Enlarge image

INDIANA 2 02 2 IT-40PNR Part-Year and Full-Year Nonresident Individual Income Tax Booklet freefile.dor.in.gov FAST • FRIENDLY • FREE

Enlarge image | INDIANA 2 02 2 IT-40PNR Part-Year and Full-Year Nonresident Individual Income Tax Booklet freefile.dor.in.gov FAST • FRIENDLY • FREE |

Enlarge image |

WAIT!

YOU MAY QUALIFY FOR FREE ONLINE TAX FILING!

More than 85 percent of Indiana taxpayers filed electronically in 2021. Consider the benefits of filing electronically:

• Faster Refund. Electronic filing reduces errors and expedites refund time – within 10 to 14 days

(compared with 10 to 12 weeks for a paper return).

• Fewer Errors. Up to 20 percent of paper-filed returns have errors, which can result in delays and possible

penalty and/or interest for the taxpayer. Returns filed electronically, however, are 98 percent accurate.

• Easier Filing. You won’t have to complete the many complicated forms in this booklet. Instead, you go online,

answer some easy questions, and before you know it your taxes are complete.

You may be eligible to file your taxes online for FREE with INfreefile. Go to www.in.gov/dor/individual-income-taxes/

infreefile to see if you qualify or learn more about INfreefile on page 4.

SP 258

(R23 / 12-22)

|

Enlarge image |

Which Indiana Tax Form Should You File? • A new credit (869) is available for qualified film and media

productions. See page 46 for more information.

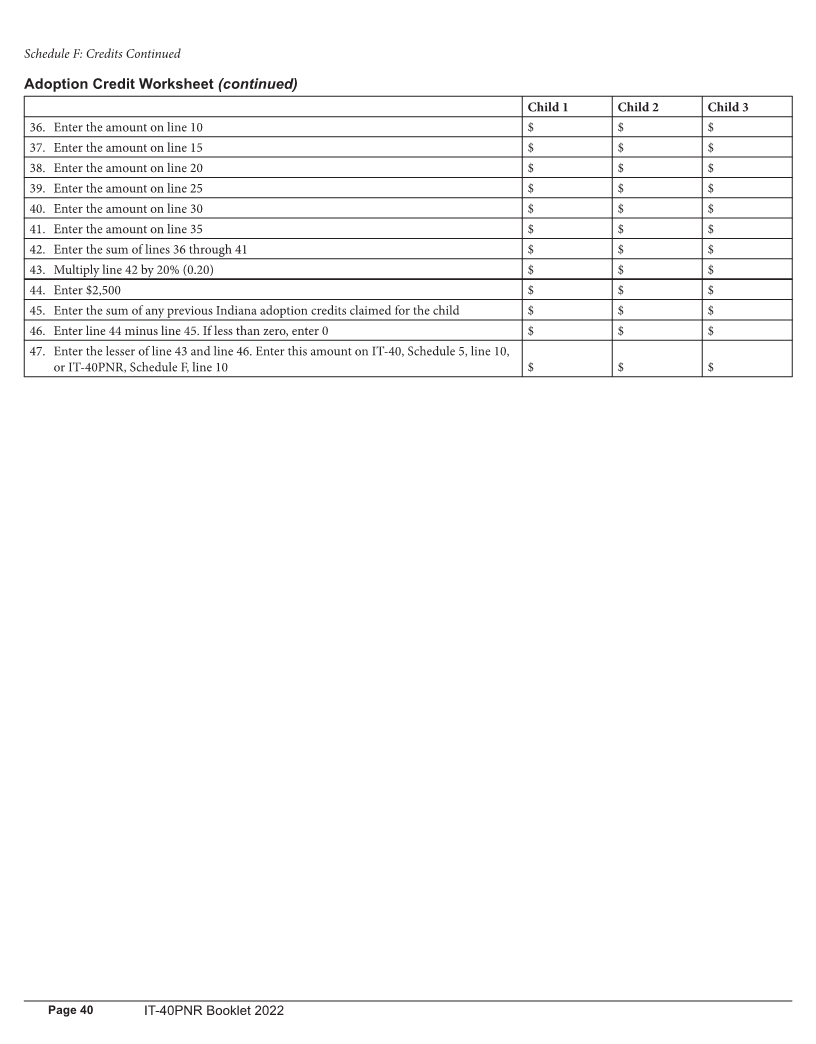

Indiana has three different individual income tax returns. Read the • The Adoption Credit has been increased to 20% of the federal

following to find the right one for you to file. adoption credit or $2,500 per eligible child, whichever is less.

Also, there is a $2,500 cap per eligible child if the credit is claimed

Form IT-40 for Full-Year Residents over multiple years. In addition, the adoption credit is now a

Use Form IT-40 if you (and your spouse, if married filing jointly) were refundable credit. See page 37 for further information.

full-year Indiana residents. • Beginning in 2022, the Headquarters Relocation Credit (818)

must be reported on Schedule IN-OCC.

Form IT-40PNR for Part-Year and Full-Year • School Scholarship Tax Credit Contribution ceiling increased.

Nonresidents The total of allowable net contributions to the program has

Use Form IT-40PNR if you (and your spouse, if married filing jointly): increased to $18.5 million for the program’s fiscal year of July 1,

• Were Indiana residents for less than a full-year or not at all, or 2022 through June 30, 2023.

• Are filing jointly and one was a full-year Indiana resident and the • Automatic Taxpayer Refund. A $200 per individual automatic

other was not a full-year Indiana resident, and taxpayer refund is available for certain taxpayers who did not

• Do not qualify to file Form IT-40RNR. qualify for the automatic taxpayer refunds issued during 2022.

Please see page 38 for additional information.

Form IT-40RNR for Full-Year Residents of Reciprocal

States Deductions

Use Form IT-40RNR if you (and your spouse, if married filing jointly) • A new deduction (635) is available for amounts paid from

were: Indiana education scholarship accounts for qualifying expenses,

• Full-year residents of Kentucky, Michigan, Ohio, Pennsylvania or but only to the extent the payment is included in federal gross

Wisconsin, and income. See page 25 for more information.

• The only type of income from Indiana was from wage, tip, salary • A new deduction (637) is available to report student loan interest

or other compensation.* payments to the extent the interest was paid by your employer and

required to be added back to Indiana adjusted gross income. See

*You are required to file Form IT-40PNR if you have any other kind of page 24 for more information.

Indiana-source income. • A new deduction (638) is available for amounts paid from

Indiana enrichment scholarship accounts for qualifying expenses,

Note. If you have income that is being taxed by both Indiana and but only to the extent the payment is included in federal gross

another state, you may have to file a tax return with the other state. income. See page 25 for more information.

• For 2022, the COVID-related Employee Retention Credit

Military Personnel Disallowed Expenses Deduction (634) is limited to certain cases.

See the instructions on page 7 to determine which form to file. See page 24 for more information.

Military personnel stationed in a combat zone should see the

instructions on page 7 for extension of time to file procedures. Exemptions

• A new $3,000 exemption is available for qualifying adopted

children. See page 28 for more information.

• A new Schedule IN-DEP-A has been created to report any

2022 Changes qualifying adopted children for purposes of claiming the adopted

child exemption. See page 31 for more information.

Update. Line 36A of Form IT-40PNR, Schedule A, assumes conformity

with the Internal Revenue Code of 1986, as amended and in effect

Miscellaneous

on March 31, 2021. If the 2023 Indiana General Assembly does not • A new Schedule IN-W is available to report taxes withheld on

conform to the most current changes to the Internal Revenue Code,

your behalf (and your spouse, if married filing jointly).

you may have to amend your tax return at a later date to reflect

any differences between Indiana and federal law. You may wish to

periodically check DOR’s homepage at www.in.gov/dor for updates.

Need Tax Forms or Information Bulletins?

Add-backs

• The Student Loan Discharge Add-Back (150) rules have been Use Your Personal Computer

adjusted. See page 18 for more information. Visit our website and download the forms you need. Our address for

tax forms is www.in.gov/dor/tax-forms.

Credits

• A new credit (867) is available for qualifying donations to

approved foster care organizations. See page 46 for more

details.

• A new credit (868) is available for the venture capital investment

credit for amounts provided to a Qualified Indiana Investment

Fund. See page 50 for more information.

IT-40PNR Booklet 2022 Page 3

|

Enlarge image |

links and a calendar with filing due dates. Visit DOR’s website at www.

in.gov/dor.

Need Help With Your Return?

Local Help Moving?

You may be eligible to take advantage of the IRS Volunteer Return Notify DOR if you move to a new address after filing your tax return,

Preparation Program (VRPP). This program offers free tax return Change your address with us by doing one of the following:

help to low income, elderly and special needs individuals. Volunteers • Use DOR’s e-services portal, the Indiana Taxpayer Information

will fill out federal and state forms for those who qualify. Call the IRS Management Engine (INTIME), to change your address at intime.

at 1-800-829-1040 to find the nearest VRPP location. Be sure to take dor.in.gov. INTIME offers customers the ability to manage their

your W-2s and 1099s with you. tax account(s) in one convenient location, 24/7.

You can change your address by creating an INTIME log on. Once

Information Line logged in, go to the “All Actions” tab and locate the “Update Name

Call the information line at (317) 232-2240 to get the status of your and Addresses” panel and select the “Addresses” tab.

refund, billing and payment plan information, a copy of your tax An INTIME User Guide for Individual Income Tax Customers is

return, or prerecorded tax topics. If you wish to check for billing available at www.in.gov/dor/files/intime-individual-guide.pdf to

information, be sure to have a copy of your tax notice. The system will help you through the process.

ask you to enter the tax identification number shown on the notice. To • Fax your request, including your Social Security number, old

speak to a representative, please call during regular business hours, 8 address, new address and signature, to 317-615-2608.

a.m. to 4:30 p.m., Monday - Friday. • Mail the request, including your Social Security number, old

address, new address and signature, to Indiana Department of

Internet Address Revenue, P.O. Box 6197, Indianapolis, IN 46206-6197.

If you need help deciding which form to file, or need to get information • Visit one of our District Offices (find locations here: www.in.gov/dor/

bulletins or policy directives on specific topics, visit our website at www. contact-us/district-office-contact-info) in person. Make sure to bring

in.gov/dor. your Social Security number, old address, and new address with you.

Telephone Filing an Amended (Corrected) Tax Return

Call us at (317) 232-2240 Monday - Friday, 8 a.m. to 4:30 p.m., for help If you need to amend (correct) your 2022 individual income tax return

with basic tax questions. after you initially filed:

• Prepare another IT-40 PNR return that reflects all changes and

check the “Amended” box on the front page. Failure to do so can

delay processing.

Ready to File Your Return? • Attach a copy of all required schedules reflecting all changes and

documentation. Failure to do so can delay processing.

Use an Electronic Filing Program • File the amended return electronically, if possible.

More than 85% of Hoosier taxpayers used an electronic filing program

to file their 2021 state and federal individual income tax returns. Note. All amounts previously paid should be reported as an estimated

Electronic filing provides Indiana taxpayers the opportunity to file their payment. All refunds previously received should not be reported on an

federal and state tax returns immediately, and receive their Indiana amended filing.

refunds in about half the time it takes to process a paper return. It takes

even less time if you use direct deposit, which deposits your refund If you are filing an amended return for 2022 reporting additional tax and

directly into your bank account. Even if there is an amount due on you previously received a refund, the department will issue either a notice

either return, Indiana taxpayers can still file electronically and feel of proposed assessment or demand for payment to request repayment of

comfortable knowing that the returns were received by the IRS and the the refund plus interest and penalty.

