Enlarge image

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

*60412231W*

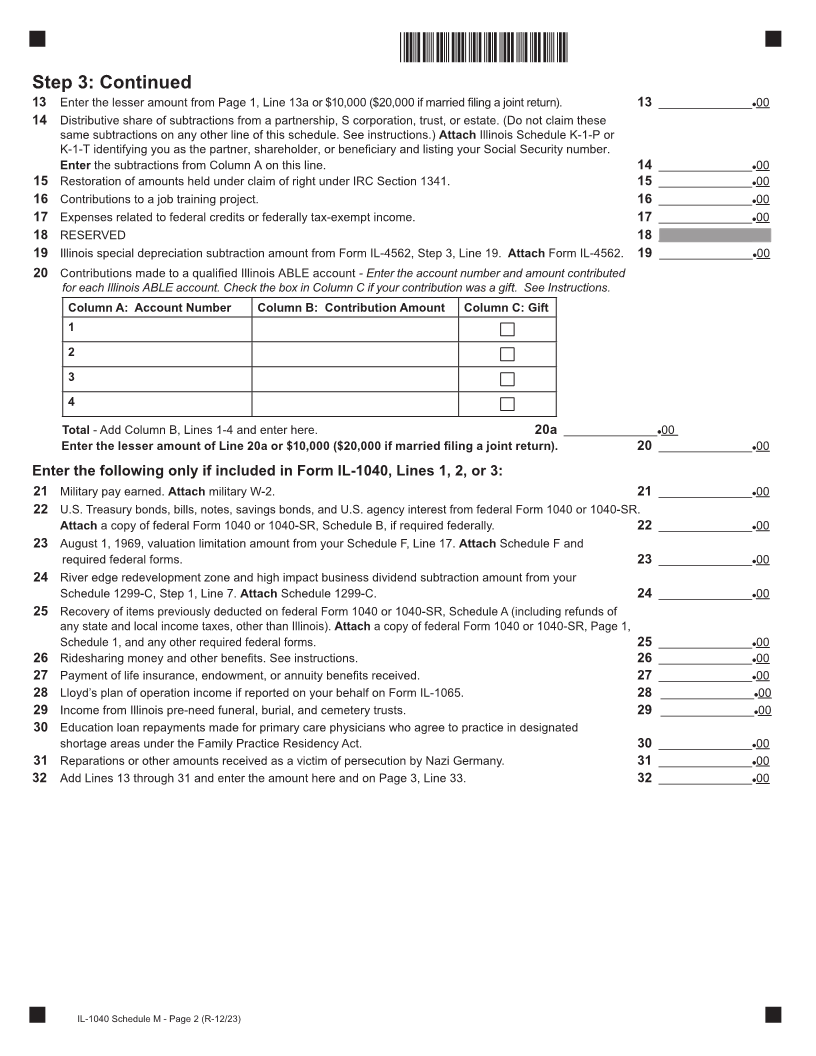

Illinois Department of Revenue

2023 Schedule M Other Additions and Subtractions for Individuals

Attach to your Form IL-1040 IL Attachment No. 15

Read this information first

Complete this schedule if you are required to add certain income on Form IL-1040, Line 3, or if you are entitled to take subtractions on

Form IL-1040, Line 7.

Note: If you are required to complete Schedule 1299-C, Schedule F, or Form IL-4562, you must do so before you complete this schedule.

Step 1: Provide the following information

– –

Your name as shown on Form IL-1040 Your Social Security number

Step 2: Figure your additions for Form IL-1040, Line 3

Enter the amount of (Whole dollars only)

1 Your child’s federally tax-exempt interest and dividend income as reported on federal Form 8814. 1 ______________ 00

2 Distributive share of additions you received from a partnership, S corporation, trust, or estate.

Attach Illinois Schedule K-1-P or Schedule K-1-T and enter the additions from Column A on this line. 2 ______________ 00

3 Lloyd’s plan of operation loss, if reported on your behalf on Form IL-1065 and included in

your adjusted gross income. 3 ______________ 00

4 Earnings distributed from IRC Section 529 college savings, tuition, and ABLE programs if not

included in your adjusted gross income. (Do not include distributions from “Bright Start,” “Bright Directions,” or

“College Illinois” programs, or other college savings and tuition programs that meet certain disclosure

requirements, or Illinois ABLE account programs. See instructions.) 4 ______________ 00

5 Illinois special depreciation addition amount from Form IL-4562, Step 2, Line 4. Attach Form IL-4562. 5 ______________ 00

6 Business expense recapture (nonresidents only). 6 ______________ 00

7 Recapture of deductions for contributions to Illinois college savings plans and ABLE plans transferred to an

out-of-state plan. 7 ______________ 00

8 Student-Assistance Contribution Credit taken on Schedule 1299-C. 8 ______________ 00

9 Recapture of deductions for contributions to college savings plans and ABLE plans withdrawn for

nonqualified expenses or refunded. 9 ______________ 00

10 RESERVED 10 ______________ 00

11 Other income - Identify each item. _______________________________________________ 11 ______________ 00

12 Total Additions.Add Lines 1 through 11. Enter the amount here and on Form IL-1040, Line 3. 12 ______________ 00

Step 3: Figure your subtractions for Form IL-1040, Line 7

Enter the amount of

13 Contributions made to “Bright Start” and “Bright Directions” College Savings Programs and “College Illinois” Prepaid Tuition Program -

Enter the account number and amount contributed for each. Check the box in Column C if your contribution was a gift. See Instructions.

Column A: Account Number Column B: Contribution Amount Column C: Gift

1

2

3

4

5

6

7

8

9

10

Total - Add Column B, Lines 1-10 and enter here. 13a ______________ 00

Continue Line 13 calculation on Page 2.

IL-1040 Schedule M - Page 1 (R-12/23) This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

Printed by authority of the state of Illinois, Electronic only, one copy. this information is required. Failure to provide information could result in a penalty.