Enlarge image

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

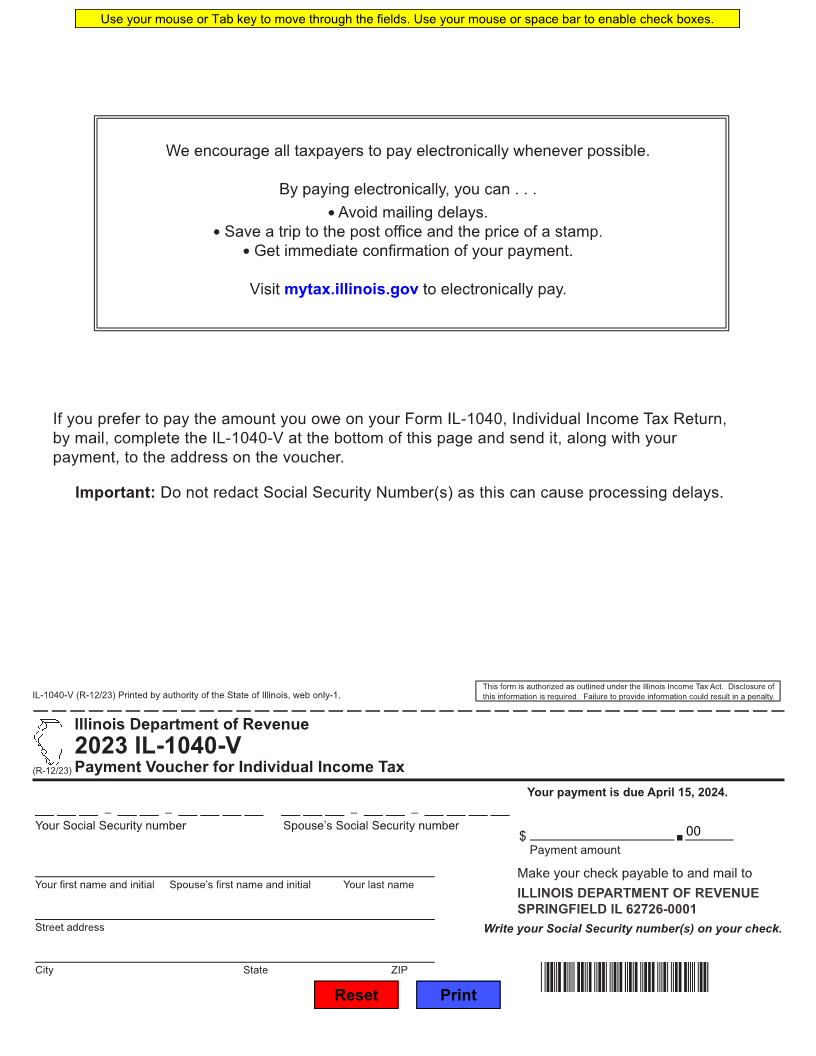

We encourage all taxpayers to pay electronically whenever possible.

By paying electronically, you can . . .

Avoid mailing delays.

Save a trip to the post office and the price of a stamp.

Get immediate confirmation of your payment.

Visit mytax.illinois.gov to electronically pay.

If you prefer to pay the amount you owe on your Form IL-1040, Individual Income Tax Return,

by mail, complete the IL-1040-V at the bottom of this page and send it, along with your

payment, to the address on the voucher.

Important: Do not redact Social Security Number(s) as this can cause processing delays.

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

IL-1040-V (R-12/23) Printed by authority of the State of Illinois, web only-1. this information is required. Failure to provide information could result in a penalty.

Illinois Department of Revenue

2023 IL-1040-V

(R-12/23) Payment Voucher for Individual Income Tax

Your payment is due April 15, 2024.

– – – –

Your Social Security number Spouse’s Social Security number 00

$

Payment amount .

Make your check payable to and mail to

Your first name and initial Spouse’s first name and initial Your last name

ILLINOIS DEPARTMENT OF REVENUE

SPRINGFIELD IL 62726-0001

Street address Write your Social Security number(s) on your check.

City State ZIP

*60212231W*

Reset Print