Indiana Department of Revenue (DOR). Use an electronic vendor or

contact your tax preparer to see if he or she provides this service. The Form IT-40PNR and supporting schedules are located at www.

in.gov/dor/tax-forms/2022-individual-income-tax-forms. For prior

INfreefile years, please see the instructions for that year.

This tax season Indiana continues to offer a free tax filing service

through the cooperation of the Free File Alliance. Eligible Indiana Annual Public Hearing

taxpayers can file both the federal and Indiana individual tax returns In accordance with the Indiana Taxpayer Bill of Rights, DOR will

using highly interactive and easy-to-use web-based applications that conduct an annual public hearing in Indianapolis in June 2023. Event

speed both returns and refunds. You can choose from a list of multiple details will be listed at www.in.gov/dor/news-media-and-publications/

vendors that provide this free service. DOR estimates nearly 2 million dor-public-events/annual-public-hearings. Please come and share

Indiana taxpayers are eligible for this free service. See if you are feedback or comments about how DOR can better administer Indiana

eligible by visiting www.in.gov/dor/individual-income-taxes/infreefile. tax laws. If not able to attend, please submit feedback or comments in

writing to: Indiana Department of Revenue, Commissioner’s Office,

Our Website MS# 101, 100 N. Senate Avenue, Indianapolis, IN 46204. Our homepage

Our website offers tax filing options, downloadable blank forms and provides access to forms, information bulletins and directives, tax

instructions, information bulletins, an online helpdesk, helpful email publications, email, and various filing options. Visit www.in.gov/dor.

Page 4 IT-40PNR Booklet 2022

|

Enlarge image |

• Married Persons Who Live Apart Filing Status

If you were not divorced or legally separated during the tax year

Before You Begin

you may have qualified for and filed as ‘head of household’ on

Important. You must complete your federal tax return first. your federal income tax return. If you did, do not check the

married filing separately box. Also, do not enter either your

Filling in the Boxes – Please Use Ink spouse’s name or Social Security number.

If you are filling out the form by hand, please use black or blue ink and

print your letters and numbers neatly within each box. If you do not Military Address

have an entry for a particular line, leave it blank. Do not use dashes, Overseas military addresses must contain the APO, FPO designation

zeros or other symbols to indicate that you have no entry for that line. in the “city field” along with a two-character “state” abbreviation of

AE, AP, or AA and the ZIP code. Place these two- and three-letter

Social Security Number designations in the city name area.

Be sure to enter your full 9-digit Social Security number in the boxes

at the top of the form. If filing a joint return, enter your Social Security ZIP/Postal Code

number in the first set of boxes and your spouse’s full 9-digit Social Enter your five- or nine-digit ZIP code (do not use a dash). For

Security number in the second set of boxes. An incorrect or missing example, enter 46217 or 462174540. If filing with a foreign address,

Social Security number can increase your tax due, reduce your refund, enter the associated postal code.

or delay timely processing of your filing.

Foreign Country Code

Individual Taxpayer Identification Number (ITIN) Complete this area if the address you are using is located in a foreign

If you already have an ITIN, enter it wherever your Social Security country. Enter the 2-character foreign country code, which may be

number is requested on your tax return. If you are in the process of found online at www.in.gov/dor/legal-resources/tax-library/foreign-

applying for an ITIN, check the box located directly beneath the Social country-code-listing.

Security number area at the top of the form. For information on how

to get an ITIN, contact the IRS at 1-800-829-3676 and request federal County Information

Form W-7, or find it online at www.irs.gov. Enter the two-digit code numbers for the county(s) where you and

your spouse, if filing jointly, lived and worked on Jan. 1, 2022. You

Name and Suffix can find these code numbers on the chart found on the back of

Please use all capital letters when entering your information. For Schedule CT-40PNR. See the instructions beginning on page 51

example, Jim Smith Junior should be entered as JIM SMITH JR. for more information, including the definitions of the county where

you live and work, details for military personnel, retired individuals,

Name. If your last name includes an apostrophe, do not use it. For homemakers, unemployed individuals, out-of-state filers, etc.

example, enter O’Shea as OSHEA. If your name includes a hyphen, use

it. For example, enter SMITH-JONES. Refund Check Address

Your refund check will be issued in the name(s), address and Social

Suffix. Enter the suffix associated with your name in the appropriate box. Security number(s) shown on your tax return. It is very important that

• Use JR for junior and SR for senior. this information is correct and legible. Any wrong information will

• Numeric characters must be replaced by alphabetic Roman delay your refund.

Numerals. For example, if your last name is Charles 3rd, do not

use 3rd; instead, enter III in the suffix field. Rounding Required

• Do not enter any titles or designations, such as M.D., Ph. D., RET., Each line on which an amount can be entered has “.00” already filled

Minor or DEC’D. in. This is to let you know that rounding is required when completing

your tax return.

Married Filing Requirements

• Married Filing Jointly You must round your amounts to the nearest whole dollar.

If you filed your federal income tax return as married filing

jointly, you also must file married filing jointly with Indiana. To do this, drop amounts of less than $0.50.

Example. $432.49 rounds down to $432.00.

• Married Filing Separately

If you file your federal income tax return as married filing separately, Increase amounts of $0.50 or more to the next higher dollar.

you must also file as married filing separately with Indiana. Enter Example. $432.50 rounds up to $433.00.

both of your Social Security numbers in the boxes on the top of the

form, and then check the box directly to the right of those boxes. Losses or Negative Entries

Enter the name of the person filing the return on the top line, but When reporting a loss or negative entry, use a negative sign.

do not enter the spouse’s name on the second name line. Example. Write a $125 loss as -125.

IT-40PNR Booklet 2022 Page 5

|

Enlarge image |

Commas If you were a legal resident of another state(s) (exception: see next

Do not use commas when entering amounts. For instance, express paragraph) and had income from Indiana (except certain interest,

1,000 as 1000. dividends, or retirement income), you must file Form IT-40PNR.

Enclosing Schedules, W-2s, IN K-1s, Etc. Full-Year Residents of Kentucky, Michigan, Ohio,

You will find an enclosure sequence number in the upper right-hand Pennsylvania or Wisconsin

corner of each schedule. Make sure to put your completed schedules If you were a full-year resident of Kentucky, Michigan, Ohio,

in sequential order behind the IT-40PNR when assembling your tax Pennsylvania or Wisconsin, and your only income from Indiana was

return. Do not staple or paper clip your enclosures. If you have a from wages, salaries, tips or commissions, then you need to file Form IT-

schedule on which you’ve made no entry, do not enclose it unless you 40RNR, Indiana Reciprocal Nonresident Individual Income Tax Return.

have completed information on the back of it.

Full-Year Residents

Also, enclose: Full-year residents must file Form IT-40, Indiana Full-Year Resident

• All W-2s, 1099s, Forms IN-MSID-A and IN K-1s on which Individual Income Tax.

Indiana state and/or county tax withholding amounts appear

• All 1099Gs showing unemployment compensation You are a full-year Indiana resident if you maintain your legal residence

• A check/money order, if applicable in Indiana from Jan. 1 – Dec. 31 of the tax year. You do not have to be

physically present in Indiana the entire year to be considered a full-year

A note about your W-2s. It is important that your W-2 form is resident. Residents, including military personnel, who leave Indiana for

readable. The income and state and county tax amounts withheld are a temporary stay, are considered residents during their absence.

verified on every W-2 form that comes in with your tax return. We

encourage you to enclose the best copy available when you file. Retired persons spending the winter months in another state may still

be full-year residents if:

A note about the $200 additional taxpayer refund. • They maintain their legal residence in Indiana and intend to

If you or your spouse (if married filing jointly): return to Indiana during part of the taxable year

• are claiming the $200 additional taxpayer refund on you or your • They retain their Indiana driver’s license

spouse’s behalf, and • They retain their Indiana voting rights

• the individual for whom the credit is being claimed received any • They claim a homestead deduction on their Indiana home for

Social Security benefits other than Supplemental Security income property tax purposes

(SSI),

the Form SSA-1099 for that individual must be attached to the return. If you were a full-year resident of Indiana and your gross income (the

total of all your income before deductions) was greater than certain

• If the individual for whom the credit is being claimed received exemptions*, you must file Indiana Form IT-40.

only SSI, you must attach a benefits verification letter

• See the instructions for Schedule F, Line 11 on page 38 for * To figure your exemptions for filing requirement purposes, Indiana

special instructions related to electronically-filed returns. allows a $1,000 exemption for you and a $1,000 exemption for your

spouse (if married filing jointly). You also get a $1,000 exemption

for each dependent you are eligible to claim. See instructions

beginning on page 28 for additional information concerning how

Who Should File?

You may need to file an Indiana income tax return if: to figure your dependents. If your gross income is less than your total

• You lived in Indiana and received income, or exemptions figured above, you are not required to file. However, you

• You lived outside Indiana and had any income from Indiana. may want to file a return to get a refund of any state and/or county

tax withheld by your employer, or other refundable credits, such as an

Filing Status Requirement. If you and your spouse file a joint federal earned income credit or estimated tax payment.

tax return, you must file a joint tax return with Indiana. If you and

your spouse file separate federal tax returns, you must file separate tax Deceased Taxpayers

returns with Indiana. If an individual died during 2022, or died after Dec. 31, 2022, but

before filing his/her tax return, the executor, administrator or

Note. There are three types of Indiana tax returns available. The type you surviving spouse must file a tax return for the individual if:

need to file is generally based on your residency status. Read the following • The deceased was under the age of 65 and had gross income more

to decide if you are a full-year resident, part-year resident, or nonresident than $1,000

of Indiana, and which type of return you should file. In addition, if you • The deceased was age 65 or older and had gross income more

filed Schedule IN-COMPA, you must file an Indiana tax return. than $2,000, or

• The deceased was a nonresident and had gross income from

Indiana.

Part-Year Residents and Full-Year Nonresidents

If you were a part-year resident and received income while you lived

in Indiana, you must file Indiana Form IT-40PNR, Part-Year Resident Be sure to enter the month and day of death for the taxpayer or spouse

or Nonresident Individual Income Tax Return. in the appropriate box located on Schedule H. For example, a date of

death of Jan. 9, 2022, would be entered as 01/09/2022.

Page 6 IT-40PNR Booklet 2022

|

Enlarge image |

Note. The date of death should not be entered here if the individual

died after Dec. 31, 2022, but before filing the tax return. The date of

When Should You File?

death information will be shown on the individual’s 2023 tax return. Your tax return is due April 18, 2023. If you file after this date and owe

tax, you will owe interest on the unpaid amount and you may owe

Signing the Deceased Individual’s Tax Return penalty, too. See page 11 for more information.

If a joint return is filed by the surviving spouse, the surviving spouse

should sign his or her own name and after the signature write: “Filing Fiscal year tax returns are due by the fifteenth (15) day of the fourth

as Surviving Spouse.” (4th) month after the close of the fiscal year. You must complete the

fiscal year filing period information at the top of the form.

