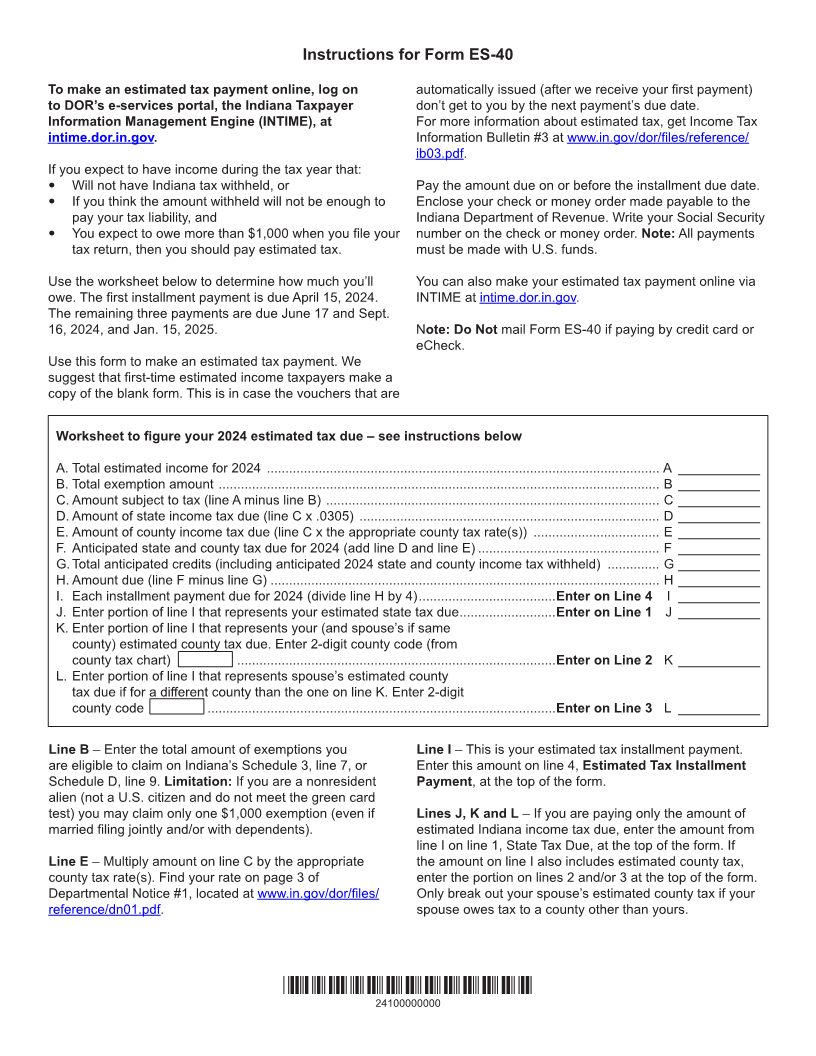

Enlarge image

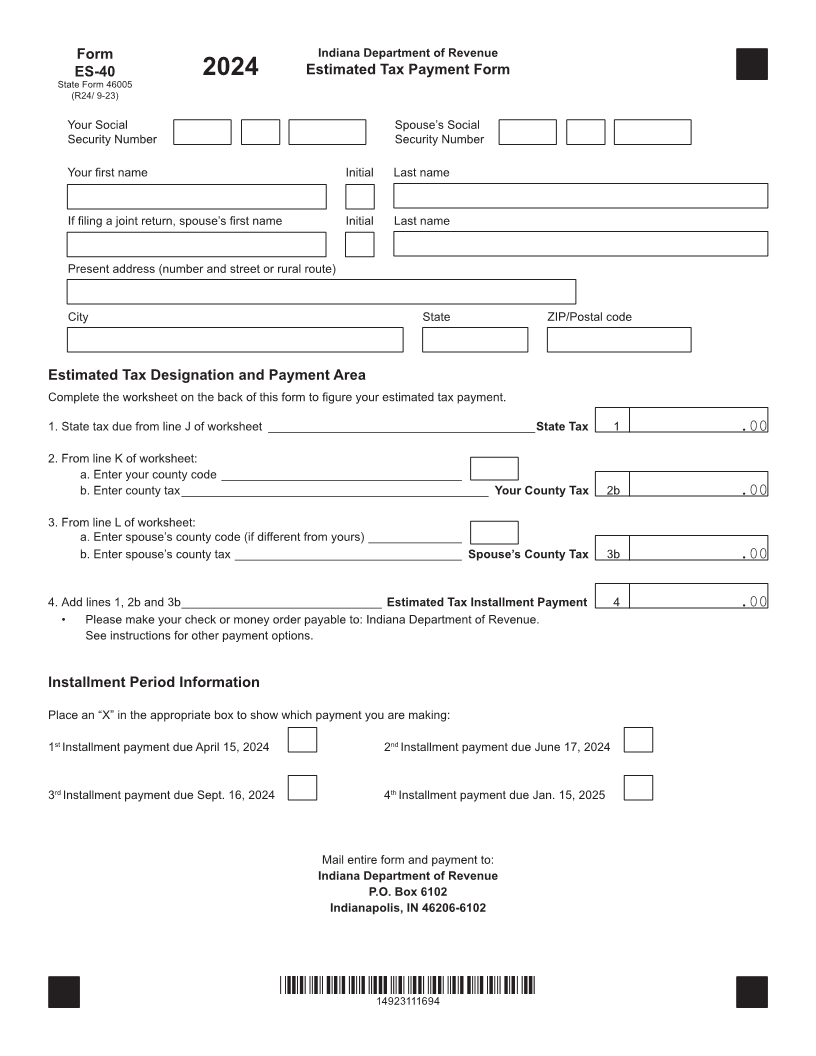

Form Indiana Department of Revenue

ES-40 2024 Estimated Tax Payment Form

State Form 46005

(R24/ 9-23)

Your Social Spouse’s Social

Security Number Security Number

Your first name Initial Last name

If filing a joint return, spouse’s first name Initial Last name

Present address (number and street or rural route)

City State ZIP/Postal code

Estimated Tax Designation and Payment Area

Complete the worksheet on the back of this form to figure your estimated tax payment.

1. State tax due from line J of worksheet ________________________________________ State Tax 1 .00

2. From line K of worksheet:

a. Enter your county code ____________________________________

b. Enter county tax ______________________________________________ Your County Tax 2b .00

3. From line L of worksheet:

a. Enter spouse’s county code (if different from yours) ______________

b. Enter spouse’s county tax __________________________________ Spouse’s County Tax 3b .00

4. Add lines 1, 2b and 3b ______________________________ Estimated Tax Installment Payment 4 .00

• Please make your check or money order payable to: Indiana Department of Revenue.

See instructions for other payment options.

Installment Period Information

Place an “X” in the appropriate box to show which payment you are making:

1stInstallment payment due April 15, 2024 2ndInstallment payment due June 17, 2024

3rd Installment payment due Sept. 16, 2024 4th Installment payment due Jan. 15, 2025

Mail entire form and payment to:

Indiana Department of Revenue

P.O. Box 6102

Indianapolis, IN 46206-6102

*14923111694*

14923111694