Enlarge image

Illinois Department of Revenue

Schedule NR IL-1040 Instructions 2023

General Information

What is the purpose of Schedule NR? ■ earned or received income from Illinois sources while you were

Schedule NR, Nonresident and Part-Year Resident Computation not an Illinois resident, or

of Illinois Tax, allows part-year or nonresidents of Illinois to determine ■ are entitled to receive a refund of Illinois Income Tax.

the income that is taxed by Illinois during the tax year and to figure

Illinois Income Tax. As a part-year resident, the rules you use to determine Illinois income

and tax depend on whether or not you were a resident of Illinois

Attach: Schedule NR to Form IL-1040, Individual Income Tax Return. when you received the income.

What if I was a nonresident of Illinois for the entire tax year? If you were a resident of Illinois when you received the income, you

If you were a nonresident of Illinois during the entire tax year, will (within certain limitations) be taxed on 100 percent of the income

you must complete and file Form IL-1040 and Schedule NR if you you received while you were a resident, regardless of the source.

● earned enough taxable income from Illinois sources to have a If you were a nonresident of Illinois when you received the income,

tax liability (i.e., your Illinois base income from Schedule NR is you will be taxed only on the income you received from Illinois

greater than your Illinois exemption allowance on Schedule NR), sources.

or When completing Schedule NR, you must include in Column B

● are entitled to a refund of Illinois Income Tax that was withheld of each line the income you received during the time you were

from your pay in error. a resident and the Illinois income you received during the time

Note: If you were not a resident of Iowa, Kentucky, Michigan, or you were not a resident. See “Part-Year Resident Step-by-Step

Wisconsin, you must attach a statement from your employer, on Instructions” for details.

company letterhead, indicating that your wages were not earned in Use the same method of reporting that you use for filing your federal

Illinois and Illinois tax was withheld in error. return. Report your income when you receive it and your deductions

What if I was a resident of a reciprocal state for the tax when they are paid. However, if you use the accrual method,

“received” means “earned or received.” Income that you received

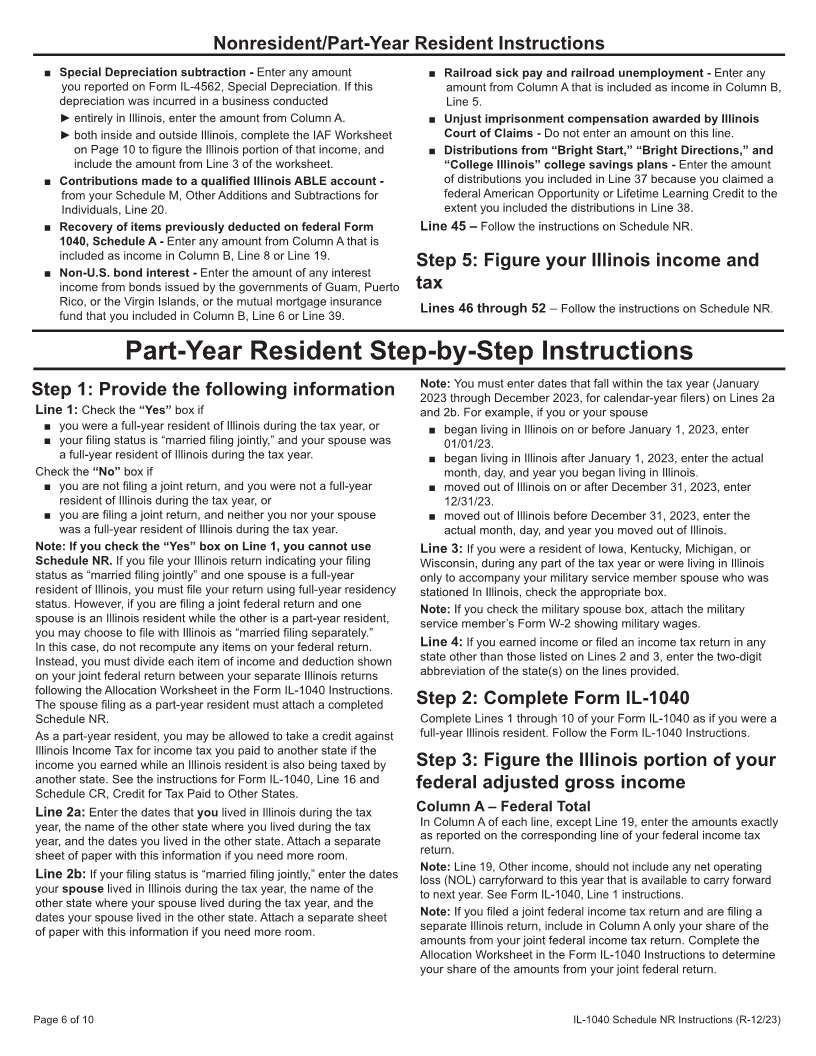

year, I was a resident of another state living in Illinois

through partnerships, S corporations, trusts, or estates is considered

only to accompany my spouse who was stationed in received on the last day of the entity’s tax year.