An executor or administrator appointed to the deceased’s estate must

file and sign the return (even if this isn’t the final return), indicating Extension of Time to File — What if You Can’t File on

their relationship after their signature (e.g. administrator). Time?

You must get an extension of time to file if you:

If there is no executor, or if an administrator has not been appointed, • Are required to file, and

the person filing the return should sign and give their relationship to • You cannot file your tax return by the April 18, 2023 due date.

the deceased (e.g. “John Doe, nephew”). Only one tax return should be

filed on behalf of the deceased. Whether you owe additional tax, are due a refund, or are breaking

even, you still need to get an extension if filing after April 18, 2023.

Note. DOR may ask for a copy of the death certificate, so please keep a

copy with your records. Note. Indiana’s Application for Extension of Time to File, Form IT-9,

extends the filing date to Nov. 15, 2023.

Refund Check for a Deceased Individual

If you (the surviving spouse, administrator, executor or other) have If You Owe…

received a refund check and cannot cash it, contact the State Auditor’s

Office at www.in.gov/auditor/contact-us to get a widow’s affidavit Option 1. File Indiana’s Application for Extension of Time to File,

(POA-30) or a distributee’s affidavit (POA-20). Send the completed Form IT-9. This must be filed by April 18, 2023, for the extension

affidavit, the refund check and a copy of the death certificate to the request to be valid.

State Auditor’s Office so a refund check can be issued to you.

Note. You may file Indiana’s Application for Extension of Time to File

Military Personnel — Residency online if you make a payment with it by April 18, 2023.

If you were an Indiana resident when you enlisted, you remain an Pay electronically using DOR’s e-services portal, the Indiana Taxpayer

Indiana resident no matter where you are stationed. You must report Information Management Engine (INTIME), by visiting intime.dor.

all your income to Indiana. in.gov. INTIME offers customers the ability to manage their accounts

in one convenient location, 24/7.

If you changed your legal residence (military home of record) during

the tax year, you are a part-year resident and should file Form Option 2. Filing for a federal application for extension of time to file

IT-40PNR. You must also enclose a copy of Military Form DD-2058 with the IRS will automatically provide for a state extension of time to

with the tax return. As an Indiana part-year resident you will be taxed file. You must file your state tax return by Nov. 15, 2023, paying any

on the income you earned while you were a resident of Indiana, plus balance due with that filing.

any income from Indiana sources.

While interest is due on any amount paid after the original April 18 due

If you are stationed in Indiana and you are a resident of another state, date, penalty will be waived if both of the following conditions are met:

you won’t need to file with Indiana unless you have non-military • The remaining balance due is paid in full by Nov. 15, 2023, and

income from Indiana sources. • You paid at least 90% of the tax expected to be owed by the

original April 18 due date.

Example. Annie, who is a Kansas resident, is stationed in Indiana. She

earned $1,300 from her Indiana part-time job. She will need to report If You Don’t Owe…

that income to Indiana on Form IT-40PNR.

You’ll need to file for an extension if:

If you are a full-year Indiana resident in the military, your spouse is a • You are due a refund, or

legal resident of another state and you filed a joint federal return, you • You don’t expect to owe any tax when filing your tax return, and

will need to file Form IT-40PNR. • You are unable to file your return by April 18, 2023.

Important. Refer to the instructions on page 52 for an explanation There are two ways to accomplish this:

of county of residence for military personnel. • If you have a federal extension (you filed Form 4868, or made

an extension payment via an electronic filing method), you

automatically have an extension with Indiana and do not have to

file for a separate state extension (Form IT-9).

• If you do not have a federal extension, file Form IT-9 by April 18, 2023.

IT-40PNR Booklet 2022 Page 7

|

Enlarge image |

Extension Filing Deadline. processes and formulas, goodwill, trademarks, trade brands,

Both state Form IT-9 and federal Form 4868 extend your state filing franchises, and other property where earnings are a part of an

time to Nov. 15, 2023. Indiana business;

7. Income from trusts and estates derived from Indiana sources and

Will You Owe Penalty and/or Interest? distributed to nonresident heirs; and

Penalty will not be owed if you have: 8. Pensions and most interest and dividends are taxed by your state

• Paid 90% of the tax you expect to owe by April 18, 2023, of residence when you receive them.

• Filed your tax return by Nov. 15, 2023, and

• Paid any remaining amount due (including interest) with that filing. Note. If you were a full-year nonresident and your only income from

Indiana sources was from pensions, interest and/or dividends (which

Interest is owed on all amounts paid after April 18, 2023. See page were not a basic part of the business in Indiana) and/or unemployment

11 for instructions on how to figure interest. compensation, you are not required to file an Indiana income tax return.

Indiana’s Extension of Time to File, Form IT-9 Reciprocal States: Special Filing and Income

You may get Form IT-9 online at www.in.gov/dor/tax-forms/2022- Reporting Instructions

individual-income-tax-forms. You may file Indiana’s Application for If you are a resident of Kentucky, Michigan, Ohio, Pennsylvania or

Extension of Time to File online if you make a payment with it by Wisconsin, and:

April 18, 2023. Pay electronically using DOR’s e-services portal, the • You received wages, salaries, tips, or commissions from Indiana,

Indiana Taxpayer Information Management Engine (INTIME), by you will not owe Indiana adjusted gross income tax on that

visiting intime.dor.in.gov. INTIME offers customers the ability to income. However, you may owe a county tax. If this is the only

manage their accounts in one convenient location, 24/7. type of income you received from Indiana, you should file Form

IT-40RNR, reciprocal nonresident Indiana individual income

Where to Report Your Extension Payment. tax return. See the “Need Tax Forms or Information Bulletins?”

Add your state extension payment to any estimated tax paid. Report section on page 3 for options; or

the total on Schedule F, line 3. • You received other types of Indiana-source income besides wages

tips, salaries or commissions (see items 1 through 8 above), you

Military personnel on duty outside of the United States and Puerto must file Form IT-40PNR instead of Form IT-40RNR; or

Rico on the filing due date are allowed an automatic 60 day extension of • You received both Indiana-source income (see items 1 through

time to file. A statement must be enclosed with the return verifying that 8 above) and wage income from Indiana, you must file form IT-

you were outside of the United States or Puerto Rico on April 18, 2023. 40PNR. The wage income will not be subject to Indiana adjusted

gross income tax. However, see the county tax instructions for

Military personnel in a presidentially declared combat zone have an Reciprocal state residents on page 54 if these wages were

automatic extension of 180 days after they leave the combat zone. In earned in an Indiana county.

addition, if they are hospitalized outside the United States because of

such service, the 180-day extension period begins after being released Example. Fred and Deanna are full-year residents of Michigan, and

from the hospital. The spouse of such service member must use the filed a 2022 joint federal income tax return. During 2022 Fred received

same method of filing for both federal and Indiana (e.g. single or $10,000 winnings from an Indiana riverboat, and Deanna earned

joint). When filing the return, write “Combat Zone” across the top of $55,000 wage income from an Elkhart, Indiana employer. Fred’s

the form (above your Social Security number). riverboat winnings will be taxed by Indiana. Enter Fred’s $10,000

winnings on Indiana Schedule A, line 20, Columns A and B. Deanna’s

wage income is not subject to Indiana adjusted gross income tax.

Therefore, enter Deanna’s wage income in Column A only.

Nonresidency and Income Taxable to

Indiana Note. See county tax instructions for Reciprocal state residents on

A part-year resident owes tax on taxable income received from page 54 to determine if county tax is due on her wage income.

all sources while being a resident of Indiana. A part- or full-year

nonresident also owes tax on income from Indiana sources as listed

below while a legal resident of another state.

Completing Form IT-40PNR

Indiana income includes income from the following sources:

1. Winnings from Indiana riverboats, pari-mutuel wagering, and Line 1 – Income Taxed by Indiana

lotteries; Complete Indiana Schedule A: Income or Loss; Proration; and

2. Labor or services performed in Indiana, including salaries, wages, Adjustments to Income. Instructions for Schedule A begin on page

tips, commissions, etc.; 12. Carry the line 36B amount to line 1 on the front of Form IT-

3. A farm, business, trade or profession doing business in Indiana; 40PNR. Make sure to enclose Schedule A when filing.

4. Any real or personal property located in Indiana, including any

income from the sale or exchange of property located in Indiana; Line 2 – Add-Backs

5. A partnership or an S corporation doing business in Indiana; Enter on this line any add-backs from Schedule B: Add-Backs.

6. Stocks, bonds, notes, bank deposits, patents, copyrights, secret Instructions for Schedule B begin on page 17. Make sure to enclose

Schedule B when filing.

Page 8 IT-40PNR Booklet 2022

|

Enlarge image |

Line 4 – Deductions Example. Mark and Megan have a $420 overpayment, and want to

Enter on this line any deductions from Schedule C: Deductions. apply $300 of it to their 2023 estimated tax account. Their worksheet

Instructions for Schedule C begin on page 20. Make sure to enclose from Form ES-40 has the following breakdown:

Schedule C when filing. • Line I (each installment payment) is $300;

• Line J (portion that represents state tax due) is $270; and

Line 6 – Exemptions • Line K (portion that represents county tax due) is $30.

Enter any exemptions from Schedule D: Exemptions on this line.

Instructions for Schedule D begin on page 28. Make sure to enclose They will enter $30 on line 19a (along with their 2-digit county code),

Schedule D when filing. $270 on line 19c, and the $300 total amount to be applied will be

entered on line 19d. They will get a $120 refund ($420 overpayment

Line 9 – County Tax minus $300 applied to their 2023 estimated tax account).

Complete Schedule CT-40PNR to figure your county tax. Instructions

for Schedule CT-40PNR begin on page 52. Example. Stu wants to pay $500 in estimated tax for each installment

period. He has a $30 overpayment on his tax return. He chooses to

Line 10 – Other Taxes enter the full $30 overpayment on line 19c (Indiana adjusted gross

Enter any other taxes from Schedule E: Other Taxes on this line. income tax amount), and carries it to line 19d. (He will pay the $470

Instructions for Schedule E begin on page 33. Make sure to enclose additional amount by filing the Form ES-40.)

Schedule E when filing.

