Enlarge image

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

*61112231W*

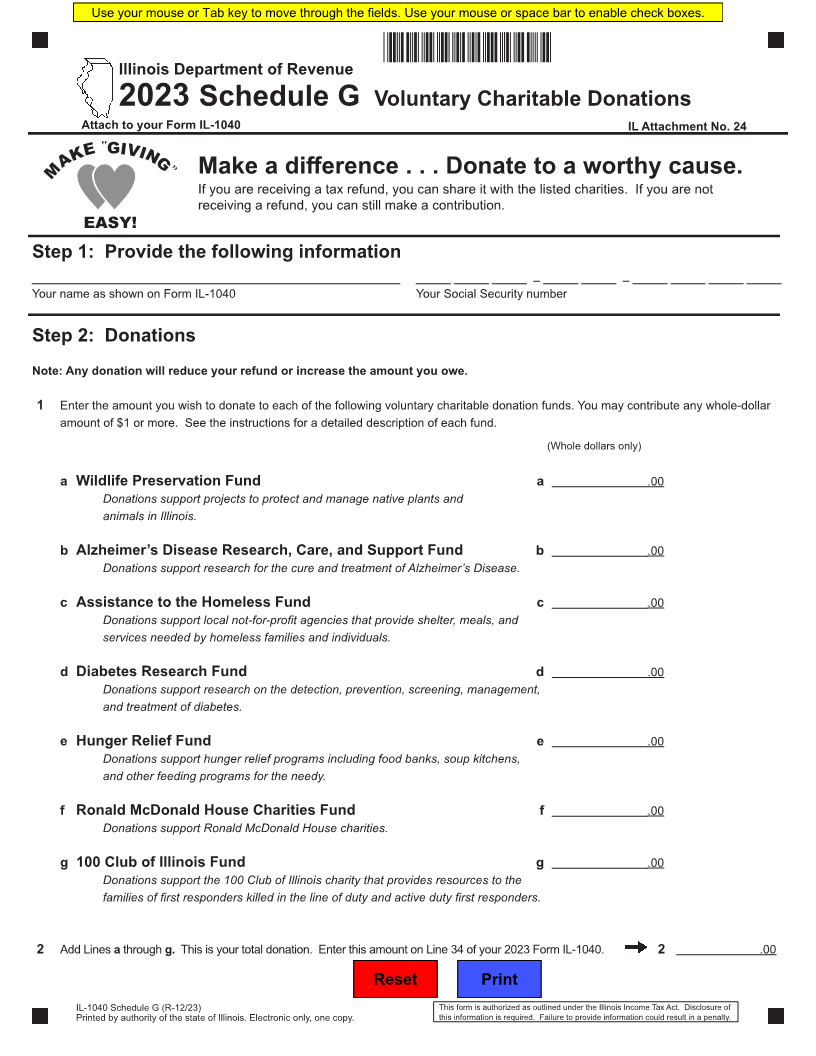

Illinois Department of Revenue

2023 Schedule G Voluntary Charitable Donations

Attach to your Form IL-1040 IL Attachment No. 24

Make a difference . . . Donate to a worthy cause.

If you are receiving a tax refund, you can share it with the listed charities. If you are not

receiving a refund, you can still make a contribution.

Step 1: Provide the following information

– –

Your name as shown on Form IL-1040 Your Social Security number

Step 2: Donations

Note: Any donation will reduce your refund or increase the amount you owe.

1 Enter the amount you wish to donate to each of the following voluntary charitable donation funds. You may contribute any whole-dollar

amount of $1 or more. See the instructions for a detailed description of each fund.

(Whole dollars only)

a Wildlife Preservation Fund a .00

Donations support projects to protect and manage native plants and

animals in Illinois.

b Alzheimer’s Disease Research, Care, and Support Fund b .00

Donations support research for the cure and treatment of Alzheimer’s Disease.

c Assistance to the Homeless Fund c .00

Donations support local not-for-profit agencies that provide shelter, meals, and

services needed by homeless families and individuals.

d Diabetes Research Fund d .00

Donations support research on the detection, prevention, screening, management,

and treatment of diabetes.

e Hunger Relief Fund e .00

Donations support hunger relief programs including food banks, soup kitchens,

and other feeding programs for the needy.

f Ronald McDonald House Charities Fund f .00

Donations support Ronald McDonald House charities.

g 100 Club of Illinois Fund g .00

Donations support the 100 Club of Illinois charity that provides resources to the

families of first responders killed in the line of duty and active duty first responders.

2 Add Lines athrough g.This is your total donation. Enter this amount on Line 34 of your 2023 Form IL-1040. 2 .00

Reset Print

IL-1040 Schedule G (R-12/23) This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

Printed by authority of the state of Illinois. Electronic only, one copy. this information is required. Failure to provide information could result in a penalty.