Enlarge image

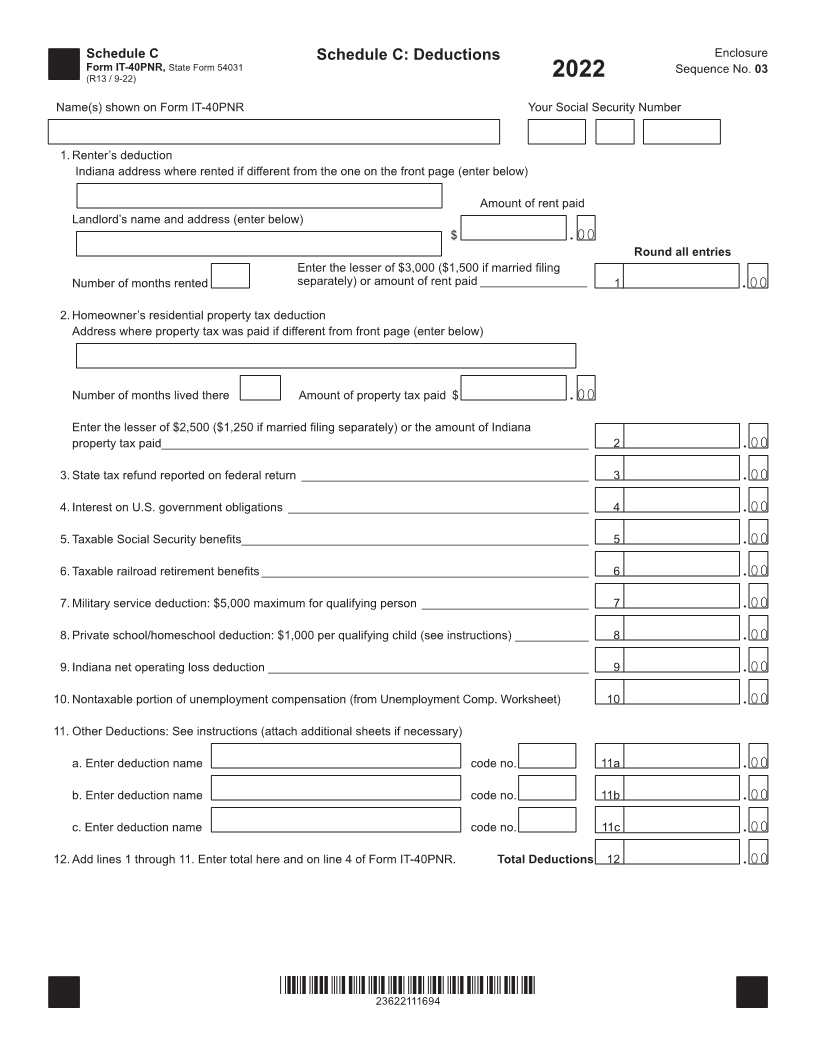

Schedule C Schedule C: Deductions Enclosure

Form IT-40PNR, State Form 54031 Sequence No. 03

(R13 / 9-22) 2022

Name(s) shown on Form IT-40PNR Your Social Security Number

1. Renter’s deduction

Indiana address where rented if different from the one on the front page (enter below)

Amount of rent paid

Landlord’s name and address (enter below)

$ .00

Round all entries

Enter the lesser of $3,000 ($1,500 if married filing

Number of months rented separately) or amount of rent paid ________________ 1

.00

2. Homeowner’s residential property tax deduction

Address where property tax was paid if different from front page (enter below)

Number of months lived there Amount of property tax paid $ . 00

Enter the lesser of $2,500 ($1,250 if married filing separately) or the amount of Indiana

property tax paid ________________________________________________________________ 2 .00

3. State tax refund reported on federal return ___________________________________________ 3 .00

4. Interest on U.S. government obligations _____________________________________________ 4 .00

5. Taxable Social Security benefits ____________________________________________________ 5 .00

6. Taxable railroad retirement benefits _________________________________________________ 6 .00

7. Military service deduction: $5,000 maximum for qualifying person _________________________ 7 .00

8. Private school/homeschool deduction: $1,000 per qualifying child (see instructions) ___________ 8 .00

9. Indiana net operating loss deduction ________________________________________________ 9 .00

10. Nontaxable portion of unemployment compensation (from Unemployment Comp. Worksheet) 10 .00

11. Other Deductions: See instructions (attach additional sheets if necessary)

a. Enter deduction name code no. 11a .00

b. Enter deduction name code no. 11b .00

c. Enter deduction name code no. 11c .00

12. Add lines 1 through 11. Enter total here and on line 4 of Form IT-40PNR. Total Deductions 12 .00

*23622111694*

23622111694