Important. Estimated tax installment payments made for the 2023 tax

Line 12 – Credits year are due by:

Enter your credits from Schedule F: Credits on this line. Instructions • April 18, 2023 (1st installment)

for Schedule F begin on page 35. Make sure to enclose Schedule F • June 15, 2023 (2nd installment)

when filing. • Sept. 15, 2023 (3rd installment)

• Jan. 16, 2024 (4th installment)

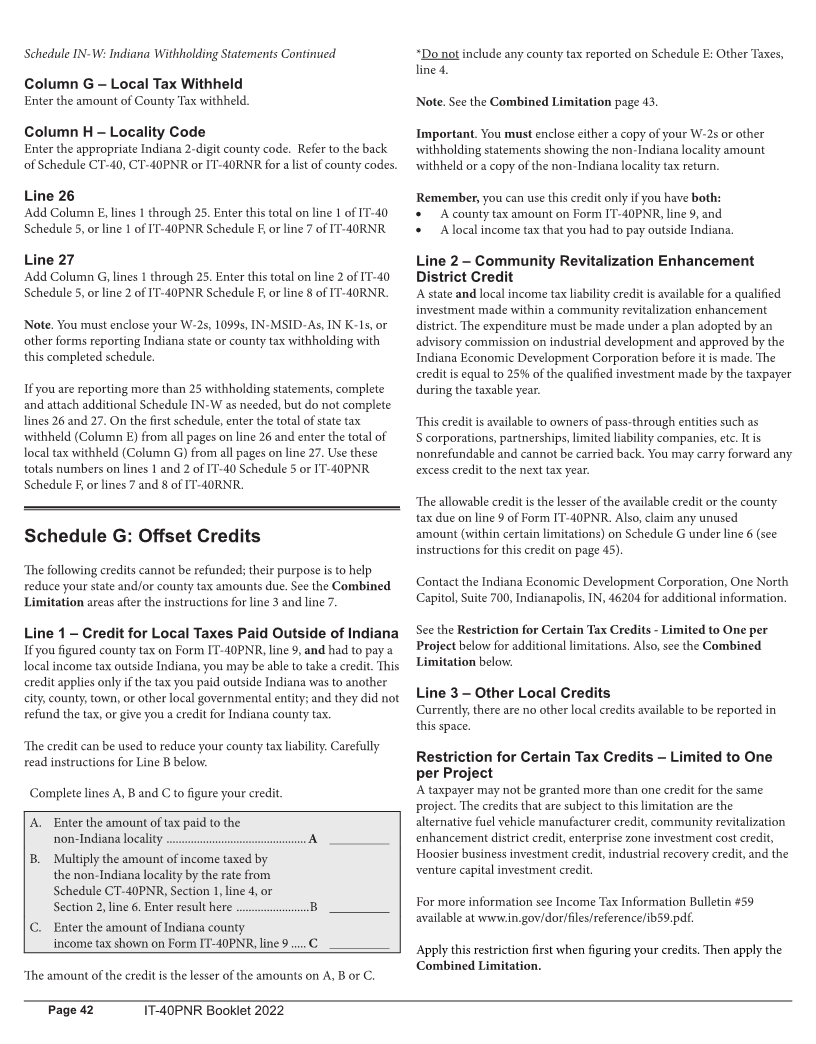

Line 13 – Offset Credits

Enter the total of any offset credits reported on Schedule G: Offset Any installment payment amount entered on line 19d will be considered

Credits on this line. Instructions for Schedule G begin on page 42. to be paid on the day your tax return is filed (postmarked). For instance,

Make sure to enclose Schedule G when filing. an installment payment shown on a return filed on: April 18, 2023, will

be considered to be a 2023 first installment payment; June 3, 2023, will

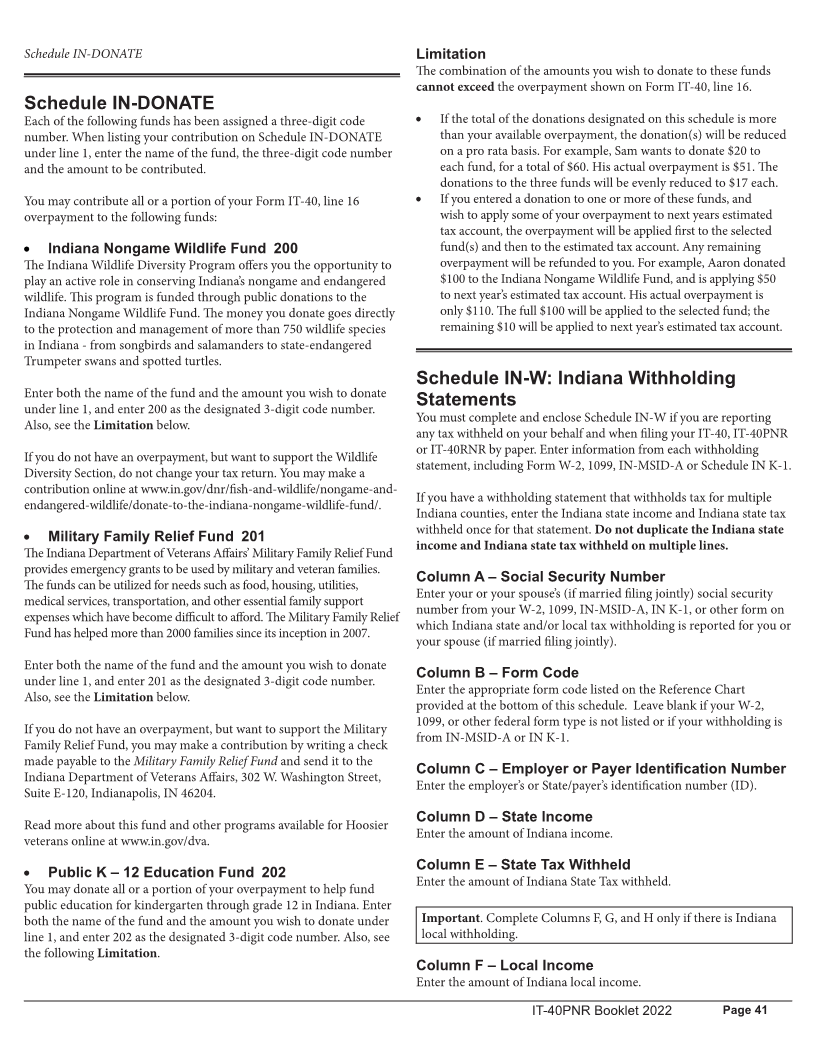

Line 17 – Donation Check-Offs be considered to be a 2023 second installment payment; and July 22,

Enter on this line the total of any donations made on Schedule IN- 2023, will be considered to be a 2023 third installment payment.

DONATE. Make sure to enclose Schedule IN-DONATE, which is

located at the bottom of Schedule F: Credits, when filing. See page Note. You may complete and mail the ES-40, Estimated Tax Payment

41 for more information. form, along with your payment to DOR’s return address on the form.

Estimated payments can also be made online with an electronic bank

Line 19 – Amount to be Applied as a 2023 Estimated payment (ACH/e-check) or Visa, MasterCard and Discover debit or

Tax Installment Payment credit cards by using DOR’s e-services portal, the Indiana Taxpayer

You should pay estimated tax if you expect to have income during the Information Management Engine (INTIME), at intime.dor.in.gov. See

2023 tax year that: line 26 instructions on page 11 for details about payment options.

• Will not have Indiana income taxes withheld, or

• You think the amount withheld will not be enough to pay your tax See Income Tax Information Bulletin #3 at www.in.gov/dor/files/

liability, and reference/ib03.pdf for additional information about estimated taxes.

• You expect to owe more than $1,000 when you file your tax return.

Line 20 – Penalty for Underpayment of Estimated Tax

There are several ways you can make estimated tax payments. First, visit our You might owe a penalty for the underpayment of estimated tax if you

website at www.in.gov/dor/tax-forms/2022-individual-income-tax-forms did not have taxes withheld from your income and/or you did not pay

to get Form ES-40. Use the worksheet on Form ES-40 to see how much you enough estimated tax throughout the year.

will owe. Then, if you have an overpayment showing on line 18 of your tax

return, you can have some or all of the overpayment applied to next year’s In fact, not properly paying estimated tax is one of the most common

estimated tax account. To do so, enter any portion of the overpayment: errors made in filing Indiana tax returns. Generally, if you owe $1,000

• On line a, if you want to apply an amount to offset estimated or more in state and county tax for the year that’s not covered by

county tax due (from Form ES-40 worksheet, line K). Also, enter withholding taxes, you need to be making estimated tax payments.

the 2-digit county code from line K; and/or

• On line b, if your spouse lived in a different county than you did You might owe this penalty if:

on Jan. 1, 2023, and you want to apply an amount to offset your • The total of your credits, including timely made estimated tax

spouse’s estimated county tax due (from Form ES-40 worksheet, payments, is less than 90% of this year’s tax due or 100% of last

line L). Also, enter the 2-digit county code from line L; and/or year’s tax due, ** or

• On line c, if you want to apply an amount to offset your estimated • You underpaid the minimum amount due for one or more of the

state tax due (from Form ES-40 worksheet, line J). installment periods.

IT-40PNR Booklet 2022 Page 9

|

Enlarge image |

If either of these cases apply to you, you must complete Schedule IT-2210 Option 1. Pay your estimated tax in one payment on or before Jan. 18,

or IT-2210A to see if you owe a penalty or if you meet an exception. 2023, and file your tax return by April 18, 2023; or

• If you owe this penalty, complete Schedule IT-2210 or IT-2210A Option 2. Make no estimated tax payment and file your tax return and

and write the penalty amount on Form IT-40PNR, line 20. pay all the tax due by March 1, 2023.

• If you meet an exception, complete Schedule IT-2210 or IT-2210A

to show which exception was met. Example. More than two-thirds of Henry’s gross income is from

farming. He should complete Schedule IT-2210. Henry will be able

Keep the completed form with your records as DOR may request it at to use the Section D Short Method to figure his penalty or to show he

a later date. meets an exception to owing a penalty.

*You must have timely paid 100% of lines 8 and 9 of your 2021 IT-40 Visit our website at www.in.gov/dor/tax-forms/2022-individual-

or IT-40PNR. Note: If last year’s Federal adjusted gross income was income-tax-forms to get Schedule IT-2210 or Schedule IT-2210A.

more than $150,000 ($75,000 for married filing separately), you must

pay 110% of last year’s tax (instead of 100%) to meet this exception. Line 21 – Refund

You have a refund if line 18 is greater than the combined amounts

**Farmers and fishermen should see the special instructions on page 10. entered on lines 19d and 20.

Important. DOR will automatically assess an underpayment penalty if Important. If the combination of line 19d plus line 20 is greater than

it looks like you owe a penalty for the underpayment of estimated tax. the amount on line 18, you must make an adjustment. The estimated

tax carryover amount on line 19d is limited; it cannot be greater than

Should You Use Schedule IT-2210 or Schedule IT-2210A? the remainder of line 18 minus line 20. See the second example about

Schedule IT-2210 should be used by individuals who receive income Stu under the Line 19 instructions on page 9.

(not subject to withholding tax) on a fairly even basis throughout the

year. This schedule will help determine whether a penalty is due, or A Note About Refund Offsets

whether an exception to the penalty has been met. Indiana law requires that money you owe to the state, its agencies,

and certain federal agencies, be deducted from your refund or credit

Example. Jim and Sarah together received $4,500 in pension income before a refund is issued. This includes money owed for past-due

each month. Since their income is received on a fairly even basis, they’ll taxes, student loans, child support, food stamps or an IRS levy. If

use Schedule IT-2210 to figure their penalty or exception to the penalty. DOR applies your refund to any of these debts, you will receive a letter

explaining the situation.

Farmers and fishermen have special filing considerations. If at least

two-thirds of your gross income is from farming or fishing, complete When to Expect Your Refund

Schedule IT-2210, using the Section D Short Method. Generally, 10 to 14 business days is the average wait for a refund if

the tax return is electronically filed; it can take up to 12 weeks for the

Schedule IT-2210A may be used by individuals who receive income refund to be issued if you mail in your tax return.