Illinois for military service, or I was a spouse who elected Note: Temporary absences from Illinois during the tax year do not

to use my service member spouse’s state of residence qualify you for part-year resident status.

for tax purposes pursuant to the Veterans Benefits and

Transition Act of 2018? What if I received income from a business or a

If you were an Iowa, Kentucky, Michigan, or Wisconsin resident or farm during the tax year?

a military spouse, and earned income in Illinois, you are exempt If, while you were a nonresident of Illinois, you received

from paying Illinois Income Tax on income you earned from ■ business income earned both inside and outside Illinois, or

salaries, wages, tips, and other employee compensation. You are

exempt because Illinois has a reciprocal agreement with these ■ farm income earned both inside and outside Illinois,

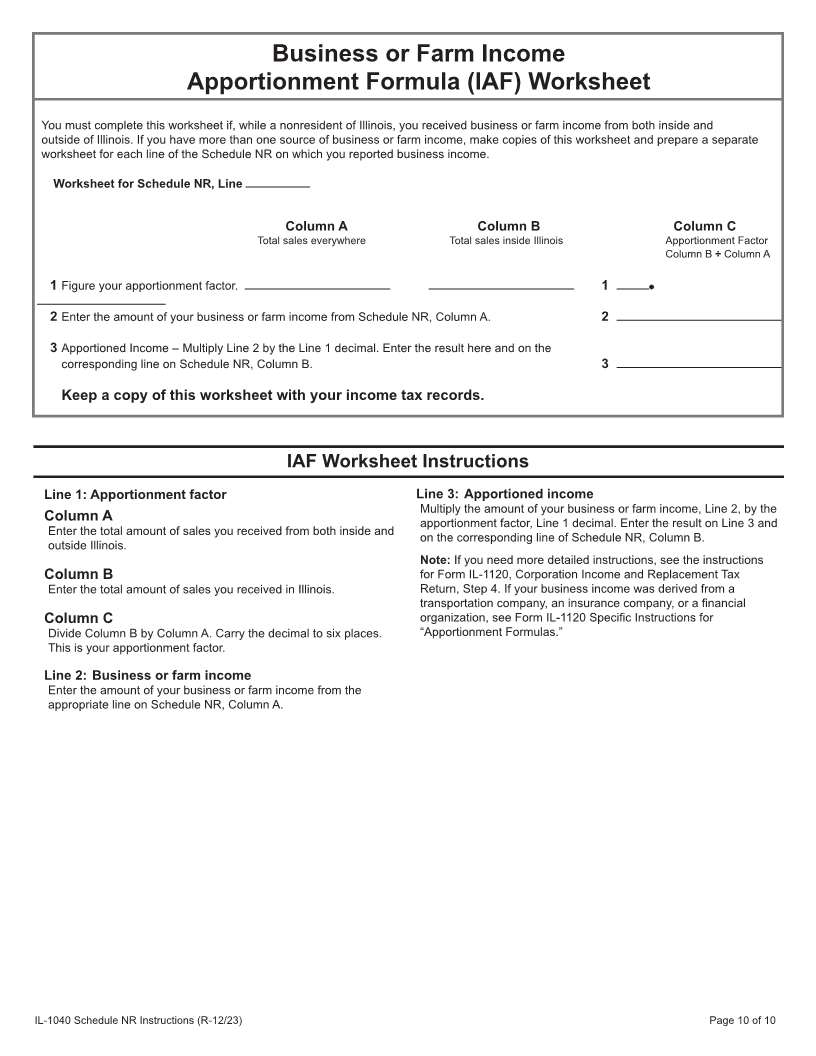

states or because military spouse wages are taxable to the state of you must complete the Business or Farm Income Apportionment

residence. You must file Form IL-W-5-NR, Employee’s Statement Formula (IAF) Worksheet on Page 10. The IAF Worksheet allows you

of Nonresidence in Illinois, with your employer to be entitled to to figure the Illinois portion of your business or farm income. Be sure

exemption from withholding. If you are a resident of a reciprocal to keep a copy of this worksheet with your income tax records.

state or a military spouse, you do not have to file Form IL-1040 and

What is business income?

Schedule NR unless you

Business income is income you earned or received from any

● earned income in Illinois from sources other than wages paid to activity that you took part in during the regular course of your trade

you as an employee, or or business. It does not include wages or other compensation

● had Illinois Income Tax withheld from your pay in error. you received as an employee. It includes all income (other than

compensation) that may be apportioned by formula among the states

What if I was a nonresident professional athlete? in which you are doing business without violating the Constitution of

All nonresident members of a professional athletic team are the United States. All income (other than compensation) you received

subject to Illinois Income Tax on the Illinois portion of their total is business income unless it is clearly attributable to only one state

compensation for services performed as a member of such a team. and is earned or received through activities totally unrelated to any

For more information, see Publication 130, Who is Required to business you are conducting in more than one state. Business

Withhold Illinois Income Tax, or refer to “What if I need additional income is net of all deductions attributable to that income.

assistance?” on page 2 of these instructions.

What if I received income from partnerships,

What if I was an Illinois resident for part of the tax year? S corporations, trusts, or estates?

If you were a resident of Illinois during part of the tax year, you If you received income from an Illinois partnership or S corporation,

are considered a part-year resident and must complete and file that entity is required to send you an Illinois Schedule

Form IL-1040 and Schedule NR if you K-1-P, Partner’s or Shareholder’s Share of Income, Deductions,

Credits, and Recapture. Also, the entity is required to send you the

■ earned or received income from any source while you were partner’s and shareholder’s instructions for completing Schedule NR.

an Illinois resident,

IL-1040 Schedule NR Instructions (R-12/23) Printed by authority of the State of Illinois. Electronic only, one copy. Page 1 of 10