Enlarge image

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

*66212231W*

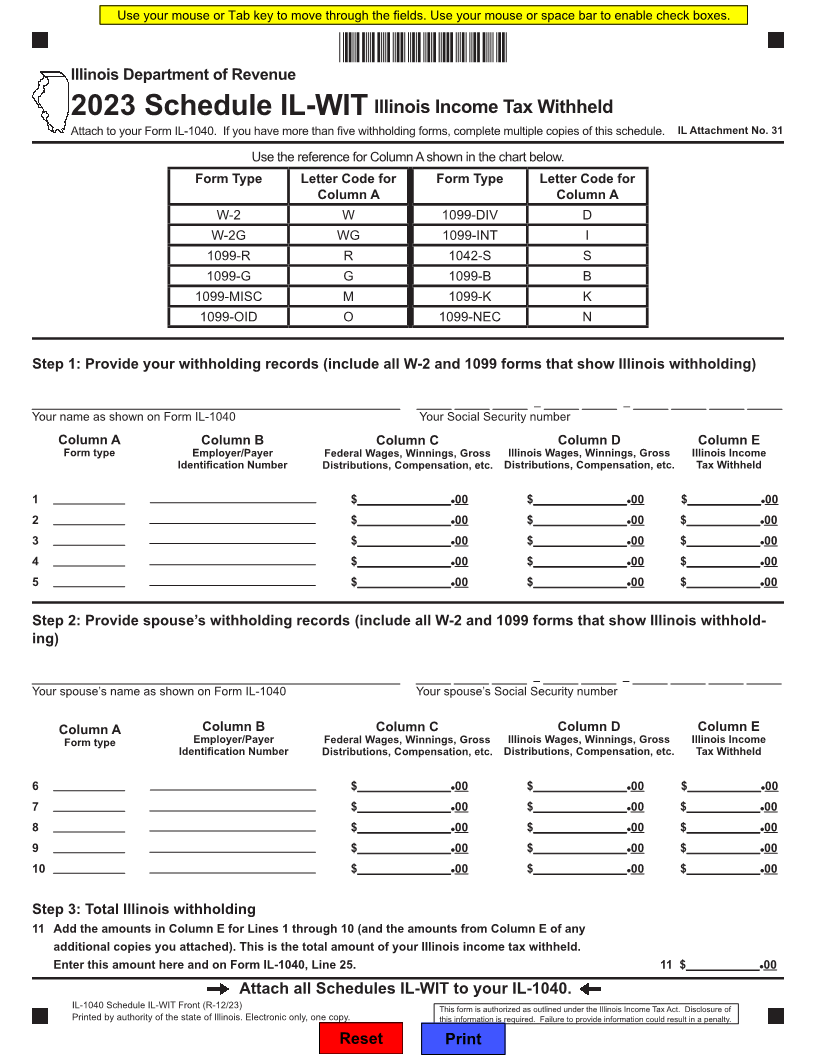

Illinois Department of Revenue

2023 Schedule IL-WIT Illinois Income Tax Withheld

Attach to your Form IL-1040. If you have more than five withholding forms, complete multiple copies of this schedule. IL Attachment No. 31

Use the reference for Column A shown in the chart below.

Form Type Letter Code for Form Type Letter Code for

Column A Column A

W-2 W 1099-DIV D

W-2G WG 1099-INT I

1099-R R 1042-S S

1099-G G 1099-B B

1099-MISC M 1099-K K

1099-OID O 1099-NEC N

Step 1: Provide your withholding records (include all W-2 and 1099 forms that show Illinois withholding)

– –

Your name as shown on Form IL-1040 Your Social Security number

Column A Column B Column C Column D Column E

Form type Employer/Payer Federal Wages, Winnings, Gross Illinois Wages, Winnings, Gross Illinois Income

Identification Number Distributions, Compensation, etc. Distributions, Compensation, etc. Tax Withheld

1 $______________ 00 $______________ 00 $___________ 00

2 $______________ 00 $______________ 00 $___________ 00

3 $______________ 00 $______________ 00 $___________ 00

4 $______________ 00 $______________ 00 $___________ 00

5 $______________ 00 $______________ 00 $___________ 00

Step 2: Provide spouse’s withholding records (include all W-2 and 1099 forms that show Illinois withhold-

ing)

– –

Your spouse’s name as shown on Form IL-1040 Your spouse’s Social Security number

Column A Column B Column C Column D Column E

Form type Employer/Payer Federal Wages, Winnings, Gross Illinois Wages, Winnings, Gross Illinois Income

Identification Number Distributions, Compensation, etc. Distributions, Compensation, etc. Tax Withheld

6 $______________ 00 $______________ 00 $___________ 00

7 $______________ 00 $______________ 00 $___________ 00

8 $______________ 00 $______________ 00 $___________ 00

9 $______________ 00 $______________ 00 $___________ 00

10 $______________ 00 $______________ 00 $___________ 00

Step 3: Total Illinois withholding

11 Add the amounts in Column E for Lines 1 through 10 (and the amounts from Column E of any

additional copies you attached). This is the total amount of your Illinois income tax withheld.

Enter this amount here and on Form IL-1040, Line 25. 11 $___________ 00

Attach all Schedules IL-WIT to your IL-1040.

IL-1040 Schedule IL-WIT Front (R-12/23) This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

Printed by authority of the state of Illinois. Electronic only, one copy. this information is required. Failure to provide information could result in a penalty.

Reset Print