(not subject to withholding tax) unevenly during the year. Also use

this form if you had substantial changes in withholding during the Where’s Your Refund?

year. See Income Tax Information Bulletin #3 available at www.in.gov/ There are several ways to check the status of your refund. You will

dor/files/reference/ib03.pdf for further information. This schedule will need to know the exact amount of your refund, and a Social Security

help determine whether a penalty is due, or whether an exception to number entered on your tax return. Then, do one of the following:

the penalty has been met. • Go to www.in.gov/dor/individual-income-taxes/check-the-status-

of-your-refund and click Check the Status of Your Refund.

Example. Bill’s income is from selling fireworks in June and July. He • Call (317) 232-2240 for automated refund information; to speak

will want to figure any penalty due on Schedule IT-2210A, which may to a representative, please call during regular business hours, 8

exempt him from having had to pay estimated tax on the April 18, a.m. to 4:30 p.m., Monday - Friday.

2022 first installment due date.

A refund directly deposited to your bank account may be listed on

Example. Rachael received a sizeable lump sum distribution in your bank statement as a credit, deposit, etc. If you have received

December of 2022. She figured how much estimated tax was due, and information from DOR that your refund has been issued, and you are

paid it in full by the Jan. 17, 2023, fourth period installment due date. not sure if it has been deposited in your bank account, call the ACH

By completing Schedule IT-2210A, she shows she owes no penalty Section of your bank or financial institution for clarification.

for the first three installment periods, and that a proper payment was

made for the fourth installment period. She will owe no penalty. Important. If we are unable to deposit your refund to the listed

account (incorrect/incomplete account numbers; account closed;

Farmers and Fishermen. refund to go to an account outside the United States; etc.), DOR will

Special options are available if more than two-thirds of your gross mail a paper check to the address on the front of the tax form.

income for 2021 and/or 2022 was from farming or fishing.

Note. A refund deposited directly to your Hoosier Works MasterCard

account will appear on your monthly statement.

Page 10 IT-40PNR Booklet 2022

|

Enlarge image |

Statute of Limitations for Refund Claims Exception. No penalty will be due if you have:

There is a statute of limitations when filing for a refund of overpaid • An extension of time to file,

taxes for tax year 2022. In general, a claim for refund must be made • Are filing and paying the remaining tax due by the extended filing

by April 15, 2026 (Nov. 14, 2026 if filing under extension). The claim due date, and

for refund is considered to be made on the day your tax return • Have prepaid at least 90% of the amount due by April 18, 2023.

is postmarked. If you file your 2022 tax return after the statute of

limitations has expired, no refund will be issued. Line 25 – Interest

You will owe interest (even if you have an extension of time to file) if

Line 22 – Direct Deposit your tax return is filed after the April 18, 2023 due date and you have

You may choose to have your refund deposited in your checking, savings an amount due. Interest should be figured on the sum of line 23 minus

or Hoosier Works Master Card account. If you want your refund directed line 20. Contact DOR at (317) 232-2240 or visit our website at www.

into your checking or savings account, complete lines 22 a, b, c and d. in.gov/dor/files/reference/dn03.pdf to get Departmental Notice #3 for

the current interest rate.

Caution. If you choose this option, make sure to verify the account

information after you have entered it. This will help ensure your Line 26 – Amount Due – Payment Options

refund is deposited into your desired account. There are several ways to pay the amount you owe.

The routing number is nine digits, with the first two digits of the Electronic payments can be made via DOR’s e-service portal, the Indiana

number beginning with 01 through 12 or 21 through 32. Do not use a Taxpayer Information Management Engine (INTIME), at intime.dor.

deposit slip to verify the number because it may have internal codes as in.gov. INTIME offers customers the ability to manage their accounts in

part of the actual routing number. one convenient location, 24/7. Accepted forms of payment via INTIME

include electronic bank payment (ACH/e-check), Visa, MasterCard

The account number can be up to 17 digits. Omit any hyphens, accents and Discover debit or credit cards. No fees are assessed for electronic

and special symbols. Enter the number from left to right and leave any bank payments. Fees apply to payments made with credit or debit cards.

unused boxes blank. You do not need to logon to INTIME to make payments. Simply select

the “Make a Payment” option on the page. An INTIME User Guide for

Check the appropriate box for the type of account you are making Individual Income Tax Customers is available at www.in.gov/dor/files/

your deposit to: either a checking account or savings account. intime-individual-guide.pdf to help you through the process.

To comply with banking rules, you must place an X in the box on line Another option is to mail your payment to:

d if your refund is going to an account outside the United States. If you Indiana Department of Revenue

check the box, we will mail you a paper check. P.O. Box 7224

Indianapolis, IN 46207-7224

If you currently have a Hoosier Works MasterCard and wish to have

your refund directly deposited in your account, enter your 12-digit You may pay in person at one of DOR’s district offices with cash, but with

account number on line 22b, where it says “Account Number” (do the exact amount only. Other in-person options include paying with a

not write anything on line 22a “Routing Number”). You can find money order, cashier’s check or personal check made payable to DOR.

your 12-digit account number in the upper right-hand corner of your

account monthly statement. Note. All payments to DOR must be made with U.S Funds.

Note. DO NOT use your MasterCard 16-digit number. Make sure to Payment plan option. If you cannot pay the full amount due at the

check the “Hoosier Works MC” box on line 22c. time you file, you may be eligible to set up a payment plan online

using DOR’s e-services portal, the Indiana Taxpayer Information

For more information on direct deposit, please see “Where’s Your Management Engine (INTIME), at intime.dor.in.gov. INTIME offers

Refund?” in the left-hand column. customers the ability to manage their tax account(s) in one convenient

location, 24/7. After you get a tax bill, go to intime.dor.in.gov and

Line 23 create a log on using the Letter ID on your tax bill. Set up a payment

If line 21 is less than zero, you have an amount due. Enter here as a plan from the “All Actions” tab menu.

positive number and skip to line 24.

OR Important. If using the payment plan option, penalty and interest will

If line 15 is greater than line 14, complete the following steps: be due on all amounts paid after the April 18, 2023 due date.

Subtract line 14 from line 15 and enter the total here .. A __________

Enter any amount from line 20 ........................................ B __________ If you have questions, contact DOR in one of three ways:

Add lines A + B. Enter total here and on line 23 ........... C __________ • Use the secure messaging feature in the Indiana Taxpayer

Information Management Engine (INTIME). If you are not

Line 24 – Penalty registered, create an online account at intime.dor.in.gov. Select

You may owe a penalty if your tax return is filed after the April 18, “New to INTIME? Sign up” and follow instructions to complete

2023 due date and you have an amount due. Penalty is 10% of the the process. You will need your taxpayer ID (FEIN, SSN, etc.) and

amount due (line 23 minus line 20) or $5, whichever is greater. the unique Letter ID, printed in the upper-right hand corner of

IT-40PNR Booklet 2022 Page 11

|

Enlarge image |

Schedule A

this letter. Once logged in, select “Respond to a letter, notice, or Schedule A

bill” under the “All Actions” menu.

Sections 1, 2 and 3 Instructions

• Call DOR Customer Service at 317-232-2240, Monday through

Sections 1, 2 and 3 will help you to separate the income to be taxed

Friday, 8 a.m. - 4:30 p.m. EST.

and adjustments to be allowed by Indiana.

• Correspond with DOR via mail using this address:

Indiana Department of Revenue

General Information

100 N. Senate Ave.

Income received from Indiana sources should be reported as Indiana

Indianapolis, IN 46204-2253

income by nonresidents, except certain types of Indiana-source

income that are subject to tax only by your state of residence at the

Returned Checks and Other Types of Payments time you receive it.

If you make a tax payment with a check, credit card, debit card,

electronic funds transfer, or any other instrument in payment by any

For part-year residents, the portion of the following types of income

commercially allowable means, and DOR is unable to obtain payment

from Indiana sources that were received while a nonresident should

for its full amount when it is presented for payment through normal

not be reported as income taxed by Indiana: interest from bonds,

banking channels, a $35 penalty will be assessed.

dividends, unemployment compensation, and gains from the sale of

stock, bonds, or other securities. However, gains from real or tangible

The assessed amount will be due immediately upon receipt of the tax

personal property located in Indiana should be reported as income

due notice and must be paid by certified check, bank draft or money

taxed by Indiana. In addition, if you receive income from a pass

order. Note. Any permits and/or licenses issued by DOR may be revoked

through entity (e.g., an S corporation or partnership) that conducts

if the assessed amount is not paid immediately.

business in Indiana, your share of the entity’s income derived from

Indiana sources should be reported as income taxed by Indiana.

Signatures and Signing Dates

First, read the Authorization area on Schedule H. Then, sign and date

For full-year nonresidents, the portion of the following types of income

the tax return. If this is a jointly filed tax return, both you and your

from Indiana sources should not be reported as income taxed by

spouse must sign and date it. Make sure to enclose the completed

Indiana: interest from bonds, dividends, unemployment compensation,

Schedule H when filing.

and gains from the sale of stocks, bonds, or other securities.

Taxpayer Advocate Example. The distributive share of income received from an

As prescribed by the Taxpayer Bill of Rights, DOR has an appointed

S corporation doing business in Indiana must be reported by

Taxpayer Advocate whose purpose is to facilitate the resolution of

nonresidents as income taxable in Indiana to the extent the S

taxpayer complaints and complex tax issues. If you have a complex tax

corporation is doing business in Indiana.

issue, you must first pursue resolution through normal channels, such

as contacting the customer service division at (317) 232-2240. If you

Example. Interest income received by an Illinois resident from an

are still unable to resolve your tax issue, or a tax assessment places an

Indiana personal savings account is not income taxable to Indiana.

undue hardship on you, you may receive assistance from the Office of

the Taxpayer Advocate.

Read the following line-by-line instructions for more information.

Also, see Income Tax Information Bulletin #28 at www.in.gov/dor/

For more information, and to get required schedules if filing for an offer

files/reference/ib28.pdf for more information.

in compromise or a hardship case, visit our website at: www.in.gov/

dor/contact-us/tao. You may also contact the Office of the Taxpayer

Important Information about Possible Year-End

Advocate directly at taxadvocate@dor.in.gov, or by telephone at (317)

Federal Legislation

232-4692. Submit supporting information and documents to: Indiana

This publication was finalized before all year-end federal legislative

Department of Revenue, Office of the Taxpayer Advocate, P.O. Box

changes were complete. Therefore, some of the income/loss and

6155, Indianapolis, IN 46206-6155.

adjustments reported may need to be adjusted.

Where to Mail Your Tax Return You may wish to periodically check DOR’s homepage at www.in.gov/

dor for updates about any impact of late federal legislation.

If you are enclosing a payment, please mail your tax return with all

enclosures to:

How to Report a Loss

Indiana Department of Revenue

When reporting a loss or negative entry, use a negative sign.

P.O. Box 7224

Example. Write a $125 loss as -125.

