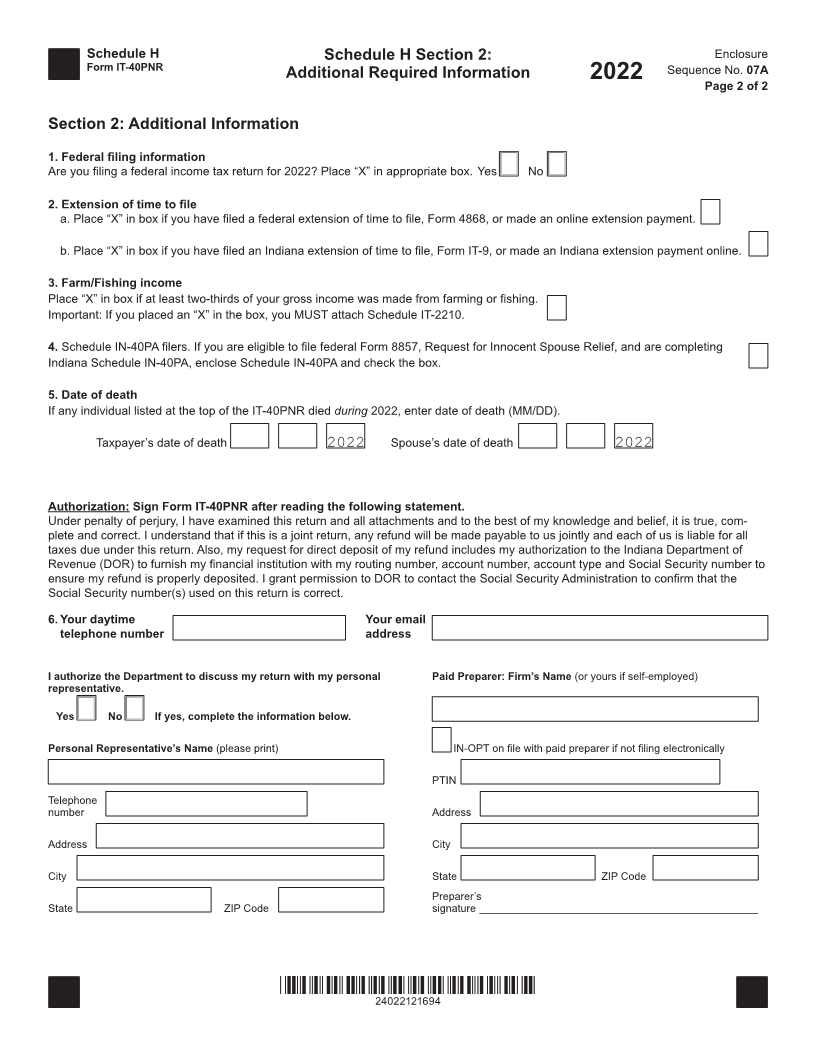

Schedule H Schedule H Section 1: Residency Information Enclosure

Form IT-40PNR (Complete Section 2: Additional Information on back) Sequence No. 07

State Form 54035 2022

(R13 / 9-22) Page 1 of 2

Name(s) shown on Form IT-40PNR Your Social Security Number

Section 1: Residency List all state(s) and dates of your (and your spouse’s, if filing jointly) residency during 2022. Enter 2-letter

state name (e.g. “IL” for Illinois) or the letters “OC” if you were a resident of a foreign country (see instructions).

Information

Example

State of Date From Date To Did you file a tax return with the state/country?

Residence (MM/DD) (MM/DD) Place “X” in appropriate box.

IL 01 01 2022 06 01 2022 Yes X No

IN 06 02 2022 12 31 2022 Yes X No

Your information

(a) (b) (c)

State of Date From Date To Did you file a tax return with the state/country?

Residence (MM/DD) (MM/DD) Place “X” in appropriate box.

1A 2022 2022 Yes No

1B 2022 2022 Yes No

1C 2022 2022 Yes No

1D 2022 2022 Yes No

Spouse’s information if married filing jointly

(a) (b) (c)

State of Date From Date To Did you file a tax return with the state/country?

Residence (MM/DD) (MM/DD) Place “X” in appropriate box.

2A 2022 2022 Yes No

2B 2022 2022 Yes No

2C 2022 2022 Yes No

2D 2022 2022 Yes No

Turn over to complete Section 2

*24022111694*

24022111694