Enlarge image

Illinois Department of Revenue

2023 Schedule IL-WIT IL-1040 Instructions

General Information Step-by-Step Instructions

What is the purpose of Schedule IL-WIT? Step 1: Provide your withholding records

Schedule IL-WIT, Illinois Income Tax Withheld, allows you to enter

your withholding information in one place and calculate total Illinois (include all W-2 and 1099 forms that show Illinois

withholding. withholding)

Enter your name and Social Security number as shown on your Form

What must I attach to Form IL-1040? IL-1040.

If you enter an amount on Form IL-1040, Line 25, attach a copy of your Lines 1 through 5 - See the Column instructions below.

Schedule IL-WIT and all your Forms W-2 and 1099 showing Illinois

income and withholding.

How do I report multiple W-2G forms from the Step 2: Provide spouse’s withholding records

(include all W-2 and 1099 forms that show Illinois

same payer?

withholding)

If you received more than five W-2Gs from the same payer, add

the amounts for Columns C, D, and E from all W-2Gs issued by the Enter your spouse’s name and Social Security number as shown on

same payer FEIN reported in Column B and report only the total your Form IL-1040.

in each column. See the form reference tables below to determine Note: If your filing status is “married filing separately,” do not include

which boxes should be reported in Columns C, D, and E. your spouse’s withholding records.

What if I received withholding forms without Lines 6 through 10 - See the Column instructions below.

Illinois withholding? Column A: Form type

If your withholding form does not show Illinois income or withholding, Enter the form type letter code found in the reference chart at the top

do not include it on this schedule. However, if the withholding form of the form.

provides verification of amounts reported on lines other than Line 25

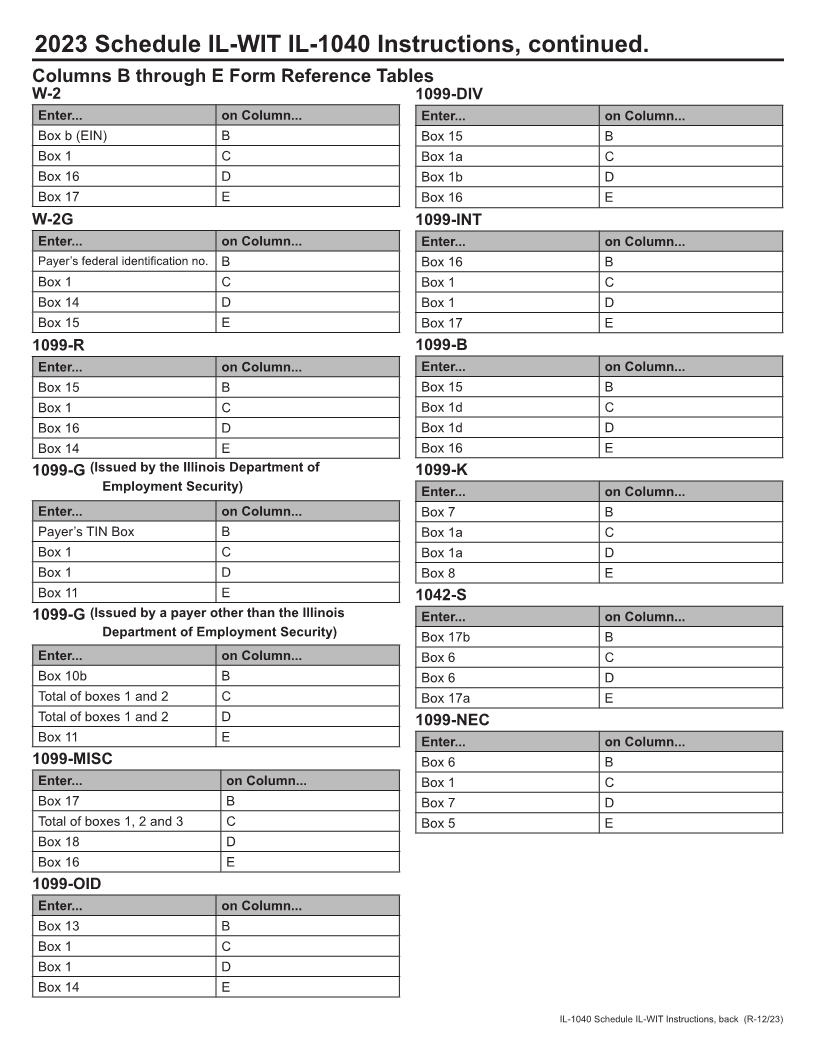

on your form IL-1040, attach a copy of the withholding form to your Columns B through E: Form Reference Tables

return. Examples include:

Use the tables on the back of the instructions to determine what

• A military W-2 received for combat pay that does not include information from each withholding form to enter in each column.

Illinois withholding but supports the subtraction reported on

Schedule M, Line 21. Column B: Employer/Payer Identification number

• A W-2 from an out-of-state employer that does not include Illinois Enter the identification number referenced by form type on the tables.

withholding but supports the foreign tax credit claimed on your

Schedule CR. Column C: Federal Wages, Winnings, Gross,

• A 1099-MISC form that does not include Illinois withholding but Distributions, Compensation, etc.

supports the non-employee compensation reported as business

income (or loss) on your US 1040, Schedule 1, and Schedule Enter the amount referenced by form type on the tables.

IL-E/EIC, Line 2.

Column D: Illinois Wages, Winnings, Gross,

What if I need additional assistance or forms? Distributions, Compensation, etc.

• Visit our website at tax.illinois.gov for assistance, forms or Enter the amount referenced by form type on the tables.

schedules.

• Write us at: Column E: Illinois Income Tax Withheld

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19001 Enter the amount of Illinois income tax withheld referenced by form

SPRINGFIELD IL 62794-9001 type on the tables.

• Call 1 800 732 8866 or 217 782-3336 (TYY at 1 800 544-5304).

• Visit a taxpayer assistance office - 8:00 a.m. to 5:00 p.m.

(Springfield office) and 8:30 a.m. to 5:00 p.m. (all other offices), Step 3: Total Illinois withholding

Monday through Friday. Line 11 - Follow the instructions on the form.

Note: If you have more than 5 withholding forms for you and your

spouse, complete multiple copies of this schedule.

Attach: Copies of all W-2 and 1099 forms.

IL-1040 Schedule IL-WIT Instructions, front (R-12/23) Printed by authority of the State of Illinois. electronic only, one copy.