Indianapolis, IN 46207-7224

For all other filings, please mail your tax return with all enclosures to:

Indiana Department of Revenue

P.O. Box 40

Indianapolis, IN 46206-0040

Page 12 IT-40PNR Booklet 2022

|

Enlarge image |

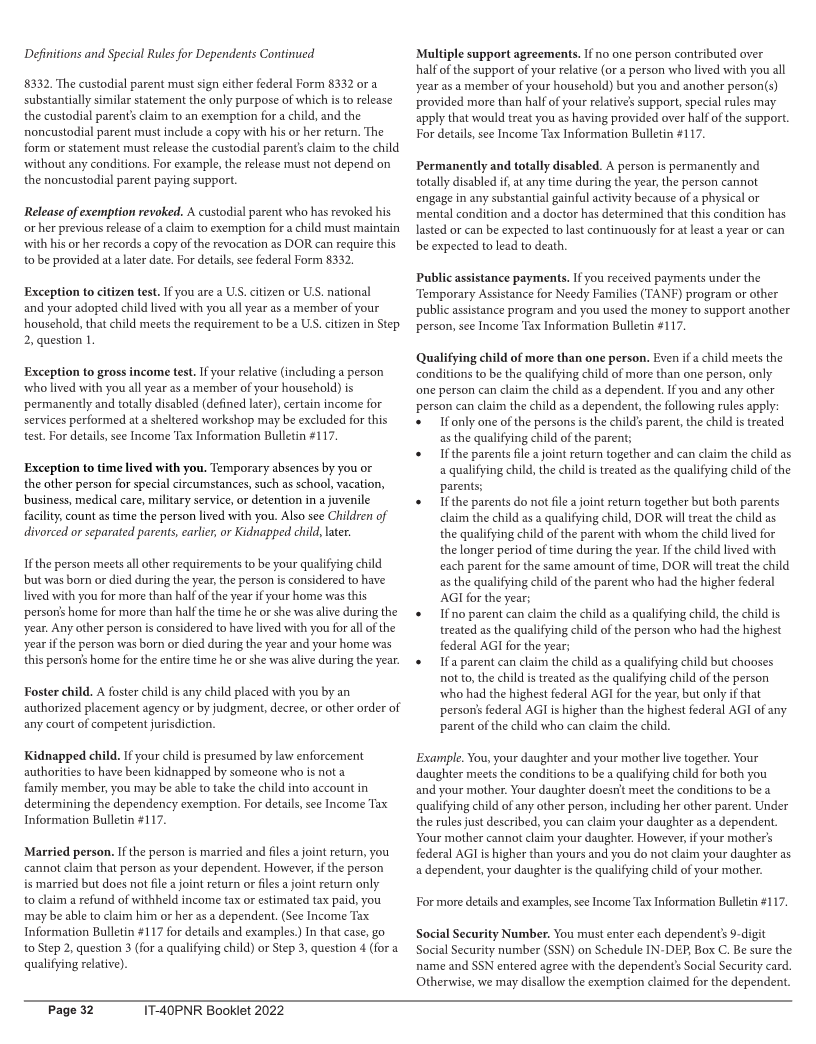

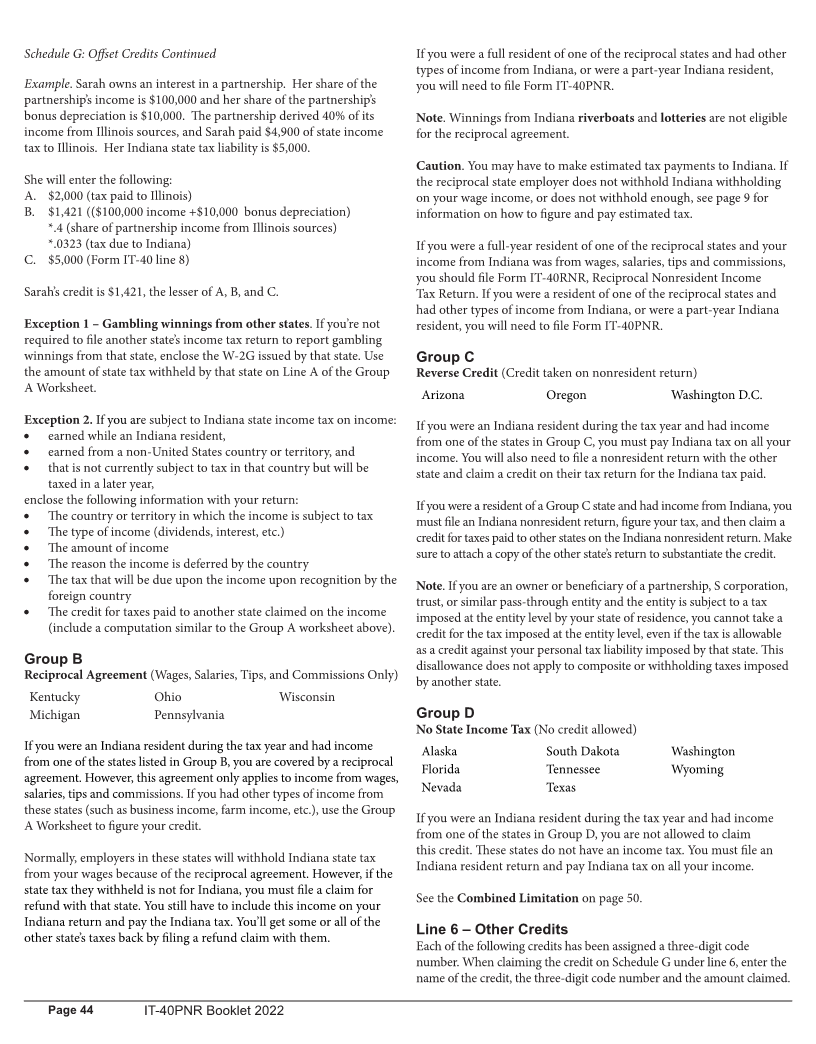

Schedule A: Section 1: Income or Loss Line 7 – Business Income or Loss

Enter in Column A the business income from Schedule C that is reported

on federal Schedule 1, line 3. Enter in Column B that portion of business

Schedule A income subject to tax in Indiana. Also, see the instructions for:

• Tax Add-Back on Schedule B, line 1, on page 17,

Section 1: Income or Loss • Apportionment on line 19 if this income is from a business doing

You must complete your federal income tax return first.

business both within and outside Indiana, and

Unless otherwise stated: • Other Income on line 20.

• Enter in Column A your income and adjustments as they appear

on your federal return, Form 1040/1040-SR; and

Line 8 – Capital Gain or Loss from Sale or Exchange

• Enter in Column B the portion of your income and adjustments

of Property

that is subject to Indiana income tax.

Enter in Column A the capital gain or loss from federal Schedule

D that is reported on federal Form 1040/1040-SR, line 7. Enter in

Lines 1 and 2 – Wages, Salaries, Tips, Etc.

Column B that portion received while you were an Indiana resident

Enter wages, salaries, tips, other compensation, and any other amounts

and/or from the sale or exchange of property located in Indiana.

entered on Lines 1a through 1h. You should report your income on

line 1 and your spouse’s income on line 2. Enter in Column B income

Note. Any capital loss claimed is subject to the same capital loss limitations

received while you were an Indiana resident, and/or income from

that apply for federal tax purposes. For more information about federal

Indiana sources received while you were not an Indiana resident.

capital loss limitations, get federal Schedule D, Capital Gains and Losses.

Note for part-year or full-year nonresidents. Do not enter that

Line 9 – Other Gains or Losses from Form 4797

portion of your Indiana source wage, salary, tip or commission

Enter the gain or loss from the sale or exchange of property as

income in Column B earned while you were a resident of a reciprocal

reported for federal tax purposes on federal Schedule 1, line 4. Enter

agreement state (see Reciprocal States: Special Filing and Income

in Column B that portion received:

Reporting Instructions on page 8). • If the property was Indiana property, and/or

• While you were an Indiana resident, regardless of the source.

Lines 3 and 4 – Interest and Dividend Income

Enter in Column A your taxable interest and dividend income as

Line 10 – IRA Distributions

reported on your federal return, lines 2b and/or 3b, and report the

Enter in Column A the taxable portion of the IRA distribution

interest and dividend income attributable to Indiana in Column B.

reported on your federal Form 1040/1040-SR, line 4b. Enter in

If any of the interest reported in Column B is from U.S. government

Column B that portion received while you were an Indiana resident.

obligations, including U.S. savings bonds, Treasury notes, T-Bills, etc.,

you may deduct these amounts on Form IT-40PNR, Schedule C, line 4.

Line 11 – Pensions and Annuities

Enter in Column A the taxable portion of all pensions, annuities and

Interest from municipal obligations. Do not report any interest

other retirement income as reported on your federal Form 1040/1040-

from municipal obligations on line 3. However, if you were an Indiana

SR, line 5b. Enter in Column B that portion received while you were

resident when receiving interest from a non-Indiana municipal

an Indiana resident.

obligation, see OOS municipal obligation interest add-back on page

17 to see if you are required to add it to your Indiana income to be

Note. You will be eligible for a deduction if you included any railroad

taxed. See Income Tax Information Bulletin #19 at www.in.gov/dor/

retirement benefits issued by the U.S. Railroad Retirement Board on this

files/reference/ib19.pdf for more information.

line in Column B. See Schedule C, line 6 instructions for more information.

Line 5 – Taxable Refunds, Credits or Offsets

Line 12 – Net Rent or Royalty Income or Loss

Enter in Column A the amount of taxable refunds, credits or offsets

Enter in Column A the net rent and royalty income or loss included in

of state and local income taxes that was reported on your federal

the total on federal Schedule 1, line 5.

Schedule 1, line 1. Enter in Column B that portion received while you

were an Indiana resident.

Enter in Column B the net royalty income/loss:

• Received while you were an Indiana resident; and

Line 6 – Alimony Received • Received while you were an Indiana nonresident if the income/loss

Enter in Column A the amount of alimony reported on your federal

results from the conduct of a trade or business conducted in Indiana.

Schedule 1, line 2a. Enter in Column B that portion you received while

you were an Indiana resident.

Enter in Column B the net rental income/loss:

• Received while you were an Indiana resident; or

Lines 7, 12 – 16 • From real property located in Indiana received while you were a

Important. The amounts on line 7 and lines 12 through 16 should

nonresident; and

reflect the amounts reported on your federal Schedule 1 (after any • In general, from personal property located in Indiana.

application of passive activity loss limitations from federal Form 8582).

Also, see the instructions for tax add-back for Section B, line 1, on

page 17.

IT-40PNR Booklet 2022 Page 13

|

Enlarge image |

Schedule A: Section 1: Income or Loss Continued Indiana income tax return, and report any withholding amounts from

that schedule on Indiana’s Schedule F, lines 1 and 2.

Lines 13, 14 and 15 – Partnership, Trust and Estates,

and S Corporation Income or Loss Note. See the instructions for tax add-back for Schedule B, line 1, on

Enter in Column A the income or loss from partnerships, trusts and page 17.

estates, and S corporations, that is included in the total on federal

Schedule 1, line 5. Line 16 – Farm Income or Loss

Enter in Column A the farm income/loss from federal Schedule 1,

Enter in Column B that portion of income received from the line 6. Enter in Column B that portion of farm income/loss subject to

partnerships, trusts and estates, and S corporations while you were tax in Indiana.

an Indiana resident and/or the portion received from Indiana sources

while being a nonresident. Also, see the instructions for:

• Apportionment on Section 1, line 6 if this income is from a farm

Fiduciary*. If you are a nonresident, the Indiana fiduciary(s) should doing business both within and outside Indiana, and

provide to you an apportioned amount to be taxed by Indiana on • Tax add-back for Schedule B, line 1, on page 17.

Schedule IN K-1. If the fiduciary does not apportion its income, then

enter in Column B the same amount as you entered in Column A. Line 17 – Unemployment Compensation

Enter in Column A the unemployment income from federal Schedule

Partnership and S Corporation*. If you are a nonresident, the Indiana 1, line 7. Enter in Column B that portion of unemployment income

partnership/S corporation should provide to you an apportioned received while you were an Indiana resident.

amount to be taxed by Indiana on Schedule IN K-1. If that Indiana

entity does not apportion the income, then enter in Column B the Important. You may qualify for a deduction if you received

same amount from that entity(s) as you entered in Column A. unemployment compensation while you were an Indiana resident. For

more information, see page 22 for Schedule C, line 10 instructions.

*Information for Nonresidents. Partnerships, S corporations, and trusts

and estates located in and/or doing business in Indiana are required to: Line 18 – Social Security and Railroad Retirement

• File an annual return, Form IT-65/Form IT-20S/Form IT-41; Benefits

• Withhold Indiana state and county (when applicable) income tax on Enter in Column A the portion of Social Security and/or railroad

behalf of their nonresident partners/shareholders/beneficiaries*; and, retirement benefits that are taxed on your federal Form 1040/1040-SR,

• Figure and pay (with the filing of that annual return and Schedule line 5b and/or line 6b. Enter in Column B* the portion received while

Composite) Indiana state and county income tax due on their you were an Indiana resident.

individual nonresident partners/shareholders/beneficiaries.*

*Note. Indiana will not tax Social Security benefits or railroad

*This withholding requirement does not apply to the residents of retirement benefits which are issued by the U.S. Railroad Retirement

Arizona, Oregon, and Washington D.C., who are subject to and pay Board. Therefore, if you listed any of these benefits in Column B. then

income taxes at rates of 3.23% (.0323) or higher to their resident state. look at Indiana Schedule C: Deductions. Enter those same amounts on

line 5 and/or line 6 on Schedule C.

Individuals who are included on the entities’ Schedule Composite are

not required to file an individual income tax return to report income Line 19 – Indiana Apportioned Income

from those entities with three exceptions: Apportioned business income from Schedule IT-40PNRA is reported

on this line. The apportionment schedule is used only by nonresidents

Exception 1. Form IT-40PNR must be filed and all taxable income with income or losses from a business that does business both within

reported if the pass-through entity withholds county tax on the and outside Indiana. Report the amount from Schedule(s) IT-

nonresident partner, shareholder and/or beneficiary. See Form IT-65/IT- 40PNRA, Part 3, line 3. You may access Schedule IT-40PNRA at www.

20S Schedule IN K-1, line 9, or Form IT-41 Schedule IN K-1, line 12. in.gov/dor/tax-forms/2022-individual-income-tax-forms.

Exception 2. Form IT-40PNR must be filed and all taxable income Note. If you are apportioning business income, make sure to:

reported if the individual has other taxable Indiana-source income • Report the full amount from your federal return onto Indiana

that is not included on a Schedule Composite. Schedule A, Section 1, Column A, and

• Not report any of that income in the corresponding Column B.

Exception 3. Form IT-40PNR must be filed if the individual completed Instead, you will report the amount to be taxed by Indiana in

Schedule IN-COMPA. Column B on this line.

However, if you have any other Indiana-source income, you are Example. Mark is a full-year nonresident of Indiana. His company did

required to file Form IT-40PNR, reporting both that income and any business both within Indiana and in other states. On Indiana Schedule

income already reported and taxed on Form IT-65/IT-20S/IT-41 (all A, Section 1, line 7, Column A, he reported the same amount of

Indiana-source income). business income as he reported on his federal Schedule 1. He left line

7, Column B blank. He entered the amount apportioned to Indiana on

You will need to include Schedule IN K-1 with the filing for the Section 1, line 19, Column B.

Page 14 IT-40PNR Booklet 2022

|

Enlarge image |

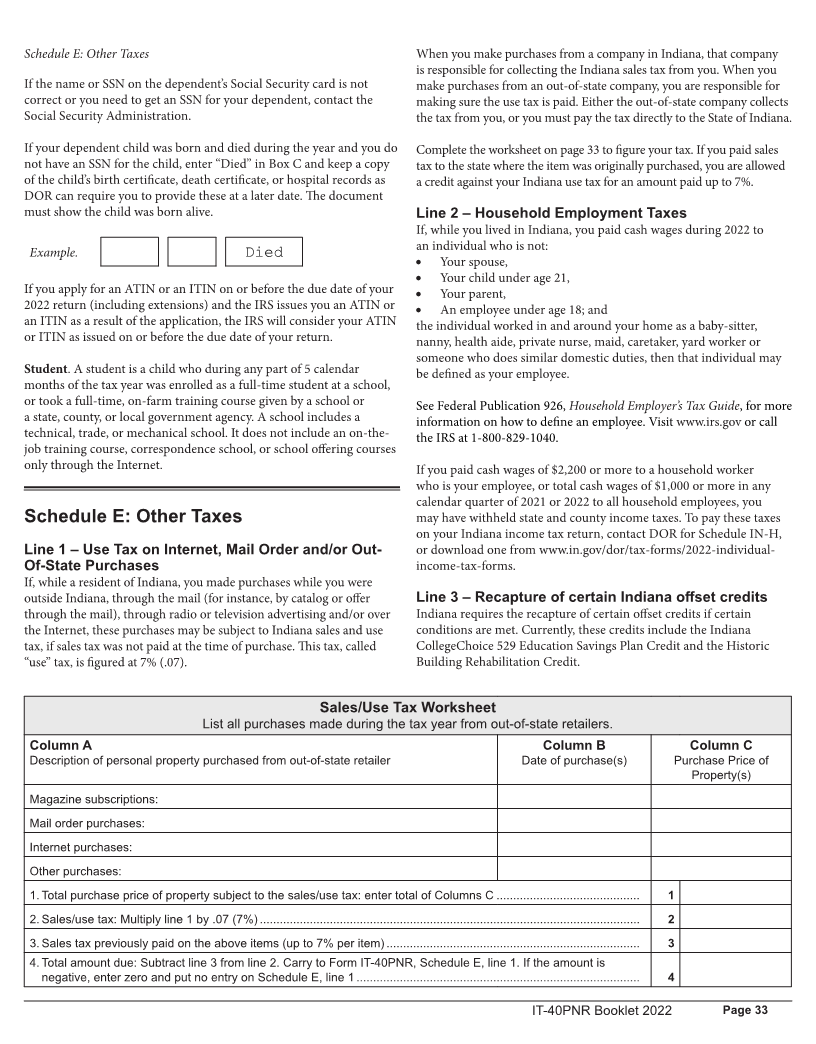

Schedule A: Proration

Line 20 – Other Income Schedule A

Enter any other income or loss for which there is no named line Section 2: Adjustments to Income

provided on the IT-40PNR return. Adjustments to income from federal Form 1040/1040-SR and

• Report any NOL from your federal Schedule 1, line 8a, as a federal Schedule 1.

negative amount in Column A only. You will show the Indiana

portion of your Indiana net operating loss deduction on Schedule List the adjustments used in arriving at your federal adjusted gross income.

C under line 11. See instructions for Indiana net operating loss

deduction on page 23 for more information. Unless otherwise stated:

• Other types of income or loss would include riverboat winnings, • Enter in Column A your adjustments as they appear on your

prizes, awards, amounts recovered from bad debts, gross lottery and federal return; and

other gambling winnings, etc., as reported on your federal return. • Enter in Column B the portion of your adjustments that are

available to offset Indiana income tax.

List the source(s) of the income or loss reported on this line.

*Important information about possible year-end federal legislation. This

publication was finalized before all year-end federal legislative changes were

complete. Therefore, some of these adjustments may need to be eliminated

Schedule A

and/ or refigured. You may wish to periodically check DOR’s homepage at

Proration www.in.gov/dor for updates about any impact of late federal legislation.

The purpose of this section is to compare the Indiana Schedule A,

Section 1, line 21A income taxed on your federal return to the line 21B

Line 22 – Educator Expense

income taxed by Indiana. To do this, divide the amount on line 21B Enter in Column A any educator expense deduction claimed on your

by the amount on line 21A. Please round your answer to a decimal federal Schedule 1, line 11. Enter in Column B the portion of the

followed by three numbers. expense that was spent while you were an Indiana resident.

Example. $3,100 ÷ $8,000 = .3875, which rounds to .388. Enter the

Line 23 – Certain Business Expenses of Reservists,

result here and on Schedule D: Exemptions, line 8.

Performing Artists, Etc.

Enter in Column A the adjustment claimed for certain business expenses

Note. If line 21B is a loss, enter zero (0) in Box 21D and on Schedule of reservists, performing artists and fee-based government officials

D: Exemptions, line 6. If line 21A (or Box 21C) is a loss, and line 21B claimed on your federal Schedule 1, line 12. Enter in Column B that

is a positive amount, enter 1.00 (100%) in Box 21D and on Schedule portion of the deduction that is directly related to the reported income

D: Exemptions, line 8. (in Section 1, Column B) produced in conjunction with those expenses.

Special instructions for non-Indiana military personnel. If you are

Line 24 – Health Savings Account Deduction

in the military and Indiana is not your home of record, your military If you are eligible to take this adjustment on your federal Schedule

income will not be used to reduce your Indiana exemptions. 1, line 13, you are also allowed the adjustment on your Indiana tax

Complete the worksheet below. return. Enter the amount of the federal deduction in Column A. If

some or all of the income on which this deduction was based is taxed

Step 1 Enter the amount from Schedule A, by Indiana, then you will be able to take a deduction in Column B.

line 21A .............................................................................1 __________

Line 25 – Moving Expenses

Step 2 Enter any non-Indiana service You may have deducted moving expenses on your federal Schedule 1,

member’s military income included on line 14, if you are a member of the Armed Forces on active duty and, due

Schedule A, lines 1A and/or 2A.....................................2 __________ to a military order, you moved because of a permanent change of station.

Enter in Column A the amount of moving expense deduction reported

Step 3 Subtract Step 2 from Step 1. on your federal Schedule 1, line 26. If Indiana is your home of record,

Enter result here and in Box 21C on report this amount in Column B. If it is not, leave Column B blank.

Schedule A, Proration Section .......................................3 __________

Line 26 – Deductible Part of Self-Employment Tax

Step 4 Enter the amount from Schedule A, Enter in Column A the amount claimed on federal Schedule 1, line 15.

line 21B .............................................................................4 __________ If some or all of the income on which this deduction was based is taxed

by Indiana, then you will be able to take a deduction in Column B.

Step 5 Divide Step 4 by Step 3. Round

the result to a decimal followed by three If some or all of your self-employment tax is figured on income

numbers. Enter result here and in Box 21D derived from other states as well as Indiana, you must prorate your

of the Proration Section on Schedule A .......................5 __________ total federal adjustment reported in Column A to arrive at the amount

to be reported in Column B. Use the formula below to figure your

deduction for Column B.

IT-40PNR Booklet 2022 Page 15

|

Enlarge image |

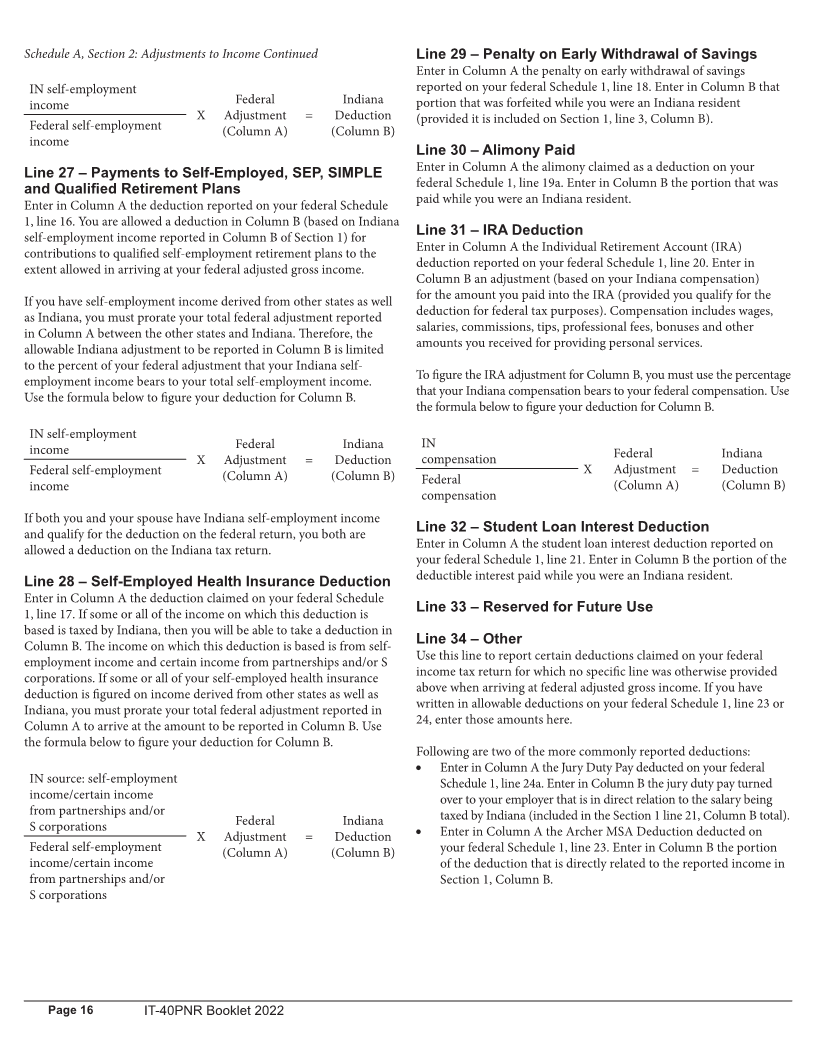

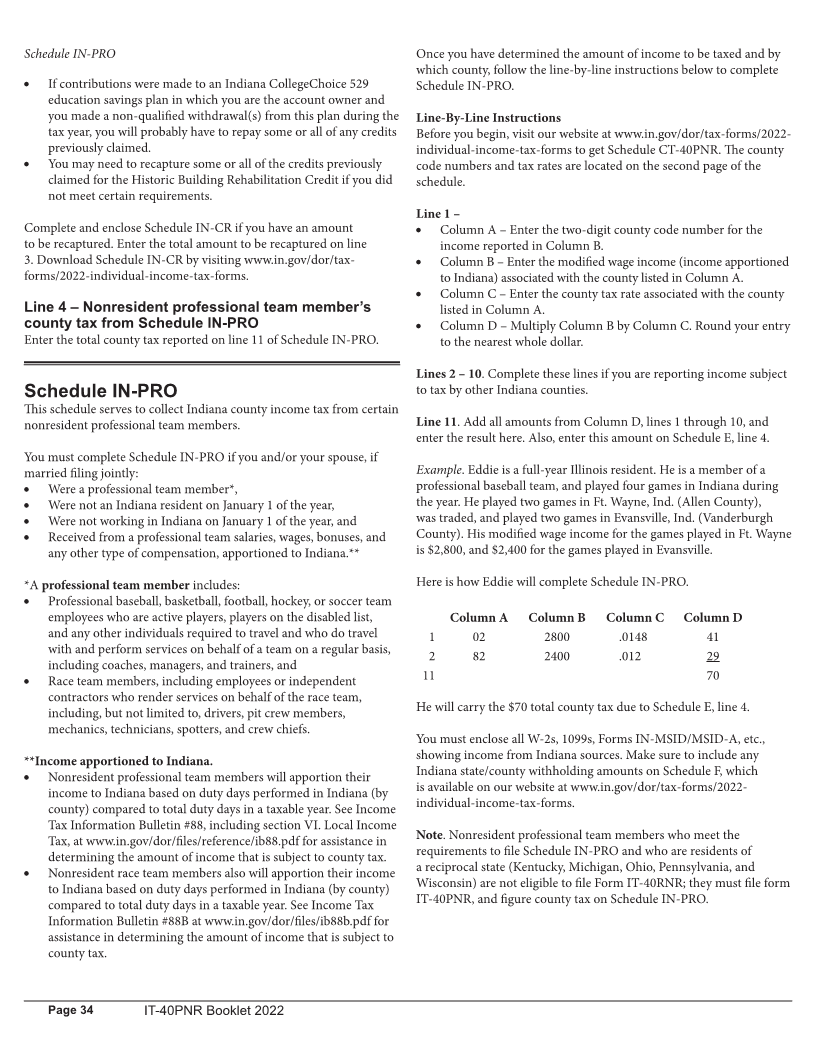

Schedule A, Section 2: Adjustments to Income Continued Line 29 – Penalty on Early Withdrawal of Savings

Enter in Column A the penalty on early withdrawal of savings

IN self-employment reported on your federal Schedule 1, line 18. Enter in Column B that

income Federal Indiana portion that was forfeited while you were an Indiana resident

X Adjustment = Deduction (provided it is included on Section 1, line 3, Column B).

Federal self-employment (Column A) (Column B)

income

Line 30 – Alimony Paid

Enter in Column A the alimony claimed as a deduction on your

Line 27 – Payments to Self-Employed, SEP, SIMPLE

federal Schedule 1, line 19a. Enter in Column B the portion that was

and Qualified Retirement Plans

paid while you were an Indiana resident.

Enter in Column A the deduction reported on your federal Schedule

1, line 16. You are allowed a deduction in Column B (based on Indiana

self-employment income reported in Column B of Section 1) for Line 31 – IRA Deduction

Enter in Column A the Individual Retirement Account (IRA)

contributions to qualified self-employment retirement plans to the

deduction reported on your federal Schedule 1, line 20. Enter in

extent allowed in arriving at your federal adjusted gross income.

Column B an adjustment (based on your Indiana compensation)

for the amount you paid into the IRA (provided you qualify for the

If you have self-employment income derived from other states as well

deduction for federal tax purposes). Compensation includes wages,

as Indiana, you must prorate your total federal adjustment reported

salaries, commissions, tips, professional fees, bonuses and other

in Column A between the other states and Indiana. Therefore, the

amounts you received for providing personal services.

allowable Indiana adjustment to be reported in Column B is limited

to the percent of your federal adjustment that your Indiana self-

To figure the IRA adjustment for Column B, you must use the percentage

employment income bears to your total self-employment income.

that your Indiana compensation bears to your federal compensation. Use

Use the formula below to figure your deduction for Column B.

the formula below to figure your deduction for Column B.

IN self-employment

income Federal Indiana IN

X Adjustment = Deduction compensation Federal Indiana

Federal self-employment (Column A) (Column B) X Adjustment = Deduction

income Federal (Column A) (Column B)

compensation

If both you and your spouse have Indiana self-employment income

and qualify for the deduction on the federal return, you both are Line 32 – Student Loan Interest Deduction

Enter in Column A the student loan interest deduction reported on

allowed a deduction on the Indiana tax return.

your federal Schedule 1, line 21. Enter in Column B the portion of the

deductible interest paid while you were an Indiana resident.

Line 28 – Self-Employed Health Insurance Deduction

Enter in Column A the deduction claimed on your federal Schedule

1, line 17. If some or all of the income on which this deduction is Line 33 – Reserved for Future Use

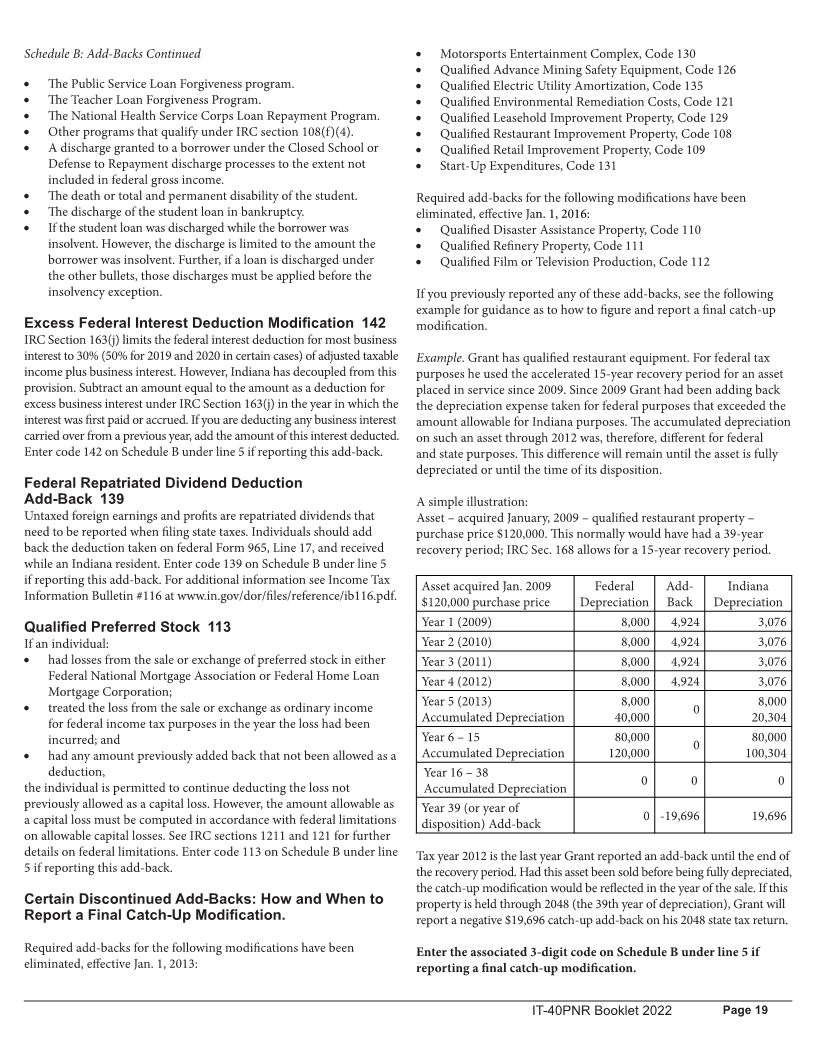

based is taxed by Indiana, then you will be able to take a deduction in